Summary:

- Outside of some lows set in October 2022, AT&T Inc. is back to the lowest share prices since the 90s.

- DISH Network Corporation entering as a 4th competitor is a major risk given that all large tech companies have the capital to run circles around AT&T, Verizon Communications Inc., and T-Mobile US, Inc.

- The company is a valuable investment at this time, given that its cash flow should enable it to drive substantial shareholder returns.

Brandon Bell

AT&T Inc. (NYSE:T) is one of the largest telecommunication companies in the world. The company is, however, the smallest out of the largest 3 by market capitalization, with a $110 billion market cap. That’s versus peers that have a market cap of more than $150 billion. As we’ll see throughout this article, the company’s recent weakness should enable increased future returns.

AT&T Core Businesses

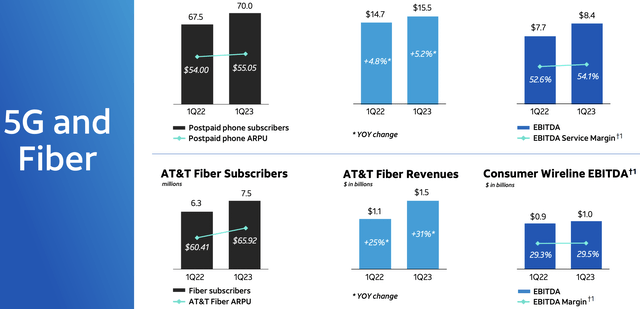

The company has managed to consistently grow its 5G and fiber businesses despite volatility in its financials.

The company’s ARPU has increased roughly 2% YoY, relatively weak financial performance. That resulted in a strong YoY increase in the company’s revenue from $14.7 to $15.5 billion along with growth in both the company’s EBITDA and the company’s EBITDA margin. The revenue growth for the company is a double-whammy because growth in margin and EBITDA helps profits doubly.

The company’s fiber business is an even larger bright spot in the company’s portfolio, although it needs more effort to be a sizable part of the company’s portfolio. The company’s fiber subscribers have grown from 6.3 million to 7.5 million YoY, and its ARPU has grown from $60.41 to $65.92. As a result, revenue has increased by 31% YoY.

EBITDA and subsequently margins have remained more constant for the company. However, we expect the company to continue investing substantial capital to grow here.

AT&T Share Price Performance

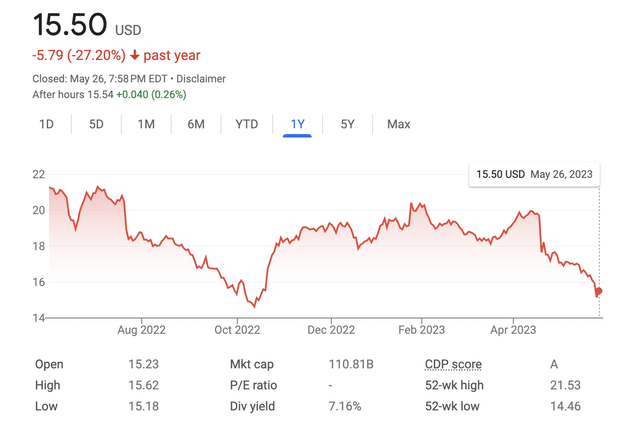

The company’s share price underperformed over the past year as the company revisits its October 2022 lows.

The company hit a 52-week low of $14.46 / share last October. Since then, the company’s share price has seen substantial weakness and its share price mimics last October. Current share prices are just 7.2% above their 52-week lows and we wouldn’t be surprised if, dependent on the overall market, weakness continues.

Before this, the company had not hit these share price levels since the early-90s. That weakness, given the company’s overall strength, represents a unique time to invest.

Dish as a 4th Competitor

DISH Network Corporation (DISH) has seen its share price skyrocket on the basis that the company could begin selling phone plans through Amazon.com, Inc. (AMZN). There’s a fundamental problem that AT&T has here that the market understands. The tech market is dominated by a few massive companies and all of them have the money run circles around AT&T. Amazon is one of those companies.

Dish has been struggling to build out a 5G network, and it’s a financial issue. The company has a $3.5 billion market cap and it’s spent $4 billion on a 5G network. It needs to spend billions more. Support from Amazon could help the company join the triple ownership of the 5G industry and substantially increase its revenue.

AT&T FCF Concern

The company’s 2023 free cash flow (“FCF”) guidance is $16 billion.

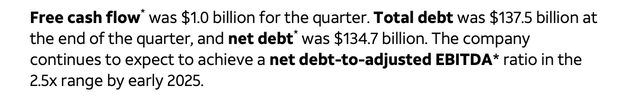

The company’s FCF was a mere $1 billion for the quarter, down from $2.8 billion a year ago. The company’s cash flow from operations declined from $7.6 billion to $6.7 billion, but the company continued to maintain substantial capital spending. It spent $5.7 billion in capital spending in the quarter, in line with the company’s annualized capital spending.

The company’s net debt is still a massive $134.7 billion and the company’s net debt to adjusted EBITDA target is 2.5x by early 2025. The company earned $8.4 billion in EBITDA for the quarter up 8% YoY. Annualized EBITDA targets are just under $34 billion, which could grow to $40 billion by 2025. That implies an aggressive target to reduce debt to $100 billion.

That’s not surprising though. The company’s debt is heavily frowned upon by the market, and in a rising interest rate environment it’s dangerous. Historically, the company could get 4-5%, but the current federal funds rate implies more like 8% for refinancing. That could imply several $ billion in additional interest expenditures.

The market is telling the company that it needs to solve its debt problem.

Our View

At the end of the day, AT&T Inc. is continuing to generate substantial cash flow.

The company’s guidance is $16 billion in FCF, and the company has maintained that guidance despite weakness for the most recent quarter. We expect the company to utilize most of its FCF towards debt repayments which we like to see. The company’s 7% dividend yield forms a valid basis for its shareholder returns in the meantime.

Longer term, we’d like to see the company begin a share repurchase program at these levels. As capital spending from the 5G build out decreases along with debt interest, the company will be able to substantially increase shareholder returns. That will make the company comfortably capable of generating double-digit shareholder returns.

Thesis Risk

The largest risk to our thesis is increased competition. AT&T’s core business is its mobility offering, and it generates high margins in that business. Any threat to the margins of the business, from future competition, could hurt the company’s ability to drive shareholder returns in the future.

Conclusion

AT&T Inc.’s business, like that of any other companies, has risk. The company has been punished by substantial indications that Dish could become a major competitor for its operations, hurting margins in an industry that’s already been impacted by the rise of T-Mobile as a key competitor with its long-time partner Verizon.

However, AT&T Inc. has an impressive portfolio of assets. It’s paying a 7+% dividend yield that makes it worth holding right now. It’s directing all free cash flow to paying down debt, which we expect to continue, saving on interest payments in a rising interest rate environment. Putting all of this together, AT&T Inc. stock is a valuable long-term investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.