Summary:

- Microsoft is a great business, but one whose valuation has become excessively inflated in the recent AI boom.

- MSFT stock is extremely unlikely to produce market-beating returns from current levels, even if it hits the 14% EPS growth target.

- I present my reasoning, which leads me to believe that a rotation out of tech is likely, and show that MSFT price is likely to be flat over the next two years.

- I also present alternative, which I believe offers better risk-adjusted return.

KanawatTH

Dear readers/followers,

I’ve recently published a bearish article on NVIDIA (NVDA) arguing that (1) I see potential for a rotation out of tech as the AI-driven rally likely got ahead of itself in the current macroeconomic environment and (2) buying the stock around 50x earnings with extremely aggressive growth assumptions is very risky and likely won’t produce significant risk adjusted outperformance.

Judging by the comments on that article, I didn’t articulate my thesis clearly enough and it seems that many investors are not focusing enough on price and the bigger picture and simply buying into the hype. So today I want to expand on the idea that an AI bubble is being formed and provide some additional charts that I see as helpful to understanding the situation and to clearly conveying my thesis.

Specifically, I want to illustrate this on Microsoft (NASDAQ:MSFT) which is a company I have very high regards for and consider to be one of the businesses on the planet. Still, I liquidated my position last week as the stock approached an all-time high, after rallying 50% from the October low. My decision to sell has nothing to do with how good or bad the business and everything with how much it costs.

Tech driven rally got out of hand

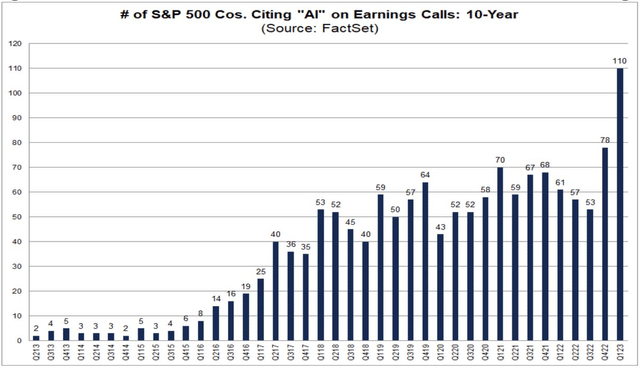

Let’s first have a look at some recent market dynamics. Unless, you’ve been living under a rock, you must have noticed the recent AI-craze. In Q1 2023, the number of companies citing AI in their earnings call, reached an all-time high of 110, essentially double compared to Q3 2022. This is quite normal as management teams often try to highlight how their business is on top of current trends. It was the metaverse in 2021, then pricing power in 2022 and finally we have AI in 2023.

FactSet

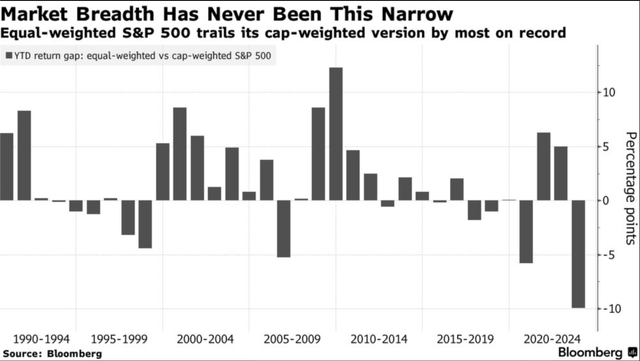

Investors jumped on trend by buying big tech and as a result sparked a massive rally in the top 7 S&P 500 Stocks. These include Nvidia, Apple (AAPL), Tesla (TSLA), Microsoft, Google (GOOGL), Meta (META), Amazon (AMZN). Year-to-date these 7 companies have returned 60% on average. Meanwhile the remaining 493 companies in the index have returned just 3% YTD. We all know that tech has been leading the market this year, but I didn’t realize until recently just how big this “imbalance” has got.

Index investors should beware, because they’re now basically tech investors as these 7 companies account for 30% of S&P 500. Moreover, the tech rally has resulted in the highest return spread ever between an equally-weighted and the traditional cap-weighted S&P 500. The spread now stands at -10% and we’re just halfway through the year.

Bloomberg

Look, I don’t have a crystal ball and of course the rally could continue, but one thing I’ve learned is that the market has a tendency to revert to the mean, it always has. The chart above clearly shows this, as every period with a negative spread (like the one we have now) has been followed by a reversal and a substantially longer period with a positive spread (i.e. tech underperforming). The reversal doesn’t have to come right away, but it will come.

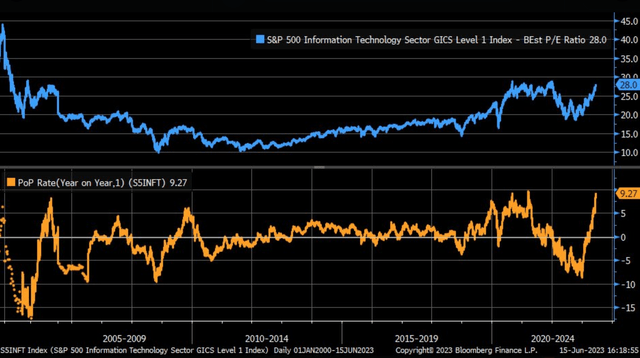

The tech part of the S&P 500 now has an average P/E of 28.0x which is almost the highest it’s ever been, except for the tech bubble of early 2000s. That is extremely aggressive, especially in light of high interest rates and the Fed trying to push us into a recession. Also notice on the bottom orange chart how fast the multiple expansion has been. The multiple expanded from 20x to 29x (+45%) in just 6 months and this is where the YTD stock returns came from. It had nothing to do with earnings growth and everything to do with multiple expansion. And since fundamentally the economy has changed very little over the last 6 months, the expansion has largely been speculation driven.

Bloomberg

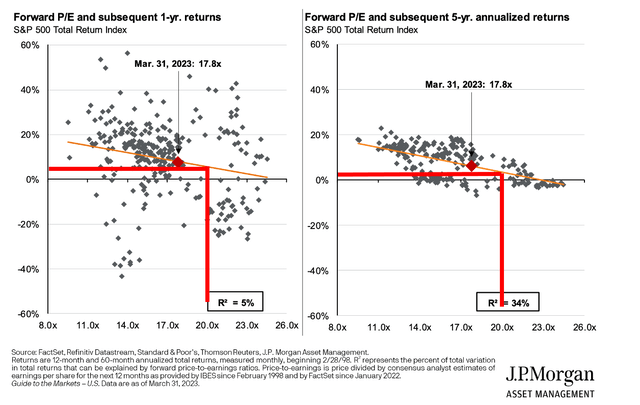

Now that we’re here, the S&P 500 trades at a forward P/E of around 20x, which according to JPMorgan (JPM) on average results in sub-par subsequent returns over the next 5-years. In fact a forward P/E of 20x has historically been followed by 5-years total returns of less than 5%. This suggests that the index is too expensive to realistically produce at least the 8-10% it has averaged historically. Combined with the fact that tech multiples have expanded by 45% in just 6 months and the fact that in history this has always reversed, I don’t expect tech to outperform the market on a risk-adjusted basis either.

JPMorgan asset management

Great business with an expensive price tag

A lot has been written about MSFT here on Seeking Alpha and elsewhere and pretty much everybody is familiar with what the company does. The focus of this article is not to comment on Microsoft’s business nor its involvement in AI. Microsoft is an incredibly strong business, one that has been around for over 20 years and has produced nothing but great results. It’s also one of just two AAA rated S&P 500 stocks with the other one being Johnson & Johnson (JNJ).

But the question is, is it worth buying at any price?

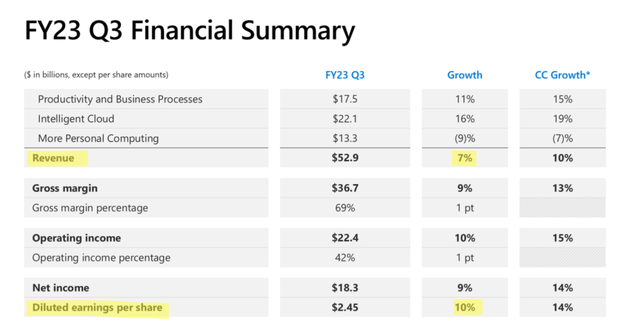

For me the answer is no and throughout this article I will try to present my view and come up with a fair valuation for the company. Their Q3 2023 results (note that their fiscal year ends in June) have been solid, with 7% YoY revenue growth and 10% YoY EPS growth and quarterly EPS reached $2.45.

MSFT Earnings Presentation

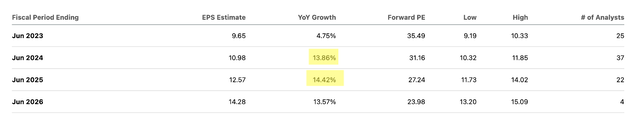

For the full 2023 fiscal year, earnings are expected to total $9.65 per share, up around 5% YoY. Going forward, the company expects its intelligent cloud division to drive growth by double digits per year. In particular, consensus is for 14% growth in 2024 as well as 2025 which should drive EPS to $12.57 by June 2025 (i.e. two years from now).

Seeking Alpha

That’s decent growth, not extraordinary and certainly not something that Microsoft hasn’t done before, but decent. Let’s say that the company can hit this target. How much do we make in that case on top of the dividend of 0.8% per year?

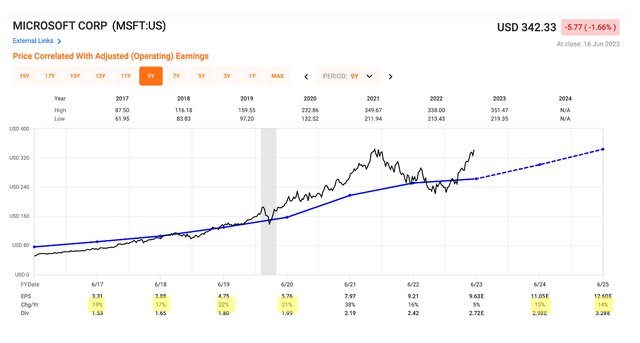

First let’s look at my base case, which many of you will likely consider a bear case. Historically, since 2016 which is when growth really picked up for Microsoft from low single digits to 17-22% per year (see highlighted YoY growth in chart below), the company has traded at an average P/E of 27x. Going forward, with slower 14% growth, I see no reason to forecast a higher multiple, especially since we now have much higher interest rates that should push valuations down. For the sake of the argument, let’s say that the 27x multiple is fair, even in a higher for longer scenario. If analysts are right and EPS reaches $12.57 per share in two years’ time, the price target stands at $339 per share. That’s flat from today’s price of $342 despite significant 14% EPS growth and with a negligible sub-1% dividend yield, it’s deeply below average market returns.

Now let’s have a look at the bull case. What multiple are you willing to use? During the 2016-2021 period earnings grew with a CAGR of 23% and the P/E multiple never went above 35x. Now the forecasted growth is only 14% (vs 23% before), but let’s say that for some reason 35x earnings is fair (which I really doubt, but bear with me). At 35x earnings, the price target is at $440 per share. That’s a 29% upside over the next two years in the most bullish scenario you can have.

Fast graphs

The fact of the matter is that Microsoft is currently priced for perfection and the upside is very limited even assuming that the company delivers on EPS growth target and using fantasy-land exit multiples. Buying or even holding here is a recipe for underperformance which is why I rate the company as a SELL here, purely because of valuation.

Conclusion

So with that said, what’s the solution?

That depends on your goals and your strategy, but for me it’s buying companies that already trade at depressed valuations and where I can realistically expect double digit returns over the next 3-5 years without high earnings growth and especially without the need to use inflated multiples. My goal is not to double my money overnight, but to consistently try to outperform the S&P 500 and with history on my side, I’m quite certain that the answer to that lies outside of tech and namely outside of Microsoft.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Landlord for a 2-week free trial

We are the largest and best-rated real estate investor community on Seeking Alpha with 2,500+ members on board and a perfect 5/5 rating from 500+ reviews:

![]()

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.