Summary:

- Much of Broadcom Inc.’s rally this year has been buoyed by market confidence in its competitive advantage in custom ASICs and networking solutions, which are critical in AI infrastructure.

- But the stock’s post-earnings pullback reflects concerns pertaining to the uncertain recovery timeline for Broadcom’s non-AI segments, which still account for the bulk of its business.

- The infrastructure software segment also faces impending risks of maturation, which limits margin expansion and cash flow improvement needed to address the elevated debt exposure acquired from VMware.

- This leaves little durability to the stock’s current valuation.

JHVEPhoto

Broadcom Inc.’s (NASDAQ:AVGO) selloff in response to its lighter-than-expected F4Q revenue guidance has largely overshadowed the company’s beneficiary position amid burgeoning AI momentum. This is consistent with a broader trend observed in the latest earnings season, whereby AI beneficiaries have been punished for falling short of or not significantly exceeding lofty expectations. Specifically, the recent selloff in semiconductor stocks indicates growing investors’ angst over the durability of an elevated AI spending environment, especially as monetization means remain uncertain.

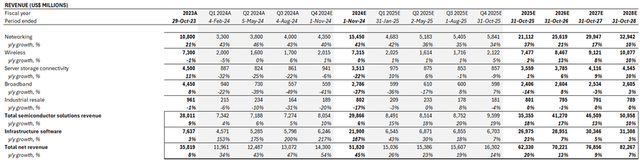

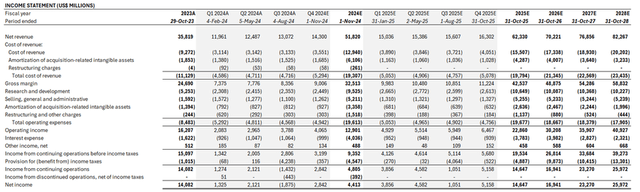

Yet, Broadcom continues to demonstrate strength in capturing emerging AI opportunities. The company grew revenue by 47% y/y to $13.1 billion, while adjusted EBITDA margin expanded by more than three percentage points sequentially to 63%. AI contributions remained a bright spot. Revenue was generated from the sale of supporting Ethernet networking and custom ASICs, likely having topped $3 billion exiting F3Q. Management has subsequently raised the full year FY 2024 AI revenue outlook to $12 billion, up from the previous projection of $11 billion.

However, the company risks facing an extended slump in Broadcom’s non-AI segments. Specifically, the company guided F4Q revenue of $14 billion, falling short of the average Wall Street estimate of $14.13 billion. In addition to the slower-than-expected cyclical recovery in demand for Broadcom’s non-AI products, a deeper dive also shows potential moderation in infrastructure software sales going forward. This is further exacerbated by the heavy debt burden that Broadcom has taken on following its acquisition of VMware last year.

Although management has reiterated confidence in the durability of Broadcom’s long-term AI growth opportunities and recovering strength in non-AI segments, resurfacing recession fears may also pose as an added multiple compression risk. The company also has substantial revenue exposure in China. This inherently increases its subjection to evolving regulatory implications that could have an adverse impact on its fundamental outlook. Taken together, Broadcom’s execution risks remain an immediate overhang on the stock’s performance, casting doubt on the durability of its current valuation premium.

Pigeon-Holed AI Tailwinds?

Broadcom’s AI revenue contributions have remained in the spotlight during its latest earnings call. Management had continued to laud on industry’s resilient demand environment for Broadcom’s Ethernet networking solutions, which are critical for stringing up to hundreds of thousands of GPUs together in forming AI systems.

The company has also deepened its foray in serving hyperscalers’ growing demand for custom ASICs – or in-house designed processors. Key customers include Google (GOOG, GOOGL), which has partnered with Broadcom in designing its Tensor Processing Units, and Meta Platforms (META), which relies on Broadcom for networking solutions and in developing its latest in-house Meta Training and Inference Accelerator (“MTIA 3”).

Compute solutions currently account for two-thirds of Broadcom’s AI sales, while networking solutions account for the remainder. And continued strength in uptake for Broadcom’s AI products have underpinned management’s decision to raise relevant full-year revenue contributions to $12 billion, up from $11 billion previously.

Yet, Broadcom’s limited exposure to other emerging pockets of demand for AI hardware – particularly the enterprise sector – could cap its outlook. While Nvidia (NVDA) has recently indicated that its improving supplies will broaden GPU access for both hyperscalers and enterprise end-markets, Broadcom has reiterated that its participation in servicing the latter segment is nominal.

But see, we do not focus very much on enterprise AI market as you know well. Our products in AI are largely, very much largely focused, especially on the AI accelerator or XPU side, but even — also just as much on networking side, on hyperscalers, on cloud, those three large platform and some digital natives, what you call, big guys. We don’t deal very much on AI with enterprise.

Specifically, Broadcom currently leads in the manufacturing of custom AI accelerators – or XPUs – for cloud service providers (“CSPs”), and does not compete in the merchant GPU market in which Nvidia dominates. And Broadcom’s limited participation in enterprise opportunities is primarily due to the substantial investment outlay required in the making of custom processors. Only hyperscalers have the economical means and scale to offer instances run on custom processors.

Broadcom currently commands about 60% of the custom ASICs market, which is estimated to be a $20+ billion opportunity. This is expected to expand further at a 7% CAGR through the end of the decade. Yet, these represent nominal figures still when punt against Nvidia’s data center revenue alone, which is expected to top $100 billion by the end of the year.

Meanwhile, Broadcom’s CEO, Hock Tan, has recently reiterated his confidence in the custom ASICs opportunity stemming from rising AI developments. In fact, he believes that custom ASICs will overtake general purpose GPUs in supporting AI workloads over the longer-term. The intuition for his belief is that custom ASICs offer better performance per watt and, inadvertently, improved TCO over merchant GPUs. While it may be expensive and economically irrational for enterprise markets to engage in the development of custom silicon, the top CSPs have the financial capability and scale in offering instances run by in-house designed XPUs.

And his rationale is not entirely false. Many hyperscalers have flocked to in-house designed silicon to optimize internal training and inferencing workloads, while also offering customers an alternative. Yet general purpose processors remain the holy grail, given flexibility and compatibility considerations. This makes it difficult to fathom a reality in which XPU instances would dominate their general-purpose counterparts, dimming expectations for an outsized AI revenue growth outlook at Broadcom.

Although hyperscalers are becoming increasingly receptive to building custom silicon, a mixed portfolio with general purpose and merchant processors is still preferred. And this is further corroborated by recent comments from Amazon (AMZN) and Google during the annual Goldman Sachs Communacopia and Technology Conference:

From there, kind of built up this expertise, and we launched our very first processor chip called Graviton and that has been a wild success…And so many of our customers to — get 40% to 50% price performance gains while also using less power and improving their carbon footprint using Graviton…Then about 5 years ago, we saw the opportunity to innovate in AI processors as well. And by the way, obviously, I’m not sharing any secrets here, NVIDIA makes a very, very, very good processor, it’s quite popular, it has done quite well. And AWS is the best place to run NVIDIA-based GPU workloads…And so we have a great partnership together and we really need them together. And we think that there are some use cases where our own custom processors can help customers save money. The very first one we launched was called Inferentia. And it was very focused on inference…Alexa, moved all of her inference to Inferentia and save 70% versus doing it on a standard GPU part…And so not all workloads will work better on our own processors, but we feel very bullish about the opportunity there.

Source: Amazon, 2024 GS Communacopia and Technology Conference.

Midjourney, a leader in AI foundation models, trains in our TPU, serves on NVIDIA GPUs, both in our cloud. It’s an example of having that diverse portfolio allows them to choose the best combination across the platform.

Source: Google, 2024 GS Communacopia and Technology Conference.

Taken together, Broadcom’s serviceable addressable market in AI compute looks restrained. Although AI workloads will improve long-term demand for custom ASICs and buoy additive growth for Broadcom, the opportunity will likely remain substantially inferior in size when compared to merchant processors. This is corroborated by current industry estimates for total Broadcom AI revenue to jump from $12 billion estimated for 2024 to the $15 billion range in 2025, which is a modest increase. And the figure remains a far cry from the eye-watering extent of data center sales and resulting earnings that Nvidia has capitalized to date on AI momentum.

Albeit an unmatched leader in addressing the rise of demand for custom AI processors, Broadcom’s market share remains second to dominant merchant GPU makers by a wide margin. This will likely underpin a tempered outlook for the stock at its current premium, as Broadcom’s share of AI compute opportunities is restrained.

Non-AI Prospects Remain Uncertain

Meanwhile, Broadcom’s non-AI offerings remain a drag on its results. Outside of AI momentum observed in resilient networking product sales, the latest results from Broadcom’s other semiconductor solution offerings have either only demonstrated a modest recovery or remained in a slump.

However, management remains optimistic that there is no reason the emerging cyclical recovery will not take Broadcom’s non-AI segments back to peak level performance. This is largely due to industry’s increased demand for bandwidth and compute to support data-intensive workloads, especially given accelerating AI developments.

But the uncertain materialization timeline continues to be an immediate overhang on both Broadcom’s fundamentals and, inadvertently, its valuation prospect. Although management has disclosed 20% y/y growth in non-AI semiconductor bookings during Q3, the amount recognizable within the near-term likely remains nominal.

This is reflected in Broadcom’s modest guidance for Q4, with revenue projected at $14 billion and missing the midpoint consensus estimate of $14.13 billion. Its exposure to protracted softness in non-AI segments is particularly evident in limited near-term broadband deployments, as telcos remain in a curtailed investment cycle. Despite previous resilience in the automotive vertical, recent alarms of slowing demand raised by industry peers could also be an added headwind to Broadcom’s industrial resales business.

Meanwhile, Broadcom’s wireless sales is expecting some near-term relief due to its largest customer, Apple’s (AAPL), debut of the iPhone 16. But ensuing sales are also unlikely to break out of typical seasonality trends due to deflating optimism over Apple’s impending AI upgrade cycle for the iPhone.

More importantly, Broadcom’s revenue mix has a substantial China exposure. About a third of its revenue in 2023 were generated from China, which remains stable from the preceding year despite tightening export curbs ordered by the US government. This suggests that the bulk of Broadcom’s China revenues are generated from non-AI product sales, since the export curbs target advanced node processors such as its XPUs and networking solutions. Considering extended macro weakness in the region, Broadcom’s elevated revenue exposure in China could be an added headwind to its non-AI business’ recovery outlook.

Underappreciated Software Woes

Despite signs of strong VMware integration, supported by the 32% sequential increase in annualized booking value and spending improvements, a deeper dive into the infrastructure software segment’s economics suggest looming moderation.

Recall that management had previously targeted a $4 billion quarterly revenue run rate at VMware, with focus on transitioning the business from a perpetual license revenue model to a subscription-based revenue model. Meanwhile, in the latest earnings call, management also confirmed that non-VMware software revenue has “reached a level of stability” at the $2 billion quarterly run rate.

Now considering management’s guidance for Q4 infrastructure software revenue at $6 billion, and expectations for non-VMware revenue at the $2 billion range, this would imply VMware revenue of about $4 billion exiting FY 2024. The guidance suggests that the newly integrated VMware business might already be nearing its targeted steady-state quarterly revenue run rate. The anticipated moderation is further corroborated by the steep implied sequential growth slowdown in VMware revenue contributions, from +40% q/q in Q3 to +11% q/q in Q4.

Looking ahead, management continues to expect the infrastructure software business’ long-term growth outlook to stay dependent on VMware performance, nonetheless:

But on the non-VMware revenue, on software revenue, I think we’ve reached a level of very clear stability. And what we are looking towards more is how VMware picks up over the next several a year and 1.5 years.

This is likely to stall margin expansion at scale within the infrastructure software segment, given its moderate long-term growth outlook. Any near-term margin improvements are likely to come out of post-integration cost synergies instead, which is also already tempering.

Specifically, management targets a quarterly spending run rate of $1.2 billion for VMware post-integration, down from $2.3 billion before the acquisition. The company had already driven that figure down to $1.3 billion by the end of Q3, highlighting a stabilizing cost structure ahead. This is consistent with management’s expectations for the infrastructure software segment’s 90% gross margin to persist at similar levels going forward.

With limited margin expansion and moderating topline growth from the infrastructure software segment, it is unlikely to be a key driver of Broadcom’s cash flows and valuation post VMware integration. This accordingly portrays an unfavorable unit economics set-up, especially given the substantial debt burden and cash interest expense that Broadcom has acquired from the VMware transaction.

Fundamental Considerations

The combination of margin dilutive AI revenue growth, and limited expansion of scalable non-AI and infrastructure software sales is expected to restrain Broadcom’s near-term earnings trajectory. And the resulting pressure on cash flows suggests the stock will unlikely experience a major uplift from current levels.

Adjusting our previous forecast for Broadcom’s actual F3Q24 results and forward outlook, we expect the company to expand revenue by 45% y/y to $51.8 billion in FY 2024. Networking unit sales within the semiconductor solutions segment will remain the company’s primary growth driver. This is consistent with strong monetization of AI opportunities in custom ASICs and networking solutions.

Meanwhile, we expect limited margin expansion in the next 12 months. The assumption is driven primarily by the increasing mix shift towards margin dilutive AI sales, and limited growth acceleration in the said product segment to unlock substantial economies of scale benefits. This is further exacerbated by stabilizing growth and profit margins in the infrastructure software segment, and limited scale from the slow recovering non-AI semiconductor business, which precludes prospects of material operating leverage improvements.

Valuation Considerations

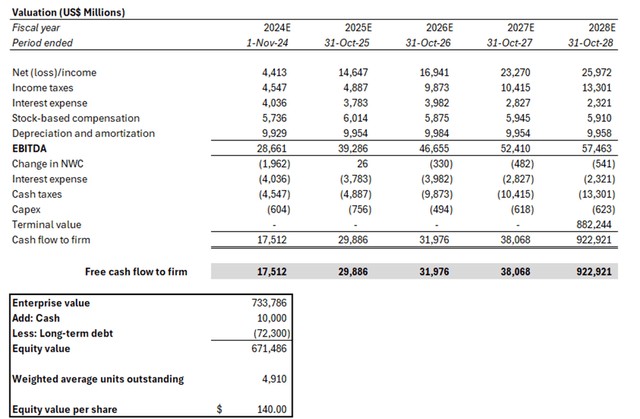

Based on the foregoing analysis, we are updating our price target for Broadcom to $140 (previously $170).

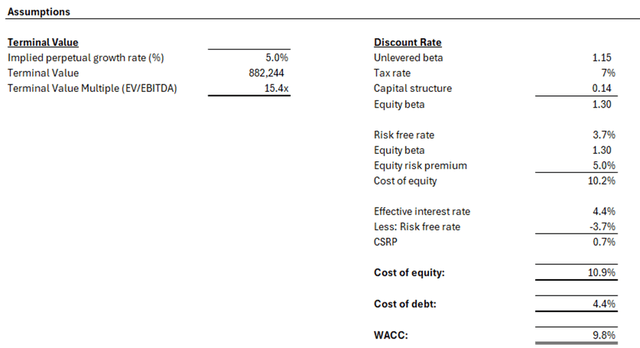

The price target is derived from the discounted cash flow (“DCF”) approach. The analysis considers cash flow projections taken with our updated fundamental forecast for Broadcom discussed in the earlier section. The DCF analysis considers a 9.8% WACC in line with Broadcom’s capital structure and risk profile. Although Broadcom has recently restructured its debt profile by increasing the portion of fixed rate borrowings at an attractive rate of 3.6%, its substantial net debt position remains an added pressure on the stock’s upside potential.

An implied perpetual growth rate of 5.0% is also considered in the analysis and applied to FY 2028E EBITDA to determine Broadcom’s terminal value. The valuation assumption is consistent with the application of a 3.5% perpetual growth rate on projected FY 2033E EBITDA when Broadcom’s growth profile, particularly pertaining to emerging AI opportunities, is expected to stabilize.

Final Thoughts

Admittedly, Broadcom’s unmatched leadership in custom ASICs and Ethernet networking solutions remains a key competitive advantage for the company amid emerging AI compute opportunities. Yet, its latest earnings results indicate that relevant prospects remain insufficient in overshadowing the immediate reality of a moderating growth outlook in its non-AI semiconductor solutions and infrastructure software businesses. This is in stark contrast to what has been observed at industry peer Nvidia, which has benefitted from breakneck GPU sales and profits that have overshadowed mediocre performance in the comparatively nominal adjacent segments.

The set-up goes to show how Broadcom’s fundamental strength is unlikely capable of supporting the stock’s premium at current levels. Although AI capex deployments from Broadcom’s core hyperscaler customer cohort remain resilient, the company’s restrained exposure to the broader AI hardware TAM remains a disadvantage. This couples with a slower-than-expected recovery outlook for Broadcom’s non-AI segments, and a potentially moderating growth outlook in the infrastructure software business post VMware integration. Taken together with its newly acquired debt burden, we believe execution risks are emerging in Broadcom’s narrative.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.