Summary:

- Home Depot is a reliable dividend payer with a reputation for strong growth.

- The company is the most powerful player in the home improvement retail industry, which will continue to experience macroeconomic headwinds in the near future.

- Home Depot’s A credit rating makes it a great pick for investors looking to significantly limit bankruptcy risk within their portfolios.

- Economic environment aside, the stock offers investors a solid value proposition at the current valuation.

- Without even considering valuation multiple expansion, Home Depot’s 2.9% dividend yield and 9% annual earnings growth consensus sets the stage for attractive total returns.

A customer speaks with a home improvement store employee. SDI Productions/E+ via Getty Images

As an investor, I often target companies that are industry leaders with wide moats. That is because such companies are capable of not only surviving difficult environments but thriving on the other side of them.

Home Depot (NYSE:HD) is one such example within my investment portfolio that has come out of every unfavorable environment stronger. Take the U.S. housing bubble in the mid-to late-2000s for instance. After prudently freezing its quarterly dividend per share from 2007 to 2009 at $0.225, Home Depot’s quarterly dividend has soared by 828.9% in the last 14 years to the current rate of $2.09.

The company almost certainly won’t deliver that level of dividend growth in the next 14 years. But it doesn’t have to do so to be a great investment. For the first time since March 2019, I will explain why I still believe Home Depot is a buy for dividend growth investors searching for a proven wealth builder.

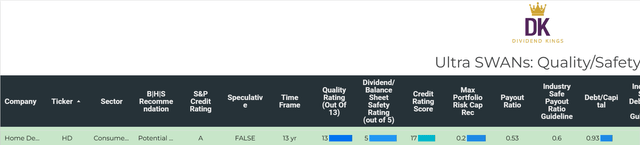

One reason to be bullish on the company is that even after its gangbuster dividend growth, the payout is still sustainable: The adjusted diluted EPS payout ratio of 53% in what should be a trough year for earnings is what I like to see. This is because the payout ratio is less than the 60% payout ratio that rating agencies desire from companies operating in Home Depot’s industry.

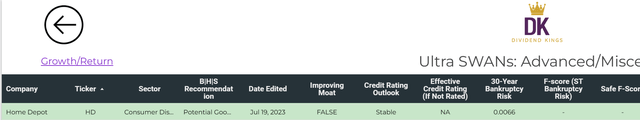

Thanks to its status as the giant of home improvement retail and healthy profitability, the company also enjoys an A credit rating from S&P on a stable outlook. Thus, the estimated risk of Home Depot going belly up in the next 30 years is just 0.66%. Put another way, the company has a 151 in 152 probability of remaining in business through 2053. Unsurprisingly, Home Depot also has a 5/5 dividend and balance sheet safety rating.

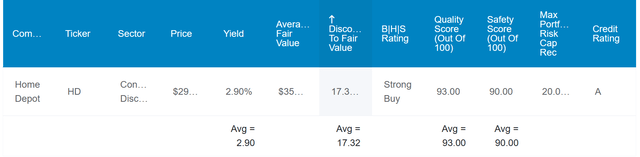

The stock looks to be trading at a 17% discount to fair value at the current $291 share price (as of October 9, 2023) and offers a 21% valuation upside from current levels. Home Depot’s 2.9% dividend yield, 9% to 12% annual earnings growth prospects, and 1.9% annual valuation multiple expansion could translate to 13.8% to 16.8% annual total returns in the next 10 years.

Home Improvement Retail’s Very Own 800-Pound Gorilla

Founded in 1978, Home Depot is the unquestionable leader of the home improvement retail industry. At the end of the second quarter concluded July 30, the home improvement retailer operated 2,326 stores in all U.S. states, Puerto Rico, the District of Columbia, the U.S. Virgin Islands, Guam, Canada, and Mexico. Based on the analyst consensus of $153.2 billion in revenue that is projected for its fiscal year 2024 ending in January, the company commands an approximately 17% share of the $900 billion and counting home improvement retail industry. This is considerably greater than the 9.8% share ($88 billion analyst revenue consensus) for Lowe’s (LOW).

Home Depot serves as proof that a business doesn’t always need a first-mover advantage to become the juggernaut of its industry. Industry rival Lowe’s was founded more than a half-century earlier in 1921. Yet Home Depot boasts almost twice the market share. What gives?

This massive discrepancy in size between Home Depot and Lowe’s can be explained by the following: Pro customers. This customer base is the most vaunted because professional contractors spend more money at stores on a more frequent basis compared to do-it-yourselfers or DIYers. Home Depot’s sales mix is roughly evenly split between Pros and DIYers, whereas Lowe’s derives only about a quarter of its sales from Pros.

The former’s investments in providing a better experience for Pros continue to pay off. EVP of Outside Sales and Services, Hector Padilla, noted in the company’s first-quarter earnings call that new supply chain assets and improved Pro capabilities have led to recent gains in wallet share among Pros.

As high mortgage rates and inflation eventually subside and Home Depot further improves its performance with this key customer demographic, the company should bounce back. This is why FactSet Research anticipates that Home Depot will generate 9% annual earnings growth moving forward.

The retailer’s interest coverage ratio of 14 through the first six months of its current fiscal year indicates that it is financially sound. That explains why Home Depot’s credit is A-rated by S&P.

Home Depot Can Keep Building On Its Dividend Growth Streak

Even with risk-free rates as high as they currently are, Home Depot’s 2.9% dividend yield isn’t exactly paltry. This is especially the case when considering that the company has delivered 18% annual dividend growth to shareholders in the past five years. The most recent 10% increase in its payout wasn’t bad for the circumstances, either.

Home Depot’s dividend is safe and predictable as well. Aside from its manageable EPS payout ratio, the dividend is covered by free cash flow. The company posted $11.5 billion in free cash flow in fiscal year 2023. Compared to the $7.8 billion in dividends paid during that period, this is a 67.8% free cash flow payout ratio (details sourced from page 44 of 113 of Home Depot 10-K filing). This is why I believe Home Depot will have no issue extending its 14-year dividend growth streak in the years to come.

Risks To Consider

As it stands now, Home Depot’s future looks promising. However, there are risks that investors need to know.

To this point, Home Depot has outperformed Lowe’s concerning winning business from Pros. The company will need to keep this up if it hopes to keep its operating momentum going. If Home Depot can’t keep beating industry competitors on customer experience, product pricing, and quality, the retailer could lose market share and experience diminished growth.

The current point in the economic cycle has analysts predicting that Home Depot will experience a modest downturn in EPS from the base of $16.69 from the last fiscal year. If the coming recession is more severe and prolonged than anticipated, Home Depot’s recovery coming out of it could be slower than is currently being forecasted (additional risks can be gleaned from the Risk Factors section of Home Depot’s 10-K).

Summary: A Blue Chip Compounder Worth Buying

Home Depot is an ultra-SWAN company that deserves the attention of dividend growth investors. This is because the stock’s $291 share price is priced 17% below its approximate fair value of $352.

Home Depot’s 2.9% dividend yield along with 9% to 12% annual earnings growth potential and 1.9% annual valuation multiple upside make it a buy in an interesting alternative to the S&P 500. The stock’s 13.8% to 16.8% annual total return prospects for the next 10 years are materially higher than the 10% projected returns for the S&P 500.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HD, LOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.