Summary:

- A list of high-quality dividend-growth stocks trading near 52-week highs is evaluated based on historical and future fair values.

- Apple appears to be overvalued based on historical and future fair value estimates, yet remains a strong financial performer with significant future potential.

- Despite its overvaluation, I am inclined to hold Apple due to its exceptional past performance, financial strength, and lack of obvious replacements.

- Other options for consideration instead of Apple could be Lam Research and Mastercard.

AngiePhotos

Introduction and Background

Well, this market sure is interesting. Just when I think we’re in for a decent correction and am ready to light the fuse on some dry powder, it takes off again.

As my followers know, I am a dividend growth investor that seeks to find the highest quality dividend growers trading below my estimates of fair value, buy them, and then hold them for a really long time. Beyond trying to find good value, I’m not big on market or investment timing, frankly, because I’m not good at it – with well over 20 years of investing experience to help me reach that conclusion.

I have been carrying more cash than normal for quite a while, waiting for more favorable value to appear. However, I’ve also been thinking a lot more about whether my approach of holding essentially forever is the right approach in all circumstances, especially when the market overall appears to be high. Typically, I subscribe to the “let the winners ride” philosophy, and frankly, it has served me very well. The recent dearth of good value in the subset of the market I watch, though, has me wondering if I should trade out some more overvalued investments, for some less undervalued investments.

With that, we’re going to try something new this time. Instead of looking at investments on my watchlist trading towards the low end of 52-week prices, like I often write about, or at least investments that look to be undervalued, let’s flip the question and see if there are holdings that I have, at the upper end of the 52-week range, that also appear over-valued, that I should consider trading for something else. I won’t ever take an entire investment I believe in off the table, regardless of valuation, because I’m just not that confident in my ability to see the future, but if I can trade for more future potential income, and potentially less capital risk, maybe it’s worth a look.

Additionally, let’s get this out of the way now – (I know we should never say never) you will never get a short recommendation from this guy. I have no interest in playing that game – I like to sleep at night. I’m not very likely to lose a lot of money investing in the high-quality companies I follow, especially with a long horizon.

I regularly calculate fair values for my watchlist, so let’s look at stocks trading near their 52-week highs that also look over-valued. I decided to filter my watchlist by companies that are trading at more than 80% of their 52-week range (52-week low being 0% and 52-week high being 100%).

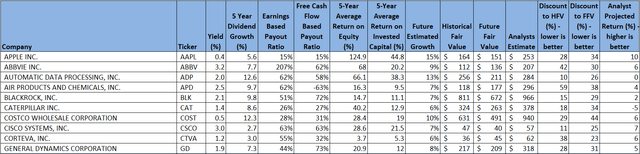

Using this first pass criteria, we will be looking at the following list of companies:

Finbox, Seeking Alpha, Author’s Analysis

Finbox, Seeking Alpha, Author’s Analysis

Fair Value Estimation

As I’ve described in previous articles, I like to calculate a fair value in two ways, using a Historical fair value estimation, and a Future fair value estimation. The Historical Fair Value is simply based on historical valuations. I compare 5-year average: dividend yield, P/E ratio, Schiller P/E ratio, P/Book, and P/FCF to the current values and calculate a composite value based on the historical averages. This gives an estimate of the value assuming the stock continues to perform as it has historically. I also want to understand how the stock is likely to perform in the future so utilize the Finbox fair value calculated from their modeling, a Cap10 valuation model, FCF Payback Time valuation model, and 10-year earnings rate of return valuation model to determine a composite Future Fair Value estimate.

I also gather a composite target price from multiple analysts, including Reuters, Morningstar, Value Line, Finbox, Morgan Stanley, and Argus. I like to see how the current price compares to analyst estimates as another data point, and as a sanity check for my own estimates.

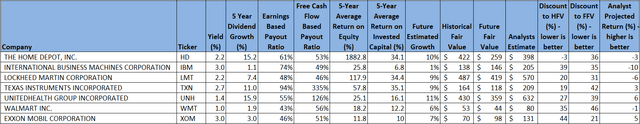

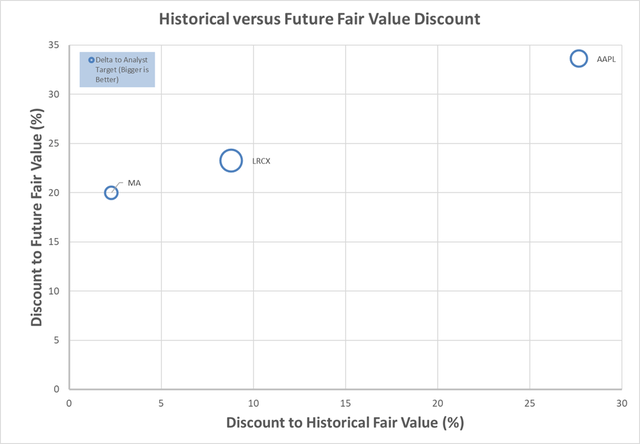

Plotting three variables on one plot is tricky, but using a bubble plot allows us to visualize three variables by plotting the Historical fair value versus the Future Fair Value on a standard x-y chart, and then use bubbles to represent the size of discount relative to analyst estimates.

Author calculation of Historical and Future Fair Value, analyst estimates

This chart is insightful once you understand how to interpret it. In this case, stocks in the upper right quadrant with the smallest bubbles are potentially the most over-valued based on Historical and Future Fair Value estimates.

I want to emphasize that I own every one of these stocks as individual holdings in my portfolio, many of them for a long time. I am not very interested in selling, but I think it’s important to continuously challenge our investment approaches, while still staying true to our core investment philosophy and principles.

For this article, I want to do a deeper dive on Apple (NASDAQ:AAPL). I have three somewhat selfish reasons for doing this:

- It is my second-largest individual holding by quite a margin (it is also one of my best overall investments, with my initial investment back in 2015).

- It has recently experienced quite a bit of insider selling.

- It is currently rated as a hold by Seeking Alpha analysts and by the Seeking Alpha quant system.

So, my question is, should I consider taking some money off the table by selling some of my holdings in Apple, and if so, what are some options to consider? To justify Apple’s current valuation, we need to examine the growth story.

I last wrote about Apple in April, where I recommended a buy around $165. True to my word, I added to my position at $164.99.

Apple Analysis

Apple has a 5-year average Return on Equity of 125%, with its most recent ROE of 161%. The 5-year average Return on Invested Capital is 45% and its most recent ROIC is 61%. There are several things I look for here. First, these are exceptional numbers. This is a dominant company, in a successful category, with little evidence of real competitive pressure. Second, the most recent numbers are at, or above, the 5-year averages. This is at least one indicator that the business is not in decline. Third, there is a gap between ROE and ROIC, which does suggest that the company may be using leverage as part of its returns, but as we’ll see, Apple is still very strong financially. Finally, when we compare the Weighted Average Cost of Capital (around 9%) to the ROIC, it shows that there is still a lot of margin for growth and returns.

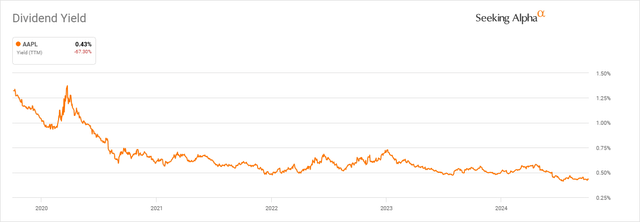

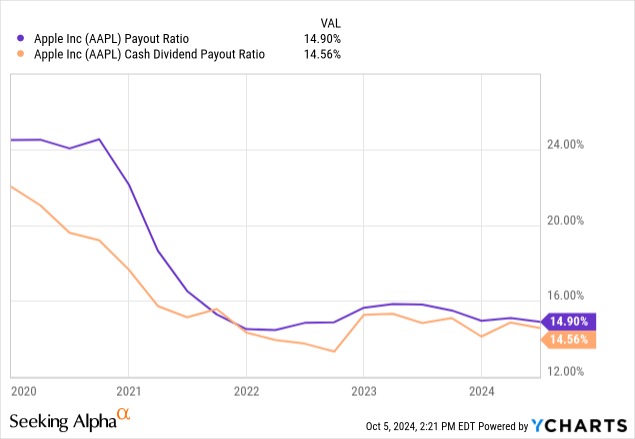

Since I’m a dividend investor at the core, from a dividend perspective, the earnings-based dividend payout ratio of 15% and free-cash-flow-based dividend payout ratio of 15% are both superb. They have paid a growing dividend for around 12 years now. For all that the payout ratios appear to offer a lot of flexibility for growth, the dividend growth has not been that outstanding (around 6%) and the starting yield right now is a pitiful 0.4%.

Additionally, Morningstar rates Apple as wide moat, with exemplary capital management, but currently has a 2-star valuation rating, further agreeing with my over-valuation, but high quality, assessment.

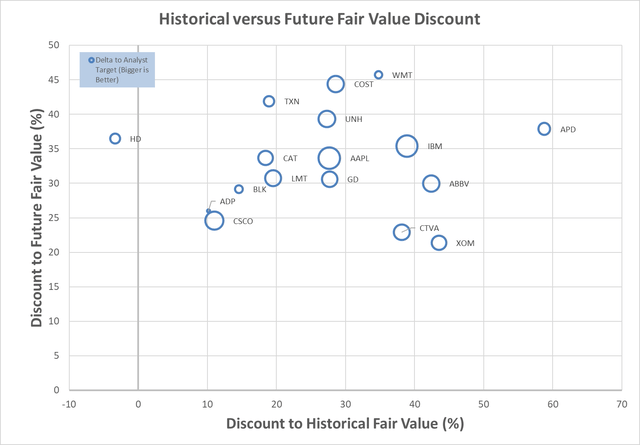

Seeking Alpha makes available a summary of ratings, as well as factor grades. These make for another nice, first pass filter for investment timing.

Seeking Alpha

Starting with the top stop-light chart – Wall Street analysts are more bullish than Seeking Alpha analysts. Going back to the size of the bubble in the valuation chart, this makes sense. The shorter-term Quant rating also has Apple as a hold, which could be another indication of over-valuation.

The Factor Grades are relative, and therefore very dependent on the peer comparisons. Apple does well relative to peers from a profitability and revisions perspective. However, it’s important to note that valuation and growth, two of the key things we’re looking at, are poor relative to peers.

Apple Historical Analysis

Before we dig deeper into the growth, I do like to look where things have been in the past. I think we realize that past performance can be somewhat indicative of the quality of the company. Obviously, it’s important to understand the key drivers for that past performance, to see if you believe anything has changed that could impact that. So, let’s start with how Apple has performed for shareholders in the past:

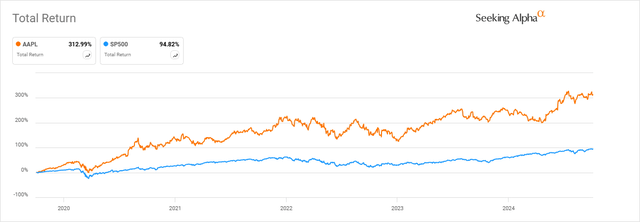

Seeking Alpha

As I stated previously, Apple has been one of my best personal investments. It has been a multi-bagger for me, with initial investments in 2015, and others along the way. It has significantly beaten the S&P 500 over the past 5-years and has grown to be my second-largest individual holding.

Let’s see if some key historical valuation metrics have improved, stayed the same, or gotten worse over the past years. Let’s start with P/E and yield for this.

Seeking Alpha

Apple is trading above its 5-year PE average of around 28. It is not the highest that it has been but is towards the higher end based on the 5-year history.

Though many investors aren’t that interested in Apple for its yield, it is important to some. From a Yield perspective, it is also trading well below the 5-year average of around 0.7%, and at close to a recent all-time low, again suggesting it could be over-valued.

Seeking Alpha

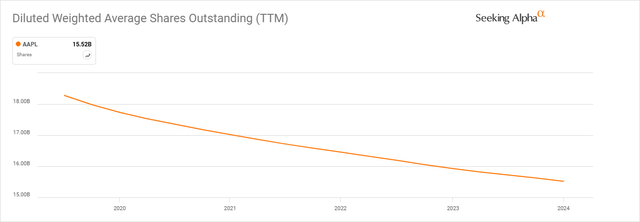

Apple has a strong history of share buybacks. There is always an argument to be had for timing of buybacks, however, a company that routinely buys back shares inherently takes advantage of dollar cost averaging. Compared to other companies that buy back a lot of shares, but effectively just offset equity compensation, Apple’s buybacks are clearly reducing shares outstanding. I also like aggressive buybacks in that they make the dividend more sustainable, can be a lever for more dividend growth, and are a safety net that can be used in the case of financial trouble, before dividends need to be cut.

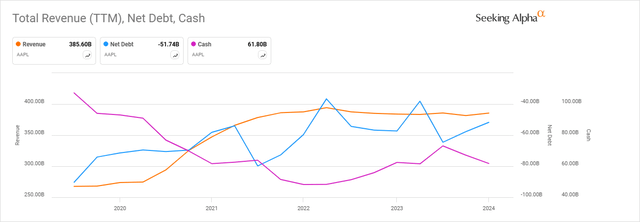

Seeking Alpha

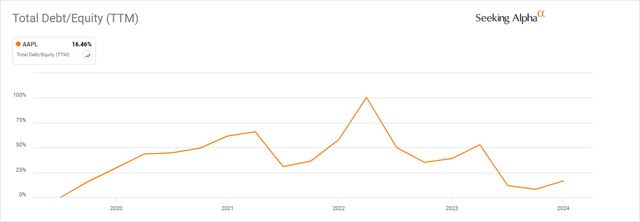

Apple has a very strong financial position. Outstanding revenue, with a good debt position and over $61B in cash on hand, makes this a true SWAN stock. The debt to equity is very strong, especially for such a large company.

Seeking Alpha

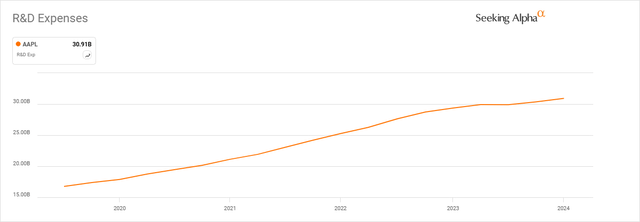

Seeking Alpha

Something I love to see in my investments, especially investments in companies that rely on their competitive edge is increasing R&D, aligned with the strong financial position. Apple delivers on this desire as well.

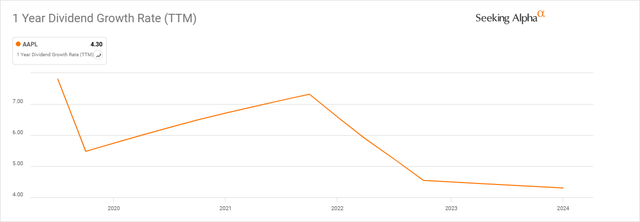

Seeking Alpha

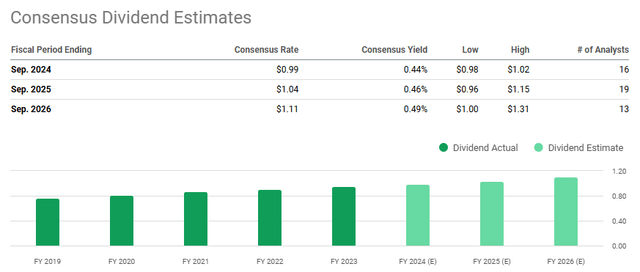

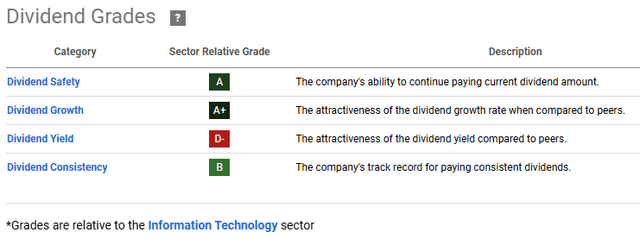

Apple has paid a growing dividend for around 12 years. The challenge with Apple is knowing whether the growth will increase, it sure appears like they have sufficient opportunity to do so, even after increases in share buy-backs, and R&D investment. However, Apple’s dividend growth rates have been generally unspectacular.

Seeking Alpha

To this point, the earnings and cash-based payout ratios have both improved, even with the buybacks and increased R&D investments. Apple has a lot of margin to improve dividend payments, or to increase other investments for growth.

Seeking Alpha

So what are my takeaways from the historical looking valuation and analysis:

- Apple has been an exceptional investment over the past several years.

- Apple is very strong financially and has the resources to continue to invest and grow, as well as the resources to continue to increase direct to investor returns.

- Apple is likely over-valued right now, at least based on historical observations.

Apple Future Analysis

With that, let’s turn to the future and see if we can ascertain if the over-valuation that we see based on historical observations is masking future opportunity. Is Apple over-valued, or is the market just anticipating an improved future?

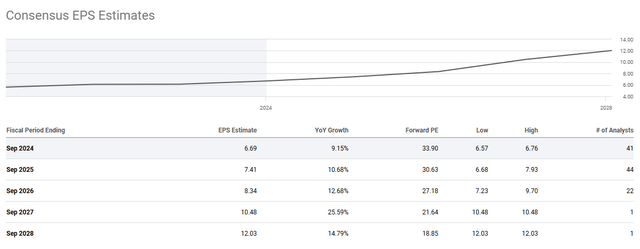

From a future earnings per share growth forecast, analysts expect Apple to continue with low-double digit growth. A little over 10% growth estimate looks reasonable.

Seeking Alpha

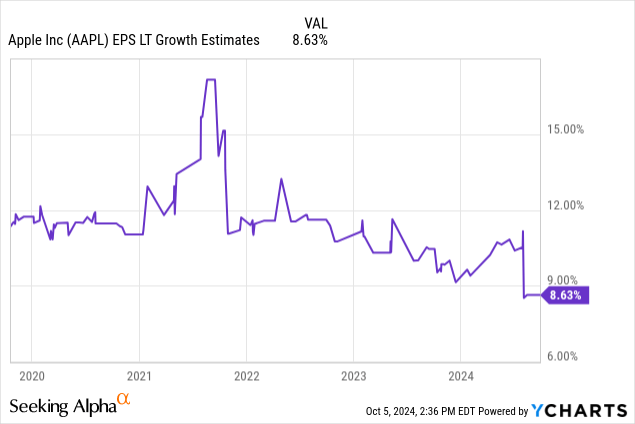

Even though it’s not future looking, I like to look at the history of growth expectations to understand how they compare to the future, to get an idea of how the stock is favored. The growth expectation has come down in the past few years, but is not far off of the future ~10% growth forecast for EPS we saw above.

Seeking Alpha

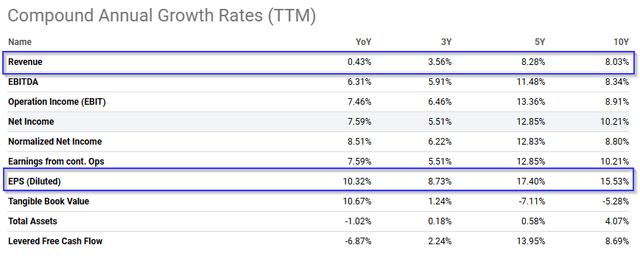

Tying this out, here are the actual growth rates that have been achieved, compared to analysts’ historical estimates. We can see that there is pretty good alignment. It’s also interesting to note that a lot of the growth in EPS has not been through growth in revenue.

Seeking Alpha

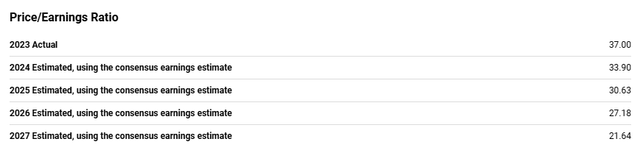

Now, looking at things through a slightly different lens, if we were to buy Apple today, what would be the future P/E that we would be giving up?

Seeking Alpha

Keeping in mind that the 5-year average P/E has been around 28, and that we don’t expect growth to change significantly from where it has been previously, it looks like, if we bought today, it would take a couple of years to achieve the historical P/E valuation.

My own estimate for Apple’s forward growth is around 15%. I derive this from a combination of various growth projections and growth models. This looks a little optimistic compared to analyst projections, but does not drastically change the story. Since this is the growth rate I use in my Future Fair Value estimations, if anything, it suggests my valuation is likely optimistic. Remember, my valuation suggests that Apple is over-valued.

It’s also interesting to note that forward projections for dividend growth are pretty flat. The consensus for growth suggests growth in-line with recent increases, and consistent valuation, based on projected yield.

Seeking Alpha

The Seeking Alpha Dividend Grades tie out with this story. There is likely some nuance in the “Growth” factor, since relative to the Information Technology sector, which contains many companies that do not pay a dividend, the growth is strong. It will be interesting to see how this changes, and if Apple feels pressure to change their approach, when other strong companies that have recently started paying dividends like Alphabet, Facebook, and Salesforce establish their record of dividend growth.

Seeking Alpha

Takeaways from the future looking valuation:

- Apple is likely to continue to grow at similar rates to the past.

- There are no signs of financial degradation or concerns looking into the near future.

- There will need to be something fairly significant to change the future trajectory either way, but Apple does have resources to do this.

- Apple is likely over-valued currently from a future perspective as well.

Risk

From a financial and quality perspective, there does not appear to be much risk here. Apple is rated AA+ by S&P, Aaa by Moody’s, and the Value Line Financial Strength rating is A+. As we discussed previously, Morningstar rates it as Wide Moat with Exemplary Capital Management. This is a high-quality company.

The risk that we are really examining in this article is whether Apple is over-valued, and whether we should consider selling Apple for something else. This is a hard question to answer, and my personal inclination is probably not right now. Based on my valuations, I believe it may be 20-30% over-valued. However, I also know my valuations have uncertainty in them. Because Apple is such a leader, and because it is so large because it has so many financial resources, and frankly because it has treated me so well, even in the past when it has appeared over-valued, I am willing to give it some grace.

Having said that, I provided a link in at the beginning of the article, but several senior executives have recently sold a not insignificant number of shares in the company. CEO Tim Cook sold 224k shares (out of 3.2M), COO Jeff Williams sold 60k shares (out of 490k), SVP Deirdre O’Brien sold 61k shares (out of 137k), General Counsel Katherine Adams sold 61k shares (out of 187k). It’s hard to say if they think they are hitting a high spot, or if they’re just rebalancing their own portfolios, given how much those shares have increased in value over the past several years.

Bonus Material

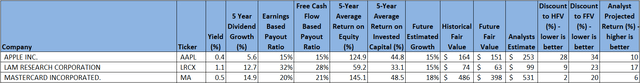

If you still have concerns after this analysis, another way to look at is, what would I invest in instead of Apple? Let’s take a look at my watchlist of high-quality dividend growers to see if there are any obvious candidates. This is a fun exercise, even if we don’t act on it.

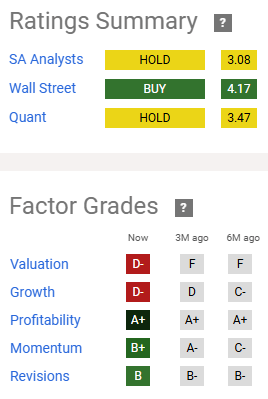

Let’s filter the watchlist for companies that have strong 5-year average ROIC (above 30% – Apple is hard to beat here), better dividend growth than Apple (above 5.6% 5-year average growth), a higher yield than Apple (above 0.4%), strong payout ratios (again, Apple is hard to beat here), and that look to be less over-valued than Apple. Out of my list of almost 100 companies that I follow, only a couple make the cut, and you can see them in the table, and plot below.

Finbox, Seeking Alpha, Author’s Analysis

Author calculation of Historical and Future Fair Value, analyst estimates

There is no doubt that Lam Research (LRCX) and Mastercard (MA) are also excellent options. I own Lam Research and Visa (V), instead of Mastercard. Again, I don’t feel like either is compelling enough for me to sell Apple to increase my holdings in them.

Summary

Apple is a high-quality company that has been one of my best investments. I believe it is currently over-valued and believe that it is an exceptionally strong company.

Will I be adding to my position right now? No. I did add some Apple in April at $165, which turned out to be a pretty good spot. I likely won’t take any more action until the next round of earnings when I can update my valuations. For now, let the winner ride!

I am always interested in feedback on my ideas. If you believe that I am missing the boat by holding on to Apple, I’d love to hear your feedback. I’d especially love to hear what you think I should trade Apple for – it’s one thing to say it is over-valued, it’s quite another, at least for me, to figure out what I would do instead.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, ABBV, ADP, APD, BLK, CAT, COST, CTVA, GD, HD, IBM, LMT, TXN, UNH, WMT, XOM, LRCX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.