Summary:

- Home Depot’s intermediate-term prospects are brighter, thanks to the Fed’s rate cut, the potential boom in real estate sales, and the boost in home improvement projects.

- This is on top of the one-time potential hurricane-related sales, as Hurricane Helene and Milton wrecked nearly $160B in damages.

- Even so, HD’s recent rally has been overly done, with it triggering expensive stock valuations and prices – similar to those observed in LOW.

- If anything, HD’s balance sheet continues to deteriorate with inventory levels ballooning – with it triggering moderate uncertainty.

- With the stock market currently overly exuberant, we may see a market wide pullback occur in the near term, with HD potentially losing part of its recent gains.

itsskin

The Worst May Be Over For HD – Albeit With Minimal Margin Of Safety

We previously covered The Home Depot, Inc. (NYSE:HD) in March 2024, discussing why we had maintained a Hold rating then, attributed to the yet-to-be successful Complex Pro monetization, with the transition still in the early days and the macroeconomic outlook still uncertain.

Combined with the less-than-impressive dividend hike, deteriorating balance sheet, and impacted bottom-line, we had believed that its inflated stock prices/ valuations offered interested investors with a relatively underwhelming investment thesis.

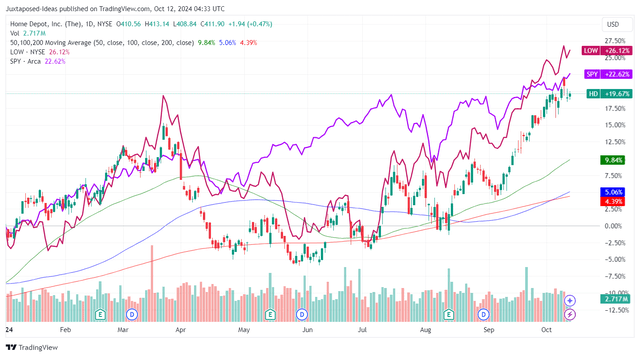

HD YTD Stock Price

Since then, HD has had a further correction by -15.2%, before recovering by +16.7%, largely thanks to the Fed’s pivot by 50 basis point in the recent FOMC meeting in September 2024 in our opinion.

With the 30Y Fixed Rate Mortgage Average in the US already moderating to 6.32% and the 15Y rate to 5.41% by October 10, 2024, down drastically from the peak of 7.79% and 7.03% observed on October 26, 2023, respectively, it is unsurprising that the market is increasingly optimistic about the retailer’s prospects.

This is attributed to the tremendous increase in mortgage-rate locks by +68% MoM on September 23, 2024, as reported by the online real estate brokerage company, Redfin (RDFN).

This builds upon the rising mortgage-purchase applications by +10% MoM, as RDFN’s Homebuyer Demand Index (a measure of tours and other buying services from Redfin agents) rise drastically to the “highest level since May during the week ending September 22, 2024.”

With increased home buying trends, we believe that both DIY discretionary spending and Pro sales may grow from current levels, with it triggering potential recovery tailwinds for HD in the near-term.

For context, HD reported an underwhelming US comparable sales growth of -3.6% YoY (compared to -3.2% YoY in FQ1’24 and -2% in FQ2’23) albeit with a stable adj operating margin of 15.4% in FQ2’24 (+1.5 points QoQ/ inline YoY/ +0.1 from FY2022 levels of 15.3%/ +1 from FY2019 levels of 14.4%).

As a result of the uncertain macroeconomic outlook and increasingly low US Consumer Confidence Index at 98.7x in September 2024 (-6.9x MoM/ -31.3x from the pre-pandemic averages of 130x), it is unsurprising that the management has opted to lower their FY2024 guidance.

This is along with a FY2024 comparable sales decline by -3.5% YoY (compared to -3.2% in FY2023), adj. operating margins of 13.85% (-0.35 points YoY), and an adj. EPS decline of -3% YoY (compared to -9.5% YoY in FY2023) at the midpoint.

This is also compared to the original guidance of -1% YoY, 14.1% (-0.1 points YoY), and +1% YoY offered in the FQ4’23 earnings call, respectively.

Even so, with the Fed already commencing on their rate cuts and consumer sentiments likely to improve soon, we believe that HD’s prospects are bound to improve sooner than later.

If anything, given the massive destruction left in the path of hurricane Helene and Milton at approximately $160B, we are likely to see the retailer report a one-time boost in FQ4’24 net sales attributed to the ongoing repair works.

This builds upon the estimated damage brought upon by Hurricane Ian at $112B in 2022 and Hurricane Irma at $50B in 2017, where HD reported hurricane-related sales of $120M and $282M, respectively, albeit minimal compared to the FQ2’24 net sales of $43.17B (+18.5% QoQ/ +0.6% YoY).

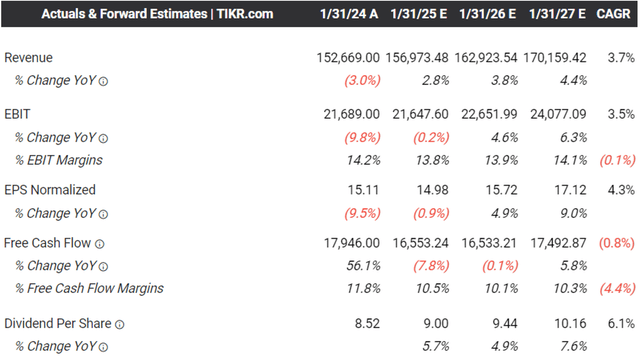

The Consensus Forward Estimates

As a result of the potential long-term recovery from the normalization in borrowing costs, we believe that the consensus forward estimates remain prudent, with HD expected to generate a top/ bottom-line growth at a CAGR of +3.7%/ +4.3% through FY2026.

This is compared to the pre-pandemic 5Y CAGR of +5.8%/ +17.5% and 10Y normalized CAGR of +6.8%/ +14.9%, respectively, implying the retailer’s potential to beat the consensus estimates, especially once we hit the “magic mortgage rate.”

Realtor.com has reported that a third of the surveyed Americans are more likely to buy homes (and, naturally, commence on home renovation projects) once mortgage rates fall below 5%.

This is drastically improved compared to the 22% reported at below 6% – with it signaling a potential real estate boom while kickstarting HD’s recovery in the intermediate term.

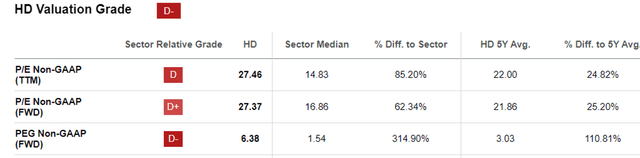

HD Valuations

Even so, we believe that HD continues to trade at elevated FWD P/E non-GAAP valuations of 27.37x, higher than the 5Y mean of 21.86x, 10Y mean of 20.95x, and the sector median of 16.86x.

Based on the projected adj EPS expansion at a CAGR of +8.1% from its FY2024 adj EPS guidance of $14.65 and consensus FY2026 adj EPS estimates of $17.12, the stock continues to trade at a relatively expensive FWD PEG non-GAAP ratio of 3.37x as well.

This is compared to its 5Y mean of 3.03x, 10Y mean of 1.40x, and the sector median of 1.54x.

The same premium can be observed when comparing HD to its direct competitor, Lowe’s Companies, Inc. (LOW) at a FWD PEG non-GAAP ratio of 2.74x, based on the FWD P/E non-GAAP valuations of 23.30x and the projected adj EPS expansion at a CAGR of +8.5% from the management’s FY2024 adj EPS guidance of $11.80 to the consensus FY2026 adj EPS estimates of $13.89.

With the market overly exuberant about their near-term prospects, we believe that there remains a minimal margin of safety here.

So, Is HD Stock A Buy, Sell, or Hold?

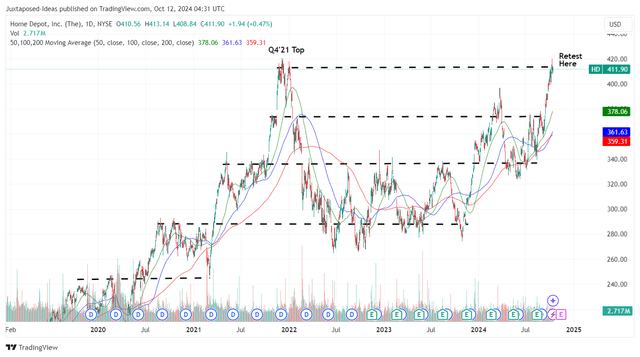

HD 5Y Stock Price

The same over optimism has already been observed in HD’s upward rally since the June 2024 bottom, as the stock runs away from its 50/ 100/ 200 day moving averages.

For context, we had offered a fair value estimate of $307.60 in our last article, based on the FY2023 adj EPS of $15.11 and the normalized 1Y P/E of 20.36x (near to its 10Y mean of 20.95x).

Based on the management’s lowered FY2024 adj EPS guidance of $14.65, it is apparent that the stock has run away from our updated fair value estimates of $298.20.

Based on the consensus FY2026 adj EPS estimates of $17.12, there remains a minimal margin of safety to our updated long-term price target of $348.50 as well.

If anything, HD’s balance sheet has continued to deteriorate to a net debt of -$52.77B (-39.6% QoQ/ -39% YoY) despite the stable Free Cash Flow generation of $16.77B over the LTM (+3.1% sequentially), with the management increasingly using debt to finance its acquisitions, worsened by the bloated inventory levels of $23.06B (inline YoY/ +58.7% from FY2019 levels).

Lastly, the stock market is currently also overly greedy, with the McClellan Volume Summation Index elevated at 1,675.10x compared to the neutral point at 1,000x, and the CBOE Volatility Index higher than its 50 days moving averages.

As a result of the fully baked in upside potential and the potential volatility, we prefer to prudently maintain our Hold (Neutral) rating here, especially since we may see a market wide pullback occur in the near-term, with HD potentially returning part of its recent gains.

Do not chase this rally.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.