Summary:

- Despite recent corrections HD stock has suffered, I would not recommend bottom-fishing attempts yet.

- Several technical signs indicate further downside potential in the near term.

- On the fundamental side, the stock is trading at a high valuation multiple.

- The valuation risks are compounded by challenges such as softened customer transactions and inventory levels.

KenWiedemann

HD stock has not found bottom yet

Stock prices of Home Depot, Inc. (NYSE:HD) have suffered large corrections recently, falling from a peak of ~$395 to the current level of $335. As such, potential investors may feel tempted to do some bottom fishing here. However, I would not recommend such attempts under current conditions. I see both technical and fundamental signs that indicate its stock prices have not found a bottom yet.

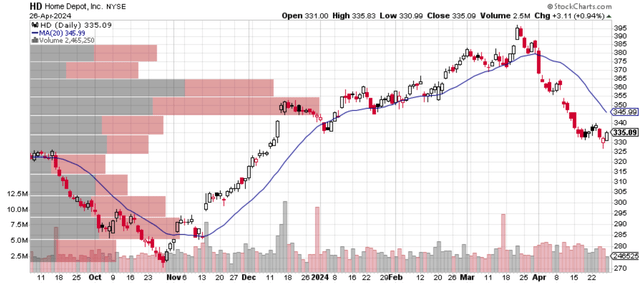

Let me start with the technical signs. The chart below shows the price-volume information of HD stock’s recent trading pattern. I see several signs that point to more downside in the near term.

First, I see a clear down-trending pattern since late March. The price action since then has been dominated by selling pressure with lower highs and lower lows. Second, the current price is substantially below the short-term moving average (20-day MV is about $346), another classic sign of a bearish trend.

Finally, I want to draw your attention to the trading volume information in the price ranges of around $350 to $355. As seen, this is the range that has cumulated the largest trading volumes recently in the past few months. Hence, this price represents a good support level in my view. HD’s current stock price has unfortunately fallen well below this level now. Thus, I do not expect the downward trajectory to be over until/unless the large number of traders/investors in the $350 to $355 range are replaced by more aggressive ones.

Of course, these traders/investors could become more bullish on HD themselves. We cannot rule out this possibility, but I see little odds here based on the fundamental signs to be detailed next.

HD stock: a good business at a high valuation

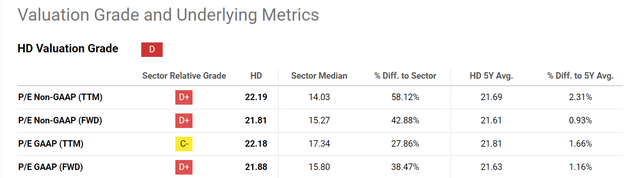

First, the stock is still trading at quite a high valuation multiple. The chart next summarizes HD stock’s valuation grade. In particular, it compares its current P/E ratios against the sector median and its 5-year average levels. Based on the chart, HD’s valuation grade is an overall D. The chart shows that its P/E ratios are far above the sector median. For example, in terms of FWD P/E on a non-GAAP basis, HD is trading at a premium of almost 43% higher than the sector median.

Second, compared to its own historical record, there is no obvious margin of safety either. Its valuation multiples are essentially on par with its own 5-year average, despite the large price correction. For example, its FWD P/E on a non-GAAP basis of 21.8x is within 1% of its 5-year average of 21.6x.

All told, it can be argued that HD is a premium business in the sector, and some degree of premium can be justified. However, based on this comparison, I think the premium here is too large, and the valuation risk is still considerable – especially considering the profit headwinds ahead.

HD has been facing considerable challenges recently and these challenges are likely to persist (or even worsen) in my view. For example, in 2023, its sales declined 3% compared to the prior year and the number of customer transactions fell 1.7% in the Jan 2024 quarter. I attribute such declines to a few key factors, such as the lower average amount spent per ticket and also the weakened large ticket items.

Looking ahead, I don’t see these issues going away anytime soon. I expect the new home construction market to remain soft. Persistently high interest rates and rising home prices have made mortgages out of reach for many and should keep a damper on new construction and home sales in my view. These headwinds could produce ripple effects as well for HD. For example, customers typically remodel shortly after buying a home. Thus, affordability issues due to high mortgage rates and house prices could lead to reduced spending in the remodeling segment as well.

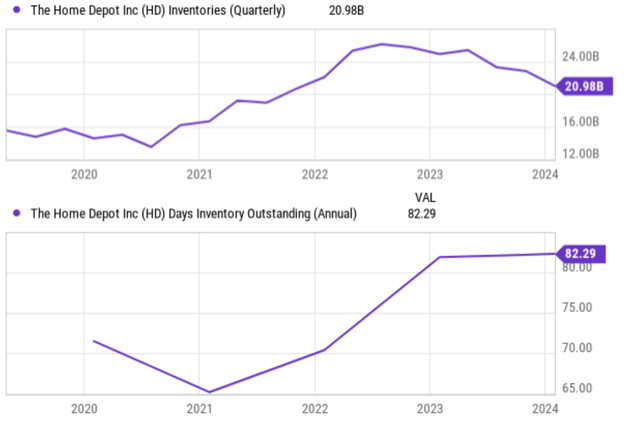

These risks are further compounded by HD’s current high inventories. The chart below shows HD’s inventory in dollar amount (top panel) and in DIO (days of inventory outstanding, bottom panel). As seen, its inventory levels have been increasing rapidly over the past few years, and its days of inventory outstanding have also been increasing. Its current inventory is close to $21B, slightly below the peak level last year but still far above the $16B in 2020 and 2021. And the bottom panel shows that HD’s DIO now hovers around 82 days, the highest level in at least 5 years. Such inventories are clear signs of weakening demand in my eyes and could potentially trigger other problems such as cash flow, cost, and balance sheet risks.

Other risks and final thoughts

There are certainly plenty of positives to consider as well. As a leader in the home improvement space, HD offers several differentiation factors and key advantages. Its scale gives it tremendous buying power and a cost advantage. HD boasts the largest store footprint among home improvement retailers in the US. This translates to significant bargaining power with suppliers, allowing them to negotiate lower prices for products. These savings can then be passed on to customers in the form of competitive pricing. Its scale also gives it a well-established and robust distribution network, with numerous distribution centers strategically located across the country. This allows them to efficiently deliver products to stores and fulfill online orders quickly. Its recent progress on the omnichannel distribution front has further augmented this advantage.

Finally, for income-oriented investors, HD provides a decent dividend yield of 2.54% currently. To better contextualize things, the chart below shows HD’s dividend yield compared to its historical average. As seen, its current yield is higher than its historical average in the last five years (2.29%) by a noticeable margin.

Considering the above positives and negatives, I don’t see a clear direction for its stock prices under current conditions. As such, my final verdict is a cautious hold thesis for the HD stock. In the near term, I see technical signals that point to a continuing downtrend in the near term. Furthermore, despite recent price corrections, HD still trades at high valuation ratios. Admittedly, HD offers plenty of unique strengths given its market leadership, expansive store network, and bargaining power for competitive pricing. However, I expect considerable challenges ahead to pressure its profitability, such as softened demand and high inventories. Yet, its current valuation offers no margin of safety against these risks, in my view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.