Summary:

- Home Depot reported a -3.1% same-store sales growth in Q3 FY23, slightly surpassing market consensus.

- Management suggests a period of moderation with rational promotional discounting activities.

- Reiterating a ‘Buy’ rating with a fair value of $360 per share.

Justin Sullivan

Home Depot (NYSE:HD) reported a -3.1% same-store sales growth in Q3 FY23, slightly surpassing the market consensus. Management suggests this year is a period of moderation, with promotional discounting activities becoming more rational. Since my initiation of coverage, the stock price has risen by 18%. I am reiterating a ‘Buy’ rating with a fair value of $360 per share.

Quarterly Result and Outlook

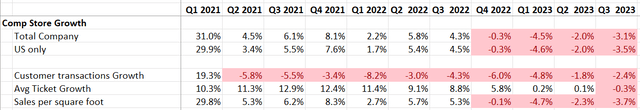

During Q3 FY23, comparable sales witnessed a year-over-year decrease of 3.1%, attributed to a -2.4% decline in transaction growth and a -0.3% dip in average ticket growth. This outcome aligns closely with the company’s expectations and slightly surpasses the market consensus. As highlighted in a previous article, the big-ticket discretionary categories persist in facing challenges. Consequently, big-ticket comp transactions, specifically those exceeding $1,000, experienced a year-over-year decline of 5.2%.

Maintaining a robust balance sheet, they sustain a close to 2x debt-to-EBITDA leverage ratio. Notably, they have repurchased $6.5 billion of their own stock thus far this year. Their capital allocation policy has demonstrated consistency over the past few years.

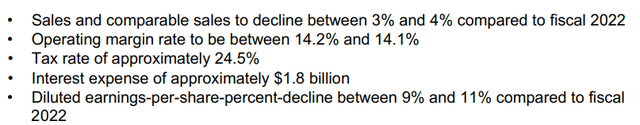

In terms of guidance, they have revised it down, projecting a decline of 3% to 4% in comparable sales growth and a decrease of 9-11% in diluted EPS year-over-year.

Overall, the quarterly results from Home Depot do not come as a surprise, and it seems the company is adeptly managing its business amid the challenges of a high inflationary market environment. A key strength lies in Home Depot’s leading market position in the PRO market. The company has been proactive in investing in various initiatives aimed at expanding its presence.

Less Promotional Discounting and Market is Stabilizing

During the earnings call, the management emphasized that promotional discounting activities are diminishing in frequency, and the market is exhibiting signs of rationalization. According to their assessment, these promotional activities have reverted back to pre-COVID times. Furthermore, they characterized this year as a period of modernization and forecasted the market is stabilizing toward the pre-COVID times.

I align with the management’s expectations for several reasons. Firstly, the labor market has shown signs of cooling down in recent months. Considering that labor costs are a significant input for home improvement projects, the moderation in labor costs could alleviate the affordability challenges for many individuals, potentially fostering growth for Home Depot.

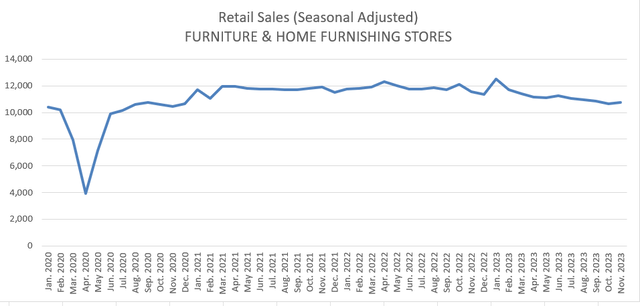

Secondly, the retail sales for furniture and home furnishing stores are gradually moderating toward pre-COVID levels, as depicted in the chart below. This moderation in demand supports a more rational market and helps establish an equilibrium between supply and demand.

Lastly, in the upcoming quarter, Home Depot will be up against a weak comparable, given that their same-store sales growth was -0.3% in Q4 FY22. It is anticipated that the company should begin to observe an improvement in comparable sales growth starting from the next quarter.

Valuation Update

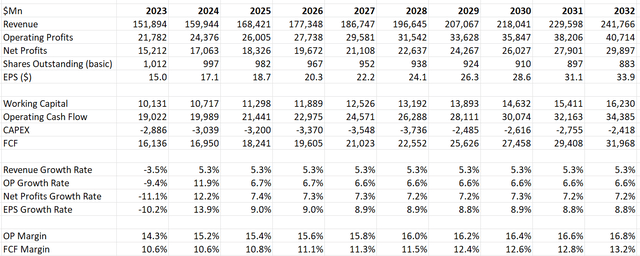

The assumptions for FY23 align with Home Depot’s guidance, taking into account the three quarters reported during this fiscal year. Anticipating a return to stabilization in the market and a trajectory back to pre-COVID conditions, I am assuming a 5.3% comparable sales growth, consistent with their historical average excluding the COVID period. The expected margin expansion is attributed to operating leverage and the implementation of cost-reduction initiatives.

The model employs a 10% discount rate, assumes a 5% terminal growth rate, and factors in a 24.5% tax rate. Based on these parameters, the forecasted fair value is $360 per share.

Conclusion

I am confident in the market’s stabilization and the diminishing frequency of promotional activities. Considering the undervalued stock price, I am reiterating a ‘Buy’ rating with a fair value of $360 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.