Summary:

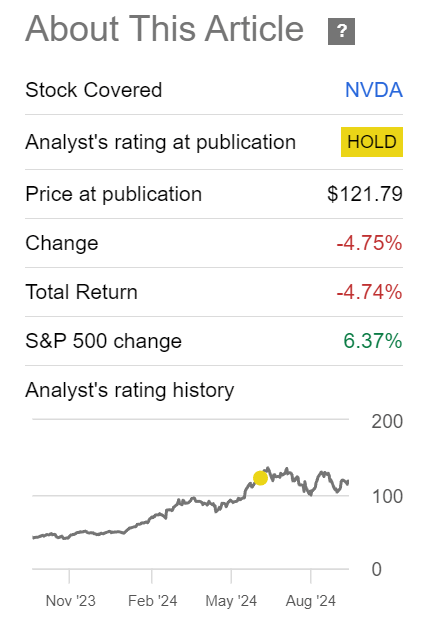

- Nvidia’s valuation suggested best-case expectations priced in in June. Therefore, Nvidia underperformed by 11%, despite another great Q2.

- Putting my words into action, I seized the opportunity during the significant correction below $100.

- Cost of capital has changed favourably since June, slightly bolstering Nvidia’s valuation.

- I remain invested and consider accumulating in the double-digit dollar range, where valuation sensitivities become less progressive.

BING-JHEN HONG

What To Expect

Through my first ever Nvidia coverage three months ago in June, I broke through the hectic storytelling surrounding the enabler of AI factories, whether in a bullish or bearish direction. Instead, I analyzed the valuation in a sober, neutral, and objective manner, in light of all publicly available analyst estimates. Since, like most investors, I am not a tech expert, I stayed within my circle of competence and provided a solid yet simplified valuation assessment, which turned out to be accurate to date. In this article, I am providing a well-founded update a quarter later, covering all scenarios and sensitivities and how they have changed since June.

In June, Nvidia’s stock price had already priced in the best possible analyst expectations available at that time, but due to its fundamental quality, I stated to be willing to initiate a position only in the event of a significant double-digit correction. Putting my money where my mouth is, I made a move at just under 100 USD in early August, nearly 30% below the all-time high and almost 20% below my Hold rating. Since this Hold rating, Nvidia has underperformed the S&P 500 by 11%, which lends credibility to this neutral approach.

Previous Nvidia Coverage (Seeking Alpha)

Foundational Assumptions Underlying This Quantitative Approach

The qualitative foundational assumption for this valuation review is that Nvidia is a legitimate company whose financial figures are not significantly inflated through dubious schemes or the like. Such allegations are not further examined here at this time, but it should be noted that these voices do exist. Under this assumption, Nvidia is a fundamentally high-quality technology company whose financial statements are generally awe-inspiring. This has not changed with the latest quarterly results. Hence, the focus is on the resulting market valuation – the only area where we can assess and influence through our own actions.

On the risk side, the possibility remains unchanged that Nvidia may not be able to maintain its leading position indefinitely. This would impact margins and limit growth. Furthermore, the company’s exposure to Taiwan as a geopolitical factor, as well as the potential political implications of a near-monopoly status in its home country, also present risks, although I would rate the latter as rather low. Additionally, Nvidia’s success will depend on the AI performance of its customers, who could sharply reduce their investment behavior if they fail to achieve success.

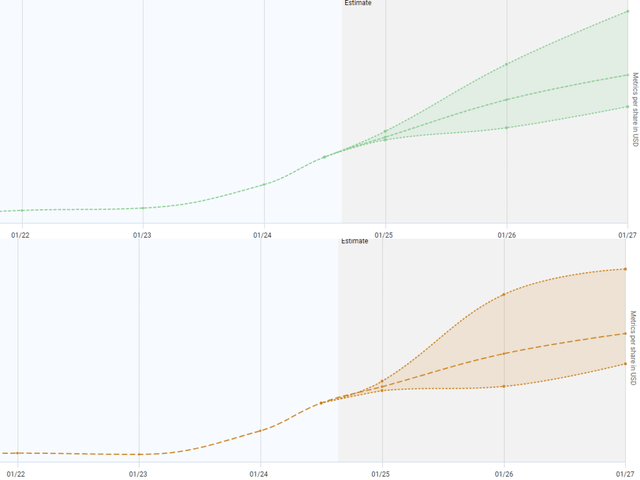

Still All Over The Place

Having received comments that DCF was not a suitable method for a company like Nvidia only reinforced my conviction that we were dealing with peak expectations at least in the mid-term. A DCF with all its underlying assumptions is the most widely used valuation tool for a reason. For example, the article pointed out the incredibly wide range of analyst estimates, which indicates increased uncertainty and risk. We account for this uncertainty in the discount rate, while growth is captured in the cash flows, and further reflected in the terminal growth rate. Additionally, scenarios and sensitivities help to further contextualize Nvidia’s valuation. Below is a graphic reminder that these are indeed appropriate approaches, as analysts’ expected sales and adjusted EPS projections show enormous variances. While some range is common, ranges to this extent are not “business as usual” in the stock market.

Sales (1) & adj. EPS (2) estimates ranges (dividendstocks.cash)

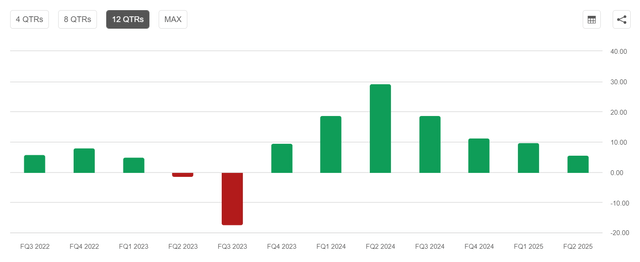

The last article also pointed out the waning momentum of positive earnings surprises. The recently reported quarterly results continued this trend, showing a positive surprise of 6%, the lowest value in almost two years. And that’s the crux of the matter. Yes, Nvidia once again delivered excellent numbers. Yes, Nvidia exceeded consensus expectations once more. But the stock’s pricing was calibrated not to consensus expectations, but to best-case scenarios. The surprises are getting smaller because the expectations are becoming higher.

EPS Surprises (Seeking Alpha)

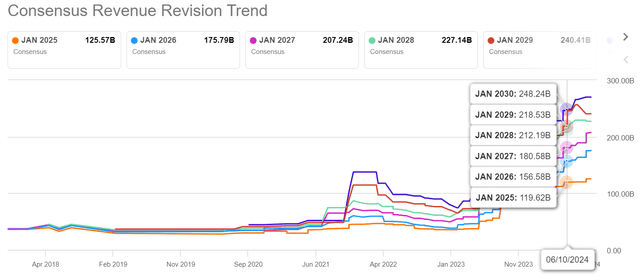

It is also interesting that since June, the consensus expectations for the next three fiscal year-ends have increased again. However, the estimates for 2028 and 2029 have been reduced for the first time in a long while. After that, consensus estimates are becoming increasingly unmeaningful to compare due to a declining number of analysts. The figure below illustrates this, using revenue forecasts as an example.

Seeking Alpha

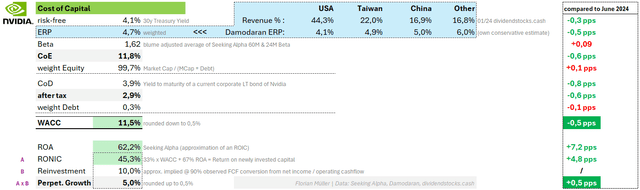

Favorable Cost Of Capital Changes Bolster Valuation

See on the right side of the chart below the changes in the individual cost of capital parameters that have occurred since June. In green, you can see value-enhancing effects, and in red, value-diminishing ones. Declining risk-free bond yields and risk premiums according to Damodaran’s semiannual research primarily contribute to value enhancement, resulting in a WACC that has become more progressive, decreasing from 12% to now 11.5%. A slight increase in the already elevated beta factor could not counteract this. This high beta factor reflects the significant uncertainty surrounding Nvidia and should not be overlooked.

Furthermore, Nvidia’s 12-month rolling return on assets has increased again, leading me to adjust my foundational assumption for the terminal growth rate from 4.5% to a more progressive 5.0%, as newly invested capital tends to return more growth. Both a reduced WACC and an increased terminal growth rate of 50 basis points each are value-enhancing compared to June.

Author | Data: Seeking Alpha, Damodaran, dividendstocks.cash

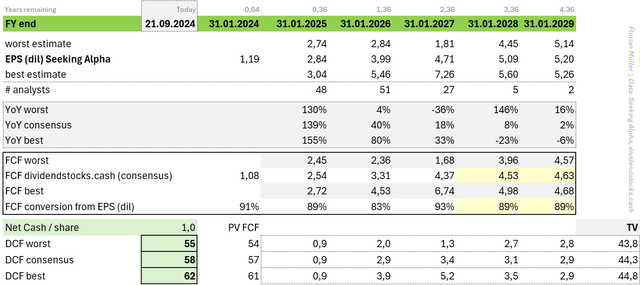

Updated Spot Estimates

While mid-term EPS expectations remain in a wide range until 2027, the fewer remaining analysts after 2027 are increasingly converging on an EPS level between $5 and $6 for 2029. This is why valuation results are also coming closer together. Overall, all analyst expectations have increased until 2027 since June, as shown earlier, but in the longer term, they have slightly decreased in the consensus and best-case scenarios compared to June. Net cash has increased thanks to debt reduction and additional liquid investments. Overall, the current spot estimates range between $55 and $62 per share, well below the current stock price of $116. Worst and consensus case increased, while best case came down.

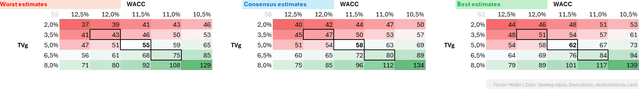

However, I understand that sometimes it is necessary to take risks, which is why I also allowed for lower discount rates and higher terminal growth rates through sensitivities in my last article to define a reasonable entry corridor that was eventually reached and used as a buying opportunity. This approach is being followed this time as well.

Author | Data: Seeking Alpha, dividendstocks.cash

Updated Scenarios And Sensitivities

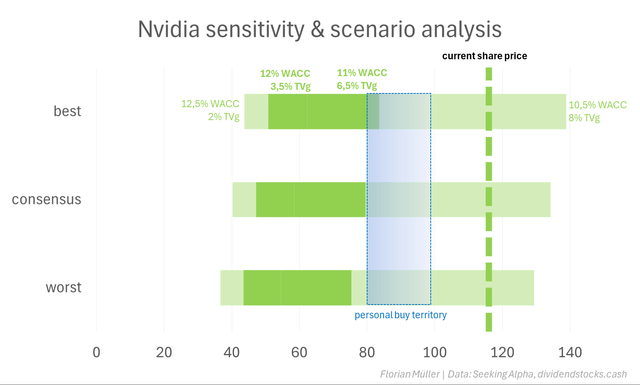

Thanks to more progressive parameters in the denominator of the discounted cash flow equation, such as the lower WACC and higher terminal growth rate, the ranges of the scenarios now align more easily with the current stock price than they did last time in June. Nevertheless, as shown below, it remains the case that, unchanged from June, the current stock price of $116 can only be justified under the most progressive assumptions for WACC and terminal growth rate.

Author | Data: Seeking Alpha, Damodaran, dividendstocks.cash

Takeaway

I am now invested and holding, having entered below $100, as previously targeted. The valuation conclusion has not changed since June. A lower WACC and a higher terminal growth rate in the base assumption appear more bullish than in June, while a mixed picture in the analyst consensus – some estimates have risen, others have fallen – acts as a counterbalance. I remain invested and would consider increasing my position in the event of reaching the double-digit dollar range again, where the less progressive valuation sensitivities lie.

Author | Data: Seeking Alpha, dividendstocks.cash

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.