Summary:

- Home Depot stock has significantly underperformed the S&P 500 since my late December update. However, I also indicated that fears of a housing crash were overblown.

- That thesis has played out accordingly, as the US consumer remains remarkably resilient, underpinning the strength of the US economy.

- HD’s underperformance is likely due to its premium valuation and growth normalization from an unsustainable pandemic-driven surge.

- Despite that, steep pullbacks have presented astute dip-buying opportunities at well-supported levels.

- I explain why the current levels are expected to see more dip-buyers return and help HD bottom out from here.

Justin Sullivan/Getty Images News

I last updated The Home Depot, Inc. (NYSE:HD) investors in late December 2022 that fears over the housing market were “overblown.” HD bottomed out in September 2022, in line with the broad market, and hasn’t looked back. However, I also urged investors to be cautious about adding then, as I gleaned an astute bull trap (false upside breakout) that could ensnare late buyers trying to chase its recovery momentum.

Again, that caution has also worked out well, as HD has significantly underperformed the S&P 500 (SPX) (SPY) since late December. Notably, that December 2022 bull trap resistance zone at the $347 remains validated.

With HD down to lows last seen in May 2023, I believe it’s opportune for me to provide a timely update to investors seeking clarity on whether the recent pullback is a buying opportunity. Accordingly, HD has declined 15% from its mid-August highs through its lows last week.

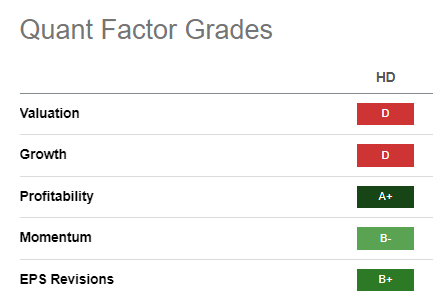

HD Quant Grades (Seeking Alpha)

The noteworthy rotation out of HD could have stunned buyers, but they shouldn’t. Accordingly, HD is still priced at a premium against its consumer discretionary (XLY) sector peers, assigned a “D” valuation grade by Seeking Alpha Quant.

Furthermore, after its pandemic growth spurt that lifted HD to unsustainable levels, Home Depot is undergoing a growth normalization phase, as it topped out at the $421 level in late 2021.

Notwithstanding the near-term challenges, wide-moat Home Depot is a behemoth in the home improvement retailing space, notching a best-in-class “A+” profitability grade, underpinning the robustness of its business model.

Moreover, its execution has also been solid, resulting in a “B+” earnings revisions grade. Accordingly, the company also outperformed analysts’ estimates in its second-quarter earnings in August.

However, the critical question facing investors is whether such outperformance could continue as interest rates spiked higher. Keen investors should recall that the 10Y Treasury surged to nearly 4.9% last week, breaking above the highs in October 2022.

Home Depot management was upbeat in its commentary at a recent mid-September conference. The company underscored the robustness of consumer spending, underpinning a resilient US economy. My thesis remains consistent with the “rolling recession” optimism and not a pessimistic broad-based hard landing. While there are valid concerns about the continued shift from physical goods spending to services, the housing market has remained resilient.

Home Depot cited the tailwinds from relatively low housing supply, curtailed further by the high mortgage rates discouraging homeowners who refinanced at low rates from putting their house on sale. The above themes underpinning investors’ confidence in HD remain valid and healthy, notwithstanding the recent pullback.

However, HD’s underperformance since my update suggests a focus on attractive risk/reward for premium-priced HD is necessary to avoid buying into unsustainable surges. Let me help investors assess whether HD’s October 2023 lows have experienced robust buying support to help bolster a more sustained recovery at the current levels.

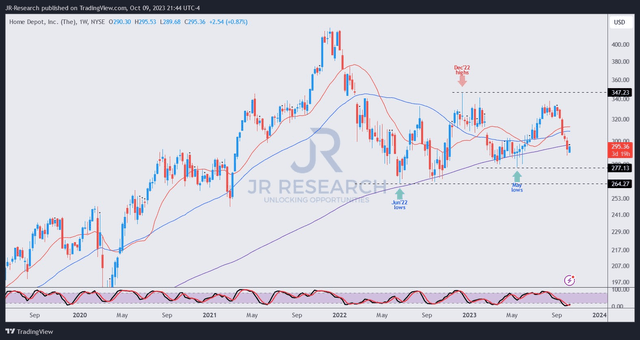

HD price chart (weekly) (TradingView)

As seen above, HD buyers have attempted to bottom out this week after falling for nearly two months since topping out in mid-August.

Furthermore, HD’s June 2022 lows remain valid at the $264 level and are not expected to be breached. HD also formed a higher low in May 2023 at the $277 level, supported above its 200-week moving average or MA (purple line).

In other words, HD remains well-supported above its long-term moving averages. However, a niggling resistance zone formed in December 2022 remains in play. As such, investors should avoid adding close to the $345 level, which could see robust selling intensity, rejecting further upside.

Therefore, I assessed that HD’s buying levels are attractive, and investor sentiments are supportive, notwithstanding its premium valuation.

Key Takeaway

Home Depot is a wide-moat home improvement retailer that has consistently demonstrated its best-in-class profitability. It has shown its resilience over the past year, even though it’s undergoing a normalization phase after an unsustainable pandemic-driven boost.

I don’t anticipate HD to fall back toward its 2022 lows, as a hard landing isn’t my base case. Also, HD buyers have consistently returned to undergird dip-buying momentum at its 200-week MA since last year. With HD falling back toward that dynamic support level, I believe it’s time to turn more constructive on HD.

Rating: Upgraded to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts