Summary:

- TG Therapeutics is a small biotech company that sell ublituximab (a new anti-CD20 monoclonal antibody) for the treatment of multiple sclerosis (MS).

- Anti-CD20 class is the largest ($9bn) and only growing drug class in MS. Ublituximab is a third-in-class drug that has some competitive edge and may reach over $1bn peak sales.

- TG Therapeutics trade at the low level of the fundamental value range (ublituximab NPV is $2-5bn). The near-term stock price primarily depends on sales performance.

- Ublituximab (TG Therapeutics) is likely to become an acquisition target.

- M&A value may be well above x2 to the current price that depends on several factors, which will play out in the next 9-12 months.

Editor’s note: Seeking Alpha is proud to welcome Grigorii Borisenko as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

PM Images

Investment thesis

On August 1, 2023, shares of TG Therapeutics (NASDAQ:TGTX) lost half of their value, because investors lost faith in the potential near-term company takeover and were disappointed with sales. Since then, TGTX have demonstrated consistent sales growth and stock rebound. However, the current market capitalization may be well below the potential fundamental value. We believe that this value will be revealed upon the clearance of several competing R&D uncertainties followed by company acquisition.

Introduction

In the twisted history of TGTX, the primary focus was always on the development of anti-cancer therapies, which included oral PI3K inhibitor and its combination with anti-CD20 monoclonal antibody ublituximab. Program of ublituximab development for multiple sclerosis (MS) seemed to be a safe plan B that could yield in between a best-in-class follow-on drug and something next to a patented biosimilar. As the years passed, cancer programs have been cleared, ublituximab has been approved by the FDA for the treatment of MS, and TGTX has become a single-drug MS-focused company.

TGTX was able to demonstrate consistent sales growth of ublituximab: company ended 2023 with $89m revenue and in first quarter 2024 raised revenue target to $270-$290m for 2024. TGTX continues to generate negative net cash flow due to new R&D programs (subcutaneous (SC) formulation of ublituximab and new allogeneic cell therapy for autoimmune disorders). However, it is anticipated that current cash position (~$210m) and positive cash flow from ublituximab business will fund all operations to cash flow positivity.

In the following sections, I support investment thesis by analyzing the company’s fundamental value and its acquisition prospects. Specifically, I briefly present the following:

- MS treatment and ublituximab position among other drugs,

- MS epidemiology and market,

- Potential threats for ublituximab from SC anti-CD20 drugs, biosimilars and other new drug classes.

I derive the possible NPV range for ublituximab and discuss how internal and external factors may shift the NPV within the range; then, I outline conditions for acquisition.

Ublituximab in the MS treatment context

MS is an autoimmune disease of the brain. MS is driven by immune cells (leukocytes), which enter the brain and destroy the neuronal sheath. Without sheath, neurons cannot function and die.

Relapsing-remitting MS is the most prevalent disease phenotype and is defined by relapses (transient exacerbations of neurological disability). A group of drugs called ‘disease-modifying therapies’ (DMTs) are targeted to prevent relapses and delay the progression of disability. One DMT group is represented by monoclonal antibodies mAbs, which outperform all other DMT drugs in terms of efficacy. The FDA has approved five mAbs for use in MS (natalizumab, alemtuzumab, ocrelizumab, ofatumumab, and ublituximab). These mAbs prevent the accumulation of leukocytes in the brain.

Natalizumab and alemtuzumab use is associated with long-term safety risks. Natalizumab may induce multifocal leukoencephalopathy and is discontinued earlier than other mAbs, while alemtuzumab treatment is associated with autoimmune thyroid disorders and with rare, but serious cardiovascular side effects.

Ocrelizumab, ofatumumab, and ublituximab are called anti-CD20 mAbs because of their similar mechanisms of action, – they deplete B-cells (a key pathogenic leukocytes in MS) by binding to their CD20 receptor. All anti-CD20 mAbs are very close to each other in efficacy and safety; however, they have not been compared in direct studies.

Ublituximab has a small competitive edge including the lowest reported relapse rate, a short infusion time and lower pricing. These may provide up to 30% of the market share for the latecomer. However, only long-term observations and studies on injection reactions, adverse events, discontinuation rates and efficacy will fully inform its use.

Traditional approaches in MS treatment recommend initial intervention with lower-efficacy therapies that would be followed by “escalation” to high-efficacy therapies (anti-CD20) upon disease progression. Real-world evidence and clinical trials have revealed that anti-CD20 mAbs are able to prevent relapses, reduce potential neuronal injury and slow disability accrual, while providing safety similar to less effective drugs. Moreover, early treatment with anti-CD20 may significantly reduce non-drug-related healthcare costs. These observations slowly shift practice toward early proactive treatment with anti-CD20 in the US and Europe. Importantly, the discontinuation rates for anti-CD20 are significantly lower than those for other therapies. Therefore, the use of anti-CD20 (along with the market) will very likely continue to increase in the coming years.

MS Epidemiology

According to epidemiological assessments the prevalence of MS is approximately 370 per 100000 population in the US, which corresponds to 900 thousand people. There are over 1 mln people living with MS in Europe and 2.9 mln worldwide. These numbers continue to rise owing to improved diagnosis and treatment, and to population growth.

Approximately 60% of diagnosed MS patients are treated with DMT that narrows the treatable patient population to ~460 thousand in the US. Industry analytics suggests that there are 360 thousand treatable relapsing-remitting MS in the US and a slightly lower figure in EU5.

Market of anti-CD20 mAbs for MS

Alemtuzumab sales were about 500 EUR in 2018, and then declined to negligible values. Natalizumab sales achieved blockbuster levels, but started to decline in the last two years. Anti-CD20 is the only growing mAb class in MS. In 2023, company-reported combined sales of anti-CD20 mAbs were over $9bn. About 40% of DMT-treated patients in the US were on anti-CD20 mAbs. Roche and Novartis expectations for ocrelizumab and ofatumumab peak sales were over $9bn and $4bn, respectively. Thus, ublituximab has entered one of the largest and growing niches in the pharmaceutical market.

Future competition for Ublituximab

In my view, the major threats to ublituximab are the entry of ocrelizumab biosimilars, subcutaneous (SC) forms of anti-CD20 and oral BTK inhibitors.

Biosimilars

The major future competition for ublituximab is associated with the entry of ocrelizumab biosimilars. Ocrelizumab is IP-protected for use in MS until 2029. SC form will have a longer patent coverage. Major biosimilar companies (e.g., Celltrion) are ready for phase 3 trials of ocrelizumab biosimilars. If it goes as planned, these biosimilars will be on the market in 2029-2030.

On average, biosimilar entry will induce a 30% drug price decline within 3y and reduce the volume sales of the originator by 60-80%. Ocrelizumab is one of the most successful drugs, therefore biosimilar competition will be hot. It is very likely that the ocrelizumab market share will significantly shrink and that ublituximab may meet a similar fate.

SC vs IV administration route

In general, patients prefer self-injectable SC drugs to intravenous infusions (IV). SC may be a preferred route of administration from both clinical and payer perspectives. In this context, the brisk growth of ofatumumab (SC) sales is not surprising. Similarly, an introduction of SC ocrelizumab to the market by Roche seems to be an essential step in marketing and extending the drug life cycle.

SC formulations will play a significant role in MS treatment, but the extent of the market shift from IV to SC can be influenced by multiple factors and is difficult to predict. In any case, SC formulations of anti-CD20 class will have a longer IP protection; therefore, TGTX move towards SC development is a necessity that unfortunately happened a bit late.

Cross-class competition: BTK inhibitors

Anti-CD20 mAbs deplete B-cells in the blood and, consequently, prevent their accumulation in the brain. However, these drugs do not reach B-cells, which are already inside the brain. These CNS-compartmentalized B cells can drive smoldering inflammation, and, hence, new drugs must be developed to block this pathogenic process.

B-cell maturation, activation and survival are regulated by the cytoplasmic enzyme Bruton tyrosine kinase (BTK). Therefore, brain-penetrating small-molecule inhibitors of BTK are considered new promising treatments, which may overcome the limitations of anti-CD20. If developed successfully, these oral medications could represent a significant threat to IV and SC biologics. Not surprisingly, all big pharma players in MS have BTK inhibitors in their R&D portfolios in phase 3 or phase 2 stages.

The development of BTK inhibitors has moved steadily until the FDA started to put hold on clinical trials due to liver toxicity. This is a class effect that, according to experts, is manageable, but potentially requires patient screening and selection to exclude drug-induced liver injury.

The next major setback came from the results of two phase 3 studies of the leading BTK inhibitor evobrutinib (Merck), which failed to demonstrate superiority in all efficacy endpoints against teriflunomide and appeared to be inferior in safety. Analysis of published pharmacokinetic/pharmacodynamic (PK/PD) data suggests that although active in plasma, evobrutinib is likely to be inactive in CNS. If CNS activity is the key, then a lack of efficacy might be a class risk. Specifically, some data suggest that fenebrutinib (Roche) may be inactive in the CNS. Tolebrutinib (Sanofi) has a higher brain penetrance, but some PK data and early signals of absent anti-inflammatory activity of the drug in the brain suggest that these levels may not be high enough to suppress B-cells.

To conclude, I will not consider market competition from BTK inhibitors, because of the high uncertainty in their development prospects.

Ublituximab NPV

I built a conservative patient-based model of ublituximab usage for RRMS in the US. The initial input parameters for this model were based on current data on prevalence and incidence of MS, use of DMT drugs, use of anti-CD20 mAbs, and drug discontinuation rates. Furthermore, several speculative assumptions were made regarding future competition, including the following:

- Anti-CD20 usage in 1st line will change with time from current 50% to 80%

- Anti-CD20 SC and IV will be used equally

- Ublituximab IV will compete for up to 40% of new patients on anti-CD20 IV

- TGTX will launch ublituximab SC in 2028, which will compete for 25% the anti-CD20 SC segment

- Anti-CD20 IV biosimilars will enter market in 2030

- Beyond 2030, TGTX will be able to continuously treat 20% of new patients of the anti-CD20 IV segment by reducing prices by 30%.

Using this model, I built a discounted cash flow model for the ublituximab programs (IV and SC). This model suggests that the anti-CD20 market for MS will not exceed $10bn, that ublituximab IV&SC usage will stay below 20% of total anti-CD20 class usage, that ublituximab sales may slowly reach $2bn. Using this model, I derived an ublituximab NPV of $2.9bn at a discount rate of 12%.

If TGTX will not be able to launch SC formulation and will completely lose biosimilar competition, then NPV will be ~$1.9bn. If, in addition to these relatively distant events, sales growth will be significantly below expectations in the coming years, then NPV will decrease to ~$1.6bn. In my model, these two cases correspond to discount rates of 17% and 20%, respectively.

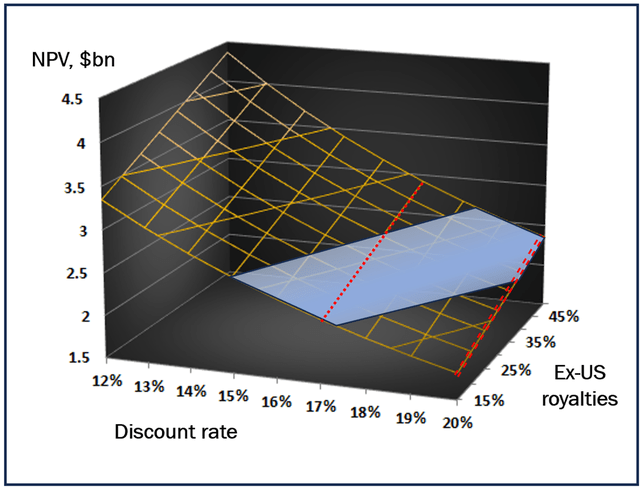

Next, I added the potential inflow from ex-US royalties to the model. I assumed that this cash flow may add to US-based NPV between modest 15% and rosy 50% value. Figure represents the potential NPV surface stretching across the ranges of discount rates (12-20%) and ex-US inflows (15-50%).

Ublituximab NPV surface (personal creation)

Yellow surface represents NPV value dependence on the discount rate and on the cash flow from ex-US sales. Blue area reflects relative company market capitalization in past 3 months. Discount 17% (red line) has a “physical” meaning of the case when TGTX will not develop SC formulation and will lose competition to biosimilars; discount 20% (double red line) reflects the case of poorly developing sales.

Acquisition prospects

In my view, Ublituximab (TGTX) may become an acquisition target. Analysis of 56 M&A deals, which occurred in the difficult for biotech post-COVID 2022-2023 years suggests that ublituximab satisfies a number of parameters characteristic for lucrative deals, including – >$10bn growing market, >$1bn drug sales potential, 3rd drug to market, limited cross-class competition. Thus, M&A seems certain; however, the price and time of such a deal are in uncertainty. I believe that this uncertainty is measurable, since M&A outcomes for TGTX depend on ublituximab sales and BTK inhibitor competition.

Small biotech companies often underperform in sales without a strategic partner. As a result, company capitalization declines, and acquisition can only occur at bargain prices. Therefore, it is vital for TGTX to demonstrate persistent and consistent sales growth. It looks like TGTX is on the right track now.

Second, SC formulation is likely to be critical for advancing ublituximab sales beyond $1bn. The development of the SC formulation (which is ongoing) and the start of a clinical trial are needed to justify significant valuation.

Finally, the major traditional players in the MS field, which do not benefit from anti-CD20 sales, Merck and Sanofi, have BTK inhibitors in the pipeline at clinical phase 3. Failure of these programs is likely to be required for bigpharma management to reconsider strategic approaches to replenish falling sales and to contemplate ublituximab. BTK programs are currently in unpredictable uncertainty, which makes TGTX an intriguing investment target.

Price prospect and conclusion

In my understanding, TGTX share price fluctuates at the low end of a justifiable fundamental value range, and it coincides with the cautious “wait and see” position. In view of the uncertainties around peak sales and takeover potential, this position seems appropriate. It is likely that the same factors underlie confusion and vacillation in company coverage by investment analysts, who suggest price target from $7 to $45 and issued ratings from sell to buy.

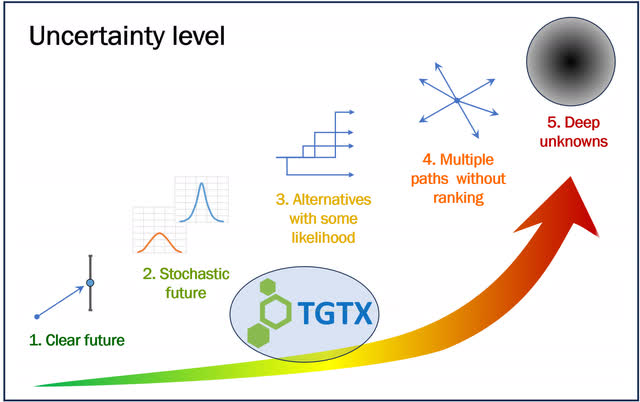

Using the analysis provided above, I can layout several futures for TGTX ranked according to their perceived likelihood.

Uncertainty for TGTX permits us to rank alternative scenarios in terms of perceived likelihood. (personal creation)

The grim and less likely future will be associated with disappointing sales and failure of the R&D program of SC ublituximab. In this scenario, the share price will fall, and TGTX will be acquired by 2nd tear player for the bargain price. Yet, the M&A value may fall into the low zone of the proposed NPV range, meaning that the share price will be close to the current trading levels.

The bright and possible future will be associated with consistent and persistent reports on growing sales and development of SC ublituximab, further supported by external news on the next failing BTK inhibitor R&D program. In this scenario, I envision M&A via hot bidding at a value above the proposed NPV range. The probability of this future has recently been growing.

Finally, the clinical success of any BTK inhibitor will limit acquisition prospects of the otherwise healthy company. If nothing else occurs, it will narrow the potential M&A value to the mid-zone of NPV range. The likelihood of this neutral-shaded future has been fading, but this is still a possible outcome. In my view, all scenarios may unfold over the next 9-12 months.

To conclude, I would like to wish the company to demonstrate strong sales performance, to develop SC formulation and to present a clear exciting strategy for new developments.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TGTX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.