Summary:

- Home Depot’s sales have declined, with a 2.3% YoY decrease in Q1 and a 3.2% decline in comparable sales in the US.

- Weak demand for larger discretionary projects and a slow housing market contribute to the decline in sales.

- The macroeconomic environment, including consumer confidence and the housing market, remains challenging, and the valuation of the company is too high.

- For these reasons, we maintain our “hold” rating.

Oleg Kovtun/iStock Editorial via Getty Images

The Home Depot, Inc. (NYSE:HD) is a home improvement retailer in the United States and internationally. It sells, among others, building materials, home improvement products, lawn and garden products, as well as repair and operations products.

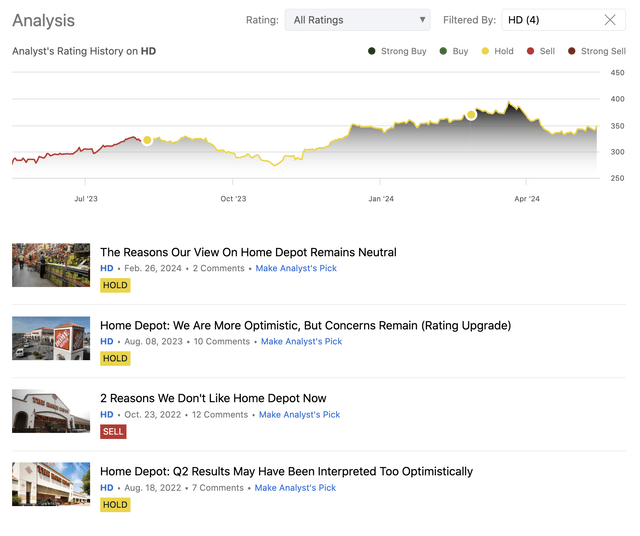

So far, we have published four articles about HD on Seeking Alpha, starting our coverage back in August 2022 with an initial neutral rating. This we have later downgraded the firm to “sell” in October 2022, citing a challenging macroeconomic environment, focusing primarily on consumer confidence, and overvaluation based on our dividend discount model. In August 2023, we became somewhat more optimistic as the macroeconomic environment has improved, and for this reason, we have once again rated the company’s stock as “hold”. We have reiterated our neutral rating in February this year, but still have not found justification to be more bullish about HD. Declining sales and weak demand have been our primary concerns.

The aim of our article today is to give you an updated view of the firm, mainly concentrating on the latest earnings results. We will highlight the developments around the demand for the firm’s products, and we will also look at a few macroeconomic indicators that could help us formulate expectations about the near future. We will conclude our writing by looking at a set of traditional price multiples to assess the valuation of the company.

Earnings results

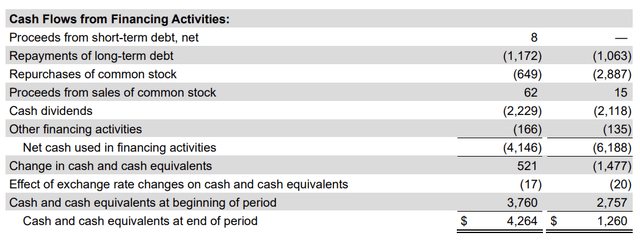

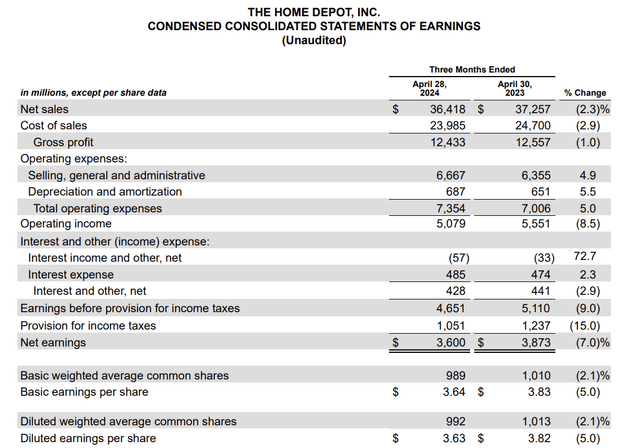

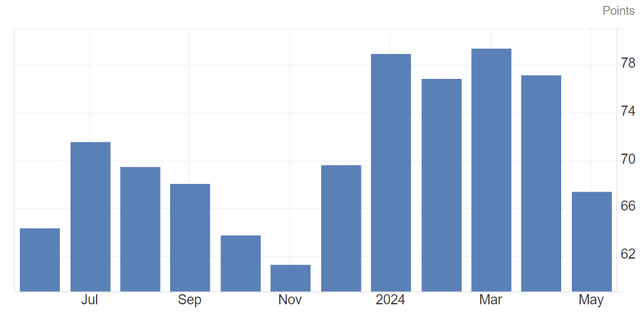

In our previous writing, we have already raised concerns about declining sales. In the past quarter, this trend has continued. In Q1, HD’s sales have declined by 2.3% year-over-year, comparable sales have declined by 2.8% and comparable sales in the United States have fallen by 3.2%. The profitability of the firm, when looking at the operating margin, has also deteriorated, as the operating costs have been increasing, regardless of the falling revenue.

The firm has cited several reasons for the weakness, including:

- Later than expected start of spring

- Weak demand for larger discretionary projects

Income statement (HD) Slide (HD)

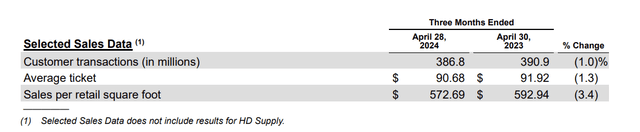

Also, important to highlight that the number of customer transactions, the average ticket amount as well as the sales per retail square foot have all fallen, further confirming the weakness in demand.

We believe that looking into the near future we cannot expect a significant improvement of the demand. On the other hand, we are likely to see a continuation of the slight sales decline. And we have several reasons to believe so:

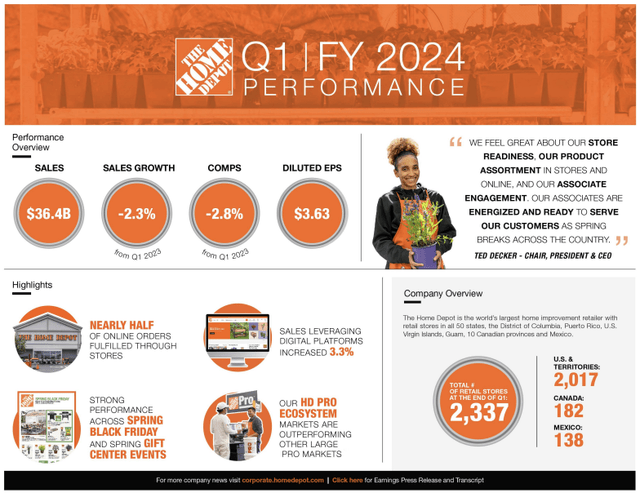

- Consumer confidence in the United States remains fragile and volatile. After a strong increase in the first quarter of the year, sentiment has once again worsened significantly in May. Consumer confidence is thought to have a significant impact on the spending behavior of the people, especially when we are talking about discretionary spending. With consumer confidence being so unstable, we do not believe that any tailwinds would come in the coming months that could stabilize the sentiment and therefore fuel the demand for larger discretionary projects.

U.S. Consumer Confidence (tradingeconomics.com)

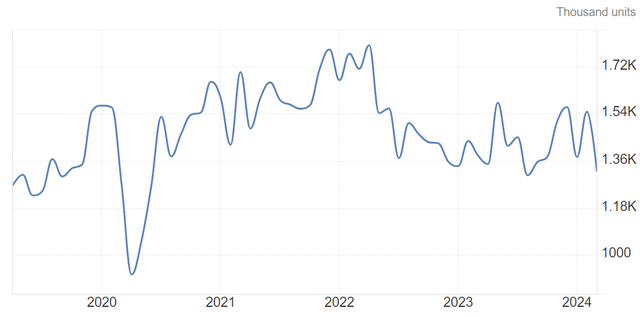

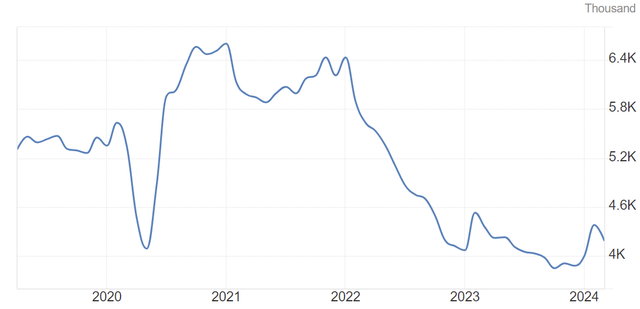

2. The weakness in the housing market also continues. Housing starts in the United States are showing continued weakness. This weakness is also visible in the number of existing home sales.

Housing starts (tradingeconomics.com) Existing home sales (tradingeconomics.com)

In our view, the health of the housing market plays a significant role in HD’s, or any other home retailer’s, success. In our view, the need for home repair/improvement items as well as for décor, the demand is much larger when people move around and have to/want to redesign the space where they would like to move in.

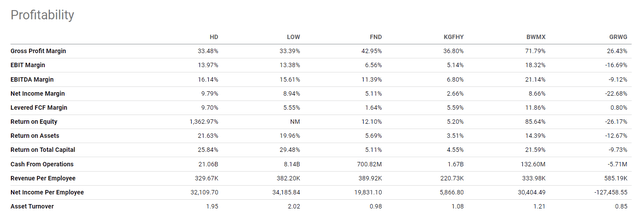

3. The company is also not showing a too optimistic picture about the near future. They have reaffirmed their full-year guidance for 2024, which confirms that they expect a single digit comparable sales decline in 2024. A 53rd week in the year, however, is expected to provide a positive impact of $2.3 billion in sales and $0.30 in diluted earnings per share. The forecasted profitability metrics of a 33.9% gross margin and a 14.1% operating margin also remain close to HD’s historic figures and also to those of the firm’s peers/competitors.

All in all, we believe that based on the weakness in demand and the uncertain macroeconomic environment, it is still not yet the time to become more bullish on the firm’s outlook. We would like to see a continued improvement in demand, before we could consider upgrading the firm’s stock to a “buy”.

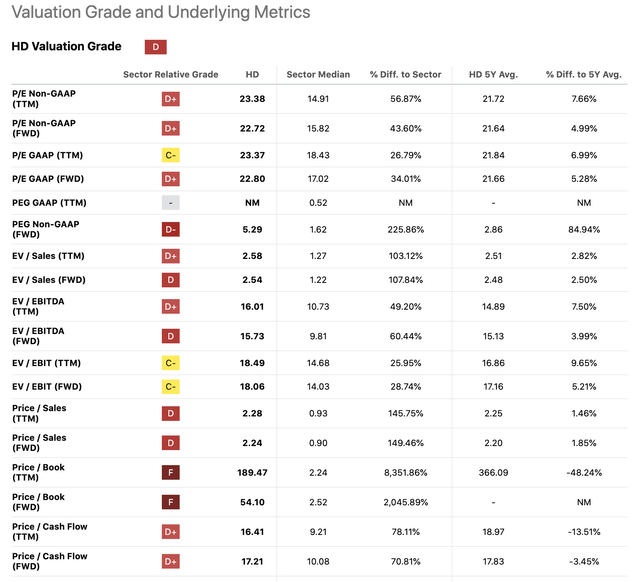

Valuation

In our articles previously, we have been assessing the firm’s fair value using either a dividend discount model or a set of traditional price multiples. Today, we will be using the price multiple approach again. The following table summarizes a set of traditional price multiples that can help us gauge, whether the current share price is attractive enough to start a new position or to add to an existing one, or not.

According to most metrics, HD’s stock continues to trade at a premium compared to both the consumer discretionary sector median and its own historic valuation. We are still on the view that such a premium cannot be justified in the current macroeconomic environment, especially when sales have been already declining for quarters.

We also do not see the need, however, to downgrade to a sell. HD is a well-established, well-known firm, which is the largest home improvement retailer in the United States. It also continues to pay a safe and sustainable dividend. It also keeps buying back its shares (although at a slower pace than in the previous year), which is another important part of shareholder returns.

Last, but not least, the weakness in the results is not driven by problems with the business itself, but more by the macroeconomic circumstances. We believe, once these circumstances improve, HD will be a much more appealing investment option.

Conclusion

HD’s latest earnings results have failed to impress us. Sales have continued to decline and the demand for the firm’s products has remained weak. The outlook for the full year also does not leave much room for optimism.

The macroeconomic environment, including the consumer confidence and the housing market, remains challenging. We do not see that any of these could provide a tailwind for HD’s business in the near term.

The valuation of the firm, despite the safe and sustainable dividend payments and the share buybacks, remains too high in our view. We believe that the premium the firm is trading at now cannot be justified.

For these reasons, we maintain our “hold” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.