Summary:

- Home Depot’s third-quarter results were largely in line with expectations, despite a stagnant housing market.

- The company continues to see strong activity with customers pursuing smaller projects.

- We think the lasting impact of the COVID-19 pandemic will continue to stimulate above-average remodeling demand for larger at-home working and living quarters.

- Our fair value estimate is largely unchanged since the last time we wrote about Home Depot on Seeking Alpha, and we continue to be in awe of the resilience of its business model.

Justin Sullivan

By Brian Nelson, CFA

We last wrote about Home Depot (NYSE:HD) on Seeking Alpha in February of this year in this article, and our fair value estimate today is only modestly higher than what it was back then ($316 per share versus $313). Home Depot’s shares were trading just under $300 back then, and today, they are trading north of $330. We like the market action at Home Depot since our last update, and we continue to like Home Depot’s business model.

In this article, we’d like to walk through Home Depot’s latest quarterly results, where we discuss recent comp performance and underlying customer buying habits, as well as update readers on the assumptions of our new fair value estimate. We’ll also explain why we think Home Depot’s intrinsic value will be much higher in the coming years.

We like Home Depot quite a bit these days. The company proved that it can pretty much weather any housing market environment during the Great Financial Crisis, and given just how important housing equity is to the net worth of many Americans these days, we think home improvement spending will continue to be resilient in almost any economic climate to preserve the value of housing stock.

Latest Quarterly Results

Home Depot reported third-quarter results on November 14 for the quarter ending October 29, 2023. The performance was largely in line with expectations, as Home Depot continues to navigate a housing market that continues to be stagnant, caused by increased mortgage rates and limited supply. Comparable store sales at Home Depot faced pressure in its fiscal third quarter, and while big-ticket, discretionary purchases are showing some weakness, management noted that it continues to see strong activity with customers pursuing smaller projects.

Thanks in part to low unemployment rates and large wage gains witnessed in the past couple of years, we think consumer spending remains healthy. The easing of inflationary trends, particularly with at-home food costs and with prices at the pump, offers considerable support to the general home improvement market, too. Many consumers, rightly so, still view their homes as crucial long-term investments, in which they can build equity and wealth over time, and the strength in housing prices over the past few years has supported such a view. We think the lasting impact of the COVID-19 pandemic on consumers’ minds will continue to stimulate above-average remodeling demand for larger at-home working and living quarters, a positive dynamic offset in part by organized retail crime at stores, which remains a retail sector-wide problem.

Hybrid working environments and work-from-home (WFH) trends are not going away, in our view, and while such dynamics will have serious implications on office REITs (VNQ), we think WFH trends will be a boon for the home improvement retail sector in the coming years, once the current malaise passes. Looking ahead to the remainder of fiscal 2023, Home Depot expects comparable store sales to face similar declines as that experienced during the fiscal third quarter, while diluted earnings per share are expected to fall 9%-11% this fiscal year compared to last year. Though Home Depot is not growing during the current housing market stagnation, results are still holding up well, and we like the long-term trends working in favor of the home improvement retailer.

Updated Valuation Statistics

We use the discounted cash flow (DCF) model to value Home Depot. It is a useful tool to determine the intrinsic value of a stock. It comes with many benefits. For starters, it forces the analyst to look at every key variable that drives the operations of a company. Inventory? It’s in there. Operating margin assumptions? Yep. Sales growth? Of course. It is one of the few methods that cut through the qualitative dynamics of a company to get to the quantitative to arrive at a fair value estimate to then be compared to the stock price.

If a company’s fair value estimate is materially above the stock price, the company could be considered undervalued. If a company’s fair value estimate is materially below the stock price, the company could be considered overvalued. It solves for the biggest problem with relative multiple analysis. When using multiples, one doesn’t truly know whether the valuation multiple of a comp or a group of comps is too high or too low. The DCF model’s absolute nature of valuation in this regard makes it a key tool for any investor’s toolbox.

Summary valuation statistics for Home Depot (Valuentum)

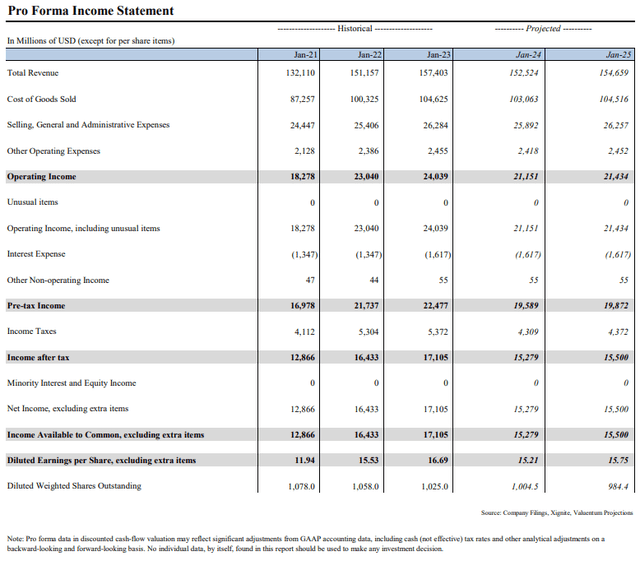

Since our last update in February of this year, our top-line assumptions and average operating (EBIT) margin assumptions in our DCF model over the next five years are slightly lower than where we had them back in February due to weakened comp performance and increased shrink expectations. We continue to expect revenue weakness in the year ending January 2024 followed by a strong rebound in the subsequent year as comp performance improves, and the company gets a better handle on shrink. Our projections for operating income follow a similar path, but in both cases, neither reach the elevated levels experienced in the prior two years. Our pro forma income statement of Home Depot is provided below.

Our pro forma income statement for Home Depot (Valuentum)

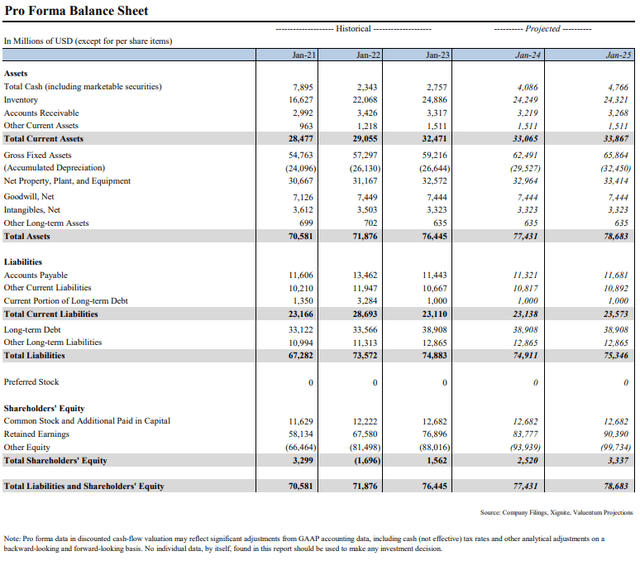

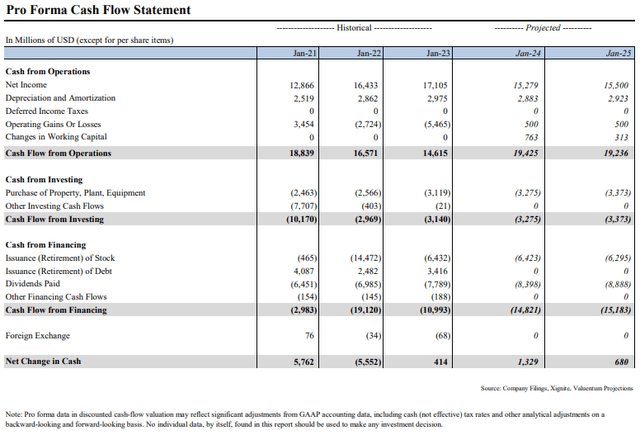

For the most part, our mid-cycle Phase II expectations are about the same, which is why our fair value estimate is similar in this update. That said, we think the biggest change to Home Depot’s intrinsic worth may be in the years ahead, when some of the favorable trends we’ve mentioned start to surface. We think homeowners will continue to plow capital into their homes to preserve their equity value, and we expect many workers to demand larger working spaces at home, which should drive re-modeling demand. We think COVID-19 has fundamentally changed the outlook and make-up for housing. Our pro forma balance sheet and cash flow statement of Home Depot are as follows.

Our pro forma balance sheet for Home Depot (Valuentum) Our pro forma cash flow statement for Home Depot (Home Depot)

Margin of Safety

Our fair value estimate range for Home Depot (Valuentum)

Whenever the DCF model is used to value a stock, it is equally important to use a margin of safety or fair value range. One of the pitfalls of the DCF is false precision, as it is almost a certainty that the future forecasts within the DCF will be wrong – in the sense, that there will be some variation when actual results come in. To capture this uncertainty, it is best to view the fair value estimate as just the most likely fair value along a distribution curve, as shown above.

Said another way, in the context of Home Depot, the most likely true fair value of Home Depot is $316, our point fair value estimate, but the values along the yellow part of the curve can also be considered reasonable fair value estimates of the firm. We’d only view Home Depot’s shares as considerably cheap if they fell below the lower bound of our fair value estimate range ($253), or materially expensive above the upper bound of the fair value estimate range ($379). Thinking in terms of a range of outcomes when it comes to valuation helps to counter the pitfall of false precision.

Concluding Thoughts

Home Depot has shown a lot over the past 15 years. When the world was seemingly falling apart during the Great Financial Crisis, Home Depot endured. When things headed south during the COVID-19 pandemic, Home Depot was able to adapt. Now, with homeowners likely to continue to invest to preserve the equity values in their homes, and as the WFH trend continues to change the type of housing stock preferred, we expect Home Depot to continue to do well. In the coming years, we would expect our fair value estimate of Home Depot to be materially higher as these trends are phased more heavily in the near-term projections of our valuation model. We are flat-out impressed by the resilience of Home Depot’s business model through thick and thin.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, RSP, QQQ, VOO, and SCHG. Some of the securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. This article and any links within are for informational and educational purposes only and should not be considered a solicitation to buy or sell any security. Valuentum is not responsible for any errors or omissions or for results obtained from the use of this article and accepts no liability for how readers may choose to utilize the content. Assumptions, opinions, and estimates are based on our judgment as of the date of the article and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.