Summary:

- Netflix’s stock has climbed towards all-time highs this year driven by robust uptake for its ad-supported tier and rising optimism on its live sports engagement prospects.

- Yet the company’s Q2 earnings outperformance has proved insufficient in addressing the market’s elevated expectations for its ad strategy, which management doesn’t expect to be a primary growth driver anytime soon.

- Paired with intensifying competition, emerging regulatory headwinds, and evolving industry dynamics, Netflix’s growth outlook is increasingly decoupling from its lofty premium at current levels.

hapabapa

Despite Netflix’s (NASDAQ:NFLX) post-earnings dip earlier this year, the stock has gradually climbed towards all-time highs, buoyed by optimism on its deepening foray into live sports streaming. This is further reinforced by a measured impact to ARM in 2Q24, despite dilution from an increasing subscription mix towards lower-priced ad-tier members. This continues to preserve Netflix’s growth trajectory, which management has narrowed the guidance for from the previous 13% to 15% range to now 14% to 15%.

The company’s increasing participation in live sports streaming has been viewed favourably by investors, as it underpins strong monetization prospects for Netflix’s growing ad inventory. This would be critical to reversing the current trend of lagging growth in ad monetization when compared to inventory and engagement expansion observed since the introduction of its ad-supported tier.

Netflix’s upcoming expansion of its “buying capabilities” through demand-side platform (“DSP”) partners such as The Trade Desk (TTD), Google’s Display & Video 360 (GOOG / GOOGL), and Magnite (MGNI), in addition to Microsoft (MSFT), is also expected to further complement its efforts in strengthening ad-driven growth. This will also pave the way for Netflix’s migration of its ad sales capabilities in-house by the end of 2025, which should improve efficiency gains for the company and, inadvertently, expand ad-related margins in the long-run.

Looking ahead, Netflix’s strong content slate in 2H24 also reinforces its idiosyncratic strength, which is additive to current secular tailwinds in long-form video streaming ad formats. In addition to several live sporting events, Netflix is also expected to debut the long-awaited Squid Game 2 later this year, which could potentially replicate momentum observed in 2021. We believe this will help to further reduce Netflix’s exposure to risks of churn, while also improving subscription gains and, inadvertently, ad impressions.

Taken together, the strong set-up reinforces confidence that 15% y/y growth for full year 2024 – the upper range of management’s guidance – may actually end up being the base case. Yet a further upsurge to its valuation from current levels is expected to require a five-year CAGR of 3% to global ARM based on our updated sensitivity analysis. This accordingly exposes Netflix to heightened execution risks, which precedes weakening durability to the stock’s premium at current levels.

Netflix’s Deepening Foray in Live Sports is a Game Changer

Live sports programming has historically been a key success driver for traditional linear TV given its extensive audience reach. And the same is expected for streamers looking to capitalize on ad dollars flowing from secular declines in linear TV viewership.

Admittedly, Netflix has long held a lukewarm approach to sports programming. It previously favoured “sports-adjacent” titles, which is reflected in the latest release of “Simone Biles Rising” leading up to the Paris 2024 Olympics this summer. And Netflix’s early engagement with live sports streaming has typically hovered around events outside of major championships and official league games, such as “The Netflix Slam” and “The Netflix Cup”.

Yet the platform has been deepening its foray in live sports streaming at a rapid clip this year. In addition to becoming the “exclusive new home” to the WWE’s (TKO) weekly airing (or streaming) of RAW – the first outside of linear TV programming in the show’s history – beginning 2025, alongside other weekly shows, Netflix will also be hosting the live match between Mike Tyson and Jake Paul in November. And in the latest development, Netflix has announced that it will be live streaming two NFL marquee games this Christmas – namely, the Chiefs vs. Steelers and Ravens vs. Texans. There will also be “at least one holiday game” in each of Christmas 2025 and 2026 as part of the three-season deal with the NFL.

All of which boasts strong viewership, which is favourable to Netflix’s “Year of Growth and Momentum” for its newfound advertising business. The three live sports streaming deals are likely to pave the way for more similar events going forward, which will be key to accelerating subscriptions to Netflix’s ad-supported tier and reinforcing viewership gains critical to attracting ad dollars.

- RAW – The weekly match has been running once a week for 31 years, attracting more than 17 million viewers annually to USA Network (CMCSA). It is currently one of the most popular shows broadcast on linear TV, with favourable exposure to the 18 to 49 years of age advertising demographic cohort. This cohort also boasts high purchasing power in the U.S., representing high-intent users critical to the appeal of advertisers. The addition of RAW and other WWE weekly shows to Netflix’s live sports programming in 2025 is expected to be additive to its ad monetization strategy going forward.

- Tyson-Paul Match – The Tyson-Paul duel is set to become one of the highest viewed fights in recent years, and draw additional subscriptions to Netflix. While boxing matches have typically aired in pay-per-view format, the upcoming livestream of the Tyson-Paul match on Netflix will be exclusive to subscribers instead. We expect the upcoming brawl, which has been rescheduled to mid-November, to drive an uptick in subscriptions and viewership to Netflix from all regions, replicating the success of historically high-profile matches such as the Mayweather-Pacquiao showdown in 2015 and UFC fights in recent years. This is corroborated by resilient demand for tickets to the in-person event, which will be held at the Dallas AT&T Stadium on November 15. Ticket resale prices have jumped as much as 80% for the most expensive tier, and close to four-fold for lower-cost tiers after the event hosts confirmed the fight has been postponed after Tyson suffered from a health scare in late May. We believe the Tyson-Paul match will be an additive event to driving up subscription volumes this year – a key near-term growth driver for Netflix. By differing from the historical PPV format typically applied for high-profile boxing matches, Netflix’s subscription strategy is expected to draw in new viewers into the platform given global interest in the upcoming fight between Paul and Tyson, with the lower-cost ad-supported tier in place to reduce post-fight churn. This is supported by recent findings from an Evercore survey on Netflix users in the U.S., which showed more than half of “potentially churning” subscribers are considering a switch to the ad-supported tier instead of leaving the platform altogether. Meanwhile, more than a tenth of current non-Netflix users and a third of past Netflix users have shown interest in the ad-supported tier. This highlights the prospective value from engagement and impressions that live sporting events like the upcoming Tyson-Paul match will bring to the company’s growing advertising business.

- NFL – NFL games attract one of the highest global viewership on linear TV, and boast an extensive audience reach that makes them a prime advertising real estate. The Christmas Day games have consistently garnered a high ranking on the list of most-watched TV programs of the year. And Netflix’s participation as a streaming partner for this year’s match between the Chiefs and Steelers, and between the Ravens and Texans are expected to grab a piece of the pie. The company is likely betting that the upcoming games will replicate the record Christmas Day viewership achieved in 2023, which was partially thanks to Taylor Swift’s attendance and support for the Chiefs. This would be a boon for Netflix’s ongoing efforts in matching its ad-supported tier engagement and inventory growth with monetization. While details remain limited on Netflix’s winning bid for the three-season holiday deal with the NFL, it was likely a pricey one. The industry is estimating a 20% to 25% premium on the purchase price for the right to stream the NFL’s Black Friday game in 2023, which Amazon Prime Video (AMZN) had won for $100 million. Yet the 2023 Black Friday games averaged close to 10 million viewers on Prime Video last year, with the 2023 Christmas weekend games drawing close to 30 million viewers. This level of impression is likely to benefit Netflix’s capture of incremental ad dollars later this year, which will be accretive to its earnings and cash flow growth trajectory that is currently underpinning the stock’s prospects.

We believe Netflix’s deepening foray in live sports will be a net positive to the platform’s ongoing efforts in prioritizing engagement, revenue and profit growth. And Netflix’s burgeoning balance sheet is expected to support the strategy, which will complement its measured cash content spend of $17 billion this year on original programming aimed at driving sustained subscriber acquisition and retention.

Specifically, live sports streaming is expected to be a critical gateway in acquiring new subscribers, while a strong content slate within the platform will be key to retention and reducing churn. This will accordingly improve Netflix’s advertising flywheel in the longer-term, whereby its expanded audience reach will reinforce the platform’s appeal to advertisers, and ensuing cash flows will help reinvestments into all of scripted, non-scripted and livestreamed content to drive further viewership gains. And in achieving the advertising flywheel, Netflix will mitigate its exposure to inevitable risks of slowing subscription growth as sign-ups from paid sharing and the newly introduced ad-supported tier start to normalize.

Internalizing Programmatic Advertising

Looking ahead, we believe Netflix’s plan to internalize its programmatic advertising capabilities will be accretive to its financial performance. At its second Upfront presentation in May, Netflix confirmed that it will be migrating from the current advertising technology hosted by Microsoft to an in-house platform by the end of 2025. Prior to that, the company will be expanding its DSP partners to The Trade Desk, Google’s Display & Video 360, and Magnite, alongside Microsoft in the current year. DSPs are key to improving Netflix’s reach to advertisers and capturing ad sales at optimized prices.

In programmatic advertising, DSPs play a key role in bidding on behalf of advertisers when ad inventory impressions match the respective campaign’s needs, such as their budgets and targeted audience. By internalizing its advertising technology platform and expanding its slate of DSP partners, Netflix is expected to extend its reach into prospective advertisers, improve cost efficiencies by “streamlining inventory quotation” for ad placement buyers, and optimize cost per mille (“CPM”) charged via real-time bidding.

Admittedly, Netflix’s advertising business has come out of the gates with a strong ask, charging advertisers as much as $65 per thousand impressions – or triple the average CPM of $22 charged by “prime-time network television”. But those numbers have since declined, which was recently confirmed by Magnite:

We’ve seen some price decline. Obviously, Netflix went out at a very, very high price point. That probably wasn’t sustainable, it was a launch, but so that’s come back down.

Netflix is also competing against incremental inventory from rivals such as Prime Video, which introduced its ad-supported tier by default earlier this year. As a result, the combination of expanding its DSP partners and internalizing its advertising technology platform will be key for Netflix in selling its growing slate of premium ad inventory at optimal market pricing going forward, and improve scalability for both advertisers and the platform itself.

This is corroborated by a similar undertaking recently observed at Uber Technologies (UBER). Specifically, the ride-hailing giant’s proprietary “Journey Ads” platform has recently expanded its DSP partnerships with Google’s Display & Video 360 and The Trade Desk as well, similar to Netflix’s upcoming plans. The new strategy will help Uber further its targeting capabilities and improve “campaign performance measurement” – a key consideration factor for advertisers. Similar to Netflix, Uber also boasts a “predominantly affluent and young” customer demographic. By improving its programmatic advertising technology capabilities, Uber is able to better monetize its high-purchase-intent customer base and first-party data advantage. This accordingly offers a glimpse into the favourable prospects and efficiency gains of Netflix’s upcoming shift in its ad tech capabilities.

Upcoming enhancements to Netflix’s ad tech strategy are also in line with our expectations as discussed in the previous coverage. Specifically, increasing automation of its ad distribution and pricing strategy would be favourable to Netflix, as it improves efficiencies and accessibility for advertisers. We believe Netflix’s expansion of its DSP partners and upcoming internalization of its ad technology platform are a step in the right direction, and potentially precede the future roll-out of additional AI-enabled ad creation and placement tools for advertisers. This would replicate the strategy currently adopted by rival high-growth digital walled gardens like Alphabet’s Performance Max for Google Search ads and Meta Platforms’ (META) Advantage+ for Facebook ads, which have promised favourable scalability and economics for the respective formats.

Taken together, Netflix’s transition to an in-house programmatic advertising technology platform is expected to better complement its leading audience reach in long-form video streaming than current reliance on Microsoft. This will accordingly reinforce Netflix’s capture of secular tailwinds in CTV digital advertising – the fastest growing format with an estimated 18% y/y growth in ad placements this year.

Fundamental Considerations

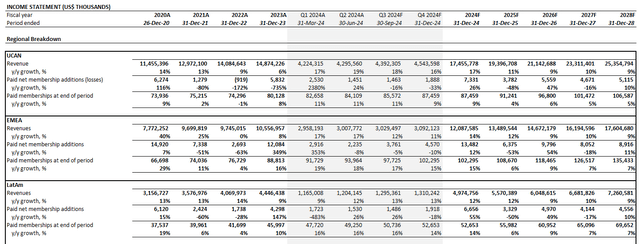

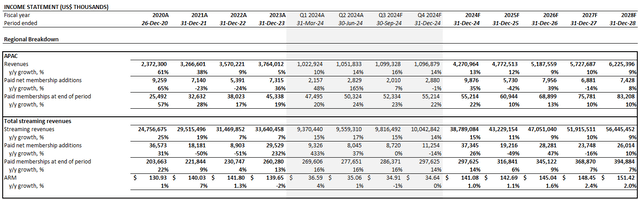

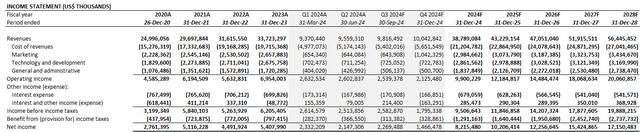

Adjusting our previous forecast for Netflix’s actual 2Q24 results and outlook, as well as growth considerations from the foregoing analysis, we expect the company to grow its revenue by 15% y/y in the current year to $38.8 billion.

Author

Author

Admittedly, incremental growth previously observed from paid sharing contributions are starting to taper off, with Netflix facing a tougher comp in 2H24. This is consistent with management’s expectations for flat net membership additions in 3Q24, as it laps a prior year period that included the first full quarter’s impact from paid sharing contributions. And limited price tailwinds with the roll-out of an ad-supported tier currently preferred by new subscribers remain a near-term pressure on ARM. Specifically, the ad-supported tier currently accounts for more than 45% of new subscriptions, highlighting consumers’ inherent price sensitivity and high tolerance for ads.

Yet Netflix’s strong original content slate for the remainder of the year, alongside several blockbuster livestreaming events capable of garnering a global audience, are expected to bolster ad sales growth. This will be a key accretive earnings growth driver for the company in the near-term and potentially compensate for impending subscription headwinds.

Meanwhile, Netflix’s continued focus on disciplined spend management, alongside an increasing mix shift towards higher margin ad sales are expected to become increasingly accretive to its bottom line. This is consistent with ongoing progress in Netflix’s focus on growing earnings this year, which is evident in its 2Q24 earnings beat and raised operating margin guidance for the second consecutive quarter from 25% to now 26%. This continues to reflect a sustained long-term FCF growth trajectory critical to supporting ongoing investments and Netflix’s valuation prospects.

As discussed in the earlier section, we also believe Netflix’s diversification of its DSP partners and upcoming internalization of its programmatic advertising technology platform will help optimize ad sales in the longer-term. This will in turn be further accretive to its bottom-line performance by bolstering growth in the higher-margin ad revenue stream.

Author

Valuation Considerations

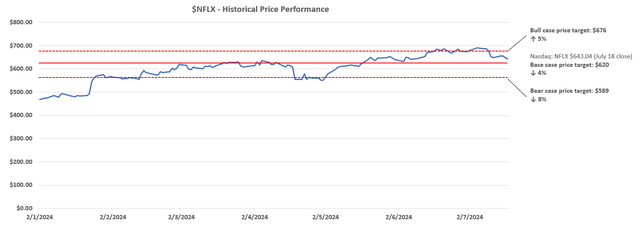

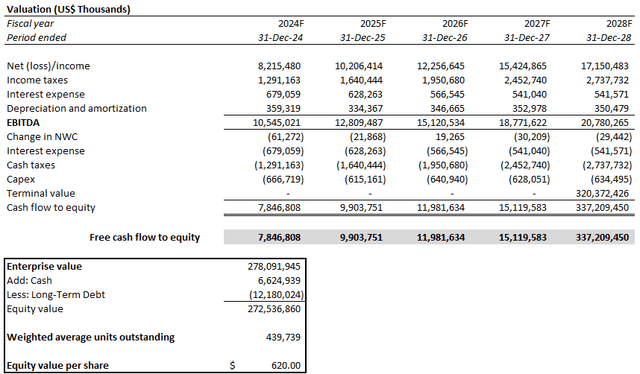

Based on the foregoing fundamental analysis, we are setting a base case price of $620 for the stock.

Author

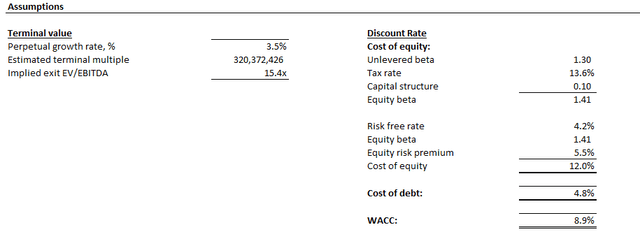

The base case price target is computed based on the discounted cash flow approach. The analysis considers Netflix’s cash flow projections over a five-year discrete period taken in conjunction with the base case fundamental forecast discussed in the earlier section. We have applied a WACC of 8.9%, which is reflective of Netflix’s risk profile and capital structure, to the analysis. A perpetual growth rate of 3.5% is also applied to 2028E EBITDA, which is in line with Netflix’s continued focus on growing engagement, revenue and earnings as it ramps its advertising business to scale.

Author

Author

In order to gauge whether Netflix has further upside potential from current levels, we have performed a sensitivity analysis on its fundamental prospects. In order to reach a valuation of $676 apiece, which would represent a 5% upsurge from current levels, Netflix will be required to deliver a five-year CAGR of 3% to its global ARM, alongside a five-year CAGR of 6% to subscription volume growth.

The anticipated subscription volume growth outlook is reasonable, given Netflix’s global share of TV screen time remains at under 10%, highlighting substantial headroom for further penetration. The addition of an ad-supported tier also effectively expands Netflix’s TAM by better addressing different viewing and price preferences amongst consumers amid rising competition in the streaming marketplace.

However, growing its global ARM at a 3% CAGR over the longer-term may prove to be a greater challenge. This will rely significantly on improved ad monetization, while competition continues to intensify with emerging rivals. Yet management continues to caution that ad sales are not expected to be a key revenue growth driver until 2026 and beyond.

But building a business from scratch takes time – and coupled with the large size of our subscription revenue – we don’t expect advertising to be a primary driver of our revenue growth in 2024 or 2025.

Source: Netflix 2Q24 Shareholder Letter

Admittedly, Netflix’s deepening foray in live sports programming represents an additive growth driver to its growing original content slate, in our opinion. And this costly strategy remains well supported by its strong cash flows and industry-leading profitability. The company’s upcoming internalization of its ad tech platform is also expected to better optimize ad placements and performance measurability for advertisers, complementing secular tailwinds in digital advertising that bests linear TV formats in traditional media.

Looking ahead, Netflix still has several levers up its sleeve to drive incremental ARM expansion. This includes potential price increases as Netflix continues to improve its content slate and adjacent value to subscribers through gaming. Recall management’s recent acknowledgement that the company has not “taken pricing in most countries for the past two years”, which leaves room for potential price changes as “overall improvement in the value of [Netflix’s] service” continues. Other key drivers to subscriber base monetization include accelerating ad sales. We believe this will build on Netflix’s ability in providing more globally attractive content, whether that will be original blockbusters like Squid Game, and/or further inclusion of prime-time event livestreaming (e.g. sports leagues finals, world series sporting events, global award shows, etc.).

Yet substantial execution risks remain that could slow Netflix’s sustained pace of ARM expansion at an elevated CAGR. Historically, Netflix has grown ARM at a modest pace that underperforms economic expansion in its core operating regions. Much of its revenue growth in recent years has been supported by subscription volume gains in higher-priced regions. Netflix’s growth drivers have also become increasingly complex, as the platform introduces a diverse mix of pricing and plans, alongside differing member features across different regions. This is consistent with management’s decision to stop reporting ARM and subscription volume metrics starting in 2025, as they become less reflective of Netflix’s forward state of business.

We believe Netflix faces imminent risks that will continue to keep monetization of its growing subscriber base at a modest rate:

Competition: Intensifying competition both at home in the U.S. and overseas remains the greatest headwind to Netflix. Specifically, Asia remains a key subscription volume growth driver. Yet the region continues to show a growing preference for low priced local streaming platforms due to greater availability of local content. This accordingly raises risks of a price war and, inadvertently, lower monetization for Netflix.

Specifically, Netflix’s APAC region already exhibits a substantially lower ARM than its other markets. And subscription prices charged in the region have also shown signs of decline in response to rising competition from local streaming platforms – particularly in high demand regions like India, Indonesia and Thailand.

Yet that pairs with Netflix’s growing investments into both original and licensed local content, highlighting how vying for market share in the region could continue to weigh on growth. Since Netflix’s entry to the Asian market in 2015, the company has spent more than $2 billion on more than 220 original titles and licensed local content. And the company has promised to double down on APAC investments in a bid to better penetrate growth opportunities in the region.

In recent years, Netflix has also contemplated the idea of potentially introducing free advertising supported streaming television (“FAST”) to better capture growth opportunities in the Asian market. While this could be one way to beat competition for eyeballs critical to fuelling ad sales, partaking in FAST could potentially deviate from Netflix’s focus on providing quality and engaging content. Specifically, FAST platforms have historically been synonymous with older, low demand content with exposure to viewers with a lower buying intent. And there is already plenty of competition in that space, which risks thwarting returns on Netflix’s existing investments in Asian markets. This accordingly leaves limited respite for Netflix in realizing cash flow accretion from the high-growth Asian markets in the near-term, as it continues to ramp monetization of substantial investment outlays for local content development.

Regulatory Constraints: In addition to intensifying competition, Netflix also faces adverse regulatory changes overseas. In the latest development, the Canadian Radio-Television and Telecommunications Commission (“CRTC”) has announced a requirement for streaming platforms to contribute 5% of their Canadian revenues towards the Canadian broadcasting system beginning the 2024 to 2025 tax year. While Netflix lumps its North American disclosures into the “UCAN” segment, and does not separately disclose its subscription revenue generated from Canada, it is currently estimated that its Canadian operations consist of close to 20 million subscribers. This translates to a quarterly revenue run-rate of more than $1 billion based on its latest UCAN results, with 5% of which equivalent to an annualized levy payable to the CRTC of $200 million.

The incremental cost headwind is further pressured by similar measures currently contemplated by other core overseas regions, including the Philippines. Specifically, the region has recently approved a bill that will potentially result in a 12% value-added tax on foreign digital services that include streaming platforms like Netflix. The proposed levy aims at better supporting local digital service developments, highlighting Netflix’s rising exposure to adverse headwinds in its foreign operations.

Changes in Industry Dynamics: As discussed in the earlier section, pricing changes remain a potential lever to pull in Netflix’s continued search for better monetization options. Yet the broader streaming industry has been showing signs of consolidation in recent years, as rapidly increasing choices are being met with growing uncertainties to how many platforms can consumers reasonably absorb.

In addition to mergers like Warner Bros. Discovery (WBD), or platform combinations like Paramount+ and Showtime (PARA / PARAA), streaming platform operators have also been increasingly attracted to bundling as a means to reduce churn. The latest includes the “StreamSaver” package offered by Comcast, which combines Peacock, Netflix and AppleTV+ for $15 a month, which represents a 30% discount to single subscriptions. Disney (DIS) also offers a trio bundle that combines Disney+, ESPN+ and Hulu for a discounted price. The entertainment giant has also recently partnered with WBD in introducing a bundle that combines Disney+ and Hulu with Max this summer for $20 a month, which represents a substantial discount to individual purchases aimed at capturing demand within the increasingly competitive marketplace.

Outside of streaming partners, Netflix also works with telco carriers like Verizon (VZ). In the latest update, Verizon will be offering Netflix premium subscriptions at no additional cost to its unlimited plan members that have opted into a one-year Peacock Premium add-on perk for $79.99. This adds on to Verizon’s existing offering of a Netflix and Max with ads add-on for its unlimited plan members at $10 per month.

These bundling dynamics are likely to drive incremental pricing headwinds to Netflix as it looks to acquire and retain market share.

Lacking Ad Muscles: The combination of intensifying competition, regulatory headwinds, and adverse industry pricing dynamics accordingly intensifies urgency for Netflix in ramping monetization for its ad strategy. As discussed in the earlier section, Netflix continues to “under-monetize” its growing ad inventory, with its premium CPM to industry’s having declined since launch.

More importantly, despite Netflix’s industry-leading reach in streaming, advertisers have raised concerns that the platform has been “slow to scale”. While the company has rolled out its ad-supported tier swiftly and smoothly with robust adoption from consumers, advertisers remain skeptical of its ability to accelerate growth of its limited reach relative to rivals like WBD and Disney, which have participated in online video advertising for years.

Yet Netflix continues to charge a premium CPM to advertisers. While Netflix has reduced its CPM from the $60 range to about $40, it remains a substantial premium to the $20 average rate observed at peers today. This accordingly leaves much work for Netflix to do in ramping up its reach and engagement levels to match its ambitions for raising CPM further. Given the barriers to becoming a breakout contender for advertisers looking for placements on streaming platforms, Netflix will likely be required to step up near-term investments in content capable of capturing a global audience. These include further penetration into livestreaming sporting events, in addition to original content investments, which could weigh on near-term cash flows and elevate execution risks ahead.

Final Thoughts

On a net basis, we believe there is limited room for Netflix in sustaining further valuation gains from current levels. Despite its latest earnings outperformance, near-term growth optimism stemming from incremental ad monetization and market share penetration has likely already been priced into the stock’s current premium.

Admittedly, Netflix has stepped up its implementation of growth accretive measures, such as the internalization of its ad tech platform and deepening its participation in livestreaming sporting events. But looking ahead, Netflix remains exposed to incremental execution risks as it continues to ramp its ad strategy amid intensifying competition, and evolving industry and regulatory dynamics, which will continue to outweigh potential for further valuation gains in the near-term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.