Summary:

- Comcast is undervalued, with a strong commitment to returning value to shareholders through dividends and buybacks.

- A dividend discount model was used to estimate a fair value of $41.5 per share, slightly above the current price, without taking into account the $2.2 billion spent on buybacks.

- Despite challenges in the theme park segment, Comcast remains attractive from a valuation perspective with stable profitability and potential for growth.

hapabapa

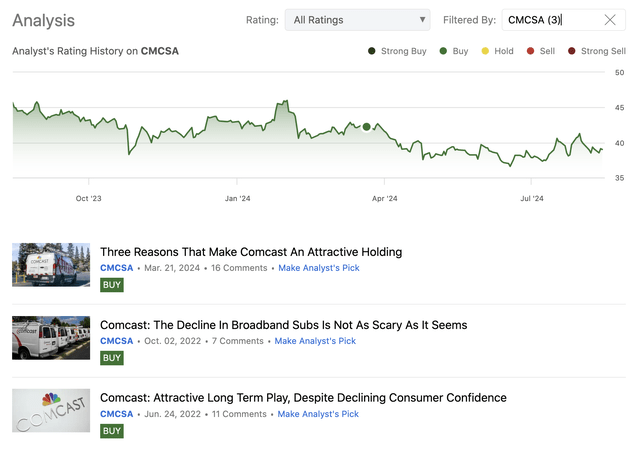

Comcast (NASDAQ:CMCSA), a leading telecommunications conglomerate and a key player in the entertainment industry. We first wrote about the firm in June 2022, with an initial bullish rating, which we have maintained twice, once in October 2022, and earlier this year, in March 2024. Each time we have highlighted the firm’s apparent undervaluation as well as its strong commitment to returning value to its shareholders through share buybacks and quarterly dividend payments.

We have however only examined the valuation from one perspective. We have only been using a set of traditional price multiples, which we compared across the sector and the industry. Today, we decided to revisit CMCSA and use a different approach. As the firm is a reliable dividend payer, plus it has been growing its dividends consistently over the years, we believe it is appropriate to examine the valuation using a dividend discount model.

Along the way, we will be discussing the latest quarterly earnings results as well, and comment whether they justify/validate our chosen method and our fair value estimates.

Valuation

Dividend discount model

Before we jump into the model itself, we would like to underline several key points, which we make justifies the use of the proposed method.

Validity of approach

1. Reliable and increasing dividend payments over a decade.

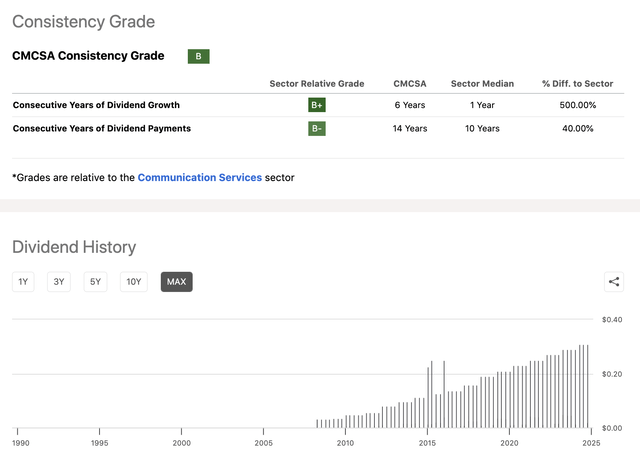

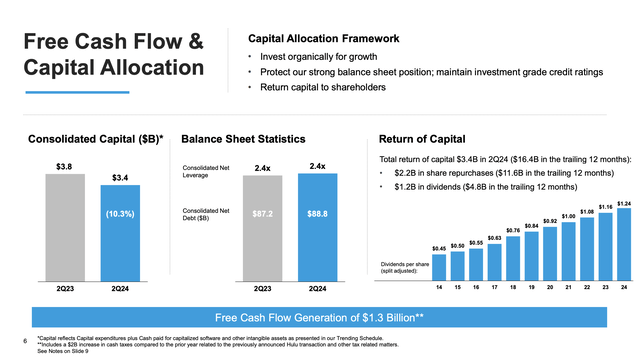

The following screenshot shows that CMCSA has been paying dividends for 14 years, consecutively, and they have also been able to increase these payments over time.

2. Sustainable dividends

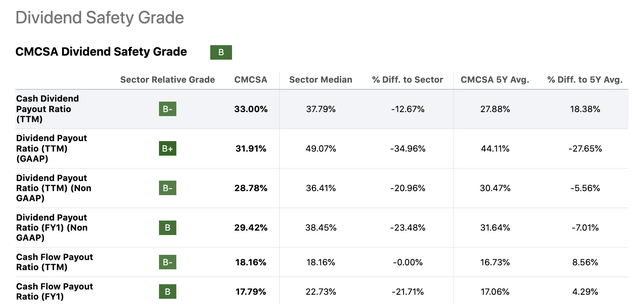

We believe that these payments are safe and sustainable. When we look at a set of payout ratios, we can see that Comcast is more than able to cover the amounts declared. The firm’s metrics compare even favourably to the communication services sector median.

If we look at the latest quarterly results, and specifically the comments on free cash flow and capital allocation, we can see that CMCSA continues to remain committed – and that they indeed are able to afford the dividends and share buybacks.

Now, that we see that our chosen model is likely appropriate, let us start our fair value calculations. To do so, we need to first define two input parameters and these are the required rate of return and the dividend growth rate.

Input parameters

1. Required rate of return

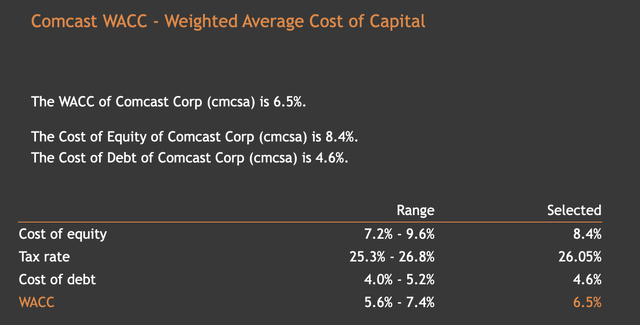

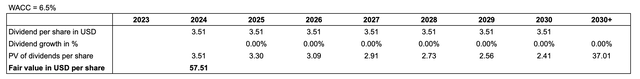

We generally like to use the firm’s weighted average cost of capital (WACC) for our required rate of return. According to the latest estimates, CMCSA weighted average cost of capital is 6.5%.

2. Dividend growth rate

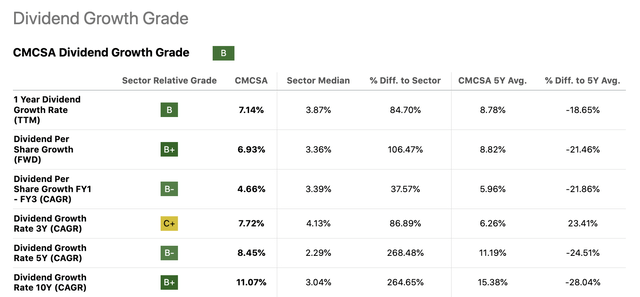

If we are using a single stage dividend discount model – meaning one growth rate in perpetuity, we normally like to use the firm’s long-term historic dividend growth rate. In CMCSA’s case it is more than 11%, which would likely lead us to a significant overestimation of the fair value, as such a growth is not sustainable in perpetuity.

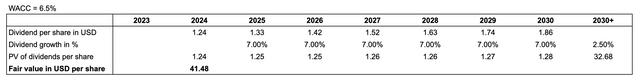

For this reason, we have decided to use a two-stage model, which assumes a dividend growth rate of 7% until 2023, and 2.5% afterwards in perpetuity.

Results

Plugging in these input parameters to our model, we get a fair value estimate of $41.5 per share for CMCSA’s stock, slightly above the current share price.

Discussion of results

So does it mean that we should go ahead and buy the stock? To answer this question, we have to discuss the risks and uncertainties related to both our calculation and the business itself.

1. Our calculation does not take into account the share buybacks.

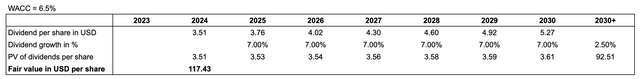

As shown on the slide above, CMCSA has returned as much as $2.2 billion in the previous quarter through share buybacks, while they have only spent $1.2 billion on dividends. $2.2 billion is a lot to ignore. So let us hypothetically see what would be the fair value if we assumed that the $2.2 billion would also be paid out as dividends. In that case, the annual dividend would be $3.51 per share, compared to the current $1.24.

This yields us a fair value of $117 per share, which seems way too high.

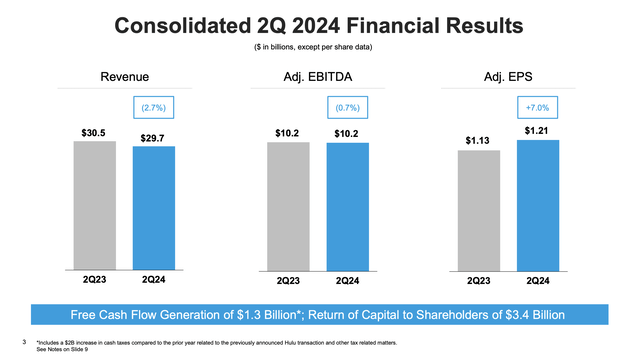

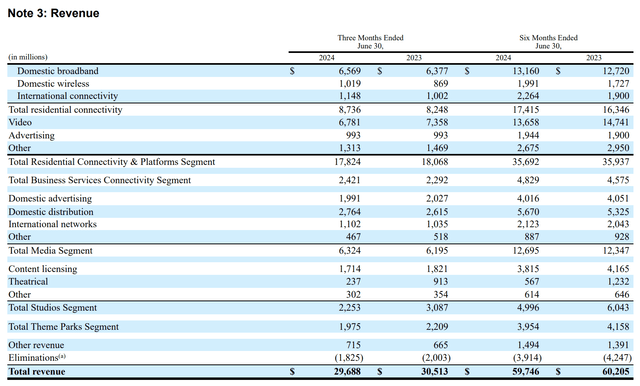

We believe it is not reasonable to assume that this amount could grow at a rate of 7% in the coming years, as the revenue and the earnings of the firm are not growing at such rates. In fact, revenue and EBITDA have declined year-over-year in Q2, primarily due to the weakness in the Content & Experiences segment, driven by the lower attendance in the domestic theme parks.

Important to note however that theme park segment is a relatively small segment of the whole business.

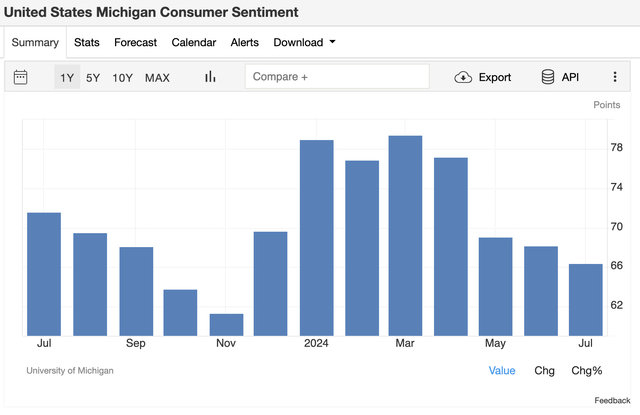

On one hand, we believe that the macroeconomic environment is likely going to start improving in the coming quarters, with consumer confidence improving. On the other hand, it will likely take several quarters or even years until the theme park business will be showing significant growth again. And even if so, the 7% of hypothetical dividend growth rate is still too aggressive.

U.S. Consumer confidence (tradingeconomics.com)

For this reason, let us assume a conservative scenario with 0% growth in perpetuity. Even in this case, however, CMCSA’s stock appears to be undervalued.

For these reasons, we believe that CMCSA remains attractive from a valuation point of view.

2. Changing interest rate environment

Our model does not take into account the potential change in the interest rate environment. With Fed likely to cut interest rates later this year, it can have a positive impact on both the firm’s cost of capital as well as on the refinancing of existing debt.

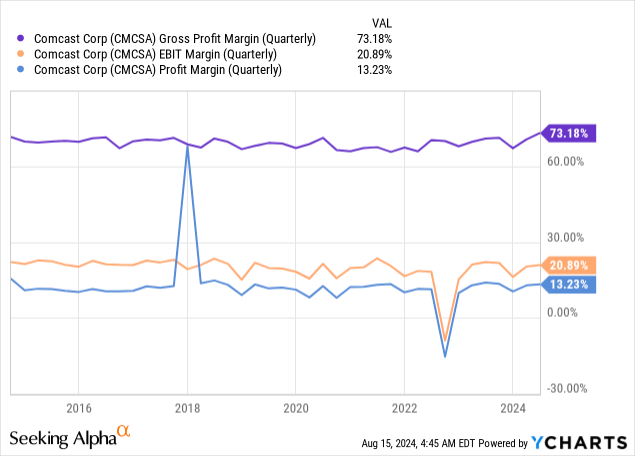

3. Stability of the margins

We believe that it is also important to highlight that over the past decade CMCSA has managed to keep its profitability relatively stable, which indicates the robustness of the business. And despite the year-over-year decline in revenue in the connectivity & platforms segment, the firm has achieved a record 41.9% adjusted EBITDA margin within the segment.

Conclusions

Based on our fair value estimates using a dividend discount model, we believe that CMCSA’s stock is undervalued. Using different assumptions for dividend growth and dividend payout, in each case we estimated the fair value to be above the current share price.

The current macroeconomic environment, especially the low consumer confidence, is creating headwinds for the business, which is clearly visible in the theme park segment. We expect this to change in the coming quarters/years, with the Fed’s likely easing of the monetary policy.

The business remains robust with stable profitability and a strong commitment to returning value to its shareholders.

For these reasons, we maintain our “buy” rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CMCSA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.