Summary:

- Home Depot, Inc. has experienced robust financial growth over the past few years as a result of the booming home improvement industry.

- The share price of Home Depot has decreased by 35.72% in 2022, but the decline is not yet complete, according to a technical analysis.

- Despite Home Depot’s strong financial performance, the share price is expected to decline further, following the emergence of the bearish hammer.

jetcityimage

Home Depot, Inc. (NYSE:HD) is viewed as a great investment due to the company’s strong financial performance, dominant market position, and expanding industry. Home Depot has a track record of strong financial performance with consistent revenue and profit expansion. Recent demand for Home Depot is related to the home improvement industry’s projected growth in the coming years, which will be driven by an aging housing stock and a growing population. According to the research, the home improvement industry has experienced tremendous growth during the COVID-19 pandemic due to the fact that consumers are spending more time at home. In 2021, US residents spent $538 billion in home improvement stores, while in 2020, 76% of American homeowners performed home improvements. In 2021, the remodeling industry in the United States generated $1.1 billion in revenue.

In 2022, Home Depot’s share price dropped by 35.72%, from $406.35 to $261.21. The share price declined as a result of the economic downturn, which negatively impacted consumer spending and led to lower sales and profits. The high inflation in 2022 has affected consumer spending and the Federal Reserve’s response to higher inflation. The interest rates also affected the company’s borrowing cost, the cost of goods and services, and economic activity as a whole. Long-term inflation is expected to prompt the Federal Reserve to maintain higher interest rates for long period. The chart patterns for the Home Depot also portray the emergence of ascending broadening formations with a bearish hammer, indicating a continuation of the decline toward the targeted support.

Financial Performance

Home Depot’s strong financial performance is a result of its dominant market position in the United States, which gives it a significant competitive advantage over smaller retailers and enables it to generate robust revenues and profits. The company’s total revenue increases continuously every year. The total revenue for 2022 was $151.16 billion, an increase of 14.42% from the year. Comparatively, the revenue growth in 2021, 2020, and 2019 was 19.85%, 1.87%, and 7.23%, respectively. Similarly, quarterly revenue is also rising steadily; however, quarterly revenue for the quarter ending October 31, 2022, was $38.872 billion, a year-over-year increase of 5.57%. The revenue for the quarter ending October 31, 2022, also decreased by 11.23% as compared to the previous quarter.

The primary competitor of Home Depot in the home improvement retail industry is Lowe’s Companies, Inc. (LOW). The Home Depot remains a superior investment due to the larger market share in the home improvement retail industry, which enables great financial stability and purchasing power. The company also offers a greater variety of tools, appliances, and construction materials and is more established in terms of online presence and e-commerce investment, both of which help to drive sales and attract customers in the digital age. In 2022, Home Depot’s annual revenue was 36% higher than Lowe’s Companies, Inc.

Technical Evaluation

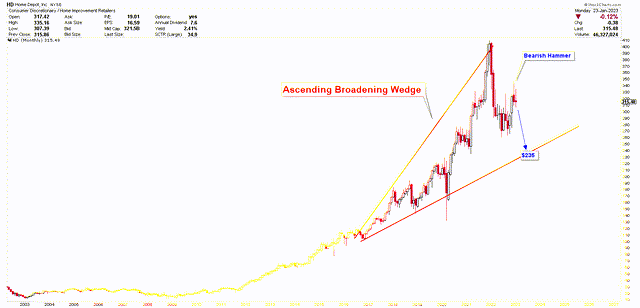

The monthly chart below depicts the formation of an ascending broadening wedge. The last month of 2022 produced a bearish hammer, indicating market selling interest. The subsequent candle for January 2023 has not yet formed, but based on the price action in December 2022, it is expected to be bearish. Home Depot’s price target remains the lower trend line of an ascending broadening wedge at $235. As a whole, the ascending broadening wedge pattern in the market is regarded as a bearish pattern that forms during an extended uptrend. Since its inception, The Home Depot has been in a strong uptrend, which has gained momentum since 2011.

Home Depot Monthly (stockcharts.com)

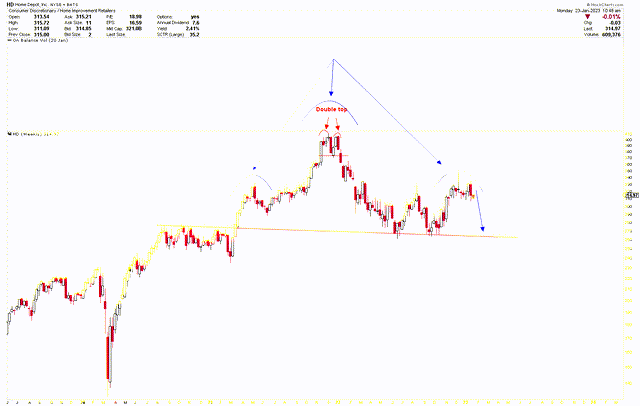

The weekly chart provides additional context for understanding the monthly bearish ascending broadening wedge formation. The weekly chart reveals the appearance of double tops, which are known as governing patterns, followed by a price decline. The price decline is followed by the appearance of mega head-and-shoulders formation. Based on the previous double top, further price declines are likely. The share price of Home Depot will decline as long as the price remains below $350.

Home Depot Weekly (stockcharts.com)

Market Risk

Home Depot faces some financial challenges due to the economic downturn, which has had a negative impact on its sales and profitability. The company has had high revenues and profits over the past few years, but consumer spending has been affected by rising inflation in 2022. In my opinion, inflation is a long-term phenomenon, and higher inflation rates will have additional effects on the stock market. Therefore, the volatility in the stock market is expected to increase with time. The Home Depot’s stores and distribution centers are located in areas prone to natural disasters, such as hurricanes, tornadoes, and earthquakes, which disrupt operations and cause lost sales and increased expenses due to supply chain disruptions.

The home improvement industry is expanding very quickly, and Home Depot has the opportunity to increase demand. If the share price of Home Depot breaks above $350 due to huge volatility in the stock market, the structure of a head and shoulders will be voided, and the price structure will convert to bullish.

Bottom Line

Home Depot generates consistent profits and year-over-year revenue growth over the past few years. In 2022, the price has decreased by 35.72%. Many investors view the recent decline with interest, and there was a demand for the stock during the third quarter of 2022. However, the share price decline of 35.76% was incomplete due to incomplete patterns. The rebound from $260 was capped by a bearish hammer in December 2022, indicating a further decline toward the $235 level. As ascending broadening patterns are typically bearish patterns, the upcoming drop to $235 will be viewed as a buying opportunity for investors, with a major rebound. Home Depot will be considered bullish, only if the share price trades above $360.

In conclusion, it is expected that Home Depot’s stock price will continue to decline in light of the bearish hammer and incomplete ascending broadening wedge that was highlighted in the previous section. Nonetheless, a decline to $235 will increase buying interest in the stock.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.