Summary:

- Investors are now well-aware that Amazon’s strategy of regionalizing fulfillment centers is paying off in the form of faster & cheaper delivery and widening profit margins in its e-commerce business.

- On the earnings call, Amazon outlined various generative AI-powered initiatives the company is taking to drive future revenue growth and profitability.

- One key AI-powered advancement offers promising potential to achieve further profit margin expansion in several ways.

- Though there are notable risks to Amazon’s AI-driven growth ambitions that investors should consider.

- Nexus maintains a ‘buy’ rating on Amazon stock.

Thos Robinson

Until recently, Amazon (NASDAQ:AMZN) was capitalizing on the AI revolution primarily through AWS, as enormous amounts of cloud computing power is required to facilitate the transformation of industry and business processes in this new are of generative AI.

In fact, in the previous article, we simplified Amazon’s savvy strategies to drive AWS growth, particularly how the deep integration between its own AI chips and cloud services offers performance and cost efficiency advantages, which add value for shareholders over the long-term.

But now let’s focus on the AI-driven growth opportunity for the e-commerce side of the business. Amid the release of the company’s Q4 2023 earnings, Amazon revealed various generative AI initiatives to supercharge the company’s next growth chapter. The most notable of these announcements was Rufus, an automated shopping assistant which should help drive Amazon’s profit margins even higher. Nexus maintains a ‘buy’ rating on Amazon stock.

Before we delve into the AI-driven opportunities, we must first appreciate a key strategy that has enabled Amazon to consistently widen profit margin in its e-commerce business in 2023.

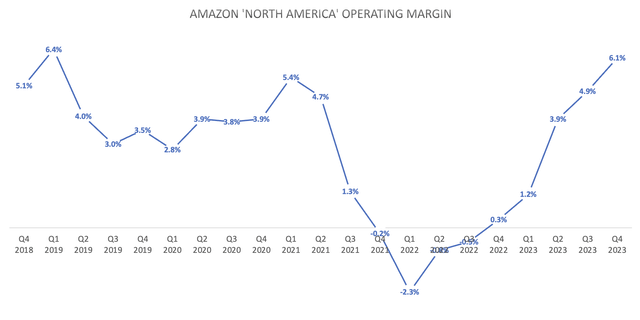

Amazon had been investing heavily in the regionalization and simplification of its fulfilment network, leveraging ‘placement algorithms’ to predict future demand and store the right products closer to consumers’ homes, and thereby reducing the fulfillment costs.

In fact, on the Q4 2023 Amazon earnings call, CEO Andrew Jassy shared that:

“In the U.S alone, cost-to-serve was down by more than $0.45 per unit compared to the prior year. Lowering cost-to-serve allows us not only to invest in speed improvements, but also afford adding more selection at lower average selling prices or ASPs and profitably.”

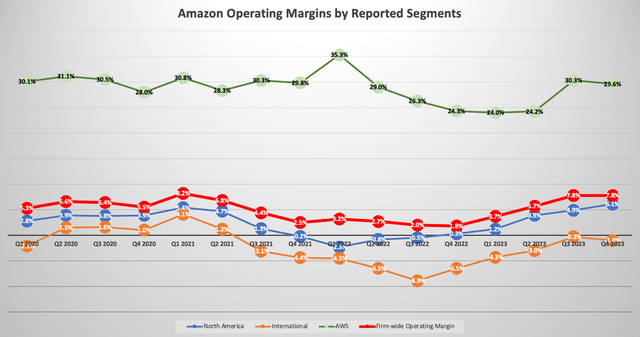

And it is this strategy that has enabled Amazon to expand the operating profit margin for its ‘North America’ segment to over 6% in 2023.

Nexus, Data from company filings

Additionally, as the CEO discussed some of the generative AI initiatives the company has already taken, he mentioned:

“We built a generative AI application that in our fulfillment centers, that forecasts how much inventory we need in each particular fulfillment center.”

Such capabilities indeed require valuable sources of shopping data. Amazon already benefits from rich sources of consumer data thanks to its extensive reach, such as through its suite of Alexa-powered home devices that collect data on users’ needs and preferences.

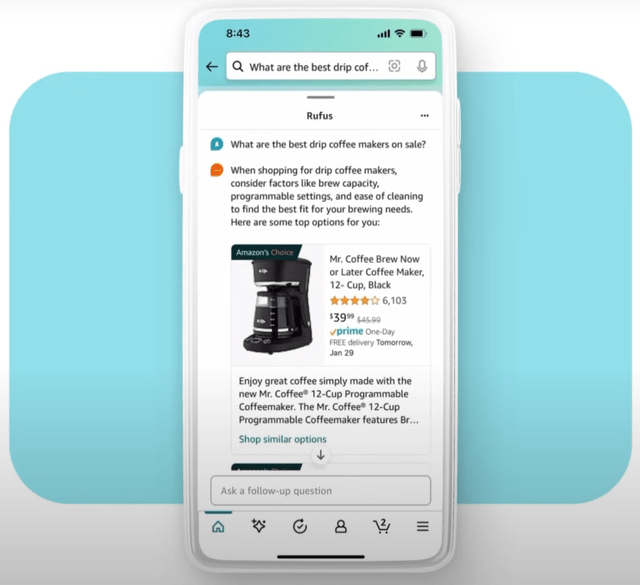

And now Amazon is rolling out a new customer-facing generative AI feature “Rufus”, essentially serving as a conversational shopping assistant on the Amazon marketplace.

Rufus has the potential the enhance Amazon’s revenue growth and profitability in various ways.

Firstly, the Rufus shopping assistant enables customers to offer a lot more context around their shopping needs, as Amazon outlined in its news article introducing “Rufus”:

Customers can search for and discover products based on activity, event, purpose, and other specific use cases by asking a range of questions such as “what do I need for cold weather golf?” or “I want to start an indoor garden.”

This marks a notable shift from the traditional shopping experience on Amazon where users can only enter specific products into the search engine.

Rufus integration into Amazon search engine (Amazon)

Now with the ability to type out broader questions and offer more context, it enables Amazon to learn much more about shoppers’ needs, improving the ability to recommend the right products.

Furthermore, the richer context around users’ shopping journeys also enhances Amazon’s ability to better anticipate future needs and store the right products in fulfillment centers near people’s homes, to be able to facilitate even faster and cheaper delivery.

For instance, using Amazon’s own example, if someone has told Rufus that they are seeking to start an indoor garden, it would allow Amazon to anticipate what type of products they are going to need on a regular basis to maintain the garden. This should enable smarter inventory placement in Amazon’s warehouses, reducing the cost to serve when the order is officially placed, and thereby inducing further profit margin expansion.

In fact, the cost of delivery becomes even cheaper on a ‘per unit’ basis when customers order multiple items together. And now with the ability to better understand consumers’ broader shopping context, Amazon becomes better positioned to cross-sell other relevant items that the user is likely to need.

As the items per delivery increases, the delivery cost per unit declines. So as per the citation earlier where CEO Andrew Jassy proclaimed that the “cost-to-serve was down by more than $0.45 per unit compared to the prior year”, Rufus could help push this cost even lower by recommending more relevant items together based on the context that users provide it, driving further profit margin expansion for Amazon.

Additionally, another generative AI capability that the CEO highlighted on the earnings call was:

“Our advertising business is building capabilities where people can submit a picture and ad copy is written and the other way around.”

Advertising is a high-margin, growing revenue segment for Amazon, making up 9% of total revenue last quarter.

Essentially, as consumers increasingly describe desired products to Rufus, Amazon will be able to use these conversational insights to automatically create product descriptions for advertisers that more closely match the phrases used by target audiences.

This should help drive conversion rates higher for Amazon ads, generating more ad revenue and further bolstering profitability.

Risks for Amazon stock

While new AI features like Rufus certainly allow Amazon to continue widening its profit margins in various ways, there also notable risks to its growth ambitions.

In Q4 2023, 42% of revenue came from the ‘Online Stores’ segment, which includes the revenue that Amazon generates from selling its own private-labelled products, such as Amazon Basics and Amazon Essentials. On the other hand, 26% of revenue derived from ‘Third-party seller services’, which includes the commissions that Amazon earns from third-parties selling products on its marketplace.

Now with the rollout of Rufus to assist consumers in their shopping journeys, it raises a familiar ‘conflict of interest’ issue. That is, when customers describe to Rufus what type of product they are looking for, would it prioritize recommending Amazon’s private-label items over those from third-party merchants?

In addition, with regards to the insights that Amazon learns about consumers’ specific preferences, it could give Amazon an unfair advantage over third-party merchants, as it could use these details to inform their own product innovation for its private-label brands.

If merchants feel unfairly disadvantaged against Amazon, it could potentially discourage them from selling on Amazon, and even encourage them to set up their own e-commerce webstores through Shopify, which is already leveraging the power of generative AI to make it much easier to start and run their own websites, as well as market their products on alternative platforms like Instagram, YouTube and TikTok.

Furthermore, while the introduction of AI-powered features like Rufus certainly opens exciting new growth opportunities, it is hardly a differentiator from competitors at this stage. Essentially all e-commerce companies will have some form of chatbot on their websites and apps to assist consumers in their shopping journeys in this new era of generative AI.

For instance, Shopify already offers an AI-powered shopping assistant in its Shop app, and will likely enable independent merchants to also deploy customized chatbots on their own webstores to facilitate customer engagement and sales.

Amazon has also not disclosed which AI model powers its new Rufus assistant feature, though it could likely be Amazon’s own family of LLMs named Titan.

The success of Rufus will be determined by the quality of user experiences, such as whether the assistant is able to appropriately grasp the broader intent behind consumers’ queries and truly make more useful recommendations based on the context provided. A lot of this will depend on the potency of the underlying AI model powering Rufus.

Meanwhile, rival Google is also striving to drive more e-commerce activity through its own platform by leveraging the natively multimodal capabilities of its latest Gemini model. Additionally, other rising e-commerce rivals will also be leveraging the power of industry-leading LLMs, like Gemini through Google Cloud and GPT-4 through Microsoft Azure, in order to build their own shopping assistants.

If such rivals can facilitate more valuable and engaging shopping experiences thanks to more powerful underlying AI models compared to Rufus’ LLM, it raises the risk of Amazon losing consumers to rising competitors over time and undermine the tech giant’s ability to drive sales growth and profitability.

Amazon’s brand power and loyalty will certainly be put to the test amid the generative AI revolution.

Amazon Financial Performance & Valuation

The improvements in operating margins for Amazon’s e-commerce business have also lifted the firm-wide operating margin to 7.8% in 2023.

Nexus, Data from company filings

These margins are likely to continue improving as Amazon continues to reap the benefits from regionalization of its fulfillment network, and leverages the power of its new generative AI features to continuously improve its prediction models and inventory placement strategies to drive greater cost efficiencies and profitability.

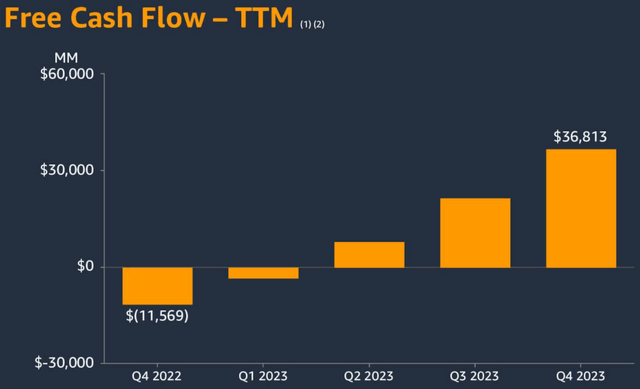

Additionally, the improved cost efficiencies in Amazon’s fulfillment network are also yielding growth in free cash flow [FCF] for the company, as CFO Brian Olsavsky shared on the call:

“The largest driver of the improvement in free cash flow is our increased operating income, which we are seeing across all three of our segments. We’re also seeing improvements in working capital, notably in inventory efficiency driven by our regionalization efforts.”

Amazon Q4 2023 Earnings Call Presentation

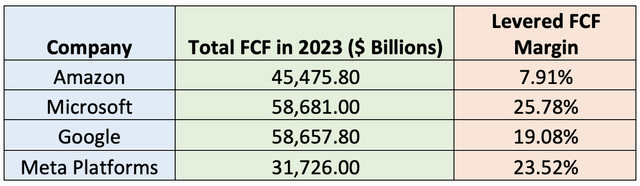

Free cash flow strength is vital amid the generative AI race as tech giants spend billions on AI infrastructure to compete in the cloud industry, and spend heavily on R&D to stay competitive in their consumer-facing business segments.

The table below compares the amount of FCF Amazon produced relative to some other key tech giants competing in the AI race, as well as the Levered Free Cash Flow Margin, a measure of a company’s free cash flow relative to total sales revenue.

Despite the improvements in Amazon’s FCF levels over the past year, the company produces less free cash flow than rivals Microsoft and Google, due to a much lower Levered FCF Margin.

Hence, in order to stay competitive in the AI race, Amazon will need to continue driving greater cost efficiencies and margin improvements to have more competitive levels of free cash flow for reinvestment into emerging growth opportunities.

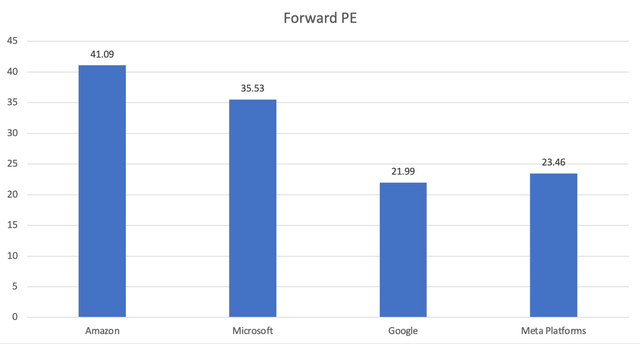

Now in terms of the valuation of AMZN stock, it trades at a forward PE of over 41x, notably more expensive than some of its tech rivals.

Nexus, Data from company filings

Although the forward PE metric is not always the best valuation metric, as it doesn’t account for the speed of earnings growth. And this is where the forward Price-Earnings-Growth [PEG] ratio comes in.

The forward PEG ratio essentially measures a stock’s forward PE multiple relative to the predicted earnings growth rates over a certain period. It aims to allow stocks with higher earnings growth rates to trade at higher forward PE multiples.

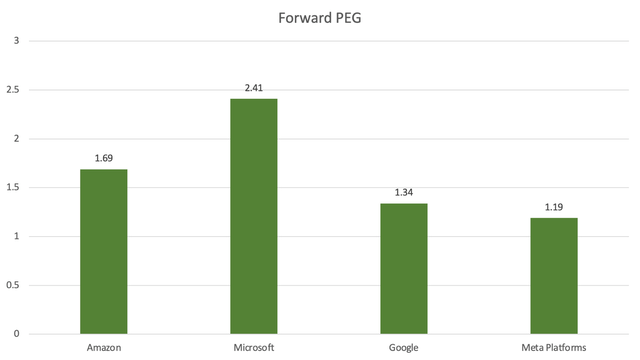

A forward PEG ratio of 1 implies that a stock is fairly valued. Although highly sought-after securities like the mega-cap tech stocks rarely tend to trade at fair value, as a premium is usually baked into these stocks.

The chart below compares the forward PEG ratio of Amazon against some key tech rivals in the AI race.

Nexus, Data from company filings

Based on this metric, MSFT stock is the most expensive. Although Microsoft is one of the few companies with a clear monetization pathway ahead in this generative AI revolution, enabling it to command a much higher valuation.

Now while AMZN stock is relatively cheaper than MSFT, it trades at a greater premium to fair value than Google and Meta Platforms. Although there may be good reasons behind why these rivals are trading at a cheaper valuation than Amazon.

Despite Meta’s strong advertising performance and promising AI-related growth prospects, its continuous heavy expenditure on the metaverse has a been a drag on its valuation. And Google’s flagship search advertising business has yet to prove to investors that it can fend off the risk of rising alternatives and monetize its new conversational search features in a highly profitable manner, the way it has monetized its traditional search engine for so many years.

That being said, Amazon is also striving to ensure that its e-commerce search engine remains a popular tool for product searches in the era of generative AI. As discussed earlier, the tech giant will also need to navigate through certain ‘conflict of interest’ issues and continuously enhance the user experience on its platform to fend of rising competition and sustain its largest sources of revenue.

Overall, Nexus maintains a ‘buy’ rating on AMZN stock given the company’s potential to continue expanding profit margins via its new AI features, but also maintains a cautious outlook over the longer-term while calibrating whether Amazon can sustain its e-commerce dominance in the new generative AI era.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SHOP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.