Summary:

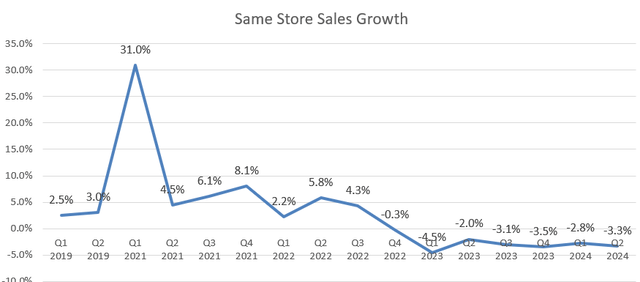

- Home Depot reported a 3.3% decline in same-store sales growth in Q2 due to weak demand and high interest rates.

- The company is navigating the challenging macro environment by expanding online services, focusing on PRO customers, and acquiring SRS Distribution.

- Despite the weak outlook for FY24, Home Depot is expected to recover as interest rates decline, with a fair value of $390 per share.

Marvin Samuel Tolentino Pineda/iStock Editorial via Getty Images

I reiterated my ‘Buy’ thesis for Home Depot (NYSE:HD) (NEOE:HD:CA) in my previous article published in March 2024, anticipating a weak home improvement market for FY24. Home Depot released its Q2 result on August 13th, reporting a 3.3% decline in same store sales growth. I appreciate the company’s efforts to navigate the challenging macro environment and the weak home improvement market. I reiterate a ‘Buy’ rating with a fair value of $390 per share.

Weathering A Weak Home Improvement Market

As shown in the chart below, Home Depot’s same store sales (SSS) declined by 3.3% in Q2. This decline was driven by the high-interest rate environment, weak demand in the home improvement sector, and a decrease in large discretionary renovation projects, such as kitchens and bathrooms.

As discussed in my previous article, I am not surprised by the weak SSS for the quarter, given the significant challenges posed by the current macro environment for the home improvement market. However, I appreciate the company’s efforts to navigate these challenging market conditions:

- Home Depot continues to pursue their online expansion strategy, achieving 4% year-over-year growth in Q2. On May 23, Home Depot and Instacart announced a nationwide partnership to offer same-day delivery services from nearly 2000 store locations. I anticipate Home Depot will form additional partnerships with delivery service companies in the future, and the same-day delivery could potentially enhance the customer experience on Home Depot’s website.

- Home Depot has further developed its Pro Xtra Loyalty Program, increasing engagement among PRO customers. Over the earnings call, the management expressed positive growth among PROs participating in the Pro Xtra Program. As a result, the PRO segment outperformed the DIY customers for the quarter.

- On June 18th, Home Depot completed the acquisition of SRS Distribution, and has made solid progress with business integration. SRS delivered high-single-digit revenue growth for the quarter, indicating strong growth momentum despite the weak macro. As communicated over the call, Home Depot plans to make SRS’s comprehensive product offering in roofing, pool, and landscape available to all Home Depot’s customers through Pro Desk.

Overall, I think Home Depot has managed to navigate the weak macro environment effectively, and I believe their business will recover as interest rates begin to decline in the future.

Outlook and Valuation

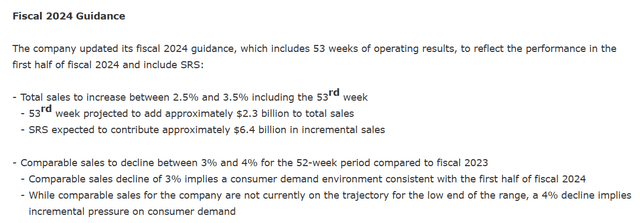

As detailed below, Home Depot guides 3%-4% decline in the comparable sales growth for FY24.

I estimate Home Depot’s growth in FY24 with the following assumptions:

- As depicted in the chart below, retail sales from furniture and home furnishing stores declined by 13% year-over-year in January, but moderated to 4% decline by June 2024. Considering the high interest rate, I anticipate the large home renovation projects will continue to be weak.

Federal Reserve Bank of St. Louis

- If the Fed begins to cut interest rates later this year, it is likely that the home renovation market will recover gradually. I anticipate Home Depot’s in-store sales will decline by 4% in FY24. Additionally, as the company continues to invest in its online channel, I anticipate the online channel to contribute 1% to the overall top line growth.

- Lastly, I anticipate the SRS Distribution will contribute 50bps to the overall top line growth.

As such, I calculate Home Depot’s revenue will decline by 2.5% in FY24.

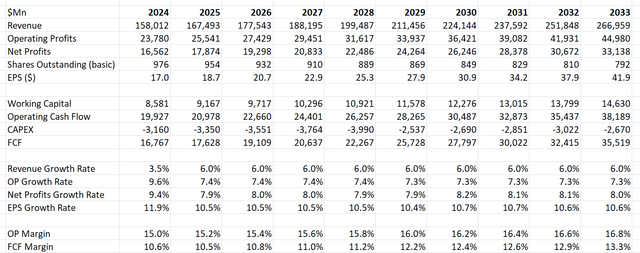

For the growth from FY25 onwards, I anticipate the company will deliver a 6% revenue growth, assuming:

- I assume the normalized SSS will be around 5%, aligned with its historical average.

- I calculate the new store opening will contribute 50bps to the top line growth, as Home Depot’s stores still have plenty of room for future expansion.

- Additionally, I assume the e-commerce will add another 50bps to top line growth.

As Home Depot continues to optimize its cost structure, I model a 20bps annual margin expansion, driven by:

- 10bps expansion from ongoing cost optimization

- 10bps from the revenue mix towards online channel, which generates higher margin.

The DCF summary is as follows:

The WACC is estimated to be 10.9% assuming: risk-free rate 3.8% (US 10Y Treasury Yield); beta 1.11 (SA); equity risk premium 7%; equity balance $347 billion; debt $43 billion; tax rate 24.5%; cost of debt 7%.

Discounting all the future free cash flow, the fair value of Home Depot is calculated to be $390 per share.

Key Risk

With the acquisition of SRS, Home Depot’s debt leverage has increased to 2.6x. The company targets to reduce the debt leverage to 2x in the future. However, considering the last $10 billion of debt financing, it is more likely for the company to reach its optimal debt leverage by 2026. Until then, the debt repayment might affect the company’s ability to repurchase its own stocks.

Conclusion

Despite the weakness in the home improvement market, I view Home Depot as a high-quality company, and I appreciate the management’s efforts on PRO growth and online channel development. I reiterate a ‘Buy’ rating with a fair value of $390 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.