Summary:

- Home Depot reported mixed Q1 FY24 results where revenue and earnings declined 2.3% and 5% YoY respectively given a delayed start to the spring season and stretched consumer budgets.

- Meanwhile, its strategic focus is to expand market share in its Pro customer segment with an estimated TAM of $250B with the acquisition of SRS Distribution completed on June 18th.

- However, the macroeconomic landscape remains uncertain, especially with the US housing market in a gridlock and construction activity declining, which could dampen Home Depot’s top-line.

- Assessing both the “good” and the “bad”, I believe that while revenue growth should accelerate at par with nominal GDP over the next 2 years, the stock is priced to perfection, making it a “hold”.

M. Suhail

Introduction & Investment Thesis

Home Depot (NYSE:HD) is the world’s largest home improvement retailer that offers its customers building materials, home improvement products, lawn and garden products, and more. The company has underperformed the S&P 500 and Nasdaq 100 YTD.

The company reported its Q1 FY24 earnings in May, where revenue and earnings declined by 2.3% and 5% YoY, respectively, as comparable sales declined from a delayed start to the spring season coupled with softness in consumer spending on discretionary projects given elevated interest rates and squeezed budgets. At the same time, the management has made it clear that it intends to gain market share in its Professional Customers (“Pro”) segment, especially with the acquisition of SRS Distribution completed as of June 18th, which is a leading residential specialty trade distribution company for verticals serving the professional roofer, landscaper, and pool contractor.

However, one of the big unknowns at this point is how quickly the acquisition will translate into revenue growth for Home Depot, given the uncertain macroeconomic environment where the US housing market is in a gridlock and construction activity in the housing market is starting to decline. While it is possible that the Fed can engineer a soft landing, which can result in a revival of consumer confidence, I believe that the stock is priced to perfection at its current levels, leaving little to no room for upside. As a result, I will be staying on the sidelines and rating the stock a “hold” at the moment.

Mixed Revenue results, but the company is focused on gaining market share with its Pro Segment as it acquires SRS Distribution

Home Depot reported its Q1 FY24 earnings, where revenue declined 2.3% YoY to $36.4B, with comparable sales declining 2.8% YoY. While the management attributed the weakness of sales to a delayed start to the spring season and softness in larger discretionary projects as consumer budgets remain stretched amid high interest rates, Billy Bastek, VP of Merchandising, threw some more light into individual categories that did better than the others. During the earnings call, he pointed out that “building materials and power departments posted positive comps, while outdoor garden, paint, lumber, plumbing, and hardware were all above the company average.” But one thing was clear in my opinion, and that is the demand for big-ticket items over $1000 was down 6.5% YoY, which usually takes place in projects where customers use financing, such as kitchen and bath remodels.

Meanwhile, the company continued to build on its strategic priorities, which include growing its Pro wallet share. The Pro customer segment consists of professional renovators, general contractors, handymen, property managers, and more, where Home Depot estimates a total addressable market (“TAM”) of $250B. As the company looks to gain market share in the Pro customer segment, it remains focused on building a customized online experience, developing more fulfillment options, a dedicated sales force, and a Pro Xtra loyalty program to improve the customer experience for their complex purchase needs, thus yielding increased engagement and increasing the likelihood of deepening adoption.

On June 18th, the company also completed the acquisition of SRS Distribution for a total enterprise value of $18.25B, which has a leading position in three trade verticals serving the roofer, the pool contractor, and the landscape professional. As the company looks to expand its market share in the Pro customer segment, I believe that acquiring SRS will enable Home Depot to gain access to its expertise and customer base within these specialized verticals.

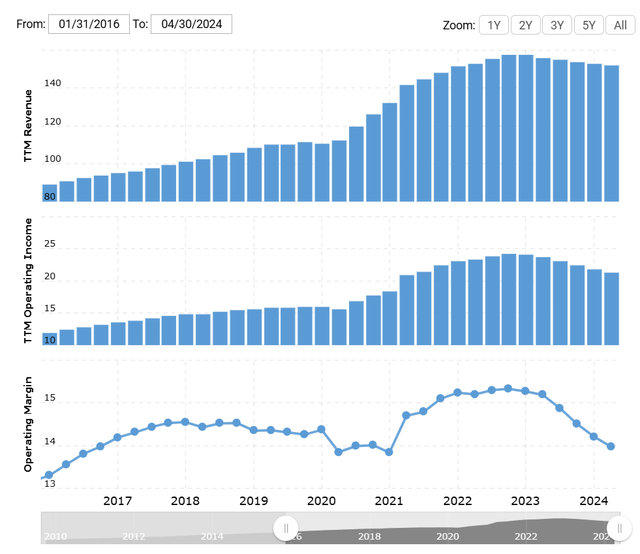

Macrotrends: Revenue growth and operating margin since 2016

Improving sales productivity and minimizing shrink while improving customer experience at the same time

When it comes to enhancing its sales productivity, the company is innovating on building capabilities within the Pro Intelligence tool that allow their sales team to have better insights into identifying the optimal Pro targets in a market, along with opportunities to cross-sell, thus driving a higher average ticket per customer, as well as higher sales productivity.

Additionally, the company has also deployed Computer Vision technology in their self-checkout that can identify complex carts to ensure all products are scanned. During the earnings call, the management sounded optimistic of the results so far in helping it reduce shrink.

At the same time, the company is also streamlining its return process, where customers can now create their own return of an online order and drop it off at a UPS, while it will enable job site pickup later this year, where it allows residential pro customers to initiate a return from their job site instead of having to return items to the store, thus improving customer satisfaction as well as store productivity.

Finally, the company continues to remove friction in their digital platforms, where they saw sales growing 3.3% YoY as they work on improving their online search functionality by rolling out intent-based search engines with enhanced filtering capabilities to help customers find what they are looking for and improve the overall experience in the process.

Profitability declines, but inventory turnover improves

Shifting gears to profitability, the company generated $3.63 in diluted earnings per share, down 5% YoY. Its GAAP operating income followed a similar pattern with declining 5% YoY to $5.07B, which represents a margin of 13.9%, down approximately 100 basis points from the previous year. This was driven by operating expenses growing 5% YoY, while revenue declined given lower customer transactions and average ticket size. Simultaneously, the company was able to draw down its inventory by 12% to $22.4B, with an improved inventory turnover ratio of 4.5, compared to 3.9 last year.

The macroeconomic landscape is a big unknown

While the management has guided revenue to grow 1% YoY to $154.19B with an operating margin (on a GAAP basis) of 14.1% while it opens 12 new stores, there is still a huge unknown when it comes to the state of the macroeconomic landscape. Given the Fed’s latest meeting, it is now increasingly evident that we may be looking at one rate cut for the full year, as inflation continues to remain sticky in certain parts of the economy.

Given that 30-year mortgage rates are close to the 7% range, the sales activity in the existing home market will remain shallow, as existing homeowners, who have already locked in low fixed mortgages before the hiking cycle began, are unwilling to put up their homes for sale. Simultaneously, while the month’s supply of new homes is going up as more supply is coming to the housing market, new home sales aren’t necessarily picking up, as the current mortgage rates and home prices are pushing more and more individuals to opt for renting instead.

Therefore, on one hand, if the US economy can sustain a strong labor market condition despite the high interest rates, boosting real personal income from here onwards, Home Depot can meet or exceed its FY24 target where existing home owners start to spend incrementally higher on complex projects, while new individuals have the confidence to buy homes, thus acting as a tailwind for Home Depot’s top-line growth.

On the other hand, if we see a weakening of the labor market from its current state, it will weigh down on existing and prospective homeowners given their extended budgets with low personal savings and record high credit card debt. In that case, we will likely see further top-line pressures for Home Depot as individuals postpone their projects.

While the company’s focus on gaining market share in its Pro customer segment, where these customers build, renovate, repair, and maintain residential properties, multifamily properties, hospitality properties, and commercial properties, can help to shield it from macroeconomic forces that affect residential home buying to a certain degree, one of the leading indicators that can be used is to look at residential housing starts. Unfortunately, housing starts have been declining for both single-family and multi-family units, indicating that the “residential” arm of its Pro customer segment may face some headwinds if we see a further worsening of overall economic conditions. In that case, its acquisition of SRS Distribution will delay producing any sizable contribution to Home Depot’s top-line growth, causing investor sentiment to worsen, especially as the company has suspended share repurchases upon acquisition of SRS.

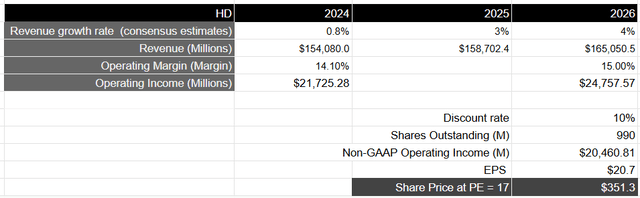

Tying it together: Home Depot is priced to perfection

Looking forward, I will take the consensus estimates for revenue and earnings over the next 3 years to come up with a fair value for Home Depot. Therefore, assuming that revenue grows by 0.8-1% in FY24, followed by a reacceleration in 3-4% in FY25 and FY26 as it is able to gain market share in the Pro segment with the acquisition of SRS allowing it to expand across verticals, while it simultaneously builds innovative customer experience and improves sales and store productivity, it should generate close to $165B in revenue. This revenue growth is also on par with the Fed’s projections of nominal GDP growth.

Assuming that Home Depot is able to grow its operating margin from its projected 14.1% in FY24 to 15% in FY26, as it unlocks operating leverage from higher average sales price per customer, absent any extended period of recession, it should generate $24.75B in operating income, which would be equivalent to a present value of $20.46B when discounted at 10%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period, with a price-to-earnings ratio of 15-18, I believe it should trade at par with the S&P 500 given the growth rate of its earnings during this period of time, resulting in a price target of $351, which is where the stock is currently trading at.

My final verdict and conclusion

While the acquisition of SRS aligns with the company’s strategic focus to gain market share in the Pro customer segment, which it estimates at $250B, there are uncertainties in the macroeconomic landscape when it comes to the state of the housing market. If the Fed is indeed able to engineer a soft landing, where it is able to properly time its interest rate cuts to spearhead the next phase of the economic acceleration, without causing a spike in inflation, it is possible that we will see renewed activity in the housing market among existing and prospective homeowners as well as a rise in construction activity, with housing starts as a proxy. However, if the economy weakens from its current levels, we may be in for some degree of short-term pain, with the acquisition of SRS taking longer to bear fruit. Assessing both the “good” and the “bad,” I believe the stock is priced to perfection, with little to no upside left from its current levels. As a result, I will be staying on the sidelines and rating it a “hold” at the moment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.