Summary:

- A list of high-quality dividend-growth stocks trading near 52-week lows is evaluated based on historical and future fair values.

- Nike appears to be attractively valued and trading near 52-week lows.

- The current risks facing NKE appear to be manageable, and the fundamental business is well positioned for continued growth.

- UPS and Chevron also appear to be trading at a discount to both historical and future fair value estimates, making them attractive candidates for further investigation.

brunocoelhopt

Introduction and Background

You would think with all the hoopla around the recent market corrections that there would be an abundance of bargains just ready for the willing investor. Based on the valuations of the high-quality dividend growers that I regularly monitor; I still feel like the bulk of the market is above fair value. That doesn’t mean there aren’t opportunities, though, which we’ll dig into in this article.

On top of regularly calculating fair values for my watchlist, one of my favorite ways to look for value in this high-quality dividend growth space is to screen for those stocks trading near 52-week lows. I decided to filter my watchlist by companies that are trading at less than 30% of their 52-week range (52-week low being 0% and 52-week high being 100%).

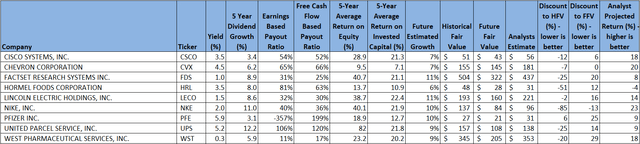

Using this first pass criteria, we will be looking at the following list of companies:

Finbox, Seeking Alpha, Author’s Analysis

Fair Value Estimation

As I’ve described in previous articles, I like to calculate a fair value in two ways, using a Historical fair value estimation, and a Future fair value estimation. The Historical Fair Value is simply based on historical valuations. I compare 5-year average: dividend yield, P/E ratio, Schiller P/E ratio, P/Book, and P/FCF to the current values and calculate a composite value based on the historical averages. This gives an estimate of the value assuming the stock continues to perform as it has historically. I also want to understand how the stock is likely to perform in the future so utilize the Finbox fair value calculated from their modeling, a Cap10 valuation model, FCF Payback Time valuation model, and 10-year earnings rate of return valuation model to determine a composite Future Fair Value estimate.

I also gather a composite target price from multiple analysts including Reuters, Morningstar, Value Line, Finbox, Morgan Stanley, and Argus. I like to see how the current price compares to analyst estimates as another data point, and as a sanity check to my own estimates.

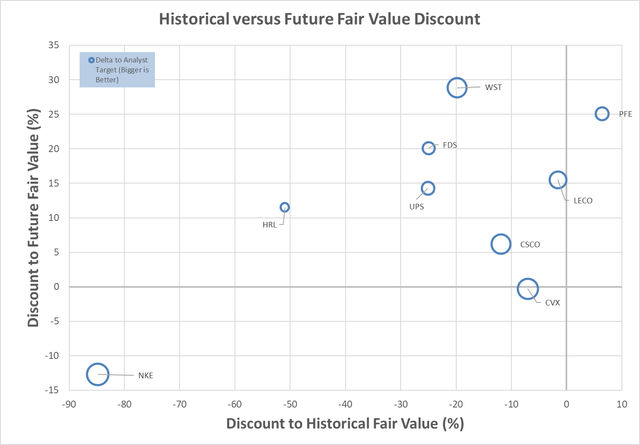

Plotting three variables on one plot is tricky but using a bubble plot allows us to visualize three variables by plotting the Historical fair value versus the Future Fair Value on a standard x-y chart, and then use bubbles to represent the size of discount relative to analyst estimates.

Author calculation of Historical and Future Fair Value, analyst estimates

This chart is insightful once you understand how to interpret it. What we are looking for are stocks that are trading at a discount to both the Historical Fair Value and the Future Fair Value. So, those stocks that are farther to the left, and farther to the bottom, are potentially the stocks trading at the largest discount to fair value. This would be the bottom left quadrant of the graph. Additionally, those stocks with the biggest bubbles are the stocks that are trading at the largest discount to analyst estimates, so in theory, stocks in the lower left quadrant that also have large bubbles, should be decent candidates for investment.

The chart suggests that Nike (NYSE:NKE) (NEOE:NKE:CA) and Chevron (CVX) appear to be attractive from a Historical Fair Value and Future Fair Value perspective, as well as having potential based on analyst estimates. Additionally, Cisco (CSCO) appears to be trading at a good discount to Historical Fair Value, while being close to Future Fair Value, with upside based on analyst estimates.

From this list, I own Cisco, Chevron, Nike, Pfizer and United Parcel Service. Since my last article, I have made purchases in Nike at $76 and UPS at $134.

If you are interested, I have relatively recent articles that are still relevant for United Parcel Service, Chevron, and Pfizer. These will provide my views of strategy, long-term investment thoughts, though I reference you to my updated valuations above for each of these stocks.

Looking at the chart and table above, Nike really stands out from a valuation opportunity perspective. There is no secret that I like Nike, and have written about it several times, with the most recent being almost a year ago, when I had made a purchase around $92. I have owned the stock since early 2022, and with dividends re-invested, have a cost basis of $89, meaning I am underwater in my investment. One thing you can be certain of when reading my articles, I buy what I write about, for better or worse, and I’ll always strive to be transparent about my performance.

The question that I want to dig into again, is basically the same question as the last time I wrote about Nike, is it a world-class company that is out of favor, or a has-been that has lost its mojo?

Nike Hypothesis

Let’s just get this out of the way, Nike continues to have two big worries from my perspective:

- It has gotten too political and alienated many of its customers

- Competition has better products, and it has lost its attraction, therefore compromising the growth story

Politics rarely mix well with investing, and politics can cause significant short-term damage to investments. There are many examples of this, like the very public fight between Disney and the state of Florida, as well as the well-publicized boycott of Bud Light. Nike has had its own controversies, including political fallout from its support of Colin Kaepernick and Dylan Mulvaney, among others.

Though I, personally, believe politics should be left to politicians, and that companies should just stay in their lanes, I also feel that the public has a short memory, many of these issues get blown out of proportion, and work themselves out, political fads come and go, and the best companies will overcome, either through a change of public opinion, fading of the historical memory, a change in leadership, direction, or stand, and the attractiveness of their products. I don’t always agree with the stand that companies decide to take, but I also don’t let those stands overly influence my long-term investment decisions. I also believe that this short-term political noise can actually result in long-term opportunity to acquire great companies at a discount when the underlying business isn’t fundamentally altered.

Of more concern to me is whether Nike has lost its mojo, lost its way, lost its growth story, lost its competitive advantage, and so forth. Though I can’t see the future, I do often think of Peter Lynch’s mantra of “Invest in what you know” (One up on Wall Street – 1989). His point wasn’t to blindly invest in the company whose products you see and use every day, but that can be a starting point for due diligence and identifying good investments. So, with Nike, as I continue to hold it as an investment, since I regularly do the due diligence, I also make sure to keep an eye out for changes in my daily observations. Here are some uncomprehensive, but personal observations:

- Proliferation of “Orange Shoes” in the Olympics (Nike’s Electric Pack) – though I appreciate many athletes are sponsored, not all of them are, and when literally hundredths of a second matter, and those athletes are wearing the orange shoes, it’s not only a brilliant marketing strategy for Nike, but a testament to the continued quality and competitiveness of the product.

- High school fashion – my daughter is a senior in high school. She is not overly fashion conscious but seems to know what is cool in our small Midwest city. We give her a modest clothing budget to allocate as she sees fit, and three “staples” in her allocation are Nike – shoes, hoodie, and shorts – in her opinion, must haves for every high-schooler, and must-have including being Nike. Having said that, my high school freshman son only has a single “staple”, which is On “Cloud” shoes – he couldn’t care less about anything else. I do think this is significant but trust my daughter more when it comes to fashion. On and Hoka shoes are definitely more prevalent in my daily observations than they once were, along with the traditional adidas, ASICS, Vans, Converse (owned by Nike), and similar shoes.

- High school track and field – as I attend regional high school track and field events, it is rare for the shorts to be anything other than Nike Pro (an absolute must according to my daughter), the majority of shoes to be Nike (similar to the Olympics, though there are more competitors represented than there used to be), and gym bags to be Nike.

- My son attends a “Ninja” class at a local gym that also trains elite gymnasts. The only shorts they all wear are Nike Pro – literally all of them in my observation.

- At work, dress casual sneakers have become very common – Nike is surprisingly well represented, with some styles that really catch my attention (I’m not a fashion guy).

There is nothing factual, data-based, or really that objective about these personal observations, but in my mind, they help me be comfortable that politics have not overly impacted Nike perception in my very politically conservative corner of small city Midwest, Nike is still part of the picture when it comes to what is cool from a fashion perspective, and Nike is still considered an important brand when it comes to competition.

Probing a little deeper into the question of Nike’s competitive standing, let’s examine the super shoe. Here is a really interesting article from MIT’s Technology Review. Nike is generally credited with revolutionizing distance running with the introduction of the Vaporfly in 2016. This was a shoe that helped the runners maintain better form, reduce fatigue, and return more energy during the stride cycle. The current marathon world record is held by Kelvin Kiptum, wearing the latest version of Nike Alphafly3. The unofficial record (sub 2-hour) is held by Eliud Kipchoge, wearing Nike Air Zoom Alphafly NEXT% prototype shoes. Of interest, the women’s world record held by Tigest Assefa was set while she was wearing adidas Adizero Adios Pro Evo 1s. In the Olympics, many events have seen winning athletes wear Nike shoes, but likewise, there have been many others as well. Here is a listing of the shoe brands worn by Olympics marathoners. There-in is a key point. Whereas Nike was dominant during the initial introduction of the modern running super shoe, others have closed the gap, and generally the consensus is that there isn’t as big of a performance difference as there was originally. Now, athletes are more likely to wear what they are sponsored by, as opposed to wearing a shoe because of an extreme competitive advantage.

This erosion of competitive advantage (to be clear, Nike is still competitive, but just doesn’t have the advantage it once enjoyed), was acknowledged in the most recent earnings update, when the CEO John Donahoe said, “We’ve been accelerating our innovation pipeline, including pulling forward several innovations, some by more than a year. We’re moving aggressively to re-establish our innovation edge,”.

So, the big question we need to ask is, can Nike do it? Well, we’ll know at some point in the future, but let’s look at a couple of objective data points.

Can disruption happen – absolutely. Do resources help a company respond to and avoid being overcome by disruption – I believe so. Let’s start with market cap compared to some of its nearest shoe competitors, with some bias towards shoes (I know this oversimplifies the comparison, since Nike is more than just a shoe company).

Factually, Nike is massively larger than its nearest competitors from a market cap perspective.

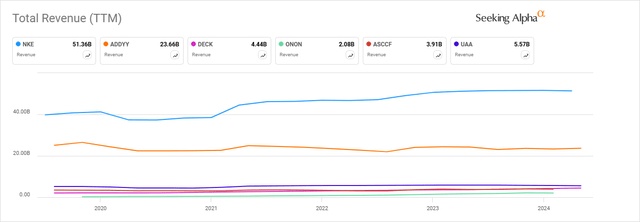

Looking at another indication of resources, let’s consider revenue.

Again, Nike is dominant over its competitors from a revenue perspective. There isn’t something funny going on with market caps, if anything, competitors have higher relative valuations than Nike does, giving them larger market caps relative to revenue.

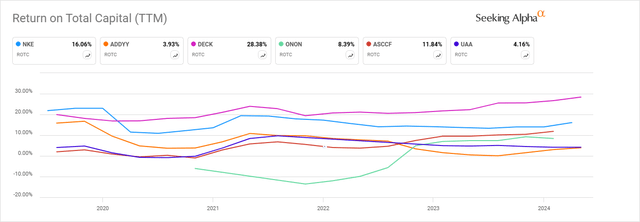

So, maybe those competitors are going to be able to massively grow and overcome Nike’s financial resources. Let’s take a look at return on total capital, which is a good indicator of how effectively a company is able to grow their assets.

Nike may not be the current leader in return on capital, but they are definitely holding their own. Competitors won’t be catching up any time soon, based on the recently passed returns.

Directly answering my second concern, do I think Nike is at risk of falling behind the competition, the answer is no. I believe that Nike has the history, experience, and most importantly, the financial resources to withstand arising competitive pressure. Even if a competitor is able to out-innovate Nike, which to this point has not really been demonstrated, Nike’s vast resources put it into a position to be a fast follower and head off the onslaught.

Nike Analysis

Now that I’ve reassured myself that Nike isn’t in a dire competitive position or that it seems to be headed off the rails, let’s do some simple analysis of the business – this is a key part of Peter Lynch’s “buy what you know” strategy. NKE has a 5-year average Return on Equity of 40.1%, with its most recent ROE of 40.1%. The 5-year average Return on Invested Capital is 21.9% and its most recent ROIC is 22.1%. There are several things I look for here. First, these are very good numbers. This is a successful company, in a successful category, with little evidence of real competitive pressure. Second, the most recent numbers are at, or above, the 5-year averages. This is at least one indicator that the business is not in decline. Third, there is a gap between ROE and ROIC, which does suggest that the company may be using leverage as part of its returns, but as we’ll see, Nike is still very strong financially. Finally, when we compare the Weighted Average Cost of Capital (around 10%) to the ROIC, it shows that there is a lot of margin for growth and returns.

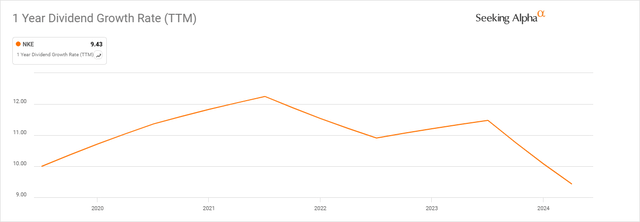

Since I’m a dividend investor at the core, from a dividend perspective, the earnings-based dividend payout ratio of 40% and free-cash-flow-based dividend payout ratio of 36% are both excellent. They have paid a growing dividend for around 22 years now. For all that the payout ratios appear to offer a lot of flexibility for growth, the dividend growth has also been attractive (around 11%) and the starting yield right now is reasonably attractive at almost 2%.

Additionally, Morningstar rates Nike as wide moat, with exemplary capital management, and currently has a 5-star valuation rating. That doesn’t happen all that often!

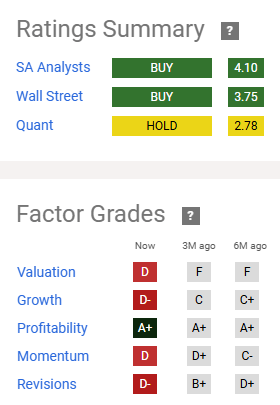

Seeking Alpha makes available a summary of ratings, as well as factor grades. These make for another nice, first pass filter for investment timing.

Seeking Alpha

Starting with the top stop-light chart – analysts are generally bullish on Nike. The shorter-term Quant rating has Nike at a hold, which could be an indication that short term, timing may not be perfect for an investment.

The Factor Grades are relative, and therefore very dependent on the peer comparisons. Not to be ignored, given the previous argument of resource strength against competition, profitability is top in class. The other indicators due hint to some of the short-term challenges that Nike is facing, leading to the recent declines in share price.

Nike Historical Analysis

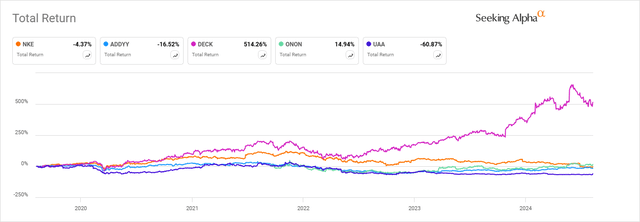

Before we dig deeper into the growth, I do like to look where things have been in the past. I think we realize that past performance can be somewhat indicative of the quality of the company. Obviously, it’s important to understand the key drivers for that past performance, to see if you believe anything has changed that could impact that. So, let’s start with how Nike has performed for shareholders in the past:

Well, on the positive side, over the past 5 years, Nike has given you a chance to reinvest dividends at similar levels to your initial investment. On the realistic side, an investment in Nike has not been a good one over those 5 years. As I mentioned earlier in the article, I am upside-down on my personal investment with a cost basis of $89, even while following a stringent strategy of investing at what I believed to be attractive valuations. Poor short-term investments can sometimes still work out to be good long-term investments. Peter Lynch suggested it sometimes takes a while for the best investments to work out, with his minimum timeframe usually being between 3 and 10 years.

To give an indication of whether this might be the case for Nike, let’s see if key valuation metrics have improved, stayed the same, or gotten worse over the past years. Let’s start with P/E and yield for this.

Nike is trading well below its 5-year PE average of around 40. Furthermore, the current P/E is close to a low point in its 5-year valuation history, suggesting, at least from a P/E perspective, that it has become a more attractive investment.

From a Yield perspective, it is also trading well above the 5-year average of around 1.1%, and at close to a recent all-time high, again suggesting it could be a more attractive investment.

For me, a key takeaway from the historical analysis to this point is that there does not seem to be evidence of decline. The valuations have improved relative to earlier pricing, but the underlying performance does not seem to be deteriorating.

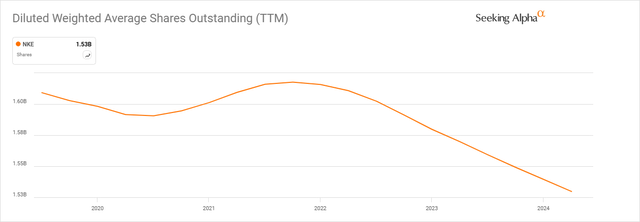

Nike has a good recent history of share buybacks. There is always an argument to be had for timing of buybacks, however, a company that routinely buys back shares inherently takes advantage of dollar cost averaging. Compared to other companies that buy back a lot of shares, but effectively just offset equity compensation, Nike’s buybacks are clearly reducing shares outstanding. I also like aggressive buybacks in that they make the dividend more sustainable, can be a lever for more dividend growth, and are a safety net that can be used in the case of financial trouble, before dividends need to be cut.

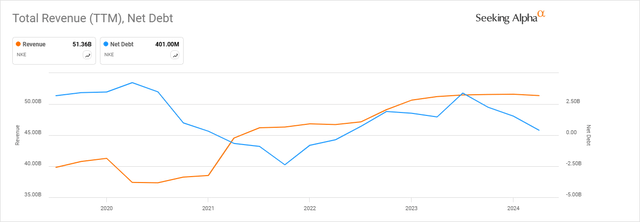

Nike has a very strong financial position, with very low net debt. With over $11.5B in cash on hand, they have a lot of resources for investment, as previously discussed, but also to weather any downturns. The cash on hand is even sufficient to buy out several of their “largest” competitors.

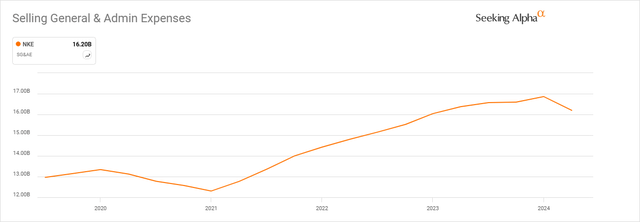

Nike doesn’t break out R&D separately, but we’ll look at SG&A as an indication of reinvestment back into the company. Nike is a marketing powerhouse, but as we’ve discussed previously, it’s also important for them to invest in innovation, to maintain the brand draw with professional athletes, which will hopefully trickle down into the regular consumer as well.

Since Nike doesn’t break out R&D from SG&A , it is difficult to determine if the recent reduction in investment is associated with innovation or something else. We do know that Nike has had significant layoffs recently as part of a $2B cost reduction program, including many senior executives within the company. This likely contributed to the reduction shown and doesn’t necessarily suggest a reduction in innovation investment, especially in light of the CEO’s commitment to increase innovation investment.

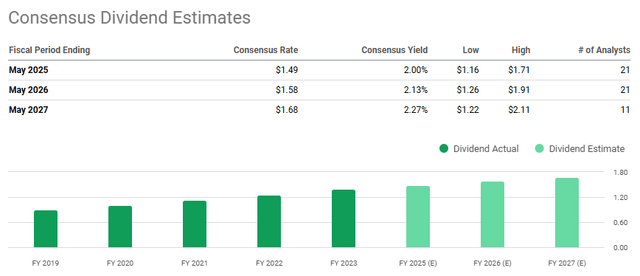

Nike has paid a growing dividend for around 22 years. The recent growth has moderated slightly, but is still attractive, especially when combined with a more attractive initial yield.

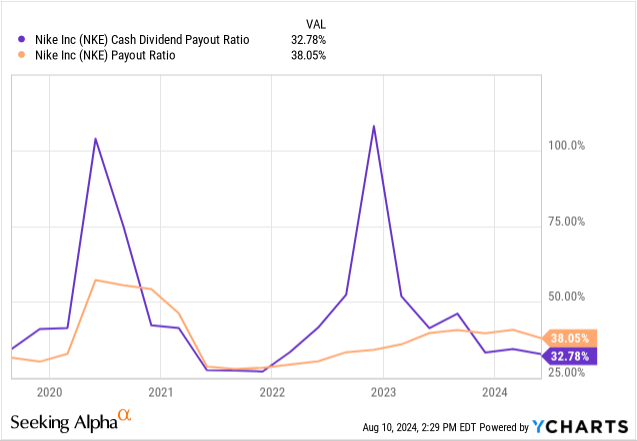

The earnings-based payout ratio has stayed in a favorable range, even against the history of strong growth. The cash-based dividend ratio has been more variable, but at the current levels also look safe and attractive. This gives confidence in the future sustainability of the dividend.

Seeking Alpha

Nike Future Analysis

What has happened in the past is obviously one thing, where the company is headed in the future is the real question, especially since that’s part of our biggest concern with Nike.

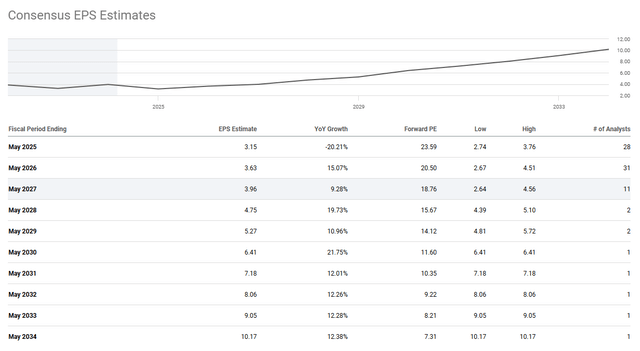

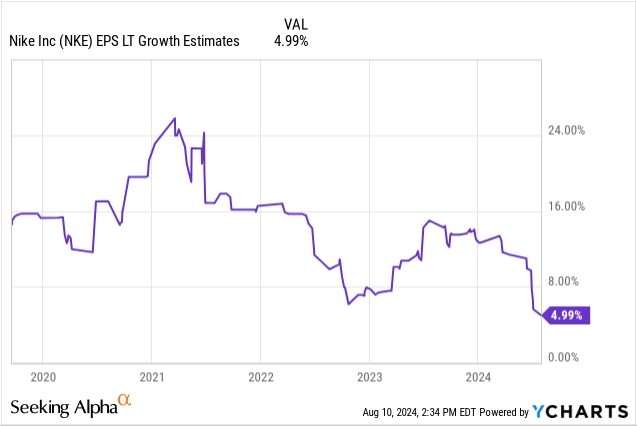

From a future earnings per share growth forecast, analysts expect Nike to continue with low-double digit growth. This is a really good indicator and gives us confidence that dividend growth should also be sustainable.

Even though it’s not future looking, I like to look at the history of growth expectations to understand how they compare to the future, to get an idea of how the stock is favored.

Seeking Alpha

Analysts do expect 2025 to be a down year, which aligns with the recent lower projections for growth, however, as we saw above, they then expect Nike to rebound, and regain the strong growth it has historically enjoyed.

My own estimate for Nike’s forward growth is around 10%. I derive this from a combination of various growth projections and growth models. This aligns well with analyst estimates, giving me confidence in my Future Fair Value-based estimates.

For a dividend growth investor, understanding future dividend growth potential is also important, especially in as much as it is sustainable. Here are the long-term dividend growth projections for Nike. The forecast growth looks consistent, and with the forecasted growth in earnings, as well as the margin of safety in current payout ratios, supports the future sustainability of the dividend and growth.

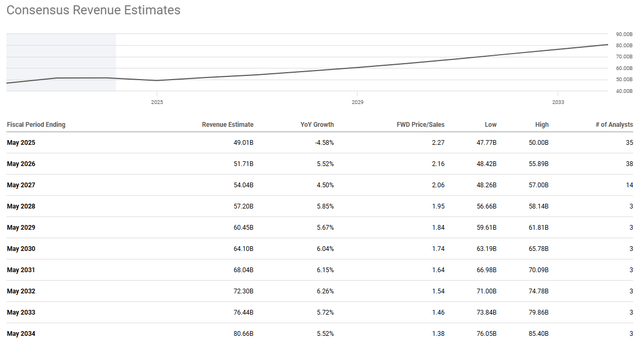

Since EPS is not a full indicator of growth, the other thing to tie out is revenue. Revenue is expected to continue on a healthy growth projection, in a stable way.

It should be noted that revenue is forecast to increase slower than EPS. This suggests that accretive buybacks are an important part of this total story, and that the returns on investment and capital need to be watched to ensure they continue to enable this.

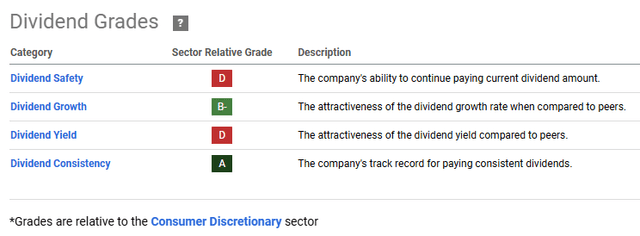

The Seeking Alpha Dividend Grades highlight a couple of areas of concern. Maybe of particular interest is the Dividend Safety Score of D. Keeping in mind that these scores are relative to the Consumer Discretionary sector, and looking deeper at the underlying metrics, I believe this grade is a little harsh. I do not see anything that suggests the dividend is at risk, especially longer term.

Risk

We’ve already covered at length a couple of concerns, the political blow-back concern, and the loss of attractiveness due to competition, trends, and so forth. These shouldn’t be ignored, but I believe them to be manageable.

From a financial and quality perspective, there does not appear to be much risk here. Nike is rated AA- by S&P, Aa2 by Moody’s, and the Value Line Financial Strength rating is A+. As we discussed previously, Morningstar rates it as Wide Moat with Exemplary Capital Management, plus has a 5-star valuation rating on it currently. This is a high-quality company.

Summary

Nike is a high-quality company that hasn’t been the greatest investment for me to this point. It has some near-term challenges that will need to be monitored and addressed; however, I believe that the potential outweighs the risks, so I plan to continue to hold and add to my position going forward. I believe that the current valuations are attractive, from a Historical based valuation perspective, a Future-based valuation perspective, and based on analyst price targets, they seem to agree with this as well.

As I mentioned earlier, I recently added to my position at $76, so as always, I’m willing to put my money where my mouth is.

Based on the initial analysis in the article, I also believe that United Parcel Service and Chevron are attractively valued, and that Cisco may also be an attractive near-term investment to watch.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CSCO, CVX, NKE, PFE, UPS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.