Summary:

- HD stock Q2 results beat estimates, but the weak retail environment and margin pressure are concerning.

- The company lowered its guidance on gross and operating margins.

- I expect the margin to keep being squeezed from both ends with higher operating expenses and weakened demand in the next 1~2 years.

M. Suhail

HD stock Q2 recap

I last wrote on The Home Depot, Inc. (NYSE:HD) about three months ago. As you can see from the chart below, that article was titled “Home Depot: Don’t Buy The Recent Dip (Technical Analysis)” and was published by Seeking Alpha on April 30, 2024. The article recommended a HOLD rating on the stock. And as the title suggests, the analysis was more focused on the technical trading patterns. More specifically, I cautioned that:

Despite recent corrections HD stock has suffered, I would not recommend bottom-fishing attempts yet. Several technical signs indicate further downside potential in the near term. The recent price action has been dominated by selling pressure with lower highs and lower lows. HD’s current stock price has unfortunately fallen well below a key support level of around $350 to $355. On the fundamental side, the stock is trading at a high valuation multiple.

The stock price has indeed moved largely sideways since then, changing only by about 3% as seen in the chart. Thus, I keep seeing all the weak technical signs.

Seeking Alpha

Although on the fundamental front, a key development since my last writing was the release of its Q2 earnings report (ER). The ER provided a few insights regarding its business operations, which will be the focus of this article. Overall, I am seeing a mixed picture from the Q2 ER and thus reiterated my HOLD rating, and you will see that my top concern is the margin pressure.

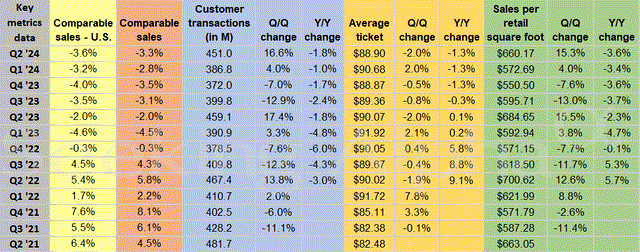

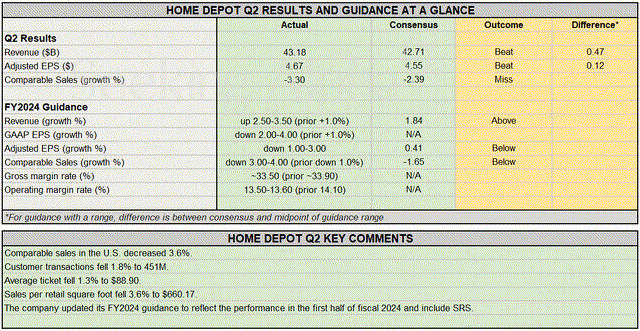

In terms of the top-line and bottom-line numbers, its Q2 results were quite solid, and both beat consensus estimates. To wit, its non-GAAP EPS came in at $4.67 and beat consensus estimates by $0.12. Its revenue totaled $43.2B and also beat consensus estimates by $490M. However, looking deeper, I see signs that the company is muddling through a challenging retail environment. I think inflation has squeezed the disposable incomes of customers together with the elevated mortgage rates (more on this later). More specifically, as you can see from the chart below, same-store sales in the second quarter fell 3.6% in the United States and 3.3% overall. Total customer transactions dropped a smaller percentage of 1.8% YOY, largely thanks to pricing changes. Average ticket sales per square foot also kept their downward trend since Q3 2023.

As to be detailed next, I don’t see the pressure reflected in its Q2 results going away in the near future.

Seeking Alpha

HD stock: margin pressure in focus

Indeed, looking ahead, the company expects revenue to grow between 2.5% and 3.5%, compared to the consensus estimate of 1.84%. Earnings per share are projected to decline between 1% and 3% on an adjusted basis. Comparable sales were expected to decrease by another 3% to 4%.

Seeking Alpha

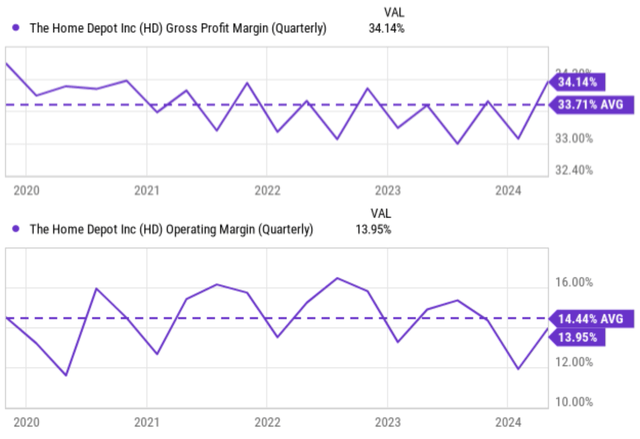

In particular, I want to draw your attention to the margin pressure. The gross margin is estimated to be around 33.5% for the full year 2024, about 40 basis points below the prior guidance of 33.90%. The operating margin is expected to be between 13.5% and 13.6%, about 50 to 60 basis points below the prior guidance of 14.1%. To provide a broader context, the next chart shows its gross margin and operating margin for the past five years, as seen, the updated guidance ranges are also noticeably below their 5-year average levels. To wit, both margins have demonstrated some seasonal fluctuations in the past. The gross margin has fluctuated between 33% and 34% in the past with an average of 33.71%. Its operating margin has shown more volatility, ranging from as low as ~12% to over 16% with an average of 14.44%. Despite the seasonality, its operating margin has been below average for several quarters since late 2023.

Such a margin squeeze is quite concerning to me. Given the macroeconomic conditions, I see a high probability for the squeeze to persist. I expect management to keep investing in its workers with higher wages and an additional manager in each store. The weaker top-line growth, when combined with rising expenses, is likely to cause the EPS to decline more than expected and also cause the downward trend to persist longer than expected. The mortgage rate further compounds the pressure.

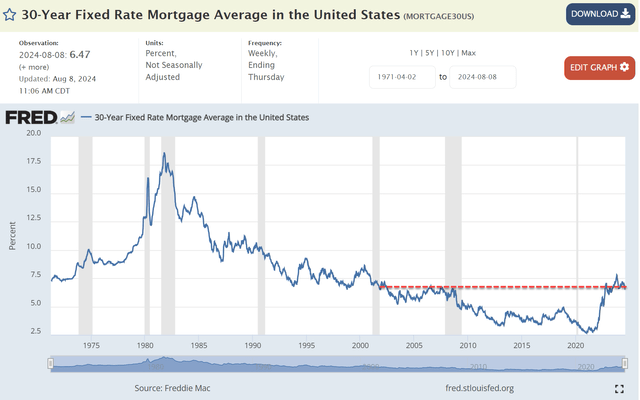

Currently, the market’s prevailing expectation is for interest rates to begin to fall rather quickly for the 2H of 2024. However, housing price pressure still persists currently and mortgage rates still remain quite high by recent historical standards. As seen in the next chart below, the current 30-year fixed rate mortgage averages around 6.47%. It has declined a bit from its recent peak of over 7.5%, but it is still among the highest levels in more than two decades as seen. I anticipate the combination of elevated inflation and high mortgage rates to keep consumer sentiment lackluster, home sales and related remodeling demand softened, and the upgrade/replacement of large appliances slow.

Seeking Alpha

FRED

Other risks and final thoughts

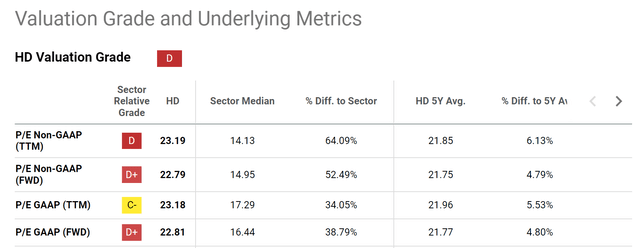

Despite the above concerns, the stock is trading at a premium P/E. More specifically, the chart below summarizes HD stock’s valuation grade. As seen, HD’s valuation grade is a “D”, suggesting that the stock is overvalued relative to its peers and its own historical track record, which is indeed the case here. For example, the P/E Non-GAAP (on a TTM basis) ratio of 23.19 is more than 64% higher than the sector median of 14.13 and also more than 6% higher than its 5-year average of 21.85. Similar trends are observed for the other P/E ratios as seen.

Seeking Alpha

In terms of upside risks, HD recently announced a sizable strategic acquisition. The company plans to acquire SRS Distribution for $18.25 billion. Assuming the deal passes regulatory approvals, it is expected to close by the end of fiscal 2024. I have a positive outlook for this acquisition. I expect the added business to greatly expand HD’s delivery capabilities for professional customers. With 4,000 trucks and 760 branches in 47 states, the SRS acquisition should increase HD’s total addressable market substantially for the years to come.

All told, the picture is very mixed to me, judging by the results from its Q2 ER and more importantly, the updated full-year 2024 guidance. Of course, there is nothing wrong with holding HD shares, a leader in a staple sector, even at a valuation premium. However, I see limited upside potential given the earnings headwinds and the valuation risks, and thus I rate the stock as a HOLD. To recap, my top concern is the margin pressure. I expect the economic backdrop to keep squeezing its margin from both ends with higher expenses and softened demand in the next 1~2 years.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If you share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.