Summary:

- Accenture plc is a global consulting firm with a market cap over $200B and a CAGR of 16.2% since inception.

- Accenture has a long history of strong revenue growth and a consistent and healthy gross profit margin.

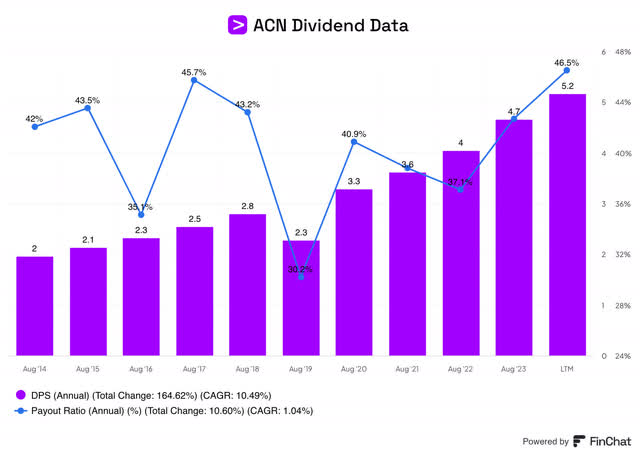

- The company just announced a 15% dividend increase, well above its 3, 5 and 10-year average dividend growth rates.

- Following the positive market reaction to the latest earnings report, Accenture has moved further into the HOLD zone based on our valuation model.

HJBC

Company Description

Accenture plc (NYSE:ACN) is a worldwide consulting company that focuses on supporting businesses with technology services and operations. The company has a current market cap of more than $200B and employs approximately 750,000 people around the globe. Since going public in July 2001 the stock has returned nearly 3,200% or an extraordinary CAGR of 16.2%.

Quality

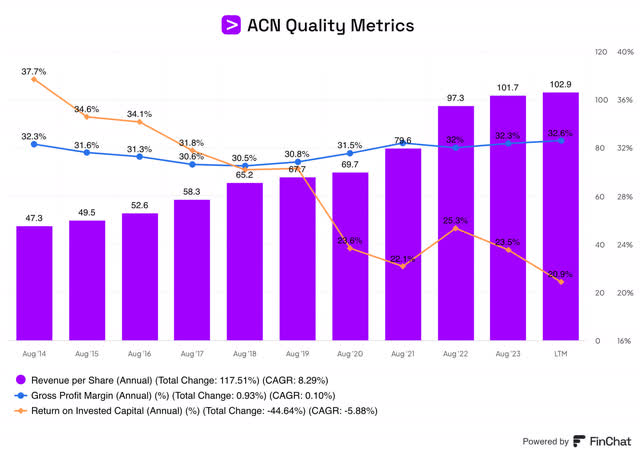

In my opinion, there are 3 important quantitative components that all high-quality companies have in common. Those were detailed in the description of the Investable Universe, as an increasing revenue stream, solid margins and a healthy return on invested capital. Let’s determine if ACN is a high-quality business based on the aforementioned metrics.

Revenue per share grew at a steady pace between fiscal year 2013 and fiscal year 2021 before jumping more than 20% in FY 2022. Following that remarkable increase, revenue per share growth came back to reality in 2023 with a more normal increase. It’s worth noting, ACN was still able to grow this metric during the pandemic, displaying the company’s resilience against unforeseen circumstances. Over the past decade, ACN’s revenue per share has grown by more than 115%, equating to a CAGR of more than 8%.

The gross profit margin has been very stable since FY 2014 where it was 32.3%. Since then, it has fluctuated to a low of 30.5% in fiscal year 2018, but has since rebounded back up to where it started in the most recent fiscal year. The consistency of this metric is admirable and should provide investors with peace of mind that the company is capable of maintaining its margins, regardless of external factors.

The return on invested capital has been inconsistent, starting at nearly 38% in 2014 before dropping almost 40% to 23.6% in FY 2020. Since then, it has fluctuated between a low of 22.1% in fiscal year 2021 to a high of 25.3% in 2022. Preferably, ACN can take steps to improve its ROIC to pre-pandemic levels, ideally north of 30%.

Overall, these metrics are solid, with the exception of the return on invested capital in recent years. Although this metric is still good, we would like to see it recover more to pre-pandemic levels. Ultimately, ACN is still worthy of being considered a high-quality business and is deserving of a spot in this investable universe.

Dividend

During ACN’s Q4 2024 earnings call a few days ago, the company announced an impressive dividend increase of nearly 15% to $1.48 per quarter or $5.92 annually. This increase was higher than its 3-, 5- and 10-year dividend growth rates which sit at 13.6%, 12.06% and 10.74% respectively. With the exception of 2019 the dividend has been growing very consistently and is safe thanks to a payout ratio lower than 50% which leaves plenty of room for future dividend increases.

Past Performance

As previously mentioned, Accenture has been a public company for nearly a quarter-century and has a CAGR of more than 16% since inception. This has led to an exceptional total return of more than 3,000%. Additionally, over the past decade, the stock has returned more than 335% and the CAGR has essentially matched what the stock has done since inception with a CAGR over the past 10 years of 15.8%. Obviously, these are very healthy and consistent returns, and based on them, ACN is a long-term winner and thus deserving of a spot in this investable universe.

Earnings Update

On Thursday, September 26th, ACN released its Q4 2024 earnings as well as full-year earnings for fiscal 2024 and some guidance for 2025.

Let’s start with Q4 earnings, revenue beat by $20M and earnings per share also beat by $0.02.

Fourth quarter revenue was $16.4B, an increase of about 3% compared to Q4 2023. Revenue was close to an even split between Consulting, $8.26B and Managed Services, $8.15B. Exchange rates also had a negative impact of about 2%.

Additionally, GAAP EPS for the quarter was $2.66 a share, an impressive 24% increase from the prior year, which was $2.15. While adjusted earnings per share for the quarter was $2.79 a 3% increase relative to last year.

New bookings for Q4 were a whopping $20.1B, another increase of more than 20%. The new bookings split was as follows, Consulting made up about 43% of new bookings or $8.6B and Managed Services made up the remaining 57% or about $11.6B. Diving into these numbers further, in the company’s earnings call, we can see their GenAI bookings are increasing quickly. Management stated in the fourth quarter alone their GenAI bookings were $1 billion, which crushed all of FY23 where the total for the year was $300M. This area is something Accenture wants to capitalize on, as it is a growing part of their clients’ needs.

Furthermore, full year 2024 results were also included in the call and again were overall good. Revenue for the year was nearly $65B, a 1% increase from the prior year. While earnings per share for the year climbed to $11.44, a solid 6% increase, and adjusted earnings per share rose 2% to nearly $12. It was also announced the company returned approximately $7.8B to shareholders, $3.2B of which were dividends, with the remaining coming from share repurchases.

Lastly, management offered guidance for Fiscal 2025 with projected revenue growth of 3% to 6%. Also, earnings per share are expected to be between $12.55 and 12.91%, this would result in 10%-13% year-over-year growth.

Overall, the market reacted very well to the earnings report with the stock jumping 7.5%, from $337 to $362. You can read/listen to the full earnings call here.

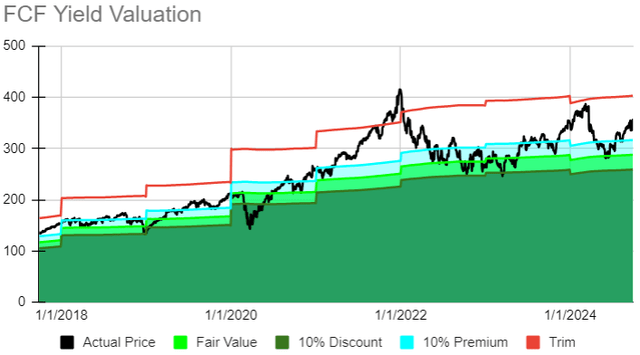

Valuation

To determine if ACN is potentially attractively valued today, let’s examine its valuation from a free cash flow perspective.

The valuation model suggests ACN is currently trading within its “hold” zone, approximately 21% over its fair value. The stock’s fair value based on the model is $288, with $302 as a good entry point to initiate or expand your position.

The long-term expected RoR for Accenture is 6.40%. The company’s earnings per share growth rate is by far the largest component, contributing more than 8.5%. ACN’s yield does not contribute much to its expected rate of return as it sits near 1.7%. The return to fair value factor which has an impact of -3.89% is the biggest lag on its expected RoR. Our objective is to seek an expected rate of return of at least 10%. Since ACN is considerably below this threshold, the stock price would need to decline in a material way or its FCF/share would need to improve dramatically, especially since it declined about 3.5% in FY 2024 vs. 2023.

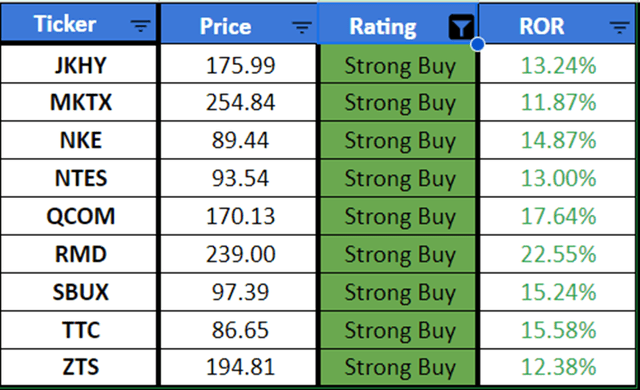

Investable Universe Update

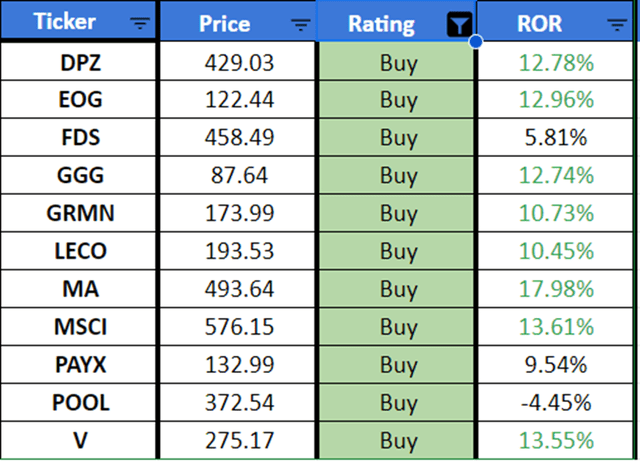

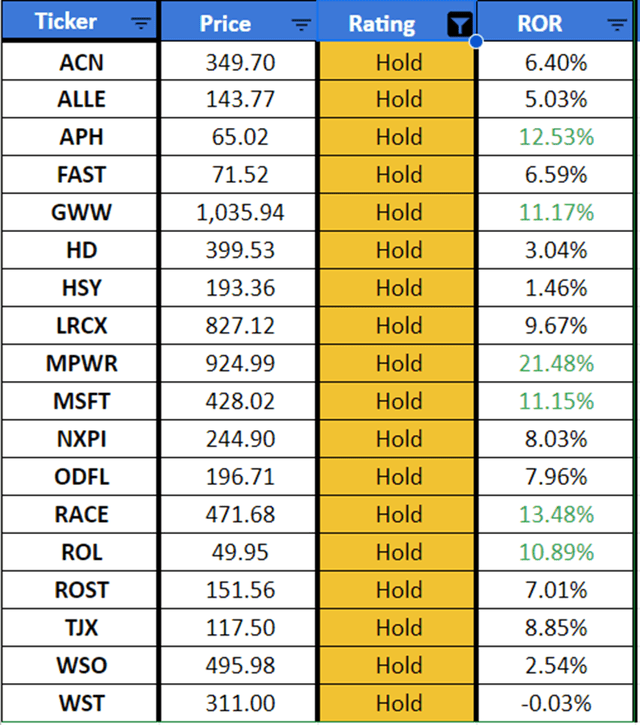

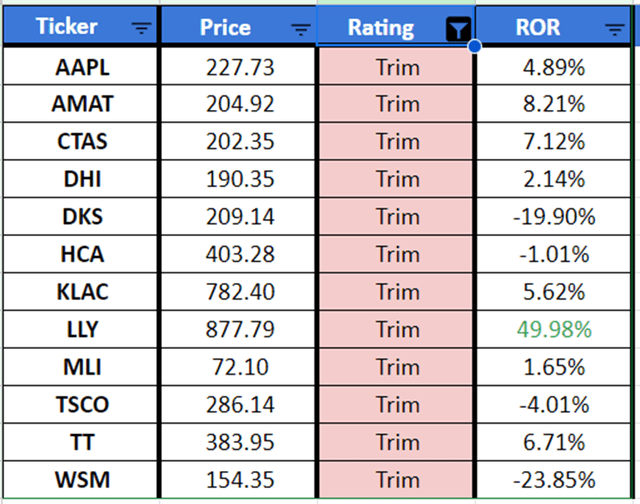

Here are the valuation ratings and expected rate of return for all 50 stocks in the High-Quality Dividend Stock Investable Universe. Notable changes since the last article are summarized below.

Created by Author Created by Author Created by Author Created by Author

Lam Research Corporation (LRCX) has been downgraded from a BUY to a HOLD.

West Pharmaceuticals Services, Inc. (WST) was downgraded from a BUY to a HOLD.

Applied Materials, Inc. (AMAT) was downgraded from a HOLD to a TRIM.

Currently, 40% of the stocks in the Investable Universe are either a BUY or STRONG BUY.

- Strong Buy – 9 stocks (18% of the universe)

- Buy – 11 stocks (22% of the universe)

- Hold – 18 stocks (36% of the universe)

- Trim – 12 stocks (24% of the universe)

How to interpret the Valuation Ratings:

- Strong Buy – The stock is potentially trading for a discount to fair value

- Buy – The stock is reasonably valued at the moment

- Hold – The stock is marginally to moderately overvalued

- Trim – The stock is overvalued or does not present a good long term potential return from its current price.

*A trim recommendation is not to be taken as a firm Sell. The base case methodology for this investable universe is long-term buy-and-hold. A trim recommendation is an option to consider trimming a given position if you would like to free up capital to invest in another opportunity that appears more lucrative.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ACN, AMAT, LRCX, WST either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.