Summary:

- Semiconductor industry stocks, led by Nvidia, have been rallying since January 2023. However, the recent tech sell-off has raised concerns.

- Although AMD has lagged behind some of its competitors, it has still been a significant beneficiary of increasing AI investments.

- Concerns about overspending on AI and the potential for a decline in AI spending by big tech companies have pressured AMD stock. These concerns are not entirely unjustified.

- Given the stock price that doesn’t appear undervalued, AMD receives a “Hold” rating.

sankai

Introduction

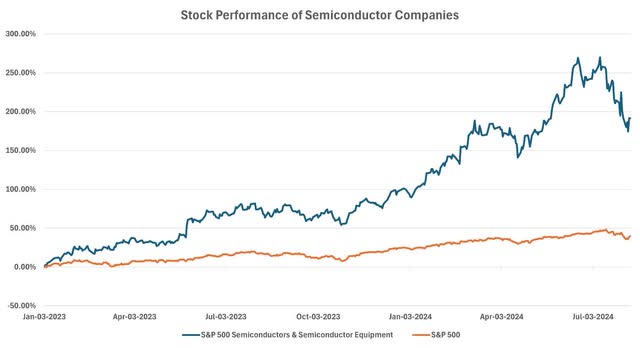

It was difficult to lose money in the semiconductor industry until very recently. Stocks have been rallying over the last year, with Nvidia (NVDA) leading the way for other players. The sector has become almost too hot and made investors hesitate before touching any of these names.

The recent tech sell-off might have changed the story. Valuations still seem expensive, but some investors view this decline as an investment opportunity. The long-term potential of these companies is huge, although they may face short-term headwinds.

One of these companies is Advanced Micro Devices (NASDAQ:AMD). Similar to Nvidia, it offers CPUs, GPUs, and other processors to data centers, enterprise clients, and consumers. Despite the concerns around “losing that AI race”, it has benefited significantly from technological developments as one of the leading suppliers.

There are many positive developments including market share gains, sustained high demand, and strong guidance. However, the current valuation implies that the expectations are too high. The stock doesn’t appear undervalued and might decline significantly if AI spending by big technology companies drops.

I believe the risk-reward profile is not worth it. Therefore, AMD gets a “Hold” rating.

Business Description

As a well-known company, AMD may not need an introduction. However, I like to go over the business fundamentals.

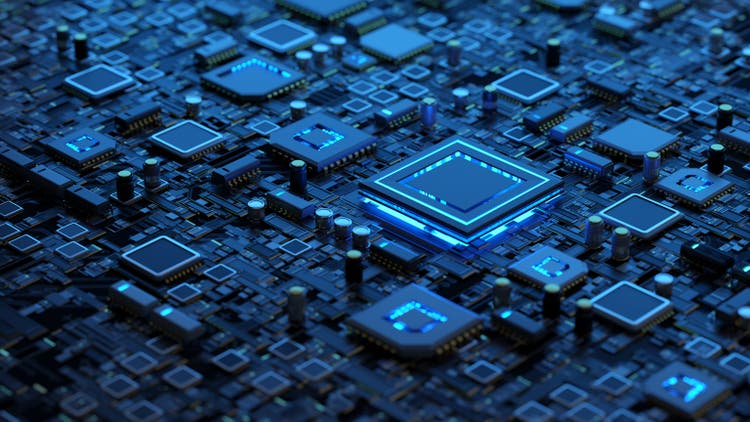

Advanced Micro Devices is a global semiconductor company, specializing in processing units. It offers CPUs, GPUs, accelerated processing units, data processing units, AI accelerators, and more. The company has four reportable segments, which are also its end markets.

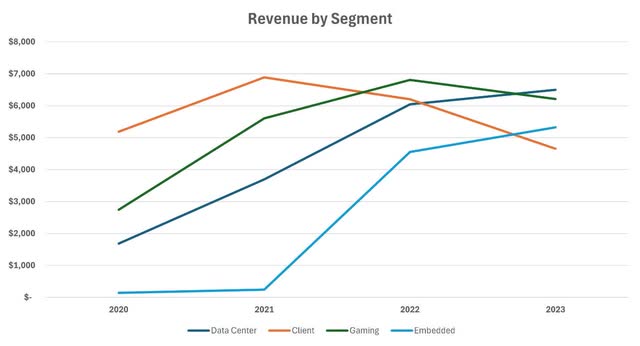

Historically, its largest end market was Client, where it sold CPUs incorporated into computing platforms. These are different enterprises that need AMDs solutions to build their own computing systems. Although revenue surged in 2021, it has been declining since.

With this decline, Gaming became the largest segment. It provides graphics processing solutions that increase the speed of rendering images. AMD benefited greatly from the surge of demand post-pandemic. People were stuck at home, and demand for gaming picked up. As new games with better graphics were released, consumers needed better computers, which had AMDs chips in them.

However, this surge in demand was also short-lived. Now, the focus has shifted to artificial intelligence and data centers, and for good reason. As the need to store and process data increases thanks to the developments in artificial intelligence, data centers need more chips that are specifically designed for machine learning and artificial intelligence purposes. Nvidia might be the first supplier that comes to mind, but AMD also benefited a lot from this surge. Revenue from data center demand increased significantly since the pandemic. This was the largest segment in terms of revenue in FY23.

While the revenue mix has been shifting from client to first Gaming and then to Data Center, the Embedded segment has grown considerably largely due to the Xilinx acquisition in 2022. This segment includes embedded chips that are used in various end markets including automotive, industrial, test, medical, aerospace and defense, networking, and security. As companies develop increasingly sophisticated technologies, the demand for more advanced chips grows.

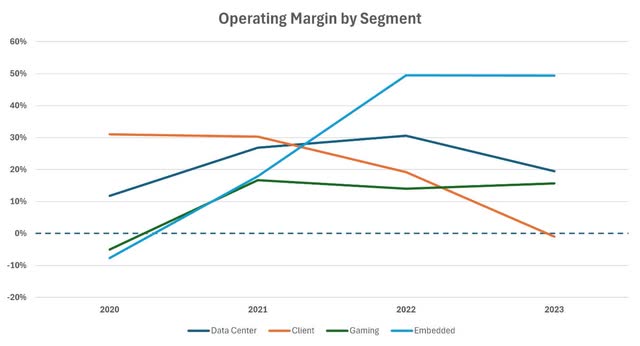

The charts below show the change in revenue and operating margin by segment. Currently, the most profitable segment by far seems to be Embedded.

Additionally, here is a summary of the products provided through these four segments.

AMD Q2 2024 Earnings Presentation

Concerns Around Overspending and The AI Race Have Pressured The Stock

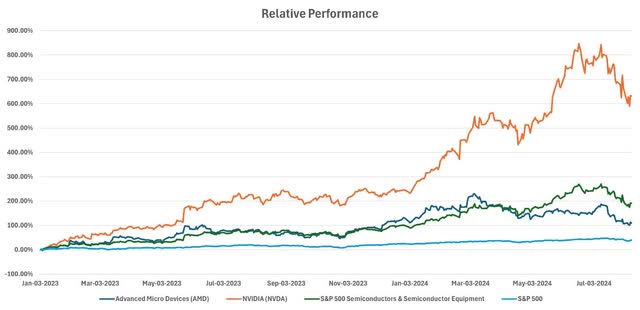

The stock has surged more than 200% between October 2022 and March 2024. However, it has declined by around 32% since then. This drop can be attributed to certain company-specific factors and industry-wide trends.

Let’s talk about the industry first. Semiconductor companies have been performing very well since the beginning of 2023. The S&P 500 Semiconductors Index is up nearly 200%, while the S&P 500 is only up 39% over the same period.

However, this semiconductor index is down 15% since July 2024, indicating that the market may be concerned about the future of these companies. This was one of the reasons for the big tech sell-off we have been seeing.

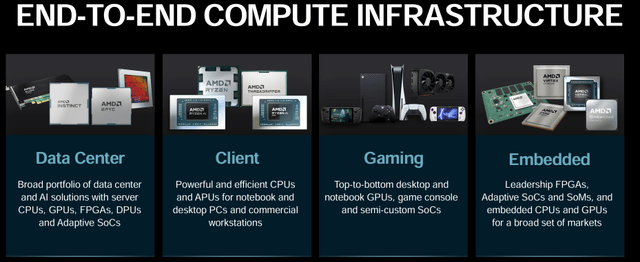

The market is worried that technology companies may have overinvested in artificial intelligence and that this significant CAPEX may not be translating into earnings. Top technology companies like Alphabet (GOOGL), Microsoft (MSFT), and Amazon (AMZN) have been the largest investors in artificial intelligence infrastructure thanks to their strong balance sheets. If these companies begin to doubt the potential of AI as a major earnings driver, they may cut their spending, which would decrease demand for AMDs products.

Additionally, the weakening consumer may eventually impact big tech companies like Amazon, potentially leading them to cut AI spending. If AI CAPEX normalizes, growth projections for Advanced Micro Devices could be revised downward.

Furthermore, some analysts and investors believe that AMD has been losing the AI race. Although the stock has overperformed the S&P 500 since 2023, it significantly underperformed Nvidia and the rest of the semiconductor space. The market is not wrong in thinking that it has not benefited from AI to the same extent as Nvidia.

Although there is some truth to these arguments, currently, the short-term outlook seems more positive for the company.

Short-Term Trends Are Not All That Bad

Let’s examine if the market is right in being concerned about the issues mentioned above.

Firstly, overspending is a valid concern. Although the possibilities with AI might be huge, it is not easy to monetize. I discussed the question “Is AI a product or a feature?” in a recent article. The answer to this question may vary depending on what the company is trying to achieve with AI, but the truth is that companies have yet to successfully monetize it so far.

Apple’s (AAPL) new AI features are nice but are probably not resulting in a massive increase in sales, Microsoft is yet to introduce a product that will significantly drive earnings, Meta’s AI hasn’t achieved the popularity of ChatGPT, and Google’s initiatives seem to produce similar results as those of Apple’s. This is not promising for the future of AI investments. Unless these companies find a way to monetize AI effectively, they might reduce their spending.

This hasn’t been the case so far. Despite concerns, big tech continues to invest in AI. Goldman Sachs predicted that big tech companies will spend over $1 trillion on artificial intelligence in the next five years, and these companies have told investors that the spending will continue.

sherwood.news

Despite the ongoing hype around AI, I believe if these companies fail to properly monetize it to drive earnings higher soon, the overinvestment in AI will become a bigger issue in the eyes of investors. It doesn’t seem likely in the short term, but there is a chance this spending will decline and so will the demand for AMDs products for data centers.

Secondly, it is a fact that AMD did not achieve the growth numbers Nvidia did. However, now, it seems to be increasing its share in the chip market. The latest reports suggest that the company is among the winners in the consumer electronics space. Although this may not be as exciting as data centers, this market share gain may be one of the catalysts for investors, boosting the stock’s performance to align more closely with the rest of the semiconductor industry.

Finally, the company announced strong quarterly results in Q2 2024. The company slightly beat revenue and EPS estimates. Year-over-year revenue growth in data center and client segments was impressive and management appeared happy with the results. Non-GAAP gross profit was up 16% and operating income was up 18% year-over-year. AMD has announced new gen products and innovations.

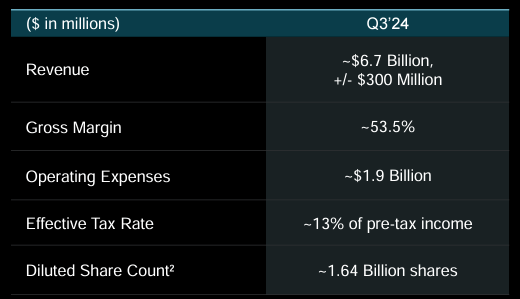

Additionally, the company initiated Q3 guidance. Management expects revenue to be around $6.7 billion vs. the consensus of $6.6 billion, and Non-GAAP gross margin is expected to be around 53.5%, flat from Q2.

AMD Q2 2024 Earnings Presentation

On the downside, gaming and embedded revenue were down significantly as the decline continued.

Overall, it seems like the market had mixed feelings about the results, as the stock is down 1% since earnings were released.

Valuation

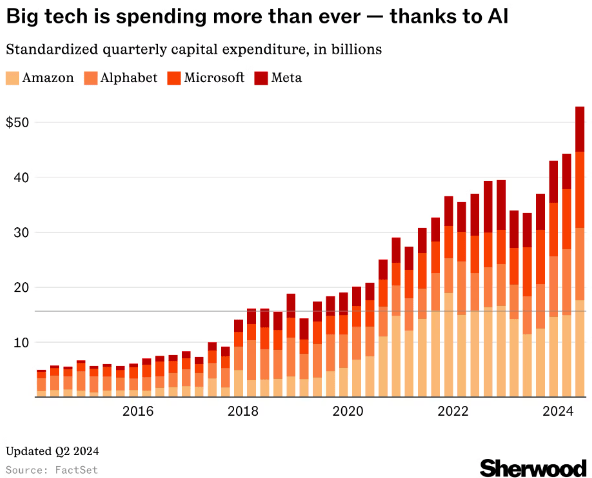

I will be using the DCF method to calculate the fair value of the company.

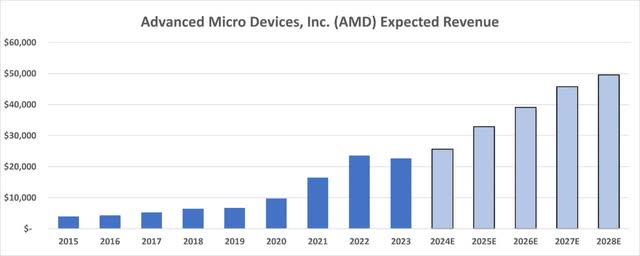

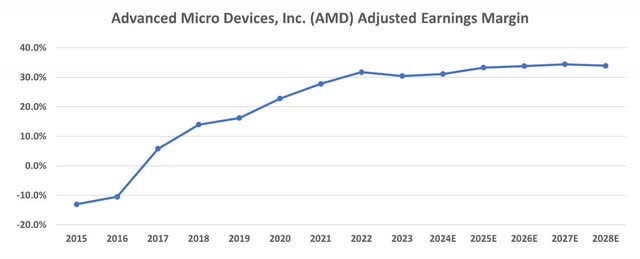

I believe my assumptions are relatively optimistic. For this valuation, I am pricing in continued strong revenue growth and sustained high earnings margin.

S&P Capital IQ & Author S&P Capital IQ & Author

For the DCF model, I am using a terminal growth rate of 3%, slightly above long-term inflation targets, a long-term risk-free rate of 2%, a market risk premium of 5.7%, and the stock’s 5-year equity beta.

I handle cash differently. I believe shareholders have a claim on excess cash, but cash that will be used for operating expenses during the year should not be included in the valuation. That portion of cash is operating that investors cannot claim.

Using the assumptions above, we find an equity value of $185 billion, translating to a target share price of $113.21. This implies a 17% downside at the time of this article’s writing.

Conclusion

As I mentioned in the introduction, the semiconductor space has been generous to investors thanks to the advancements in AI and investments in data centers. Although consumers seem to be weakening, spending on AI continues, and chip designers continue to benefit.

Advanced Micro Devices has been benefiting from this trend, although not to the extent as Nvidia. The market has been concerned about the competitive AI race, potential overspending on AI, and the possibility that this spending will decline, hurting AMDs sales.

Although these companies seem to continue investing in AI, they need to start monetizing these investments to sustain this level of spending. AMD announced strong results for data center solutions for now, and I would expect this to continue for at least another quarter, but we will need to track the AI CAPEX in upcoming quarters.

Although I believe AMD has a strong position in the industry and may continue to benefit from this AI CAPEX, the market has very high expectations from the company. Even with sustained high revenue growth and high earnings margin expectations for upcoming years, the stock price seems overvalued.

That is why Advanced Micro Devices receives a “Hold” rating. I will keep tracking the AI spending and its impact on the company and may revise this rating accordingly in the future. For now, I believe investors should be cautious.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.