Summary:

- LOW beat analysts’ expectations for fiscal 1Q24 for both revenue and earnings, but the stock declined.

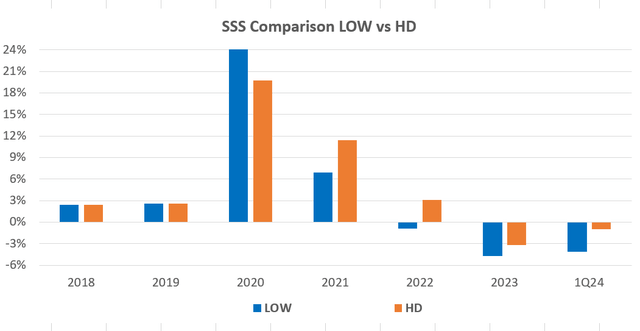

- LOW has reported five consecutive quarters of negative same store sales growth.

- America’s Home Improvement warehouse is struggling because higher inflation and interest rates have eroded consumers’ buying power and delayed major purchases and home sales.

JHVEPhoto

Although Lowe’s (NYSE:LOW) again beat Zacks’ consensus estimates for revenue and earnings and affirmed its guidance for fiscal year 2024 (F2024), investors’ reaction contrasts sharply with past quarters when the stock jumped after the earnings announcement and rallied for the next couple of days. Instead, LOW declined 2% on the day of the announcement and another 4% the rest of the week. The stock opened higher, but investors reversed course after discussion between management and analysts during the earnings call laid bare two key points that have caused me to lower my rating to Hold from Strong Buy.

- There are no tangible signs of improvement in demand or profitability.

- The guidance affirmation hinges on a turnaround in F2H24 with no expectations for material improvement in F2Q24.

When will LOW report Same Store Sales (SSS) growth?

LOW will likely remain under pressure until it reports growth in SSS. The initial favorable reaction to the earnings release was likely due to investors misinterpreting the steady improvement in SSS throughout F1Q24 as a sign of a turnaround. During the earnings call, management explained that the improvement in SSS from -6.7% in February to -1.1% in April was due to Easter and weather as opposed to a resurgence in demand.

Management’s explanation about the SSS trend left investors in the same place they have been after the last few earnings calls. LOW highlights positive SSS for its segment focused on professional contractors (PRO) and online sales while assuring investors that it is making meaningful progress on its perpetual productivity improvement (PPI) initiative and strategy for capturing more business from PRO. However, a gap in performance with Home Depot (HD) persists.

Management reiterated its SSS guidance for F2024 of -2% to -3%. However, analysts and investors were clearly skeptical because management also told them to expect results for F2Q24 to be similar to F1Q24. That implies SSS will need to improve significantly in F2H24, and there are no trends or events to support that assertion in my opinion.

Inflation

Inflation is the likely culprit for LOW’s unfavorable trends in SSS and share price. The consumer price index has increased 22% since April 2020 compared with just 7% in the four-year period ended April 2020. Higher inflation has eroded consumers’ purchase power, especially for discretionary purchases, such as upgrading tools, and large purchases that can be deferred like remodeling a kitchen. This phenomenon explains why Items costing more than $500 registered the most severe decline in SSS for the fifth consecutive quarter.

Since SSS was relatively healthy in 2021, the indirect impact from inflation in the form of higher interest rates has arguably done more damage to LOW than inflation itself. The Federal Reserve Bank has hiked its target Fed Funds Rate from less than 25 basis points in March 2022 to a range of 5.25% to 5.50% in July 2023. When a consumer finances a purchase over five years, each one percentage point increase in interest rate adds more than 2.5% to total payments.

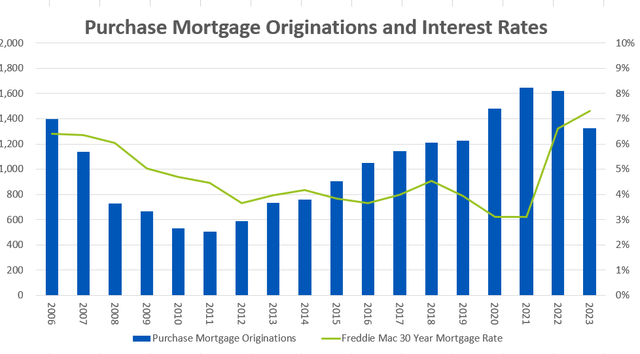

Higher mortgage rates are negatively impacting a key driver of LOW’s demand – home purchases. Some sellers purchase new appliances shortly before putting their home on their market. If the seller doesn’t update the appliances, the buyer may elect to do it after closing. Existing home sales declined 19% to their lowest level since 1995 according to the Wall Street Journal. The below chart shows inverse correlation between mortgage rates and purchase mortgage originations, which are a good proxy for home sales. The relationship means LOW’s demand for large ticket items will face serious headwinds until mortgage rates fall.

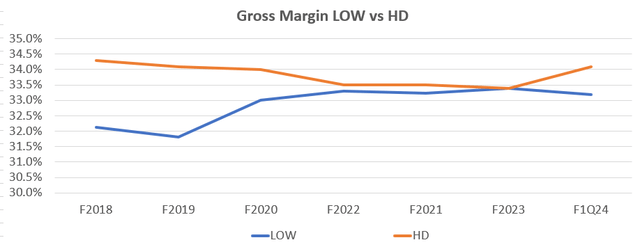

Deterioration in Margins

LOW’s operating margin tumbled 201 bps to 12.4%. Management attributed the drop to three factors.

- Cycling a legal settlement in 1Q23 for an unspecified amount

- Investments in PPI

- Impact of deleveraging due to lower sales

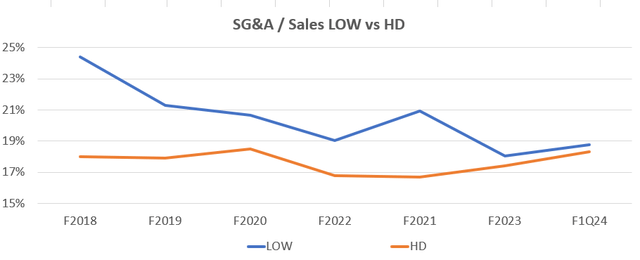

The most recent quarter represented a setback for LOW against HD regardless of the reason. LOW had essentially managed to eliminate a pre-pandemic gap in gross margin between LOW and HD. On the positive side, LOW preserved the progress it made on narrowing the gap with HD on the ratio of sales and general administrative (SG&A) expenses to sales in 2023.

Counterarguments: Macro Shift or Micro Execution

There are two reasonable counterarguments to the hypothesis that LOW won’t outperform the S&P 500 over the next year. If an unfavorable change in the macroeconomic landscape is the root cause of LOW’s negative (SSS) and decline in earning, then a favorable macro shift should result in a strong rebound in the stock. U S. News & World Reports stated that estimates for pent-up demand for housing range from 1.5 million to 3.9 million homes, including multifamily rentals. According to the National Association of Realtors, only 4.09 million existing homes were sold in 2023, and the Census Bureau’s data shows there were 666,000 new home sales. Consequently, unleashing the pent-up demand for housing would create significant demand for LOW’s products.

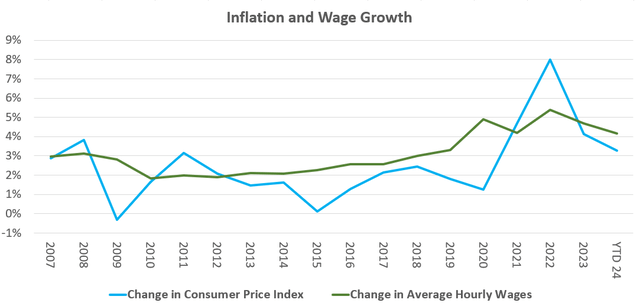

There are signs that a favorable macro shift for LOW could happen soon. The below chart shows wage growth has exceeded inflation in 2024, which will potentially help restore consumers’ purchasing power and alleviate concerns about large purchases.

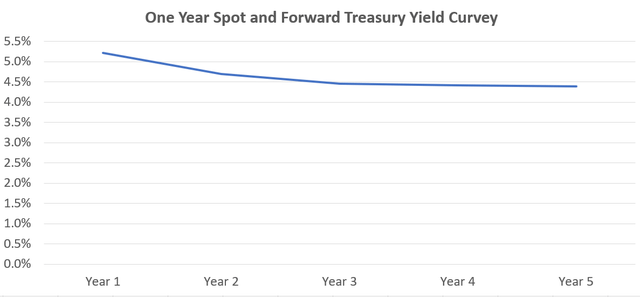

Those larger purchases would also become more affordable if interest rates decline, which the market expects based on the second below chart. According to BankRate.com, the majority of Fed Governors expect to cut rates 75 bps in 2024, and the overwhelming majority of Governors believe the Fed Funds rate will be below 4% in less than 18 months. Yields on treasuries show bond investors’ expect interest rates to decline more than 50 bps over the next year.

Even if present macroeconomic conditions persist, LOW could still outperform if it effectively executes on its five-point strategy for improving demand coupled with its PPI effort.

- Drive PRO Penetration.

- Accelerate Online Business.

- Expand Installation Services.

- Drive Localization.

- Elevate Assortment.

Recent quarters provide some evidence that LOW is making progress on its initiatives. Sales for PRO and Online were favorable. LOW announced partnerships with DoorDash (DASH) and Shipt to reduce delivery times. Management highlighted key additions of Toro and Klein to its product assortment, and noted LOW’s Springfest was more localized than ever.

Valuation and Conclusion

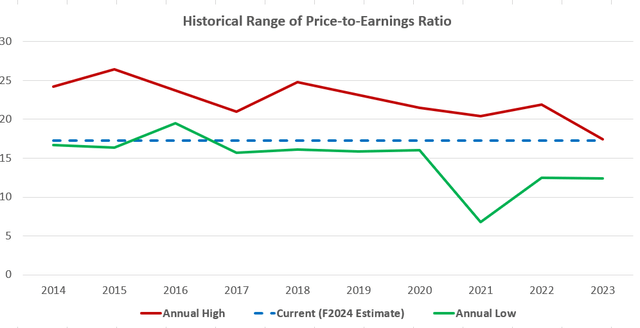

LOW’s shares have fallen to a level that creates a moderate reward if macroeconomic conditions improve or management can deliver a sustained rebound in SSS. The stock is trading at 17x its earnings per share for the past four quarters. The below chart illustrates this level was near the low point in most calendar years before 2021, and LOW often traded above 20x. Consequently, new investors could realize a 15% gain if LOW’s price-to-earnings (P/E) ratio normalizes without a shortfall in earnings. However, it’s worth noting that LOW’s P/E ratio has dipped below 16x in every calendar year since 2016.

The major driver behind my recommendation is the significant risk that there is neither a major rate cut nor evidence of strong execution by LOW in the next year. The yield on 2-month Treasuries has been above its 2-year counterpart since the beginning of 2023. That means investors have been expecting a rate cut for a long-time, and a string of bad inflation reports could further delay that rate cut. On the micro side, LOW’s management team hasn’t provided any tangible evidence that its strategy will result in a rebound in SSS. Therefore, I’m revising my recommendation for LOW stock to hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I generally hedge my long position with a covered call, and I plan to lower the strike price when I sell my next call.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.