Summary:

- A list of high-quality dividend-growth stocks trading near 52-week lows is evaluated based on historical and future fair values.

- Pfizer’s financial health is concerning, with unsustainable dividend payout ratios and negative debt-to-equity ratios, but future projections suggest a potential recovery.

- Despite political risks and activist investor concerns, PFE’s high initial dividend yield, solid ratings, and promising pipeline make it a potentially undervalued investment.

- Nike, Merck, Elevance, and Lam Research may also be attractive near-term investments to explore further.

kuri2000

Introduction and Background

The last time I wrote, I was having a hard time finding value in the high-quality dividend growth segment that I invest in. I’m happy to report that this time around, there are several stocks that potentially appear to be attractively valued.

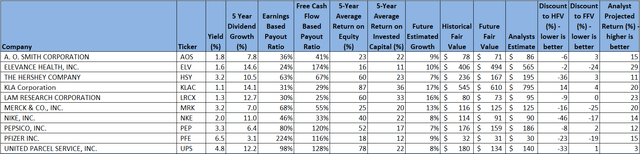

We’ll return to one of my favorite ways to look for value in this high-quality dividend growth space, which is to screen for those stocks trading near 52-week lows. I decided to filter my watchlist by companies that are trading at less than 30% of their 52-week range (52-week low being 0% and 52-week high being 100%).

Using this first pass criteria, we will be looking at the following list of companies:

Finbox, Seeking Alpha, Author’s Analysis

Fair Value Estimation

As I’ve described in previous articles, I like to calculate a fair value in two ways, using a Historical fair value estimation, and a Future fair value estimation. The Historical Fair Value is simply based on historical valuations. I compare 5-year average: dividend yield, P/E ratio, Schiller P/E ratio, P/Book, and P/FCF to the current values and calculate a composite value based on the historical averages. This gives an estimate of the value assuming the stock continues to perform as it has historically. I also want to understand how the stock is likely to perform in the future so utilize the Finbox fair value calculated from their modeling, a Cap10 valuation model, FCF Payback Time valuation model, and 10-year earnings rate of return valuation model to determine a composite Future Fair Value estimate.

I also gather a composite target price from multiple analysts including Reuters, Morningstar, Value Line, Finbox, Morgan Stanley, and Argus. I like to see how the current price compares to analyst estimates as another data point, and as a sanity check to my own estimates.

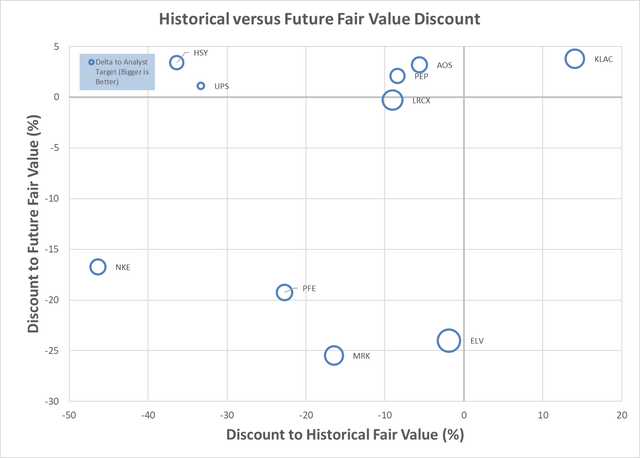

Plotting three variables on one plot is tricky but using a bubble plot allows us to visualize three variables by plotting the Historical fair value versus the Future Fair Value on a standard x-y chart, and then use bubbles to represent the size of discount relative to analyst estimates.

Author calculation of Historical and Future Fair Value, analyst estimates

This chart is insightful once you understand how to interpret it. What we are looking for are stocks that are trading at a discount to both the Historical Fair Value and the Future Fair Value. So, those stocks that are farther to the left, and farther to the bottom, are potentially the stocks trading at the largest discount to fair value. This would be the bottom left quadrant of the graph. Additionally, those stocks with the biggest bubbles are the stocks that are trading at the largest discount to analyst estimates, so in theory, stocks in the lower left quadrant that also have large bubbles, should be decent candidates for investment.

The chart suggests that Nike (NKE), Pfizer (NYSE:PFE), Merck (MRK), Elevance (ELV) and Lam Research (LRCX) appear to be attractive from a Historical Fair Value and Future Fair Value perspective, as well as having potential based on analyst estimates. It has been a while since I’ve had this many pass my valuation filters. Additionally, Hershey (HSY), United Parcel Service (UPS), A. O. Smith (AOS), and PepsiCo (PEP) appear to be trading at a good discount to Historical Fair Value, while being close to Future Fair Value, with upside based on analyst estimates.

From this list, I own Elevance, Hershey, Lam Research, Merck, Nike, Pfizer, and United Parcel Service. Since my last article, I have made purchases in Elevance at $431, Merck at $107, and Hershey at $182. They have all moved down since my last purchases – if only I could see the future…

If you are interested, I have a relatively recent article that is still relevant for Nike.

Based on the chart above, there are several good candidates for investment, and I will likely be looking at all of them, since I still have some dry powder. One that is of particular interest to me right now, due to the high yield, and that I am overall underwater by about 13%, including dividend reinvestment, since first starting to invest in this company in July 2023, is Pfizer. I wrote an article about Pfizer just about a year ago, if you are interested in what I had to say at that point. I called it a buy, and put my money where my mouth was, adding to my existing position around $29 at that point. Obviously, Pfizer has struggled the past several years, so I’d like to look deeper. I am a long term, dividend growth investor, and I am very patient when I believe in the companies that I own, but the high yield in Pfizer does have me concerned.

Pfizer Hypothesis

Let’s just get this out of the way, Pfizer has a few things that I am worried about:

- Pfizer is just a COVID company, and that story is in trouble.

- The pipeline is weak.

- Activist investors are going to cause problems.

- The dividend yield is too high – there must be something wrong.

Obviously, Pfizer really leapt to fame during COVID, as the company behind one of the first approved COVID vaccines. The story about the CEO, Albert Bourla, seizing the opportunity and inspiring his company to achieve what was thought impossible, is a great story, retold well in the Harvard Business Review. Since the end of the pandemic, cashflow and earnings have fallen, and Bourla’s leadership is being questioned. Having said that, for 2024, two of its major COVID revenue streams, Paxlovid and Comirnaty, account for about $8B in sales, versus $59-62B total – so though this is significant, it’s not the whole story. I’ll admit, a big reason I decided to invest in Pfizer was that I admired the CEO’s leadership in seizing the opportunity to develop a COVID vaccine, not just for the social benefits, but also for the investment benefits.

During the recent earnings update, Pfizer raised guidance, and specifically noted the ongoing power of its COVID franchise, but also discussed many other exciting products, as well as the growth provided by the Seagen acquisition. Year-over-year growth reached about 32%, with a lot of that attributed to the COVID franchise, but even excluding that contribution, growth was around 14%, which doesn’t look too bad. Pfizer continues to target around 9-11% growth excluding the main COVID contributors.

A lot has been written about the Starboard investment, with some interesting backroom maneuvers seeing some unusual drama involving former key executives, who were all in, and then all out, after pledging their renewed support of the CEO. There appears to be some level of agreement that Pfizer is already doing the main things an activist would normally pressure, so there is not a lot of confidence their involvement will be a major change agent.

Not really an activist, but worth mentioning, with the nomination of RFK Jr. to Health Secretary, there is a lot of concern and uncertainty about what that could mean for the health industry, with companies with large vaccine businesses of particular interest. Of note, Morningstar is using 12% as their assumption for vaccine revenue for their valuation of Pfizer, so again, RFK’s vaccine impact is not likely to be a huge driver for Pfizer. I, personally, feel that people have largely already made up their minds about vaccines, and many health interests, given the politics of the recent past, so I don’t feel like this alone, is likely to be a big driver.

To answer the question about the high yield, we really have to dig into the company health and valuation, so let’s spend some time on that.

Pfizer Analysis

Pfizer has a 5-year average Return on Equity of 18%, with its most recent ROE of 5%. The 5-year average Return on Invested Capital is 12% and its most recent ROIC is 6%. There are several things I look for here. First, these are ok numbers. I like to see these numbers above 10% at a minimum and view them as key indicators of growth potential. The recent numbers, being so much lower than average, do give me pause for concern. On a good point, there is a gap between ROE and ROIC, which does suggest that the company may be using leverage as part of its returns, but the gap is small. The Weighted Average Cost of Capital around 8% does not compare favorably with the Return on Invested Capital – I like to see the margin between these to be higher, to allow for compounding growth.

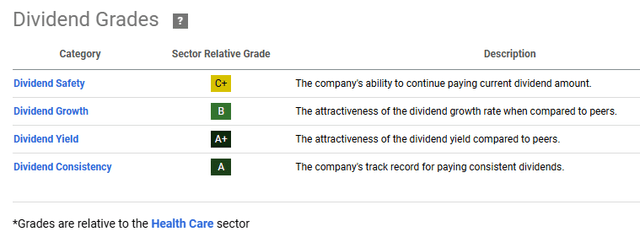

Since I’m a dividend investor at the core, from a dividend perspective, the earnings-based dividend payout ratio of 224% and free-cash-flow-based dividend payout ratio of 116% are a real concern. They have paid a growing dividend for around 15 years now. The dividend growth is also not very attractive (around 3%) though the starting yield is very attractive, if it is safe, at 6.5%.

Additionally, Morningstar rates Pfizer as wide moat, with standard capital management, and currently has a 5-star valuation rating.

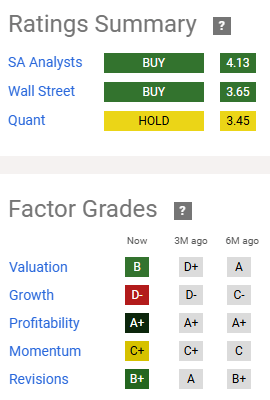

Seeking Alpha makes available a summary of ratings, as well as factor grades. These make for another nice, first pass filter for investment timing.

Seeking Alpha

Starting with the top stop-light chart – analysts are generally bullish on Pfizer. The shorter-term Quant rating has Pfizer at a hold, which could be an indication that short term, timing may not be perfect for an investment.

The Factor Grades are relative, and therefore very dependent on peer comparisons. Valuation looks attractive relative to peers, with profitability as a notable point – especially relevant to the current analysis. Growth is the struggle, which is not a surprise, coming off the back of the COVID boom, but still, I think back to the guidance suggesting low double-digit revenue growth expectations in the near future.

Pfizer Historical Analysis

Before we dig deeper into the growth, I do like to look where things have been in the past. I think we realize that past performance can be somewhat indicative of the quality of the company. Obviously, it’s important to understand the key drivers for that past performance, to see if you believe anything has changed that could impact that. So, let’s start with how Pfizer has performed for shareholders in the past:

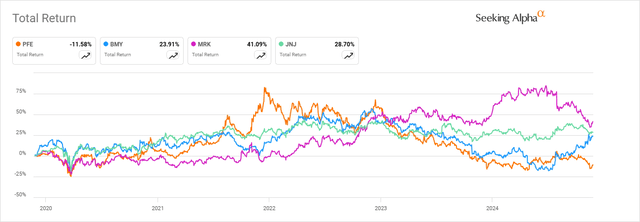

Ouch, PFE over the past 5 years, has really performed poorly compared to many of its key peers. Obviously, it outperformed during the COVID boom, but has since given up all those gains, plus some. So, is this deserved, or are we looking at a stock that is just not very popular right now?

To give an indication of whether this might be the case for Pfizer, let’s see if key valuation metrics have improved, stayed the same, or gotten worse over the past years. Let’s start with P/E and yield for this.

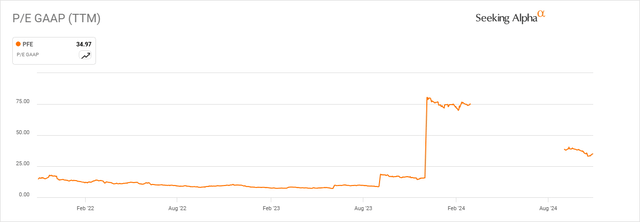

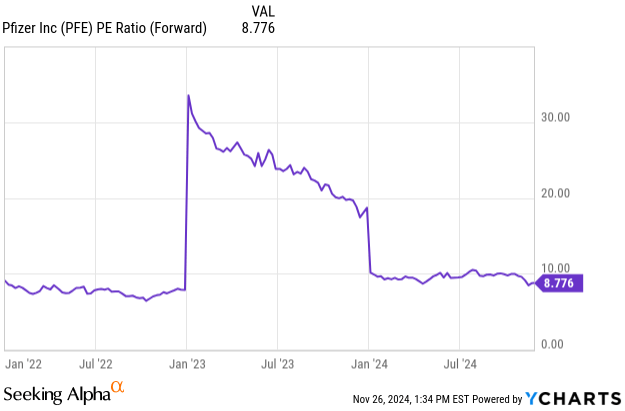

The GAAP P/E ratio is an ugly story. Pfizer has obviously had operational issues and restructuring that have impacted the recent earnings. Whereas the trailing twelve-month GAAP P/E currently stands at 34.97, the non-GAAP TTM P/E sits at 10.14. I am not a big fan of non-GAAP, but if we run with it for a minute, 10.1 would fall below the 5-year GAAP P/E average of 13.9, suggesting it could be undervalued. Let’s look at it another way as well. If we take the forward P/E ratio, which relies on analyst estimates, we can see that the valuation also looks potentially attractive, taking out the short-term noise.

Seeking Alpha

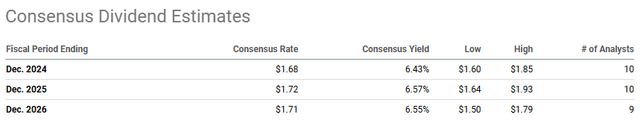

From a Yield perspective, it is also trading well above the 5-year average of around 4.9%, and at close to a recent all-time high, again suggesting it could be attractively valued.

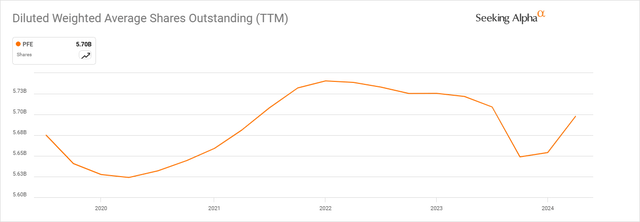

Another indicator I like to look at that helps to give insight into management confidence, as well as helping with the sustainability of the dividend, is a good recent history of share buybacks. In this case, you can see the company has struggled recently, and generally does not have a strong history of buybacks. Shares are down about 0.5% over 5 years, or call it basically flat.

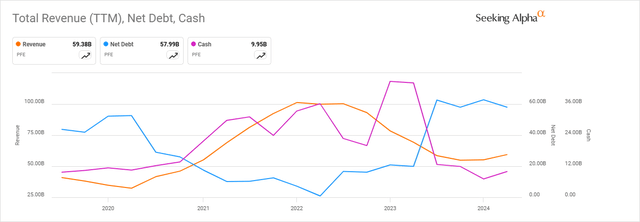

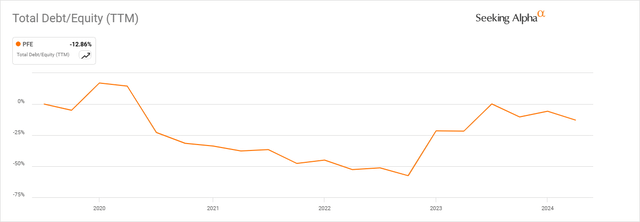

From a financial health perspective, revenue is down, and net debt is up. Neither of these are signs that you want to see in a solid investment prospect. The cash position is down from peaks, but still relatively healthy, and should provide flexibility for ongoing operations, as well as helping to fund the dividend. However, the debt / equity ratio is negative. This is a major red flag; signifying Pfizer has some real work to do on the debt load.

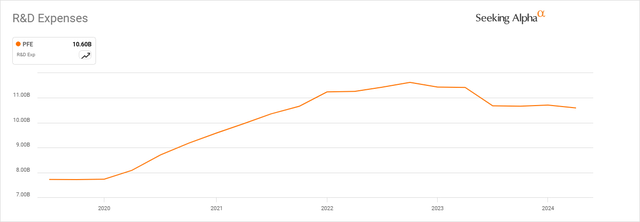

On a slightly more positive side, R&D expenses are down a little from recent peaks, but still high relative to the past. Obviously, our earlier ROE and ROIC metrics make us wonder if the debt they are accumulating to sustain R&D is worth the investment, but it does suggest the company is still pursuing growth.

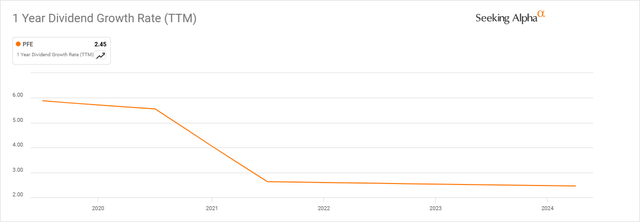

Pfizer has paid a growing dividend for around 15 years. The growth has declined significantly as of late, which isn’t a surprise compared to the other declines in the business, and challenging payout ratios.

The current dividend payout ratios are problematic, with a GAAP-based earnings payout ratio of 224% and free cash flow-based payout ratio of 116%. The dividend is not currently sustainable without a change in fortune.

Takeaways from the historical looking valuation and analysis:

- Pfizer’s valuation looks attractive, at least from a non-GAAP perspective

- The current financial situation is not sustainable – improved GAAP profitability and debt reduction is needed

- The dividend is not sustainable without a turnaround in profitability and free cash flow.

Pfizer Future Analysis

What has happened in the past is obviously one thing, where the company is headed in the future is the real question, especially since that’s part of our biggest concern with Pfizer.

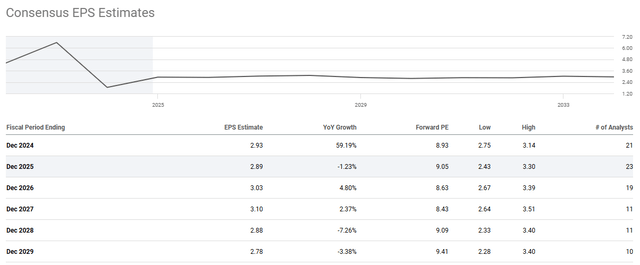

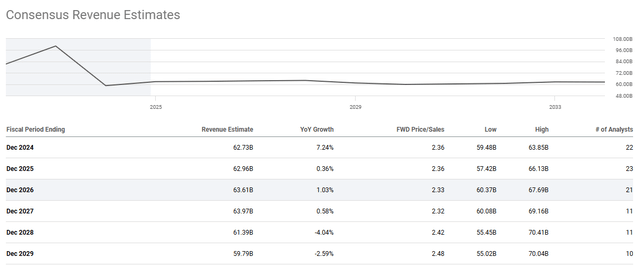

From a future earnings per share growth forecast, analysts don’t expect a lot of growth from Pfizer after this year. Having said that, the re-positioning in 2024 should help Pfizer recover to a more sustainable financial position. The projections are around flat, after a significant recovery in 2024.

Note that the projected P/E does stay below the 5-year average, which seems conservative. Also note, that from an earnings perspective, the estimates are well above the current $1.68 annual dividend, suggesting a return to healthy payout ratios, with margin for R&D growth, debt repayment, and potentially share repurchases, though I would hope that was lower priority until the debt position improves.

Revenue follows a similar trend to earnings, showing flat growth. One thing to potentially highlight is that with the significant cost reductions that have been promised, and that were highlighted in a link earlier of over $4B, this could have a material impact on the ability to pull more profit through, even on relatively flat revenue.

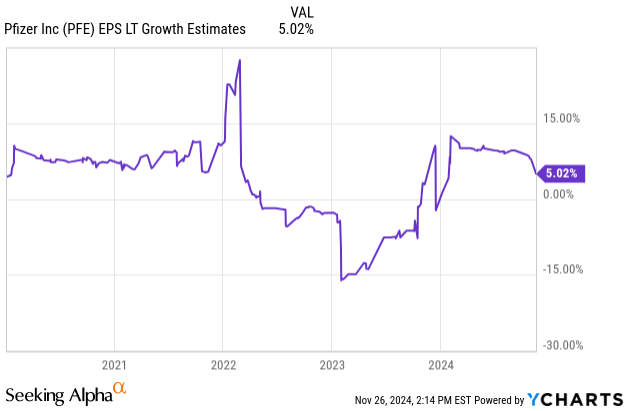

Even though it’s not future looking, I like to look at the history of growth expectations to understand how they compare to the future, to get an idea of how the stock is favored. This aligns well with the lower growth profile that analysts are expecting, as well as with a recovery coming off the back of the COVID boom.

Seeking Alpha

My own estimate for Pfizer’s forward growth is around 9%. I derive this from a combination of various growth projections and growth models. My estimate appears optimistic compared to analyst estimates, suggesting that either the future valuation is an opportunity, since it uses my growth estimate, or overly optimistic, thereby requiring a margin of safety.

Looking at future dividend projections, there isn’t a big surprise that growth is likely to remain muted. Those looking for a high grower probably need to give this one some more time. The attractive current yield, if it is sustainable, makes up for a lot of growth, though. Note, analysts also expect the yield to remain high. This could be good for reinvestment compounding, or an indicator of upside, if the yield reverts closer to past averages.

The Seeking Alpha Dividend Grades are more positive than I might have expected, given the challenges in payout ratio. However, now that we’ve seen that this appears to be a short-term issue potentially, it might make sense. Safety is obviously the key measure to watch if an expected turnaround is to occur.

Takeaways from the future looking valuation and analysis:

- Future earnings forecasts suggest a recovery in financial position and a return to healthy GAAP EPS payout ratios.

- Growth is likely to remain muted; however, there is opportunity based on management estimates, and my own estimates.

- Even reversion to mean suggests that the stock is likely undervalued based on future expectations.

Risk

We have already covered many concerns in the hypothesis section.

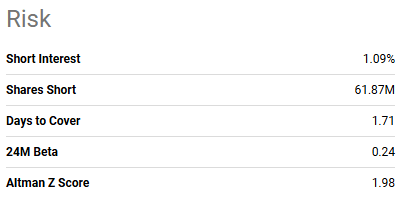

I always like to take a look at short interest because it can sometimes tell me if there is something that I might be missing. The short interest in this case appears low, so there are no warning signs here.

Seeking Alpha

It is worth noting that the Altman Z Score, which is an indicator of financial distress, is low. 1.8 is the danger threshold, with 3 being a good indicator of little to worry about. We’ve already discussed the financial worries we have for Pfizer, and how we need to see progress.

The ratings agencies appear to believe the turnaround story, and Pfizer still has strong credit ratings. It is rated A (Stable) by S&P, A2 (Stable) by Moody’s, and the Value Line Financial Strength rating is A. As we discussed previously, Morningstar rates it as Wide Moat with Standard Capital Management, plus has a 5-star valuation rating on it currently.

Summary

Pfizer is a lot of fun, if you like roller coasters. What’s to like? How about a high initial dividend yield, strong medical pipeline, a proven recent history of innovation, heavy investments in the business, and some strong promises for future financial improvements, from cost-cutting, profit and revenue. What’s not to like? How about the unsustainable dividend based on GAAP EPS and free cash flow, the negative debt to equity position, and the political risks that currently have investors spooked about this industry.

If you believe future projections, the current financial woes are temporary, and the business will return to strength next year. The pipeline is showing some indications of promise, though there haven’t been many slam dunks after the COVID wins. The activist investment campaign looks like it likely won’t make a big difference either way. We’ll all have to wait and see what happens from a political perspective, but I believe people’s minds are mostly already made up from a political health perception perspective.

Where does that leave me? I do believe Pfizer is potentially undervalued right now. The latest corrections due to political concerns, I believe, are too deep, and it was already fairly valued. I plan to add a small amount to my existing position to average down, while continuing to wait for more signs of the promised turnaround, and a return to a more financially secure position from a payout ratio perspective, and overall debt position.

For those that feel the risk is too great, based on the initial analysis in the article, I also believe that Nike, Merck, Elevance, and Lam Research may also be an attractive near-term investment to explore further.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ELV, HSY, LRCX, MRK, NKE, PFE, UPS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.