Summary:

- Home Depot reported -3.5% SSS growth in their recent results, with the U.S. market declining 4% year-over-year.

- The negative growth can be attributed to a weak home refurnishing market and commodity deflation.

- Home Depot is projecting -1% SSS and 1% EPS growth in FY24, with challenges expected from lumber deflation and soft demand in big-ticket discretionary purchases.

Justin Sullivan

Home Depot (NYSE:HD) released their Q4 FY23 results on February 20th, with a -3.5% SSS growth. I outlined my ‘Buy’ thesis in my previous coverage, noting that promotional discounting was becoming more rational in the retail industry. While the home improvement market is more likely to be weak in FY24, I continue to view Home Depot as a high-quality franchise. Considering the undervalued stock price, I reiterate the ‘Buy’ rating with a fair value of $400 per share.

Weak Home Refurnishing Market & Commodity Deflation

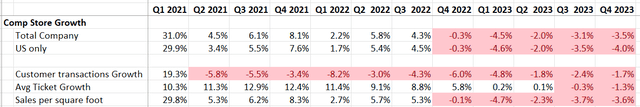

In Q4 FY23, Home Depot reported -3.5% SSS growth, with the U.S. market declined 4% year-over-year. Both customer transactions growth and average ticket growth dropped in the quarter, as shown in the table below. Despite these challenges, they generated $16.4 billion FCF for the full year, a notable 42.9% year-over-year growth. They maintain a robust balance sheet, with the debt-to-capital ratio of 97.6% in FY23.

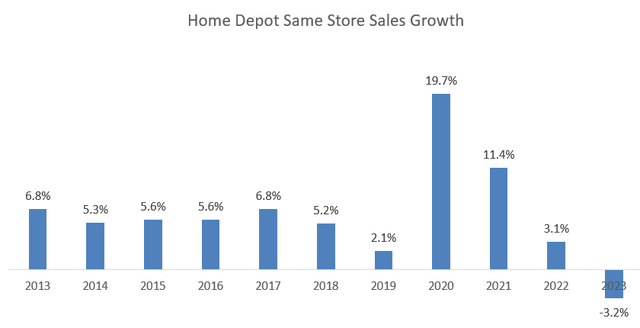

For the full year, Home Depot encountered their first negative SSS performance in the past decade, marked by -0.3% average ticket growth and -2.7% traffic growth.

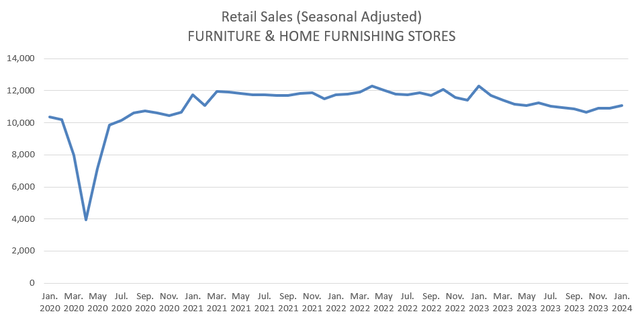

The negative SSS growth could be summarized as the following factors. Firstly, the U.S. furniture & home furnishing store retail sales declined materially in 2023 from the elevated levels in 2021-2022, as depicted in the chart below. During the global pandemic, consumers overspent their money on home refurnishing projects. In the post-pandemic era, the heightened spending trend began to diminish.

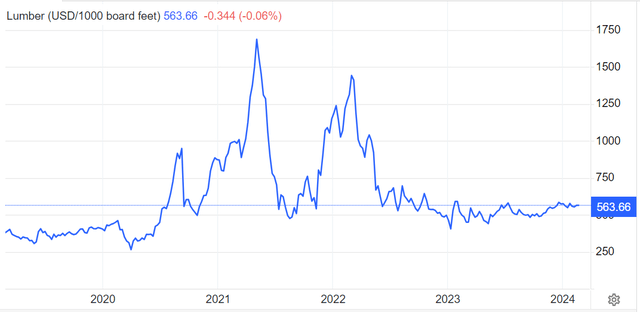

Secondly, in the post-pandemic period, commodity price started to fall as well. As disclosed in the earnings call, the deflation from core commodities negatively impacted their average ticket by 35bps in Q4 FY23. The major deflation came from lumber and copper wire. Moreover, Home Depot anticipates ongoing pressure from commodity deflation in FY24.

Lastly, as I highlighted in my previous coverage, Home Depot faced elevated promotional activities in the retail market in FY23. Currently, their management indicates that the promotional activities are returning to more normalized levels. It appears to me that the industry-wide promotional activities won’t pose a significant growth headwind for Home Depot in FY24.

Home Depot spent $7.95 billion on share repurchases in FY23 and paid out $8.38 billion in dividends, a quite consistent capital allocation policy.

FY24 Growth Projection

Home Depot is guiding -1% SSS and 1% EPS growth in FY24, signaling another weak fiscal year growth in its history. There are several factors need to consider for the growth in FY24.

New Store Opening: In FY24, they plan to open 12 new stores. With a total of 2,335 stores, the new stores would contribute around 25bps to their topline growth.

Big-ticket Discretionary Purchase: Home Depot continues to observe soft demand in big-ticket discretionary categories like flooring, countertops, and cabinets. Given the prevailing high-interest-rate environment, I don’t anticipate a swift recovery in these big-ticket discretionary purchases anytime soon.

Lumber Deflation: Home Depot is expected to persist in facing challenges from lumber deflation. As shown in the chart below, lumber prices have been quite weak in the post-pandemic period. The lumber price is partially fluctuated by new home constructions and renovation projects. The demand is also impacted by the high interest rate to some extents.

Lower Input Costs: their management anticipates the gross margin improving by 50bps in FY24, driven by lower product costs as well as transportation costs. Additionally, I expect the company to face less pressure from the labor cost inflation in FY24, as the job market begins to cool down in the U.S. market.

Putting all the pieces together, the home improvement market is more likely to be weak in FY24 due to high interest rates and weak personal consumption. Therefore, their guidance appears to be reasonable to me.

It worth noting that Lowe’s reported their Q4 FY23 earnings on February 27th, projecting -2% to -3% of SSS growth for FY24. This aligns with the broader trend indicating a weak growth year for the home improvement market.

Valuation Updates

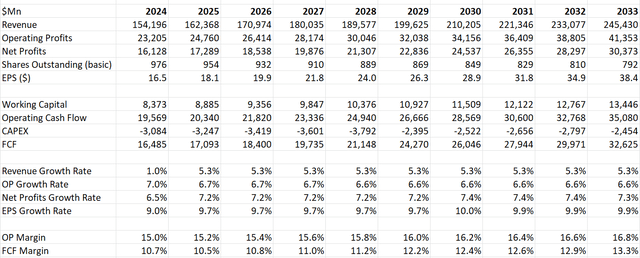

The assumptions for FY24 align with the company’s guidance. As previously discussed, I anticipate another weak growth year for Home Depot. The company is guiding capital expenditure to be 2% of group revenue, which is quite consistent with their historical average level. The new capital expenditures are primarily used for new store openings. For normalized growth, I forecast 5% SSS and 30bps growth from new stores annually. Both same store sales growth and new store openings assumptions are consistent with their historical average.

On the margin side, I calculate that their operating expenses will grow by 4.7% per year, leading to operating leverage and 20bps margin expansion annually. I keep the remaining assumptions intact in the model and the fair value is calculated to be $400 per share in the DCF model. The current stock price is trading at 23x FCF, a quite reasonable multiple for a high-quality growth company.

Home Depot DCF – Author’s Calculation

Other Risk

On November 20, 2023, Home Depot announced to acquire Construction Resources, a leading distributor of design-oriented surfaces, appliances, and architectural specialty products for professional contractors. The deal aims to enhance Home Depot’s product lines and expand their Pro customer base, and it makes strategic sense to me. I will monitor Construction Resources’s performance and integration process going forward.

Conclusion

I favor Home Depot’s high-quality business model and experienced management team. Despite the weak home improvement market, I maintain the ‘Buy’ rating with a fair value of $400 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.