Summary:

- While HD has delivered a decelerating decline in comparable sales in FQ2’23, we believe that the worst may not be here yet, with H2’23 potentially bringing further headwinds.

- The combination of elevated interest rate environment, tight housing supply, and reduced DIY discretionary spending may be worsened by the restart of the federal student loan repayments.

- With the HD stock still trading at a premium compared to LOW and the sector median, we believe that there is a minimal margin of safety at these levels.

- Investors may want to wait a little longer and wait for the housing situation/the short-term downtrend to stabilize, despite the tempting dividend returns.

AlexSava/iStock via Getty Images

We previously covered Home Depot, Inc (NYSE:HD) in April 2022, discussing its status as a staple stock during the housing boom then, pulling forward an impressive six years’ worth of revenue growth during the COVID-19 pandemic.

These developments had also led to the stock’s embedded premium and highly optimistic rally at that time, easily outperforming the wider market over the past three years.

In this article, we will be covering HD’s FQ2’23 top/ bottom line beats and reiterated FY2023 guidance, further aided by the new $15B in share repurchase authorization.

These promising developments have unfortunately been negated by the pessimistic sentiments surrounding the US housing market, with the elevated borrowing costs and consequently, impacted home improvement projects posing headwinds to the retailer’s H2’23 prospects.

The HD Investment Thesis Appears To Offer A Minimal Margin Of Safety Here

For now, HD has reported an excellent FQ2’23 revenues of $42.91B (+15.1% QoQ/ -2% YoY) and GAAP EPS of $4.65 (+21.7% QoQ/ -7.9% YoY). Much of these tailwinds are probably attributed to the steady gross margins of 33% (-0.7 points QoQ/ -0.1 YoY), near to its FY2019 levels of 34.1% (-0.2 points YoY).

These numbers suggest that the management has opted to preserve its profit margins despite the nearly doubled inventory levels of $23.26B (-8.3% QoQ/ -10.8% YoY), compared to FY2019 levels of $14.53B (+4.3% YoY).

These strategies have allowed HD’s balance sheet to remain stable at net debts of -$34.88B (-4.6% QoQ/ -1.6% YoY) by the latest quarter, while allowing the management to sustain its shareholder returns.

For example, the management has been able to expediently retire 94M of shares since FY2019, while growing its dividends over the past five years at +15.47% compared to the sector median of +7.10%.

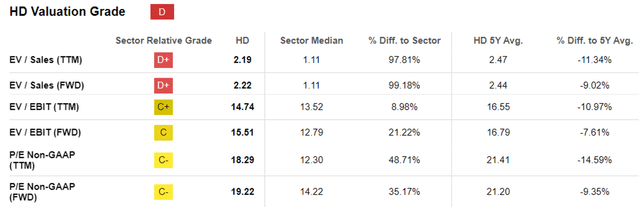

HD Valuations

Perhaps this is why HD’s valuations are still reasonably within its 1Y and 5Y means.

However, investors may also want to note that the stock trades at a notable premium compared to its direct competitor, Lowe’s Companies, Inc. (LOW) and the Home Improvement Retail sector medians.

For example, HD trades at FWD P/E of 19.22x compared to LOW’s at 14.86x and sector median of 14.22x, with the former expected to record an adj EPS CAGR of +1.2% through FY2025, against the normalized CAGR of +17.2% between FY2016 and FY2022.

This is compared to the latter’s adj EPS CAGR of +5.3% through FY2025, against the normalized CAGR of +22.9% between FY2016 and FY2022.

These numbers suggest that HD may not offer a sufficient margin of safety at current levels, given the lofty valuations and the underwhelming forward estimates.

For example, based on the consensus FY2025 adj EPS estimates of $17.30 and its FWD P/E of 19.22x, we are looking at a long-term price target of $332.50, implying a minimal +13.5% upside potential from current levels as well.

In addition, investors must note that the HD management has previously lowered its FY2023 guidance once in the FQ1’23 earnings call, with a projected decline in the fiscal year’s comparable sales by -3.5% YoY and adj EPS by -10% YoY at the midpoint.

This is compared to the previous FY2023 guidance of flattish comparable sales growth and adj EPS decline at mid-single digits, offered in the FQ4’22 earnings call.

While HD’s rate of comparable sales decline has moderated at -2% YoY in FQ2’23, compared to the FQ1’23 decline of -4.5% YoY, investors must also note that the federal student loan repayment will restart from October 2023, potentially accelerating the decline of its top-line in H2’23.

Only time may tell.

So, Is HD Stock A Buy, Sell, or Hold?

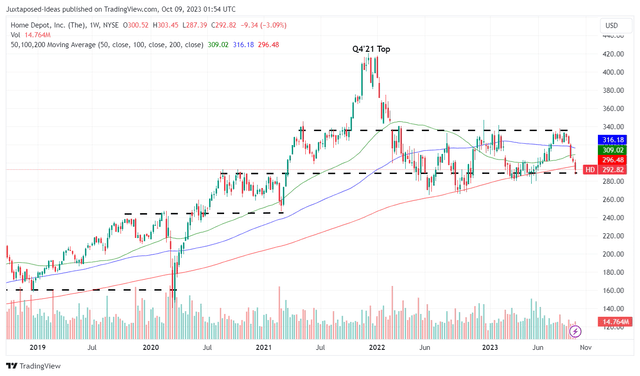

HD 5Y Stock Price

Unfortunately, HD has failed to break out of its $340s resistance levels thrice, with the stock also rapidly plunging over the past two weeks.

With the retail Consumers comprising 50% of the company’s TAM, we are not surprised that the stock has failed to hold on to its hyper-pandemic gains thus far.

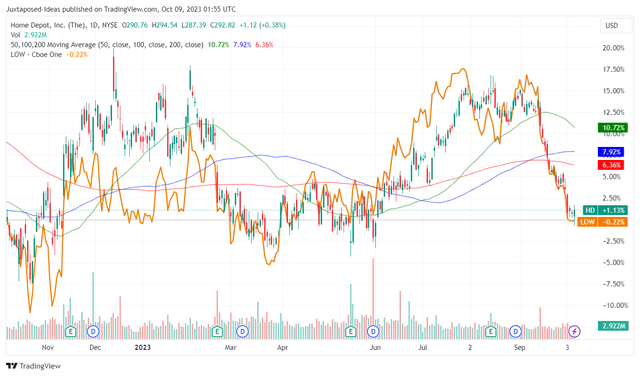

HD & LOW 1Y Stock Price

The same pessimistic trend has also been observed with LOW, likely attributed to the uncertain US housing market with impacted DIY discretionary demand, with the company’s do-it-yourself (DIY) and do-it-for-me (DIFM) customers comprising 50% of its customer base and 75% of its sales in 2022.

We believe that the worst may not be here yet, especially since existing home sales in the US have slowed to 4.04M units in August 2023 (-0.03M MoM/ -0.4M YoY), compared to the hyper-pandemic peak of over 6.5M homes and August 2019 levels of 5.25M homes.

The HD management has also offered a pessimistic commentary in the recent earnings call, with the tightened discretionary spending headwind unlikely to lift in the near term:

While there was strength in project-related categories like building materials, hardware and plumbing, we continue to see pressure in certain big ticket discretionary categories.

Pro sales performance was slightly negative in the second quarter and outperformed the DIY customer… surveys suggest that Pro backlogs are lower than they were a year ago… Additionally, projects in these backlogs are generally smaller in scale and scope. (Seeking Alpha).

On the one hand, some existing HD investors may opt to continue to their ongoing DRIP program, allowing them to regularly accumulate additional shares on a quarterly basis.

On the other hand, we prefer to cautiously rate HD as a Hold (Neutral) here. With more headwinds in H2’23, we may see its $290s support levels breached in the intermediate term, with a potential -10% downside from current levels to its next support level of $260s.

As a result of the potential volatility, new investors may want to wait a little longer and wait for the housing situation/ the short-term downtrend to stabilize, despite the tempting dividend returns.

Lastly, HD investors must also temper their intermediate-term expectations, since the Fed expects to achieve its target inflation rate of 2% only by 2026, implying that the higher interest rate environment and the impacted housing improvement projects may continue for a few more quarters.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.