Summary:

- Nvidia Corporation’s momentum supports a $143 target price, fueled by strong AI demand and positive indicators.

- Q1 2025 revenue reached $26 billion, driven by 427% YoY growth in data center revenue.

- Nvidia’s upcoming Q2 earnings are expected to reflect strong AI chip demand, solidifying its continued growth trajectory.

- Amazon, Microsoft, and Google contribute 40%+ of Nvidia’s revenue, relying heavily on its GPUs.

- Nvidia holds 80% of the AI chip market, dominating with its GPUs and CUDA platform.

gremlin

Investment Thesis

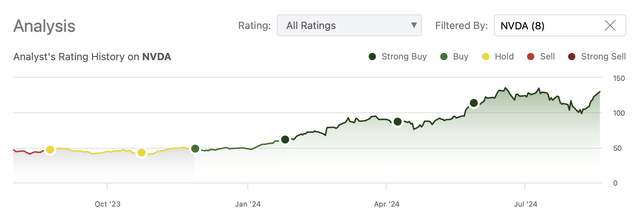

Previously skeptical due to Nvidia Corporation’s (NASDAQ:NVDA) high valuation, I changed my thesis to bullish about a year ago. Since then, Nvidia has taken off to the races with a $3 trillion market cap. In less than a year, this company has ballooned to prove its stock belongs at lofty valuations with solid execution, innovation, and demand.

We maintain a strong buy rating for Nvidia Corporation stock ahead of its August 28th earnings report. Our confidence stems from Nvidia’s leadership in AI, cloud computing, and advanced graphics, which continues to drive market enthusiasm. Nvidia’s GPUs are essential to the AI revolution, ensuring ongoing demand across data centers, cloud services, and machine learning applications.

Nvidia has almost monopolized the AI chip market at about 80%, all thanks to its cutting-edge GPUs and CUDA platform, which made it the premier solution among leading cloud service providers. Finally, due to the increased demand for its chips, Nvidia is also expected to beat the upcoming Q2 earnings again.

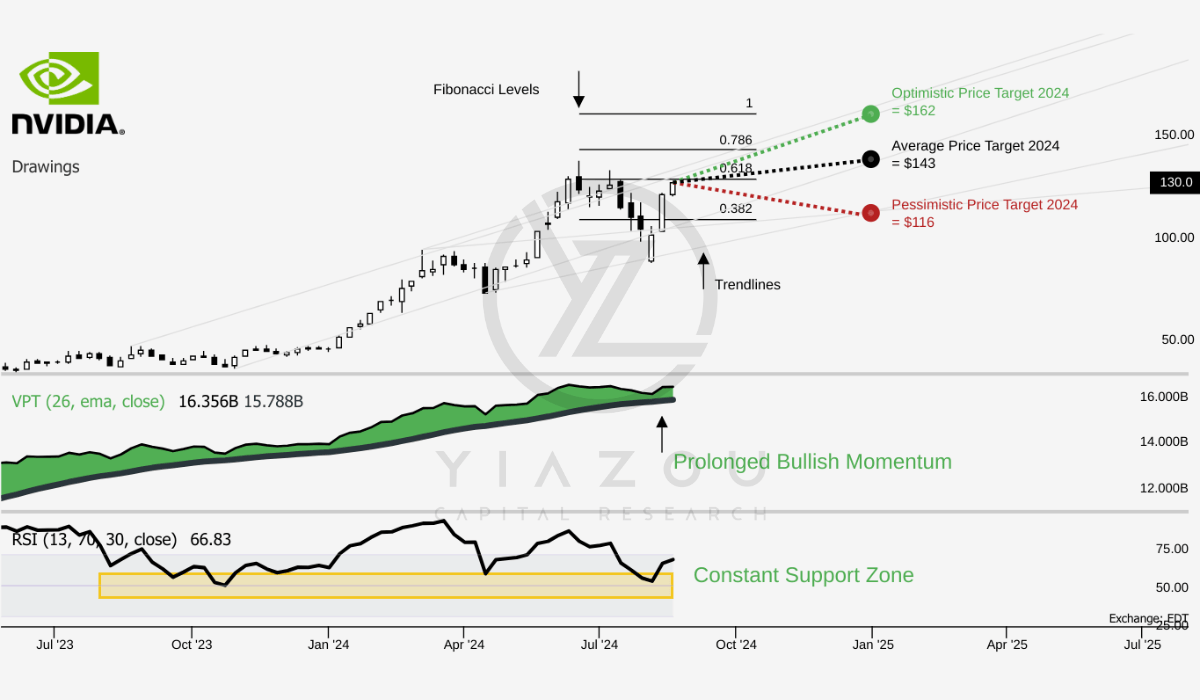

Technical Indicators Point to a Potential Upside Towards the $143 Target in 2024

NVDA trades around $130, which sits below the average price target of $143 for 2024, suggesting a potential upside. This average target aligns with the Fibonacci (three-point) retracement level of 0.786, indicating a potential resistance or support level based on past price movements. The optimistic price target of $162, which aligns with the 1.0 Fibonacci level, suggests that, under favorable conditions, NVDA could experience significant gains. Conversely, the pessimistic target of $116 aligns with the 0.382 Fibonacci retracement level, representing a potential downside risk if market conditions deteriorate.

The Relative Strength Index (RSI) at 66.83 points to a generally bullish solid trend since it is above the 50 mark and indicates an uptrend with an upward reversal. The presence of a bullish divergence further supports a positive price movement expectation, implying that momentum is strengthening despite price movements. No bearish divergence is noted, reducing the risk of potential downtrends.

The Volume Price Trend (VPT) is also favorable over the midterm, as it shows an upward trend and a reversion upwards from its moving average, currently at 15.79 billion. This positive divergence supports the RSI’s bullish signal and suggests increasing buying pressure. Considering monthly seasonality (over 26 years), there is a 77% probability of positive returns if an investment is made in August 2024, adding a seasonal advantage to the technical indicators.

Yiazou (trendspider.com)

Nvidia Set to Beat Earnings with Explosive Growth Across AI, Gaming, and Autonomous Driving Sectors

Nvidia could beat earnings driven by proven strong revenue growth and profit from more than one high-growth sector. In the past five years, the company managed to grow its revenue from $10.9 billion in fiscal year 2020 to a more solid $60.9 billion during fiscal year 2024.

As one dives into the trajectory of fiscal Q1 2025, which is consistently upheld, Nvidia has generated $26 billion in revenues while operating margins hit 69%. These numbers underline Nvidia’s position as a company that can ride the waves in two rocketing markets: AI and data centers.

In addition, such data shed light on other previously unnoticeable trends, such as the 75% CAGR of data center revenues and growth that persisted for the fifth consecutive year and added as much as $22.6 billion for Q1 2025. Earnings outperformance should be driven by a dominant position in data centers, backed by the surge in AI demand and strategic partnerships.

Nvidia has a diverse portfolio, which backs up earnings potential in numerous sectors. Gaming revenue has contributed a meaningful chunk to the top line, now growing at an 11% compound annual growth rate for the ninth year straight; this is considered a very resilient result, proving demand for Nvidia’s GPUs continues. Moreover, two other lines of business with great potential within Nvidia—the professional visualization and automotive sectors—are currently more minor contributors to overall revenue.

More importantly, they have enormous potential, not least of which is that Nvidia continues to innovate with efforts such as autonomous driving based on the Nvidia DRIVE platform and next-gen AI-driven solutions. With that presence on growth in areas of the highest demand and most leading-edge industries in AI, gaming, and autonomous driving, Nvidia’s numerous revenue streams make it well-prepared to beat earnings expectations and continue a cycle of strong financial performance.

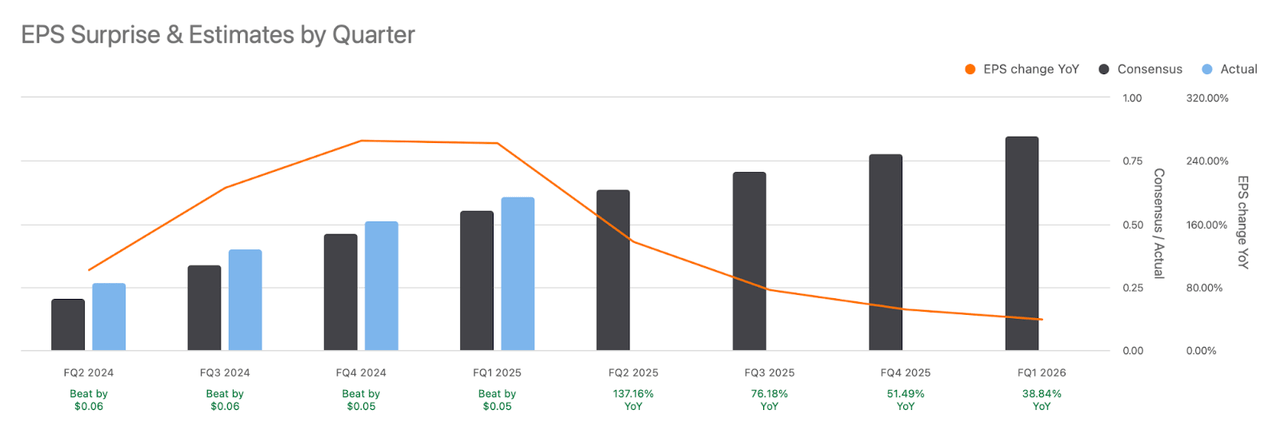

Lastly, Nvidia has consistently beaten earnings estimates in recent quarters, with slight but steady EPS outperformance across fiscal 2024 and fiscal 2025 so far. The upcoming earnings for Q2 2025 look promising, with a significant 137.16% year-over-year EPS growth expected, supported by Nvidia’s leadership in the AI and data center markets. Despite a potential decline in the YoY EPS growth rate for subsequent quarters, Nvidia’s earnings momentum appears strong, indicating a solid chance of continued outperformance.

Nvidia’s Unstoppable AI Monopoly: How It Maintains Its Dominance

Nvidia dominates the AI chip market, with an estimated 80% market share. Most of this originates from its leading-edge GPUs, now the de facto standard for training and deploying AI models in data centers. CUDA software from Nvidia further undergirds this monopoly by being used as the AI developer’s platform.

Competitors such as Advanced Micro Devices (AMD) and Intel (INTC) have taken a swing at Nvidia. AMD launched Instinct MI300X, and Intel rolled out its Gaudi 3 AI accelerator. However, these companies primarily compete in specialized sub-niches rather than the broader general training market, which remains Nvidia’s core strength and primary focus.

Furthermore, deep integration into the operations of large cloud service providers such as Amazon (AMZN), Microsoft (MSFT), and Google (GOOG)—each dependent on Nvidia’s GPUs to power their respective AI infrastructure—is also backing up Nvidia’s dominance. More than 40% of Nvidia’s revenue in the quarter came from its top customers.

While these companies have chips waiting in the pipeline, they remain very reliant on Nvidia and its high-performance GPUs. For example, even though Amazon’s in-house chip includes Inferentia and Tranium chips for AI tasks, it continues to glorify the efficiency customers with Nvidia GPUs can achieve. Google deploys the TPUs internally but offers access to the Nvidia chips through its cloud services. This situation means that these massive customers continue using Nvidia’s superior hardware, further entrenching the company’s position as the core player in the AI infrastructure market.

In summary, Nvidia holds an almost monopolistic position in the AI chip market, driven by its technological superiority, robust software ecosystem, and strong partnerships with major cloud providers. While competitors, such as AMD and Intel, are well on the way to catching up, they still have quite a long way to go regarding market share and capability. That does not include the innovation Nvidia continues to bring forward. The industry relies on its GPUs, and it will only continue to grow significantly into the future, even with new entrants that try to assert their presence within the space.

Takeaway

Nvidia’s consistent innovation, including its new Blackwell GPU series release, ensures it remains at the forefront of AI advancements. With solid customer reliance and a growing ecosystem, Nvidia is well-positioned to maintain its monopoly-like status in the rapidly expanding AI market, making it a key player to watch as the AI revolution unfolds.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AMD, INTC, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.