Summary:

- Home Depot is a market leader in home improvement with strong financial growth and capital allocation strategies, making it a good long-term investment, but short-to-medium term, I am bearish on the stock.

- Stagnating income growth and weak macroeconomic conditions pose risks to the stock price, but valuation is primed for perfection.

- I own put options in the stock as part of my broad-based market protection strategy.

sturti/E+ via Getty Images

I like Home Depot (NYSE:HD) as a business and think their business model is hard to beat. Although I have never held their stock, I think it would make a great addition to a long-term portfolio. But that’s nothing to say about what I think over the short to medium term. Over the next one-year time frame, I see some risks in the overall stock market and have been collecting a basket of cheap far OTM puts to protect my portfolio. The risks I see and the short-term outlook I have for the stock have made it a candidate in my put basket. Below, in my write-up, I will dive into my bearish view that has made the case for me.

The Good: Home Depot is a market leader and an excellent capital allocator

Home Depot is a market leader in the home improvement retail sector, with a strong brand and extensive store network. The company operates 2,317 stores in the United States and has a significant presence in Canada. This extensive footprint provides Home Depot with a competitive advantage in terms of market reach and customer base.

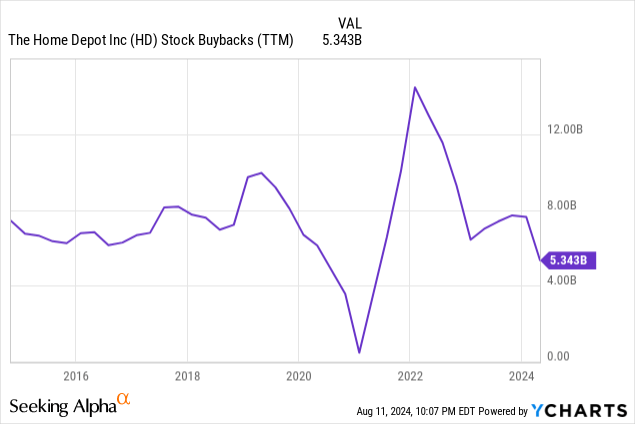

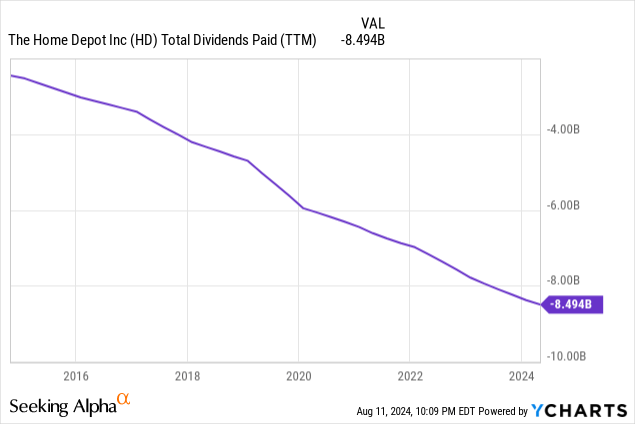

Its financial growth over the years has been strong and has been maintaining strong cash flows. Additionally, through prudent use of its balance sheet and excellent capital allocation, it has been able to fund acquisitions and allocate capital through dividends (Yield of 2.5%) and stock buybacks, thereby returning value to shareholders.

The company has spent over $10B on acquisitions in the last decade (not including the $18B on its more recent acquisition) and more than $100B on dividends and stock buybacks.

The Bad

Home Depot’s stagnating income

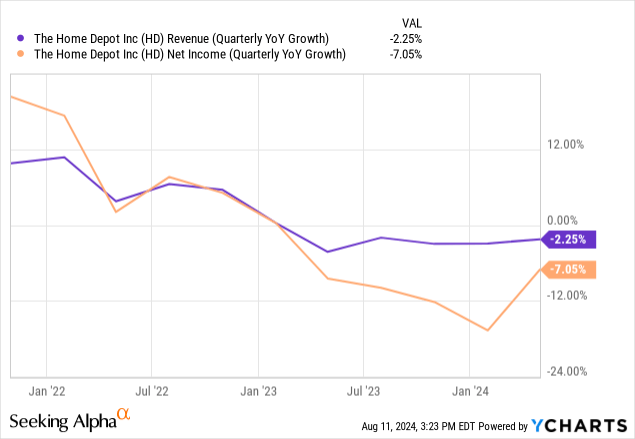

Home Depot company has shown 5 consecutive quarters of negative top and bottom-line growth rates, and a lot was attributed to softness in larger discretionary projects. It has taken steps to improve inventory productivity, reduce fixed costs, and manage cost movements, but these have not been enough to counter the slowdown in its growth.

Since the company operates in a cyclical sector, this could continue for some time.

Home Depot’s first quarter and upcoming quarter

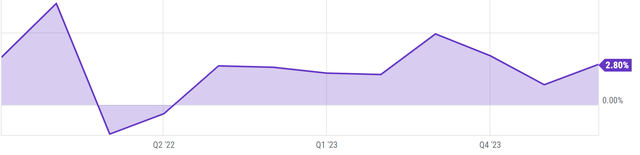

Home Depot company reported a larger-than-expected decline in quarterly same-store sales as consumers cut back on big-ticket purchases, focusing instead on smaller home repairs due to higher borrowing costs and inflation. The company saw a 6.5% drop in transactions over $1,000, and overall customer transactions fell by 1%. Comparable sales also fell 2.8%, more than analyst expectations. Despite the challenges, Home Depot reaffirmed its fiscal 2024 targets, hoping for a recovery later in the year.

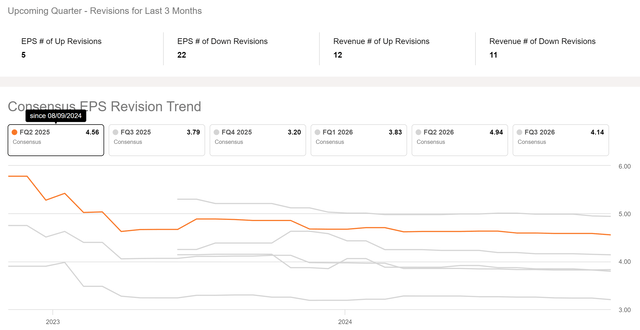

When you look at Home Depot’s earnings revisions for the coming quarter, the number of up revisions is only 5 for EPS, whereas the number of down revisions is 22! The situation is similar for the Fiscal Year End as well.

Earnings Revisions (Seeking Alpha)

There were arguments that home improvement or maintenance activities would re-accelerate if the Federal Reserve cut interest rates, but so far, we have not seen any. Even then, I doubt a 25 basis point or even a 50 basis point cut would have any noticeable effect. So here is my big question –

Small cuts won’t cut it, and big cuts most likely will indicate a recession. So, what is the upside to this business over the short to medium time frame?

A weak macro can be a distress for Home Depot stock

We are currently facing one war between Russia and Ukraine, along with a significant risk of escalation in the Israel-Palestine conflict. Additionally, the looming threat of China potentially advancing on Taiwan could impact global markets, with Home Depot stock being equally vulnerable due to its strong correlation with market movements. However, while these threats are widely recognized, I believe the underlying issues within the U.S. economy or the uncertainty surrounding it pose an even greater danger.

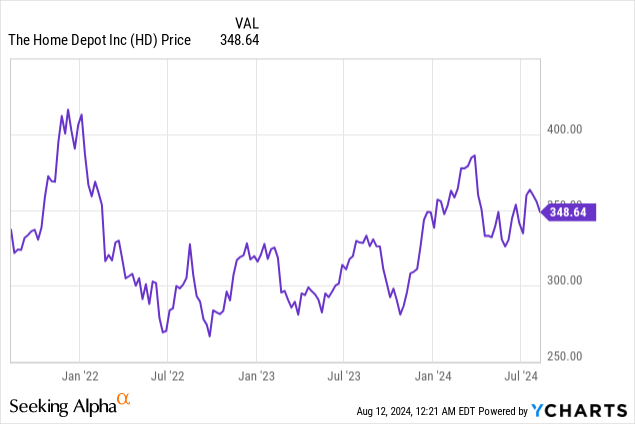

Although an official recession was never declared in 2022, we did see two quarters of negative GDP growth, and the stock cratered during this time (along with the stock market).

US Real GDP QoQ (YCharts)

What could potentially happen to the stock price if we see more quarters with negative GDP growth from here? There is an argument that the U.S. has been on a historic spending spree that has largely supported GDP growth, and this is unsustainable. Eventually, this will have to be reined in, which will weigh on the economy. Already, there are a few indicators that have been sounding the bell for an economic downturn.

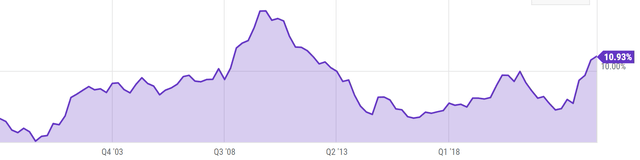

1. US Credit Card Accounts Delinquent by 90 or More Days reached close to 11% the highest in the last 11 years.

US Credit Card Delinquency rates for more than 90 days (YCharts)

2. The weakening labor market is considered to have triggered the Sahm rule that when the three-month moving average of the unemployment rate increases by 0.5% or more from its lowest point in the past 12 months, it signals the start of a recession in the U.S. economy.

3. The Conference Board’s Leading Economic Index (LEI) for the U.S. has been on a downward trend, with a 0.2% decrease in June 2024 following a 0.4% drop in May. Over the first half of 2024, the LEI declined by 1.9%, reflecting ongoing economic weakness. This decline is attributed to factors like pessimistic consumer expectations, weak new orders, negative interest rate spreads, and a rise in unemployment claims.

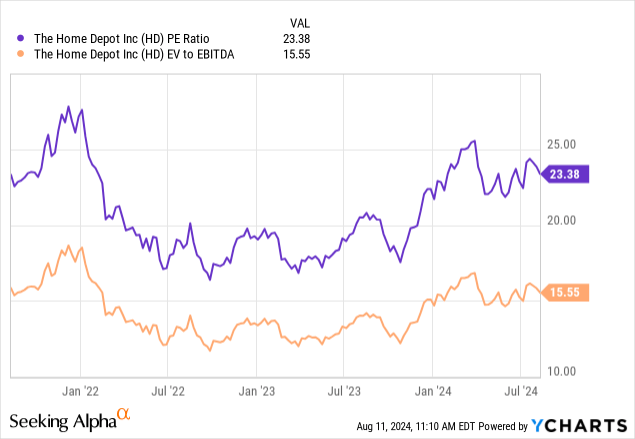

Home Depot’s Valuation is priced for perfection

Here, I want to pick two valuation ratios to demonstrate that Home Depot’s valuation is too optimistic and is primed for a reset. Looking at its Price through the lens of earnings and its enterprise value through the lens of EBITDA (which will account for its debt but ignore some of the frills associated with earnings).

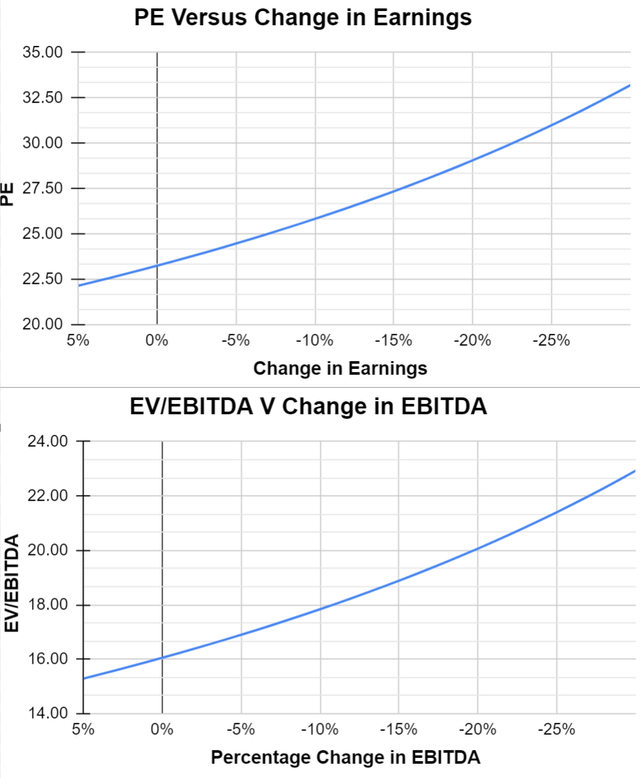

Over the last three years, both ratios are currently trading close to their highest multiples and also far above the consumer discretionary sector medians. Do the forward multiples look any different? The company has guided to a growth of 1% in sales and 1% in earnings, which barely makes a dent in the valuation. In uncertain environments, I try to build forward valuation under a range of scenarios while giving a long range for pessimistic situations (which is what is mostly unspoken).

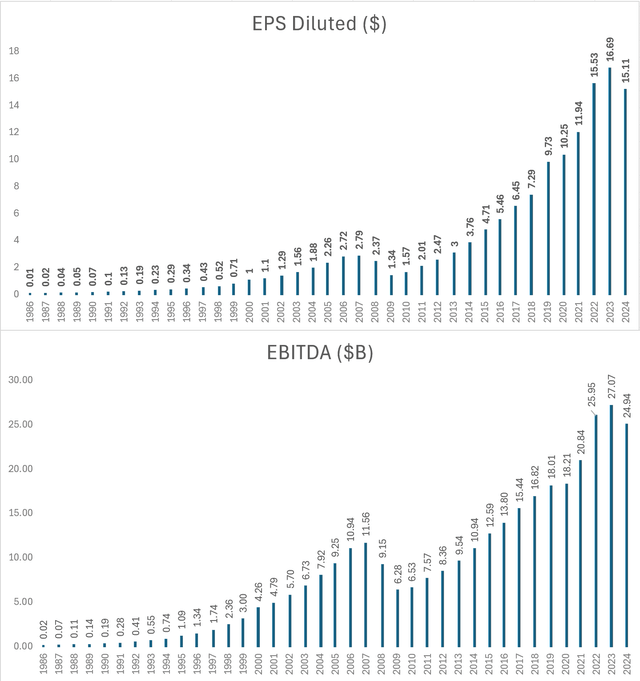

Even if the company has sandbagged the expectations, and we see higher-than-expected growth rates, the change to the valuation is negligible. But in a worst-case scenario of a prolonged recession, we see the ratios expanding to very high levels, at which point the price will reset to much lower levels. Now, a 30% drop in earnings or EBITDA could be seen as speculative. So let me present to you the trend since the company went public.

Author generated from Company data

Since the company went public, it has continuously grown its bottom line except for 2008-2009 and now. 2009 earnings dropped more than 40% and EBITDA dropped by more than 30%. We saw a dip again last year akin to 2008 while this time could be different, and we may not see that huge of a drop in the coming fiscal year, what can be said for sure is it is priced for perfection.

Risks to this thesis

The sell thesis is based on a slowing economy turning worse, down-trending income, and a price that is primed for a perfect economic outcome.

While there is plenty of data to support an oncoming slowdown of the economy, the timing could be off. Case in point, we were in a similar situation last year, and an actual recession never materialized.

Home Depot recently completed the acquisition of SRS Distribution for approximately $18B. This strategic move aims to enhance Home Depot’s capabilities in serving professional contractors, particularly in the specialty trade sectors such as roofing, landscaping, and pool contracting, and is a complementary addition to Home Depot’s existing operations. The acquisition is expected to increase Home Depot’s total addressable market by approximately $50B, and the acquired company itself reported $9.8B in revenue for 2023. Operational synergies may lead to Home Depot having a bigger impact on its bottom line, which could counter declining financials.

This can also have a knock-on effect on valuations and may drive a reset without any drop in price. It is still too early to say how much of an effect the acquisition will have on Home Depot.

Finally, the problem with a valuation-based stock outlook is that the narratives may drive the market and be deemed perfectly rational.

In bull markets the future gets a premium, in bear markets, reality gets a discount

– Jim Chanos

Final Call

Over the long term, I believe this business could be a winner as they have a sound business model, excellent capital allocation (strategic acquisitions, generous dividend and buyback program), and a market leader in its category. But over the short to medium term, I rate this business as a Sell and will be buying far OTM puts as part of my put basket. Previous positions of this nature have worked out well for me, and a recent example of my published work working well can be seen here. A few things of note –

- Deep OTM put options with at least 3 months to expiry have asymmetry but rely on high volatility or significant price correction to provide any real benefit (Payoff is significant in case my thesis works out and the price moves in my favor or implied volatility resets to a significantly higher value). I have exposure to contracts expiring on November 15 and Jan 17 at various strike prices ($280 – $210). Payoffs vary depending on the premiums paid and the move of the stock. Far OTM puts can potentially generate 10x – 50x the investment.

- Sufficient Liquidity and volume to ensure the spread between bid and ask is reasonable

- This strategy or modifications of this strategy (Ex: Shorter-dated puts such as September 20 expiry and closer strike price) could work for individuals with significant long exposure to Home Depot or stocks exposed to the economy in general and who want to protect themselves from any short-term downside.

It has to be stressed, that the implied volatility is higher than usual as earnings are imminent (pre-market August 13) and market participants are expecting a move in the stock (up to 10% moves could be priced-in for earnings). So if the stock moves up due to a favorable reaction to earnings, does not react, or even moves down matching the expected move, the premiums paid to the options could lose their entire value.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of HD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.