Summary:

- In the recent Data Center/ AI Conference, INTC presented its game plan in retaining the lion’s share in the CPU market, significantly aided by the partnership with MSFT and NVDA.

- Combined with Gaudi 3 and Sierra Forest Xeon to be launched by 2024, INTC may just claim a decent market share in the generative AI market moving forward.

- Given the excellent support the stock had enjoyed thus far, investors may consider adding INTC at the next retracement to mid-$20s for an improved margin of safety.

- Nonetheless, despite being INTC investors ourselves, we prefer to adopt a wait-and-see attitude due to the intense competition offered by its peers such as AMD/ NVDA/ ARM/ GOOG/ AMZN.

anilakkus/iStock via Getty Images

The Data Center/AI Investment Thesis

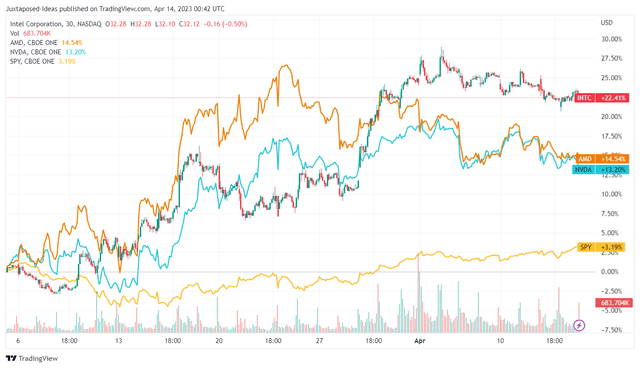

INTC, AMD, & NVDA 1M Stock Price

Intel (NASDAQ:INTC) stock has recorded an impressive recovery over the past month, easily surpassing Advanced Micro Devices’ (AMD) and Nvidia’s (NVDA) performance at the same time.

We believe part of the optimism was attributed to INTC’s Data Center and AI Investor Conference, which took place on March 29, 2023. The event helped contribute another 12% in the stock’s rally, demonstrating the excellent support it had enjoyed by its investors.

It appeared that the chip company was similarly partaking in the recent AI hype, attributed to its surprising partnership with NVDA and Microsoft Corporation (MSFT). The former would be supplying its “fourth-gen Xeon as the head node to run alongside NVDA’s H-100 GPUs,” for the training of ChatGPT and other generative AI models.

INTC stands to benefit from this partnership indeed, since up to 60 servers will feature its Xeon processors, powering NVDA’s GPUs globally. This cadence may potentially trigger an improvement in its data center CPU market share moving forward, which has declined to 70.77% as of FQ4’22, compared to 80.71% in FQ4’21.

Since direct comparisons between the Xeon processors and AMD’s EPYC has demonstrated the former’s outperformance, as similarly mentioned by Jensen Huang here, it is also unsurprising that the latter’s EPYC is out of the picture for now.

Given that NVDA’s H-100s are already in mass production by late 2022 and will be shipped by Q1’23, we reckon the tailwinds to INTC’s top and bottom line may be more than decent in the intermediate term. This suggests a potential recovery in its stock prices by H2’23 onwards, if not earlier by FQ2’23.

In addition, INTC has further streamlined its AI GPU offerings for the accelerated computing market through the next-gen Habana Gaudi 3, slated to be launched together with the Sierra Forest Xeon processor by H1’24. Given that Gaudi 3 is expected to deliver “more memory, compute and networking than its predecessor (Gaudi 2),” we reckon there is moderate tailwinds for market wins indeed.

For example, INTC’s Gaudi 2 accelerator reportedly offers 2.44x speedup and 3.18x latencies compared to NVDA’s A100 80GB for both AI training and inference, based on Hugging Face, an AI company building applications for Machine Learning.

In addition, the combination of its Gaudi accelerators and Xeon processors were reportedly able to deliver 1TB/s bisectional bandwidth and a scaling efficiency of 97%, though reportedly lower than the combination of NVDA H100/ Xeon’s bisectional bandwidth at 3.6 TB/s. Combined with Gaudi 2’s ability in supporting higher batches, we may see Gaudi 3’s performance eventually near NVDA’s H100 in performance and speed, though unlikely to match.

With an expanding global AI Total Addressable Market size of $1.84T by 2030, INTC only needs to execute its CPU and AI chip strategies competently to claim a decent market share moving forward, in our view.

It appears the company has strategically understood the importance of deep learning inference and training performance from very early on, in our view, attributed to the Habana acquisition (Israeli AI chips designer) in 2019 for $2B. This was especially given NVDA’s growing dominance in the discrete GPU segment with 84% (+6.8 points YoY) of market share by FY2022.

As a result of its dual pronged strategy, we reckon INTC may remain the largest player in the CPU market, while being relatively competitive in the AI market for the foreseeable future.

Nonetheless, investors must also note that INTC still faced long-term headwinds, since both AMD (Accelerated Processing Unit) and NVDA (Superchip) had started to design their own hybrid CPU-GPU-accelerator chips, potentially eroding the former’s market share in the distant future. This was on top of AMD’s aggressive push in the Data Center segment, with the Xilinx and Pensando acquisition in 2022.

In addition, other serious players have entered the intensely competitive computing market, such as Alphabet (GOOGL) (GOOG) and Amazon (AMZN).

With GOOG touting its TPU V4’s outperformance against NVDA’s A100 and AMZN nearly doubling its data center market share YoY to 3.16%, we may see further market losses for INTC, in our view. This was on top of ARM processors, which grew its market share to 1.52% by 2022, offering improved power efficiency while improving peak performances.

While INTC continues to hold the largest market share in the x86 CPUs segment at 62.8% by FQ4’22, we must also highlight that the number has been rapidly eroding from 68.4% in FQ4’19 and 82.2% in FQ4’16. It remains to be seen if the company’s new CPU/ data center/AI offerings may stem some of the losses as well, due to the notable delays in its product launches thus far, as highlighted by another contributor here.

So, Is INTC Stock A Buy, Sell, or Hold?

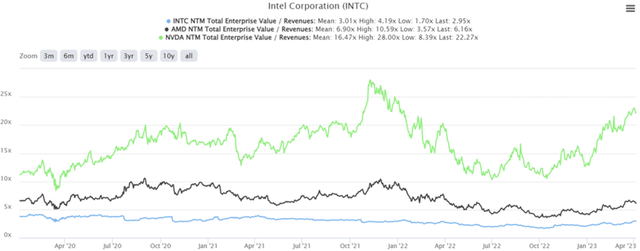

INTC, AMD, & NVDA 1Y EV/Revenue

INTC is currently trading at an EV/NTM Revenue of 2.95x, lower than its 3Y pre-pandemic mean of 3.29x, though higher than its 1Y mean of 2.26x. Particularly, the gap between its valuations has only widened against its chip peers, such as AMD at EV/NTM Revenue of 6.16x and NVDA at 22.27x.

The pessimism in INTC’s valuations is naturally reflective of the market analysts’ unimpressive top-line projection at a CAGR of -3.3% through FY2024, against AMD at 8.7% and NVDA at 17.4%. The forward projections appear lacking as well, compared to the pre-pandemic levels of 6.6% (FY2016-FY2019) and hyper-pandemic era levels of 1.9% (FY2019-FY2021).

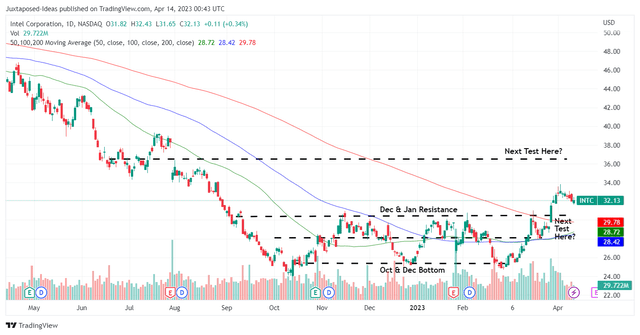

INTC 1Y Stock Price

The recent stock rally after the conference consequently demonstrated INTC’s remarkable support around the mid $20s, despite the market analysts’ pessimistic projections and uncertain macroeconomic outlook. The stock had bouncing off those levels thrice in October 2022/ December 2022/ February 2023, after the steep sell-off it has experienced since April 2021’s peak of $66.73, despite the recent dividend cut.

So, armed with this knowledge, investors keen to bet on the legacy US-designed-and-made-chips may consider doing so at the next retracement to the mid $20s for an improved margin of safety.

However, despite holding the INTC stock ourselves, we are not looking to add yet, since we remain uncertain of its long-term prospects in competing with its ambitious chip peers, such as AMD and NVDA, on breakthrough CPU/ GPU chips and Taiwan Semiconductor (TSM) on foundry capabilities.

INTC’s foundry dreams had been made further uncertain by its delayed completion of the Tower Semiconductor acquisition. Given the mixed prospects, anyone looking to add the stock needs to exercise caution and calibrate their expectations accordingly in our view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC, AMD, NVDA, GOOG, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.