Summary:

- Home Depot reported a decrease in sales and net earnings for fiscal 2023.

- Home Depot remains committed to investing in its stores and capturing more market share despite current challenges.

- The company has significant risks, including a weak balance sheet and a relatively poor valuation.

- Despite the risks, I think Home Depot is a great portfolio diversifier, and my rating for HD stock is a Buy.

Justin Sullivan

Home Depot (NYSE:HD) is a portfolio staple, and while it should not be considered to be a large contributor to alpha, it remains a key tool to diversify and mitigate risk. I am confident it is one of the best stocks to own for this reason and provides protection from potential volatility in the technology sector, where I invest most heavily.

Last Year & 2024 Outlook

In Q3 of fiscal 2023, the company reported a 3.0% YoY decrease in sales, a total of $37.7 billion. There was also a decrease in net earnings, down from $4.3 billion in Q3 2022 to $3.8 billion in 2023. There was also a reduction in comparable sales by 3.1%, which was more pronounced in the US, with a 3.5% decline.

For full fiscal 2023 results, Home Depot forecasts a decline in sales and comparable sales of 3-4% compared to fiscal 2022. They expect an operating margin of 14.2-14.1%, with diluted earnings-per-share declining 9-11% compared to fiscal 2022.

In terms of market trends and consumer behavior, existing home sales have declined by 3.3%, an 18.9% drop from the previous year. However, a 20% increase in new home sales indicates a shift in the market. Property investors have reduced home purchases by 48.6% compared to 2022, a result of high interest rates and lower rental incomes.

Regardless of these challenges, the firm is committed to investing in continued excellence in its stores, expanding its store footprint, and capturing more market share. The recent financial losses could be attributed to the general economic slowdown at the moment, but the company has maintained record profit and revenue levels amidst these conditions, representing operational resilience.

Financial Considerations

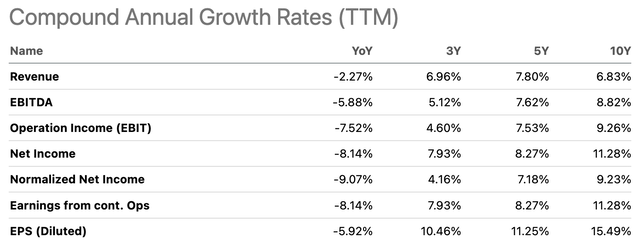

One of the less appealing elements of Home Depot stock is its growth rates, which receive a Quant Factor Grade D+ and is to be expected from a company so well developed that was founded in 1978.

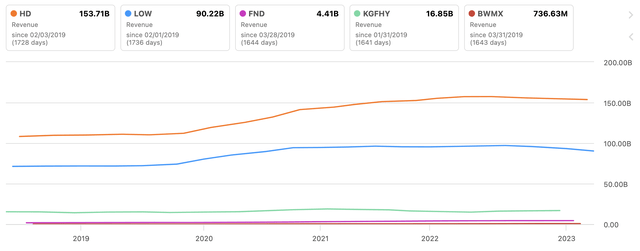

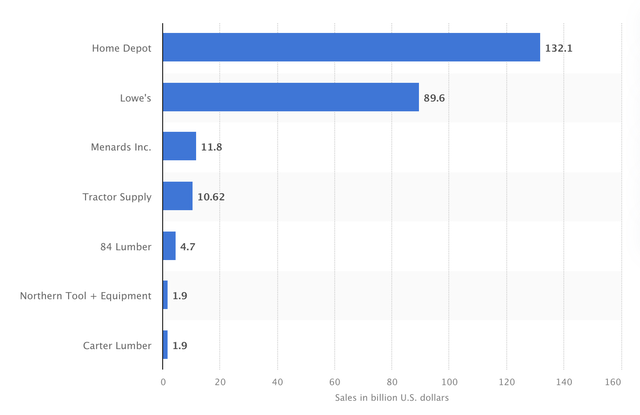

The company has the highest total revenue relative to its dominant peers, and as such it is significant that it maintained an almost 7% revenue CAGR over the last ten years.

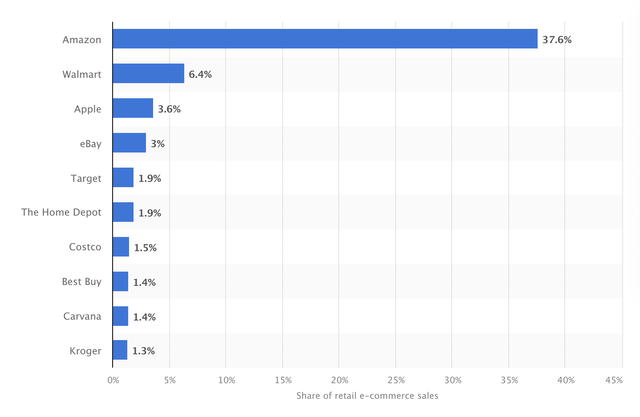

Home Depot is largely dominant in home development sales and not as significant when compared to the retail sector at large. This evidence of its large market share in home improvement and registering in total retail statistics indicates a slower growth expectation long term for the stock.

Sales of the leading home improvement chains in the United States in 2020 (Statista) Market share of leading retail e-commerce companies in the United States in 2023 (Statista)

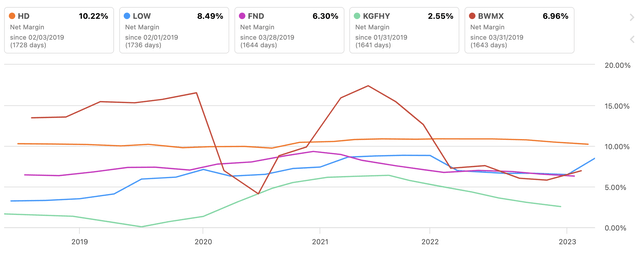

The company’s best element of its financials is arguably its profitability, which receives a Seeking Alpha Factor Grade A+. Relative to its dominant peers, its net margin is at the very top:

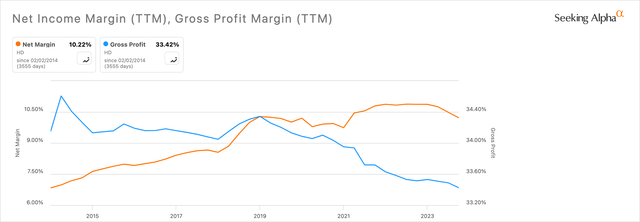

Over the last ten years, the firm’s net margin has had an uptrend, and its gross margin has had a downtrend:

This signifies greater internal operational efficiencies but a higher cost of production and cost of goods sold, likely correlated with inflationary pressures and continued diversification and store expansions.

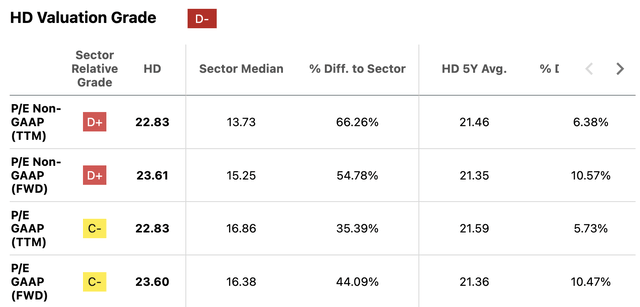

Valuation Risk

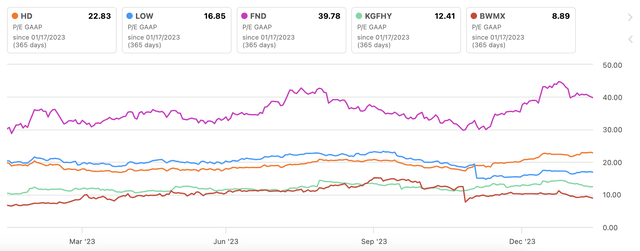

Home Depot arguably has a risk in its valuation, with a high present and forward P/E GAAP ratio when compared to its peers.

Considering this, the stock appears to be fairly valued. I say this because it has very strong profitability, and while its revenue growth rates are moderate, they are undoubtedly stable. I believe this company could be most accurately described as a stalwart, and as such, a relatively premium valuation could be expected and welcomed. The stock is priced for perfection, but not with unrealistic or speculative assumptions attached. For that reason, I like the stock for a risk-averse, long-term-focused portfolio, and I think the shares could be used to diversify even though returns may only correlate with the S&P 500 index.

So, there is a risk of the stock having potentially no margin of safety, in my opinion. As such, any slowdown in Home Depot’s growth or significant competition that arises in the home development sector could create volatility and below-index returns. For example, if advanced technology trends influence and adapt home development approaches and Home Depot is not suited to an advanced market, the shares could begin to decline. I am being optimistically cautious, with a belief that the company is one of the best stocks to own, even considering my fair value estimate.

Other Risks

The current economic climate, which includes high-interest rates and high levels of inflation, is undoubtedly going to have an effect on Home Depot stock. High interest rates particularly affect the housing market, which will indirectly affect home improvement retailers. During this period of tightened spending, consumers may prioritize essential spending over home improvements.

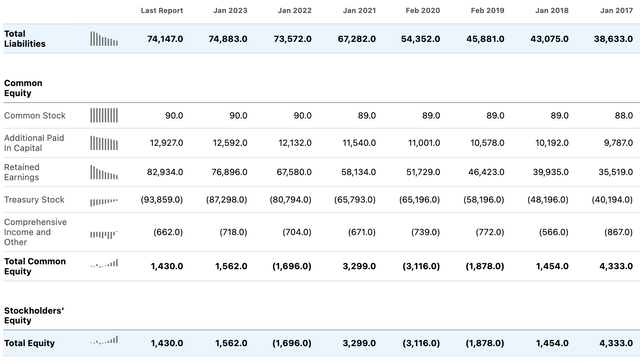

The company’s balance sheet is weak, with 98.11% of assets balanced by liabilities for the last trailing twelve months. That leaves only 1.89% of assets balanced by total equity. I think investors should be concerned by this, and it certainly puts emphasis on the company being a moderate rather than strong Buy. A large proportion of the liabilities in question are accounts payable and long-term debt.

Conclusion

Home Depot is a great portfolio diversifier, in my opinion. While I do not expect it to achieve large alpha consistently, I think it is a safe investment to allocate away from higher volatility stocks in sectors like technology. I think at the current price and considering the stalwart nature of the company’s growth rates and excellent profitability, the stock is a Buy. The risks, including a highly leveraged balance sheet, do not concern me enough to downgrade my rating to a Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in HD over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.