Summary:

- Home Depot is better managed and has gained significant market share in the US home improvement industry compared to Lowe’s.

- Home Depot’s success can be attributed to exclusive relationships with high-quality suppliers, seamless digital integration, and a Pro-focused business model.

- The company is experiencing consumption pressure in big-ticket discretionary categories, but its strategic inventory management and strong financial position make it a good long-term investment.

Justin Sullivan

Home Depot (NYSE:HD) and Lowe’s (LOW) are the two main retailers in the US home improvement space. I believe Home Depot is much better managed compared to Lowe’s, and it has gained tremendous market share in the US over the past decade. Currently, Home Depot is experiencing consumption pressure in certain big-ticket discretionary categories. I have calculated that Home Depot’s stock price is slightly undervalued, making it a good entry point to own this high-quality retailer for long-term investment. Therefore, I assign a ‘Buy’ rating to Home Depot.

Home Depot vs. Lowe’s

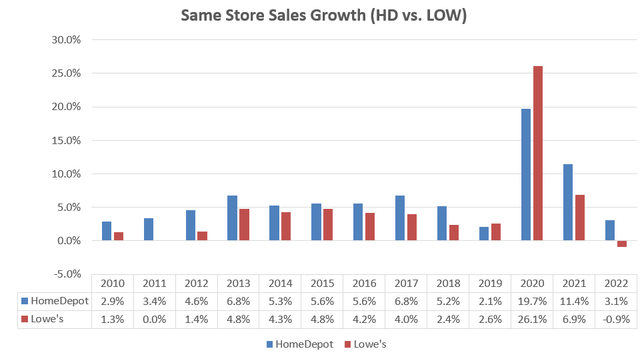

They are the two main retailers in the home improvement industry. Home Depot generated $157 billion in revenue in FY22, while Lowe’s had $97 billion in revenue. Historically, Home Depot’s same-store sales growth has outperformed Lowe’s. I believe Home Depot gained tremendous market share not only from Lowe’s but also from other small retailers.

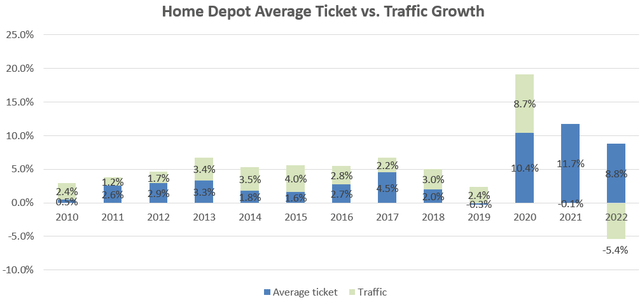

HD, LOW 10Ks (HD and LOW comp growth comparison)

I believe Home Depot’s outperformance can be attributed to several key factors. First, Home Depot has established exclusive relationships with high-quality suppliers, allowing them to offer unique products that are not available at other retailers. For instance, their exclusive partnership with Milwaukee, a top brand for power tools, sets them apart. Milwaukee’s products, known for their industry-standard single-battery platforms, are only sold at Home Depot stores, providing a distinct advantage. In contrast, Lowe’s carries brands like DeWALT and Craftsman, which, in my opinion, do not match the superior quality of Milwaukee.

Second, Home Depot boasts seamless digital integration, effectively merging their online and physical stores. The interconnected supply chains ensure a unified inventory and purchase/return logistics across both channels. This integration enhances convenience for consumers, allowing them to make online purchases and easily pick up items at nearby stores.

Additionally, Home Depot follows a Pro-focused business model, with approximately equal revenue distribution between professional contractors and consumers. Their longstanding relationships with these professionals have fostered loyalty, contributing significantly to their success.

Home Depot’s solid same-store sales growth can be attributed to both increased ticket sizes and a growing customer base. However, it’s essential to note that the recent negative trend in traffic growth, starting from FY22, reflects the impact of the weak macroeconomic conditions. This decline suggests that consumers have begun cutting back on discretionary purchases, a trend that demands careful observation.

Weakness in Big-ticket Discretionary Categories

In Q2 FY23, Home Depot’s management highlighted a decline in consumer spending, particularly in significant big-ticket discretionary categories like patio and appliances. These products experienced a surge in demand during the pandemic, but the current trend indicates a pullback in consumer interest. To address this, Home Depot has been proactive in managing their inventory levels. In Q2 FY23, their inventory decreased by almost $3 billion compared to the same period last year. I believe this strategic inventory management is a prudent move, considering the prolonged weakness in consumer spending that might persist for several quarters.

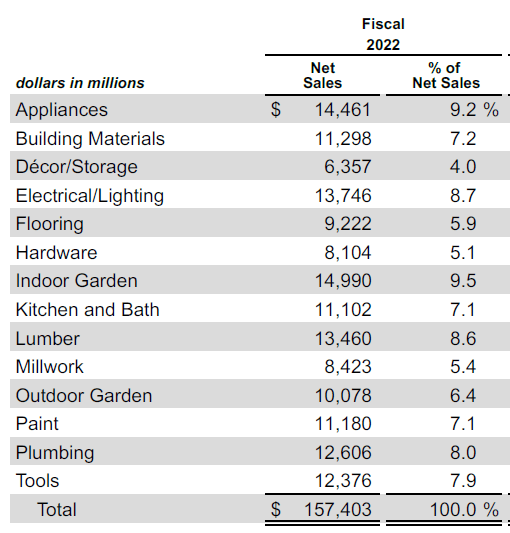

According to their disclosures, appliances account for approximately 9.2% of total sales, while outdoor garden products contribute 6.4% to the total revenue. Given these figures, the reduced spending in these high-value categories could pose significant challenges for Home Depot, making their inventory management efforts crucial in navigating these headwinds.

HD 10Ks – FY22

Recent Result and Outlook

In Q2 FY23, Home Depot reported a 2% year-over-year decline in comparable sales, with a further projected decline of 2-5% for the entire fiscal year. Despite this, their online sales increased by 1% compared to the same period last year, showcasing the resilience of their online channel even during economic downturns. The company disclosed that although the Pro backlog is lower than the previous year, it remains elevated relative to historic norms. Additionally, big-ticket comp transactions, those exceeding $1,000, experienced a 5.5% decline compared to Q2 FY22.

In terms of capital allocation, Home Depot authorized a new $15 billion share repurchase program, equivalent to about 5% of their total market capitalization. Notably, their strategic inventory reduction efforts led to a surge in free cash flow, reaching $10.5 billion in H1 FY23 from $5.7 billion in the first half of the previous year. This robust cash flow, coupled with adept management of working capital components such as inventory, accounts receivables, and payables, indicates Home Depot’s ability to navigate the current weak macroeconomic environment successfully.

As of Q2 FY23, the company held $42 billion in debts and $2.8 billion in cash. Based on my calculations, their gross debt leverage is approximately 1.6x, a level I consider manageable. This prudent financial management positions Home Depot well to weather the challenges posed by the ongoing economic uncertainties.

Key Risks

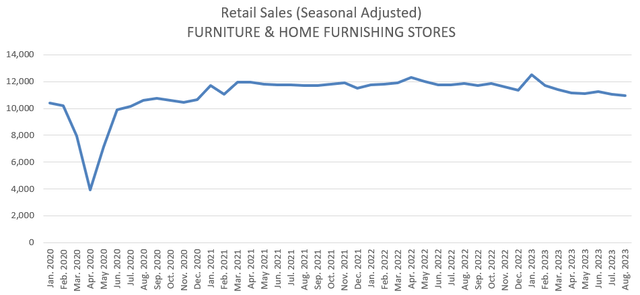

Home Depot’s earnings heavily rely on consumer spending in the home improvement sector. However, given the current challenging consumer spending climate, I am doubtful that Home Depot will be able to achieve strong sales results. Supporting this concern, data from the US Census Bureau reveals a downward trend in retail sales for furniture and home furnishing stores, starting from the end of the previous year on a seasonally adjusted basis. The most recent August release indicates a significant 7.8% year-over-year decline in retail sales for furniture and home furnishing stores. As discussed earlier, the ongoing weakness in large ticket discretionary spending suggests that Home Depot might face continued challenges in the near term.

Valuation

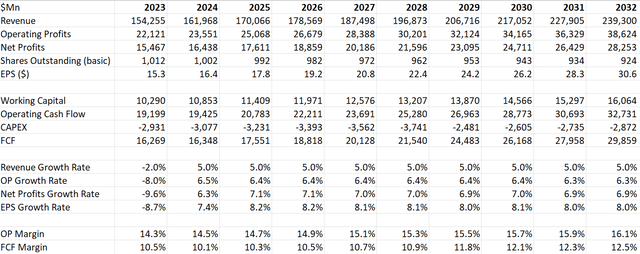

I anticipate Home Depot’s revenue to decline by 2% in FY23, aligning with their guidance. Historically, the company has achieved an average same-store sales growth of approximately 5%. Thus, I assume their normalized same-store sales growth of 5% over the next decade.

I hold the belief that Home Depot’s robust supply chain and superior working capital management will remain key strengths. Additionally, their adeptness in passing along any inflationary pressures to end-consumers reinforces their resilience. I expect a modest annual expansion of their margin, approximately 20 basis points, reflecting their operational efficiency.

In my model, I estimate the free cash flow margin to reach 12.5% by FY32, indicating a strong financial position for the company in the long term.

HD DCF Model – Author’s Calculation

Applying a 10% discount rate, a 4% terminal growth rate, and a 24.5% tax rate, the estimated fair value of total free cash flow from the firm amounts to $350 billion. After deducting the net debt balance, the calculated fair value of Home Depot’s stock price stands at $315 per share. Based on this valuation, it appears that the stock is slightly undervalued at its current market price.

Takeaways

I admire Home Depot’s integrated omnichannel business model and their strategic focus on the Pro market, which enhances their resilience compared to competitors. Despite the significant headwinds posed by weak spending in big-ticket discretionary categories, I believe Home Depot’s current stock valuation undervalues its potential. In my opinion, Home Depot is a high-quality company, making it a suitable choice for long-term focused investors. Therefore, I confidently assign a ‘Buy’ rating to Home Depot.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.