Summary:

- Home Depot is identified as a potentially rewarding investment due to its dominant position in the home improvement retail industry, attractive valuation, and strong financial performance.

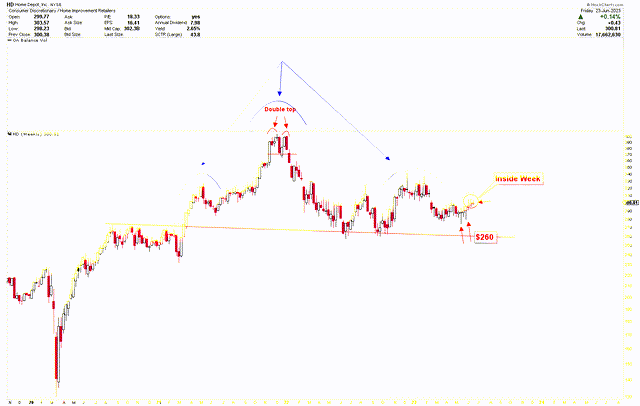

- Technical analysis shows potential for a bullish trend for Home Depot, with support expected around the $240-260 region.

- A bullish market is also suggested by the presence of a rounding bottom on Home Depot’s weekly chart, pointing towards a possible surge if the price breaks above $340.

Tim Nwachukwu/Getty Images News

In the dynamic world of investment, choosing the right stocks requires a careful blend of understanding industry fundamentals, financial metrics, and market trends. This article dives deep into the technical examination of one such potential investment opportunity – The Home Depot, Inc. (NYSE:HD). As an industry leader in home improvement retail, Home Depot has carved out a significant market position and presents a compelling investment case based on its attractive valuation, strong financials, and robust growth prospects. This article revisits a previous discussion on Home Depot that presented a bearish outlook. Nevertheless, current indications of price stability, evident from the formation of rounding bottoms and inside bars, imply a likelihood of additional consolidation. Following this stabilization phase, it’s highly probable that the price will commence an upward trajectory.

A Look at The Financial Strength

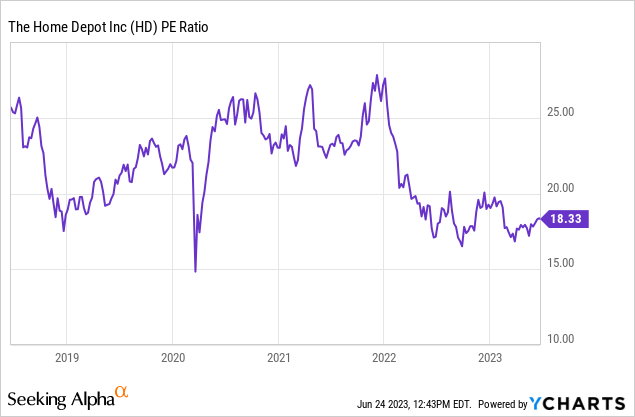

Home Depot stands out as an attractive long-term investment due to its established presence and dominance in the home improvement retail industry. The company’s performance in terms of valuation and key financial metrics provides a compelling case for its worthiness as an investment. As it currently trades at a price-to-earnings (P/E) ratio of 18.33, significantly lower than its five-year average, Home Depot presents an appealing entry point for prospective investors. Although stock prices might show some fluctuations in response to varying economic conditions, the company’s fundamentally sound operation and the persistent need for home improvement supplies provide a solid basis for future growth and stability.

The company’s commitment to returning capital to its shareholders through dividends and share repurchases further underscores its appeal as a long-term investment. Home Depot’s consistent record of dividend payments, with an increase streak spanning 14 years, points to its sustained profitability and its dedication to its investors. Although Lowe’s has a stronger record in share repurchases, the reliability and growth of Home Depot’s dividends contribute significantly to its total returns over the long run.

Despite the recent decline in net sales across the home improvement sector due to increased interest rates and shifts in consumer spending, Home Depot’s market positioning, and strong balance sheet make it well-poised for recovery. Home Depot reported a lower rate of sales decline than its primary competitor, Lowe’s, and its lower ratio of net debt to market capitalization indicates a stronger financial position. Moreover, macroeconomic conditions, including the housing situation in America, strongly favor home improvement retailers like Home Depot in the long term. The underbuilding of homes and aging housing inventory in the US create a steady demand for home improvement products and services. Even amidst short-term economic fluctuations, Home Depot is well-positioned to capitalize on this consistent demand.

Comparatively, Home Depot’s valuation and financial metrics present a stronger case than its competitors. The company’s P/E ratio and net debt position are more favorable than Lowe’s. Moreover, compared to other retail stocks like Costco, Home Depot offers a more appealing valuation, trading at a P/E of 18.33, which is considerably lower than Costco’s P/E of 38.85. Therefore, while Home Depot’s stock price may show some fluctuations in the short term due to macroeconomic factors or sector-specific challenges, its strong fundamentals, favorable valuation, and stable financial metrics, combined with the consistent demand for home improvement products and services, make it a good investment opportunity for the long term.

The Emergence of Bullish Parameters in Home Depot

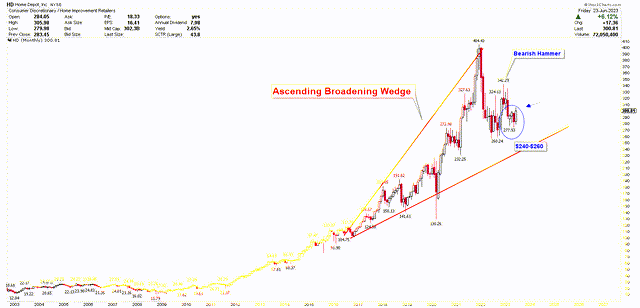

With fundamental analysis painting a promising picture for investing in Home Depot, technical analysis supports a bullish perspective as well. Home Depot appears to be breaking free from a strong base, as illustrated by the monthly chart showcasing an ascending broadening wedge pattern. This formation, previously discussed, hints at the emergence of a robust bearish trend, suggesting potential further price declines. As expected, a decline is seen, but recent consolidations hint at market improvements.

The ascending broadening wedge, indicative of substantial volatility, suggests increased uncertainty for investors. The bearish hammer at $342.29 led to a price drop, but a swift reversal candle in June 2023 has counterbalanced this bearish outlook. This turnaround neutralizes the bear trend and points to further market consolidation. Based on present price action, should Home Depot’s value fall further, robust support is likely around the $240-$260 region, aligning with the ascending broadening wedge line.

Home Depot Monthly Chart (stockcharts.com)

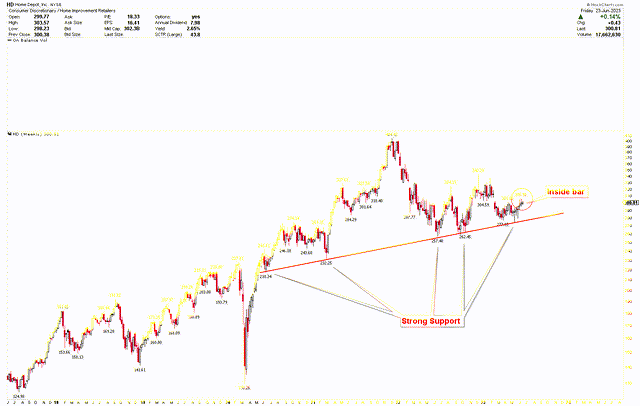

To explore Home Depot’s bullish future further, the weekly chart is presented below. The chart demonstrates the emergence of wicks at the red trendline support. When this support line was hit, the price rebounded, leading to the creation of wicks that bolster the bullish market strength. The last weekly candle represented an inside bar, suggesting market compression. If Home Depot’s stock price outperforms last week’s highs, it will break the inside week candle, releasing potential energy upwards. Last week’s high of $305.98 acts as a pivot, a break above which could trigger a strong upward rally.

Home Depot Weekly Chart (stockcharts.com)

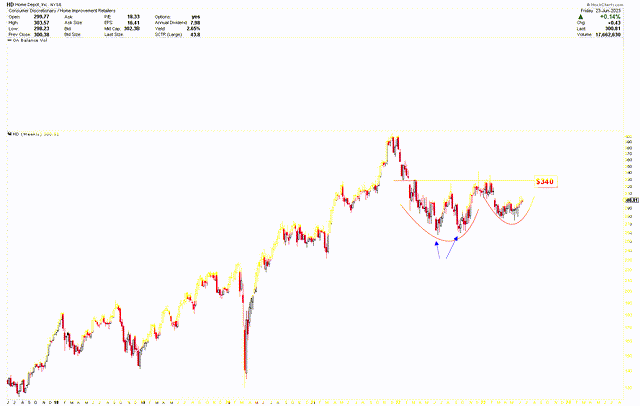

Moreover, Home Depot’s weekly chart also presents a rounding bottom, characterized by double bottom support at around $260. The price is likely to move towards the $340 region, where the rounding bottom’s neckline lies, acting as the pivot point for a potential market rally. A breakthrough above $340 will rupture the rounding bottom, and given the bullish patterns, this could ignite a continued upward rally. The last week’s candle could be perceived as a buying opportunity for investors. If the price outperforms last week’s high of $305.98, it will rise toward the $340 region, where a crucial decision will be made. As such, investors may consider buying Home Depot shares now in anticipation of a long-term price increase.

Home Depot Weekly Chart (stockcharts.com)

Market Risk

The bullish outlook faces potential obstacles, as indicated by the emergence of double top and head and shoulders patterns on the weekly chart below. The neckline of this head and shoulders pattern lies at $260, coinciding with the support level of the ascending broadening wedge. If the market price drops below the $240-$260 support region, it could potentially trigger further declines. This break would not only signify a breach of the head and shoulders neckline but also a rupture of the ascending broadening wedge support. Thus, investors should carefully monitor these key levels as a break could herald a shift in market sentiment.

Home Depot Weekly Chart (stockcharts.com)

While Home Depot enjoys a dominant position in the home improvement retail sector, it’s not immune to industry-wide challenges. The recent dip in net sales across the sector, driven by rising interest rates and shifts in consumer spending, could pose a risk to Home Depot’s revenue performance. Despite Home Depot’s strong market position and robust balance sheet, a prolonged downturn in the home improvement sector could impact its financial health.

Bottom Line

In conclusion, Home Depot emerges as an enticing proposition for investors willing to navigate the complex tapestry of financial metrics, industry dynamics, and market trends. The company’s leadership position in the home improvement retail industry, combined with an attractive valuation, robust financials, and significant growth potential, make a strong case for its inclusion in an investment portfolio. The robust recovery from the sturdy support zone signals indications of price stabilization at present levels. The confirmation of this stabilization is bolstered by the appearance of an inside bar last week. An upward break from this inside bar could set off a surge in value. The significant pivot point to trigger a price increase is $340. Surpassing this level would solidify the rounding bottom formation in the stock and trigger a substantial upward rally. Investors may consider buying the stock at its current value in expectation of a sustained upward trend.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.