Summary:

- Home Depot has been performing great over the last two decades.

- With interest rates climbing and the risk of a recession looming, Home Depot is forecasted to grow slower.

- Home Depot is a HOLD, yet investors can consider slowly buying on dips during the high volatility we see.

jetcityimage/iStock Editorial via Getty Images

Introduction

As a dividend growth investor, I seek new investment opportunities in income-generating assets. When I find these assets to be attractively valued, I often add to my existing positions. Additionally, I take advantage of market volatility as we see it today by starting new positions to diversify my holdings and increase my dividend income with less capital.

During a recession like the one economist forecast, the consumer discretionary sector may underperform as consumers stick to their basic expenses. It can be an opportunity to evaluate companies in this sector as the weakness may only be temporary, yet the long-term prospects remain intact. One of these companies is Home Depot (NYSE:HD), which traded for a high valuation for a long time.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

The Home Depot operates as a home improvement retailer. It operates The Home Depot stores that sell various building materials, home improvement products, lawn and garden products, décor products, and facilities maintenance, repair, and operations products. The company also offers installation services for flooring, cabinets and cabinet makeovers, countertops, furnaces and central air systems, and windows. In addition, it provides tool and equipment rental services.

Fundamentals

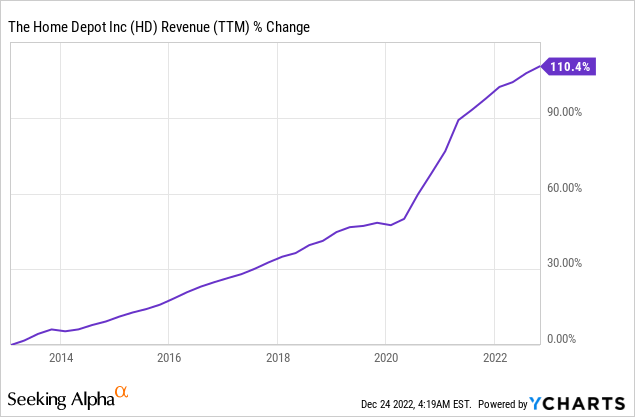

The revenues of Home Depot have been steadily increasing over the last decade. Sales have more than doubled, which means they grew at an annual rate of almost 8%. Sales increased swiftly during the pandemic as more people spent more time at home. Thus its appearance became more crucial for them. In the future, as seen on Seeking Alpha, the analyst consensus expects Home Depot to keep growing sales at an annual rate of ~3% in the medium term.

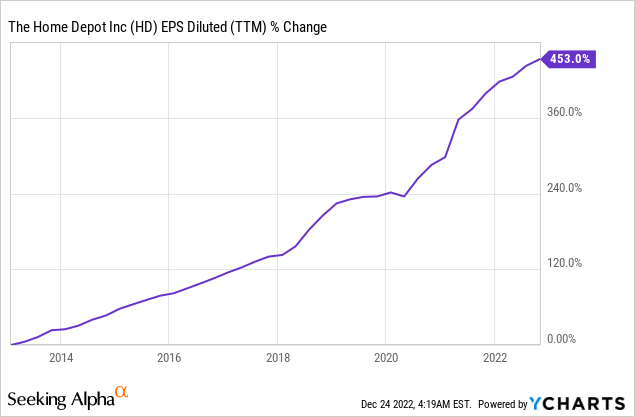

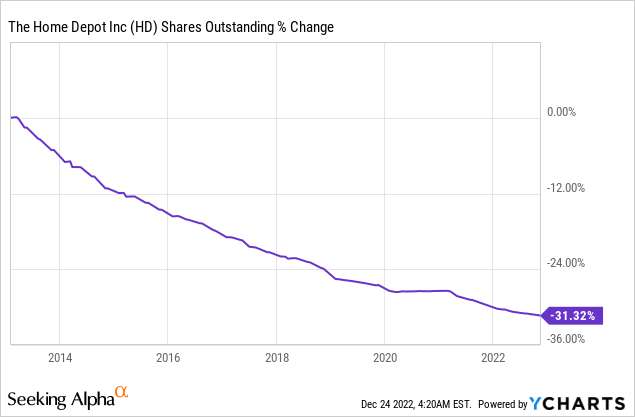

The EPS (earnings per share) has been growing much faster during the same period. The EPS increased by 450%, which means it is more than five times higher than it was just a decade ago. The company achieved EPS growth by increasing sales, buying back its shares, and improving margins by making a better digital experience and cutting costs. In the future, as seen on Seeking Alpha, the analyst consensus expects Home Depot to keep growing EPS at an annual rate of ~5% in the medium term.

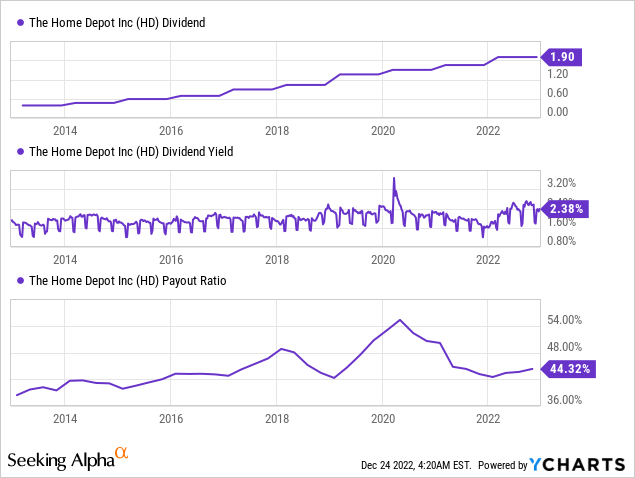

The company is a consistent dividend payer. It hasn’t decreased the dividend for more than thirty years and increased it annually for 13 years, including a 25% increase last February. The dividend seems unlikely to be cut as the company pays less than 50% of its EPS. Moreover, the entry yield is higher than its ten-year average. While the average growth rate over the last five years was 18%, investors should expect slower dividend growth in the medium term, as the EPS growth is slowing down.

In addition to dividends, companies like Home Depot reward their shareholders via share repurchase plans. Buybacks support EPS growth over time as they lower the number of outstanding shares. Home Depot bought back almost one-third of its shares in the past ten years. Buybacks are highly efficient when shares are attractively valued, and if the volatility persists, it may be an opportunity.

Valuation

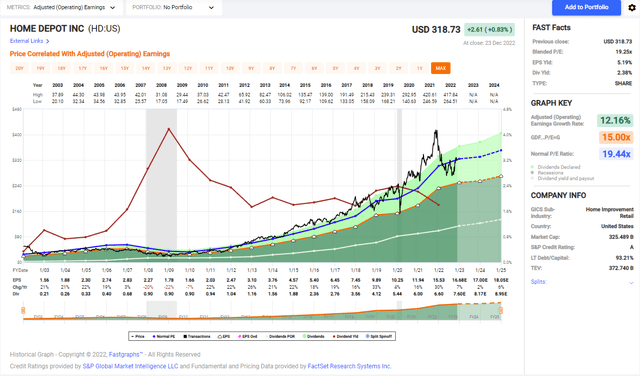

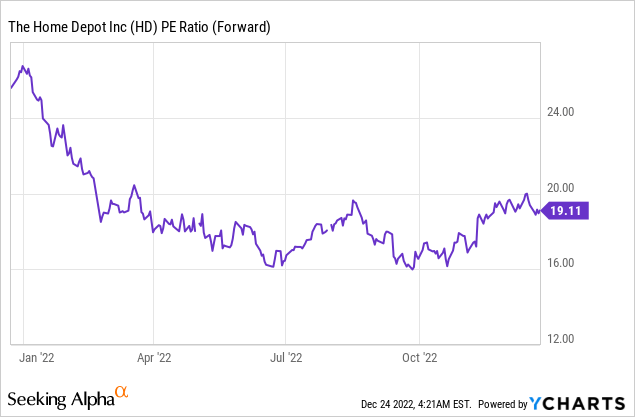

The P/E (price to earnings) ratio of the Home Dept is standing at 19.11 when taking into account the forecasted EPS of the current year. It is lower at 18.8 when looking at the 2023 EPS forecast. Over the last twelve months, the valuation has decreased from a P/E ratio of 25 to a low of 16. The consumer discretionary sector tends to be cyclical, so a challenging business environment affects its valuation swiftly.

The graph below from Fastgraphs shows that Home Depot is finally at its historical valuation again, a rare occurrence in the last five years. The current P/E ratio is like the P/E ratio we have seen in the previous twenty years. However, investors should also be aware that the forecasted growth rate for the company, which stands at 5% annually, is slower than the 12% we saw in the last two decades.

Home Depot offers investors some solid fundamentals with growth in sales, EPS, dividends, and buybacks. The valuation of the stock is in line with its historical valuation. While it may be tempting to jump into a stock at a historical valuation, it is essential to carefully consider the company’s growth prospects and potential risks, as they may have a profound impact on its EPS growth.

Opportunities

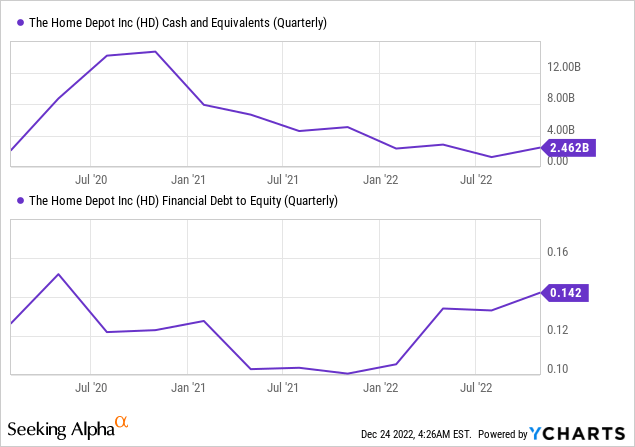

One opportunity in investing in Home Depot is the company’s solid financials and market leadership. Home Depot is the largest home improvement retailer in the world, with a presence in all 50 states and strong brand recognition. In addition, Home Depot has a strong balance sheet with a low debt-to-equity ratio and a strong cash position of more than $2B. These factors suggest that the company is well-positioned to weather economic downturns, continue growing in the long term, and maybe even acquire some competitors to improve its value proposition.

Another opportunity in investing in Home Depot is the growing demand for home improvement products and services. The trend of homeowners staying in their homes longer and investing in home renovations has been increasing in recent years, mainly because of the pandemic. Even as the economy is back to normal, we still see remote work, learning, and hybrid jobs. More time at home will see a corresponding increase in demand for home improvement products and services. It bodes well for Home Depot, as the company is well-positioned to capitalize on this trend with its wide range of products and services.

Another opportunity in investing in Home Depot is the company’s diversification. It offers not only products but also the services to build and install them. It serves both end users and professionals who resell it to their clients. Moreover, it is expanding into new countries such as Canada and Mexico. Offering more services and products in more markets with an improving digital value proposition is vital for future growth.

Risks

One risk in investing in Home Depot is the potential impact of economic downturns and recessions. Home improvement projects are often considered discretionary spending, meaning they may be among the first expenses to cut during economic uncertainty. If the economy were to enter a recession, this could lead to a decline in demand for home improvement products and services, which could negatively impact Home Depot’s financial performance.

Another risk in investing in Home Depot is the competition from other retailers and online sellers. The home improvement retail market is highly competitive, with several prominent national and regional players vying for market share, as Home Depot has a significant 18% share. In addition, e-commerce has made it easier for consumers to shop for home improvement products online, potentially leading to a decline in store traffic for Home Depot. Home Depot is battling for market share and offers services needed to use the products.

In addition to the risks mentioned above, another risk in investing in Home Depot is the potential impact of interest rates. Higher interest rates can make it more expensive for consumers to finance home improvement projects, potentially leading to a decline in demand for the company’s products and services. It means that even if many consumers were not affected by the recession, they might struggle to finance expensive house renovation projects. They may either delay it or spend time. Both are challenging for Home Depot.

Conclusions

Overall, Home Depot has strong fundamentals, a fair valuation, and decent opportunities for growth. However, it is essential to note that the company also faces several risks, particularly in the short and medium term. Investors should expect continuous dividend growth, yet maybe at a slower pace in the coming years as the company sails through a harsher business environment.

After considering all of the above aspects, I believe that Home Depot is a HOLD at the current time. Investors should consider slowly building a position in the company over time by buying on dips. It can help to average out the purchase price and potentially mitigate risk. Rating it as a BUY would have meant that this is an attractive entry price. Yet, with slower growth and volatile markets, I believe investors should buy gradually. An attractive price will be a forward P/E of 14-15, as we have seen this year.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.