Summary:

- Mixed Q3 results led to a surge in share price.

- High interest rates and surging housing costs will blunt home improvement demand over the short term.

- However, this will simply result in increased demand down the road.

Justin Sullivan/Getty Images News

Consumers, strained by inflation, are cutting back on big ticket purchases. Add to that a trend to spend on services and travel rather than goods, and you have a recipe for a retail headwind. Now factor in the effect rising interest rates have on home sales, and one could argue that the headwind could build into a hurricane for the home improvement industry.

Home Depot’s (NYSE:HD) earnings debuted this week, and there is no doubt that each of the above factors weighed on results.

However, one quarter does not an investment make. Long term housing trends could serve investors in HD well, and the firm’s dominance among professional (PRO) contractors provides some insulation from downturns.

Dissecting Q3 2023 Results

Reporting Q3 results on November the 14th, Home Depot beat on the top and bottom line. GAAP EPS of $3.81 beat analysts’ estimate by $0.05. Revenue of $37.7 billion fell 3% year over year, beating consensus by $70 million.

EPS dropped from $4.24 to $3.81; however, once again, that beat the $3.77 figure provided by analysts.

Comparable sales for the quarter also fell 3.1%,

During the earnings call, CEO Ted Decker blamed some of the fall in key metrics on “pressure in certain big-ticket discretionary categories.”

Management guided for a comparable sales decline in the range of 3% to 4% for the fiscal year versus the prior estimate of 2% to 5%.

The company also tightened the EPS forecast. Earnings per share are now expected to decline by 9% to 11%. The prior guidance was for a drop in EPS of 7%-13%.

Sales and comparable sales are expected to decline between 3% and 4% compared to fiscal year 2022. It is important that investors consider that the quarter’s results were affected by deflation in lumber, copper and wire products.

Investors cheered the results by boosting the share price by 5.4% the day earnings debuted.

The Manifest Strengths Of Home Depot

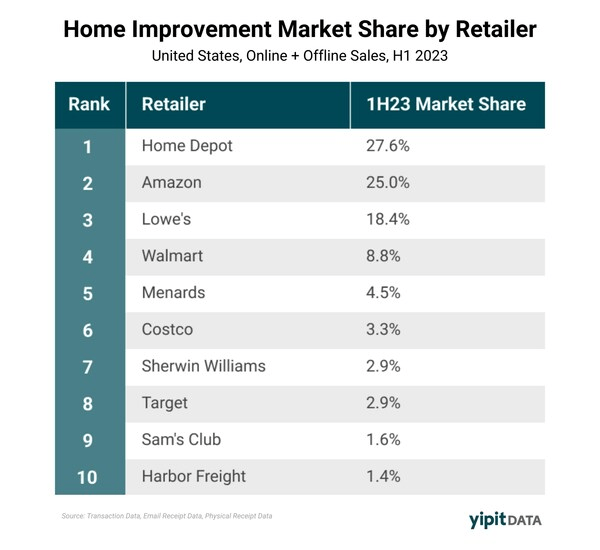

Home Depot is the 800-pound gorilla of the home improvement industry. HD has over 2,300 stores versus Lowe’s (LOW) 1,700 locations, and third place rival Menards’ 351. Home Depot’s leading position translates into considerable bargaining power with vendors and advertisers that drives down costs and boosts margins. In turn, this allows the firm to engage in competitive pricing.

With 90% of the U.S. population living within 10 miles of a Home Depot, and roughly 45% of Home Depot’s total sales stemming from Pro customers, having more locations helps to cement the relationships with that important customer segment. Many Pros operate over a relatively broad area, and the ability to pull supplies from different locations is a powerful incentive to partner with Home Depot.

It is important to understand how Home Depot’s dominance among Pro’s affect the business. The majority of big-ticket transactions, which represent about 20% of Home Depot’s sales, stem from pros. Furthermore, approximately 45% of Home Depot’s total sales come from Pro customers.

Home Depot is working to expand and cement its relationship with Pros. The company recently partnered with freight technology company Loadsmart to build an automated, supply-led flatbed platform to service the 40 largest US metro areas. The initiative is designed to provide same or next day delivery to Pros and build the capacity needed to fulfill larger customers’ requirements.

Another positive can be found in the fact that many of Home Depot’s products are non-discretionary. Rival Lowe’s CEO claims two-thirds of his company’s sales fall into that category. This means that despite inflationary and economic pressures, customers will still flock to HD when their toilets, showers, garbage disposals, and plumbing are broken or their roofs require repairs.

Additionally, much of Home Depot’s product line is ecommerce resistant, and the company is leading the pack in terms of its share of online sales.

Cision PR Newswire

HD customers fulfill 55% of online orders in store, and that practice often leads to additional sales.

Around 20% of the products sold in Home Depot are private labels which results in higher margins for the retailer.

Why Headwinds Will Metamorphosize Into Tailwinds

The S&P/ Case-Shiller national home price index reports home prices increased 29% since January 2021. Coupled with the rising interest rates, the average buyer is now facing a monthly principal and interest payment of nearly $2,200, double that of early 2021.

Those factors have stymied home sales; fewer than 1% of households will buy a house during an average month. However, 17% of Americans hope to purchase a home in the next year.

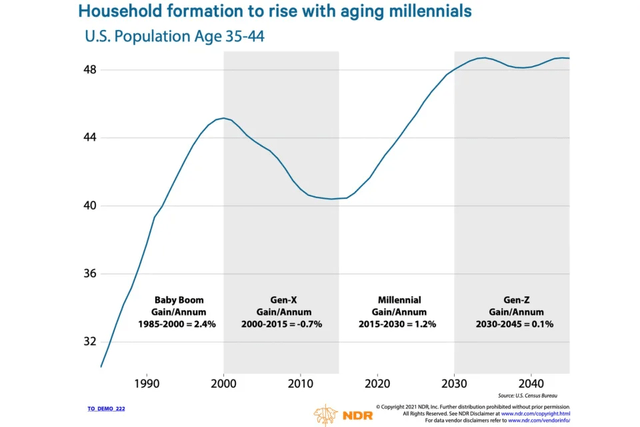

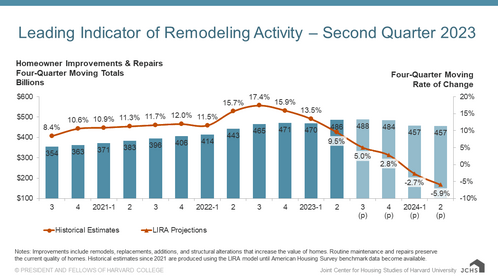

The following chart illustrates why the surge in home prices can only restrain buyers for the short term. Thereby leading to a rebound in home improvement sales over the long run.

Combine this demand with the fact that the average cost to rent in the US was $2,090 in August. The point being that you can opt for an average mortgage payment of about $2,200 or a rent payment of $2,090.

Now factor in that younger Americans are more likely to tackle home improvement projects than older folks. While 68% of homeowners started or completed a home improvement project over the last twelve months, millennials made moves to improve their homes at a 78% rate.

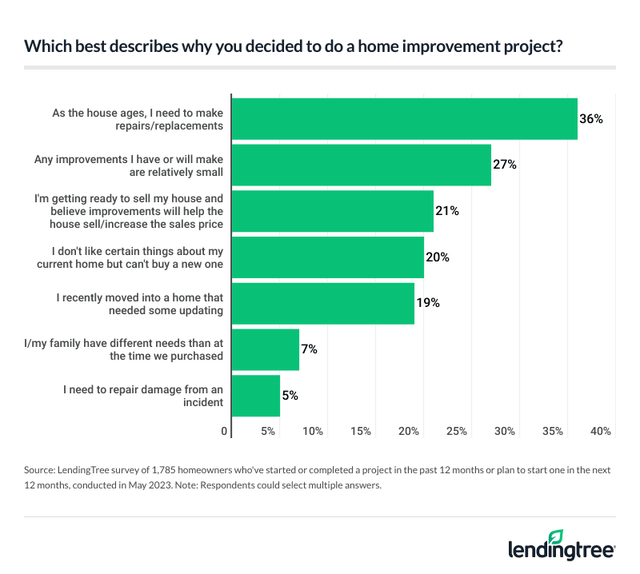

A survey by lending tree highlights the driving forces behind remodeling projects.

Note that aging homes, a desire to sell one’s home, the inability to purchase a new home, new home buyers wanting to upgrade, and repair to damaged homes, all factors that play into the current market dynamics and/or will persist no matter where interest rates and new home costs trend, constitute the bulk of home improvement projects.

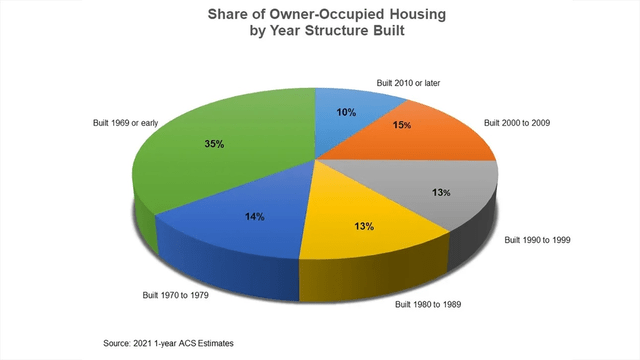

Circling back, housing stock in the US is old and getting older. Nearly half of all homes were built before 1979. Simply put, the age of a home often dictates that an owner must undertake home improvement projects.

National Association of Homebuilders

Considering the US is short about 6.5 million homes, and housing starts are now at a three-year low, all of the above factors will continue to remain in play for the foreseeable future.

Debt, Dividend, And Valuation

Home Depot’s credit ratings are solidly investment grade. The company targets an adjusted debt to EBITDA ratio at or below 2.0x. The ratio stood at 2.0x at the end of 3Q24, an increase from 1.8x year over year.

The company also owns 90% of its stores, including those where the company has a store on leased ground.

HD yields 2.71%. The payout ratio is 13.41%, and the 5-year dividend growth rate is 15.47%. This indicates the dividend is safe and is likely to continue to grow at a robust pace.

Home Depot’s 5-year PEG of 1.85x is well below the stock’s 5-year average PEG ratio of 2.58x. The forward P/E of 20.45x is marginally better than the 5-year average P/E of 21.21x.

HD currently trades for $305.48 per share. The 12-month average price target of the 28 analysts rating the stock is $339.57. The 6 analysts that rated HD after last week’s earnings report have a price target of $331.17.

I see the above metrics as indicating HD is trading at the more favorable side of a fair valuation range.

Is Home Depot A Buy, Sell, Or Hold?

Until mortgage rates drop substantially, home sales will remain muted. Aside from hamstringing potential sellers and buyers, higher mortgage rates make it harder to take out a home equity loan. In turn, this stymies larger home improvement projects.

Even so, the current headwinds simply mean that somewhere down the road, the tailwinds that drive HD stock will be all the stronger.

Despite reigning as the dominant member of a near-duopoly in the home improvement industry, HD only commands 17% of the US home improvement market, providing substantial opportunity to capture market share.

The company is also very investor friendly. Home Depot repurchased around half of its shares over the last fifteen years while rewarding investors with double-digit dividend growth most years.

There are but two negatives I see regarding a potential investment in Home Depot. The first is that remodeling activity is likely to remain muted over the short to mid term.

Joint Center for Housing Studies

That means there will be little impetus for upward stock movement.

The second negative is that I believe HD is currently trading on the better side of a fair valuation range. Consequently, I rate the stock as a HOLD.

However, I will add that I view the current share valuation as allowing me to dollar cost average into the stock. I currently have a middling sized position in Home Depot, and I hope to increase that position marginally in the near future.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HD, LOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have no formal training in investing. All articles are my personal perspective on a given prospective investment and should not be considered as investment advice. Due diligence should be exercised and readers should engage in additional research and analysis before making their own investment decision. All relevant risks are not covered in this article. Although I endeavor to provide accurate data, there is a possibility that I inadvertently relay inaccurate or outdated information. Readers should consider their own unique investment profile and consider seeking advice from an investment professional before making an investment decision.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.