Summary:

- The Home Depot, Inc. is a strong blue-chip stock with a storied history that is a great candidate for long-term compounding.

- Home Depot’s upcoming Q3 earnings report is important, as the housing market weakness may appear, but economic strength may lead to the firm beating estimates.

- HD stock should be bought even if it declines and doesn’t beat estimates, and it is less cyclical than in previous cycles due to the growing concentration of wealth.

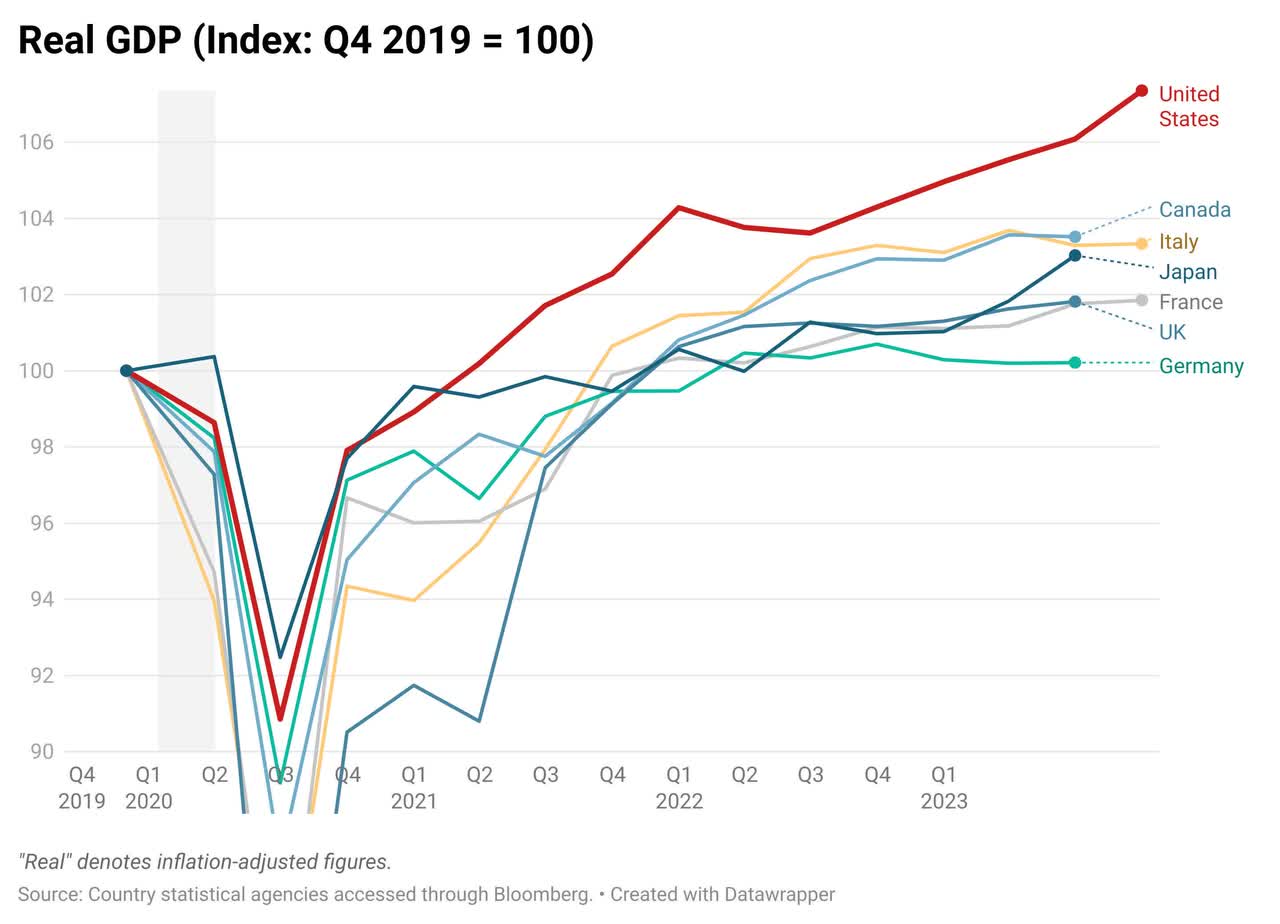

- Home Depot is a large and economically enmeshed stock. Ultimately, the path of the U.S. economy will be very consequential to its future price.

Justin Sullivan

What To Expect From Home Depot’s Q3 Earnings

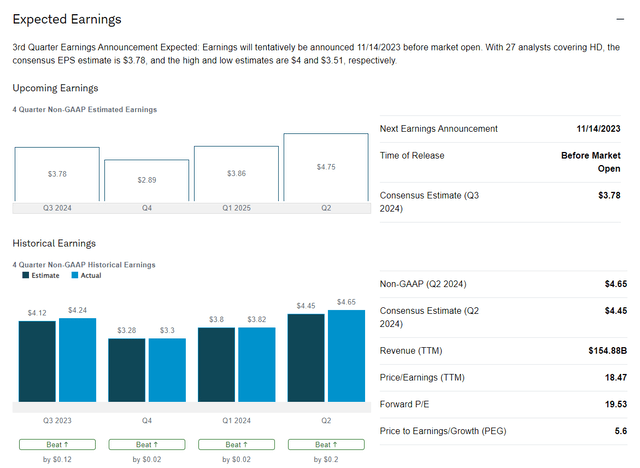

The Home Depot, Inc. (NYSE:HD) is one of the bluest of blue chips on the market. It has a storied history as one of the great brands that rose to prominence in the latter half of the twentieth century, but it retains many benefits for long-term shareholders. The firm’s last earnings report, for Q2, was strong and showed some natural decline in YoY activity caused by the aggressive Fed tightening cycle and high mortgage rates. This is a stock to own for the long term. If you’re a short-term trader, there are stocks with high betas that are much more worthy of your time.

Home Depot Investor Day Conference

The upcoming Q3 release, set for pre-market on November 14th, is a big earnings report for the company, particularly as the carnage in the housing market from high rates reaches what may be a crescendo. In my mind, a large blue chip like Home Depot with a massive customer base is something you want to own if you have confidence in the U.S. economy. So here’s the score:

Here are a few things to note about the upcoming earnings report:

- While housing market weakness may show up, I think it’s more likely that the unexpected economic strength leads to the firm beating estimates.

- The firm’s guidance will be essential, but I expect economic and persistent consumer strength to leave the guidance unchanged.

- I think it is a buying opportunity if the firm doesn’t beat estimates and the stock declines.

- The stock is currently a favorite short of hedge funds, meaning an unexpected beat could result in some significant price upside.

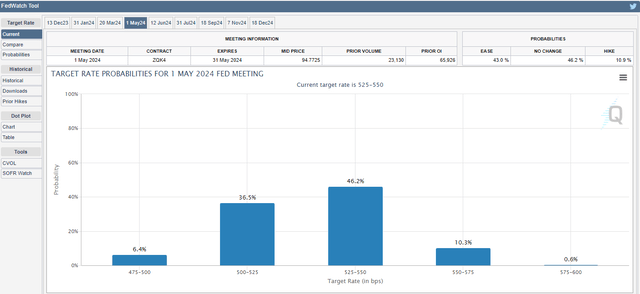

- As you can see below, the reaction function for rates and the market’s predicted course for the Fed has changed. Cuts are in play, and Home Depot will benefit from the effects on housing when they come into focus.

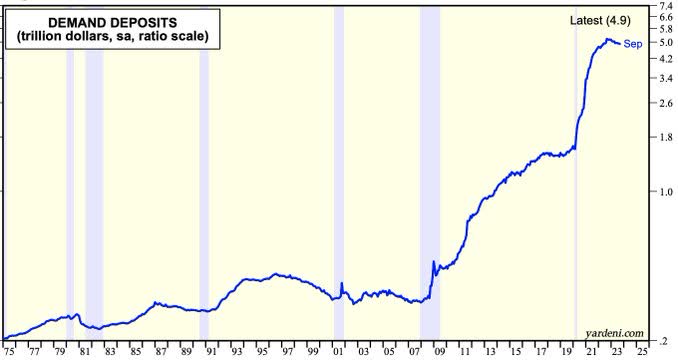

Friends, I don’t mean to judge if you don’t have confidence in the US economy at this point, but it seems like a personal problem. And yes, I know that wages haven’t kept up with prices and inflation is pinching people, but I’m talking about the resilience of the macroeconomy. There are hundreds of millions of anecdotal experiences, and many differ. However, there is undeniable strength in the U.S. economy and consumers. For example, the U.S. consumer has eroded some savings on a macro level. Still, as you can see below, their liquidity position is formidable and doesn’t suggest a recession next quarter. That’s for sure.

Yardeni.com

I like the risk/reward in this stock right now because if the earnings report is a bad miss, which reflects building weakness in the housing markets, I also think it would be a great buying opportunity. If you don’t think the economy is undergoing a soft landing, you might want to avoid Home Depot.

However, I have been on the soft landing thesis since day one. The economic data gives us repeated evidence that we are indeed experiencing the fabled soft landing. The economy is not showing evidence in many areas of one being on the verge of recession.

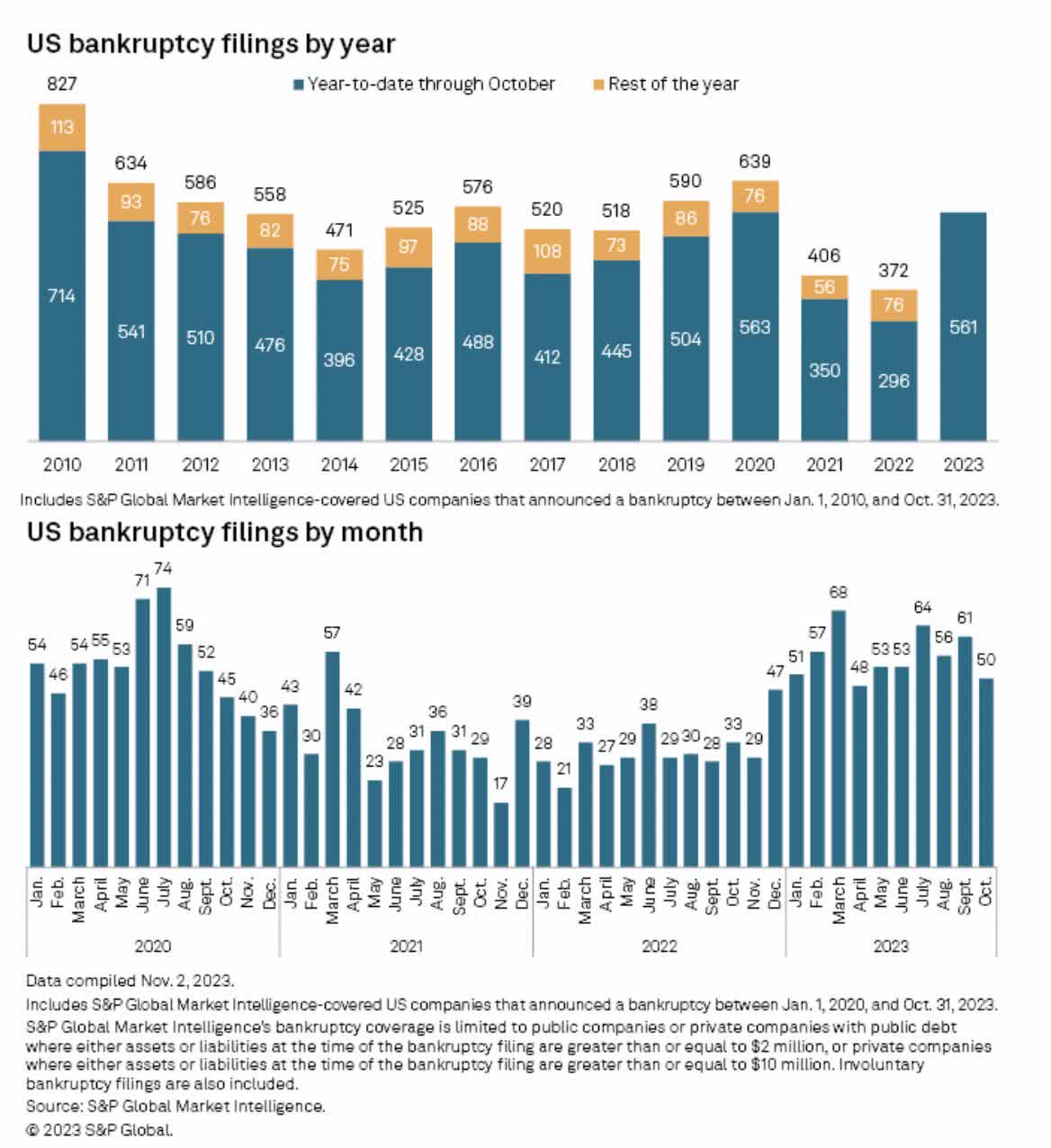

S&P Global

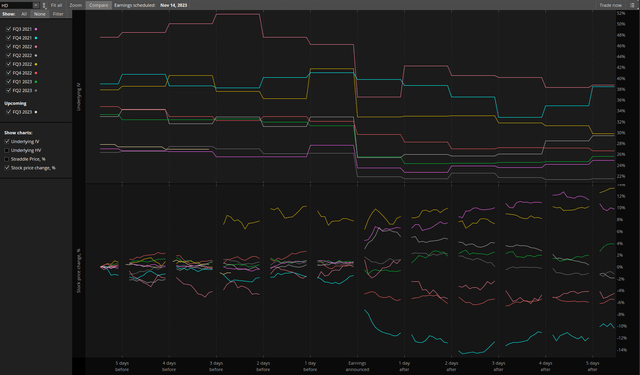

If you’re going to own Home Depot, you should buy the shares directly through computershare.com, join the Dividend Reinvestment Program, and just set and forget it. The stock can be a bit volatile around earnings, and over the last eight quarters, there has been a pretty diverse post-earnings performance.

But ultimately, I don’t think it’s a good bet to be short Home Depot, given the underlying strength in the U.S. economy. It’s just bad form, and I think the hedge funds that are short are going to regret it.

At the beginning of June, I covered Home Depot and suggested the stock should be able to outperform expectations if we avoided recession, which has indeed come to pass so far. And while a surprise recession is possible, the data seems to be moving in the opposite direction. Home Depot has become big enough that it is somewhat of a bellwether for the broader economy.

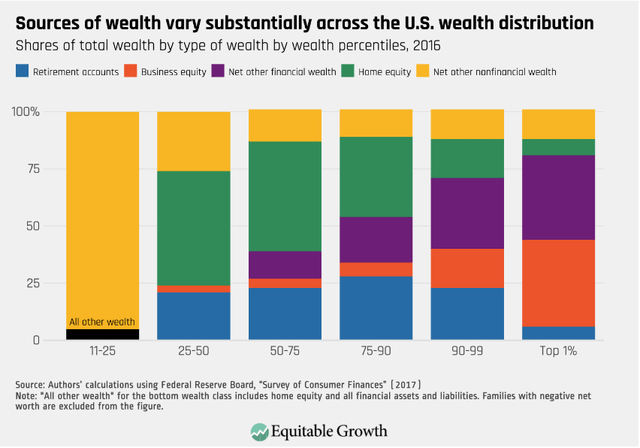

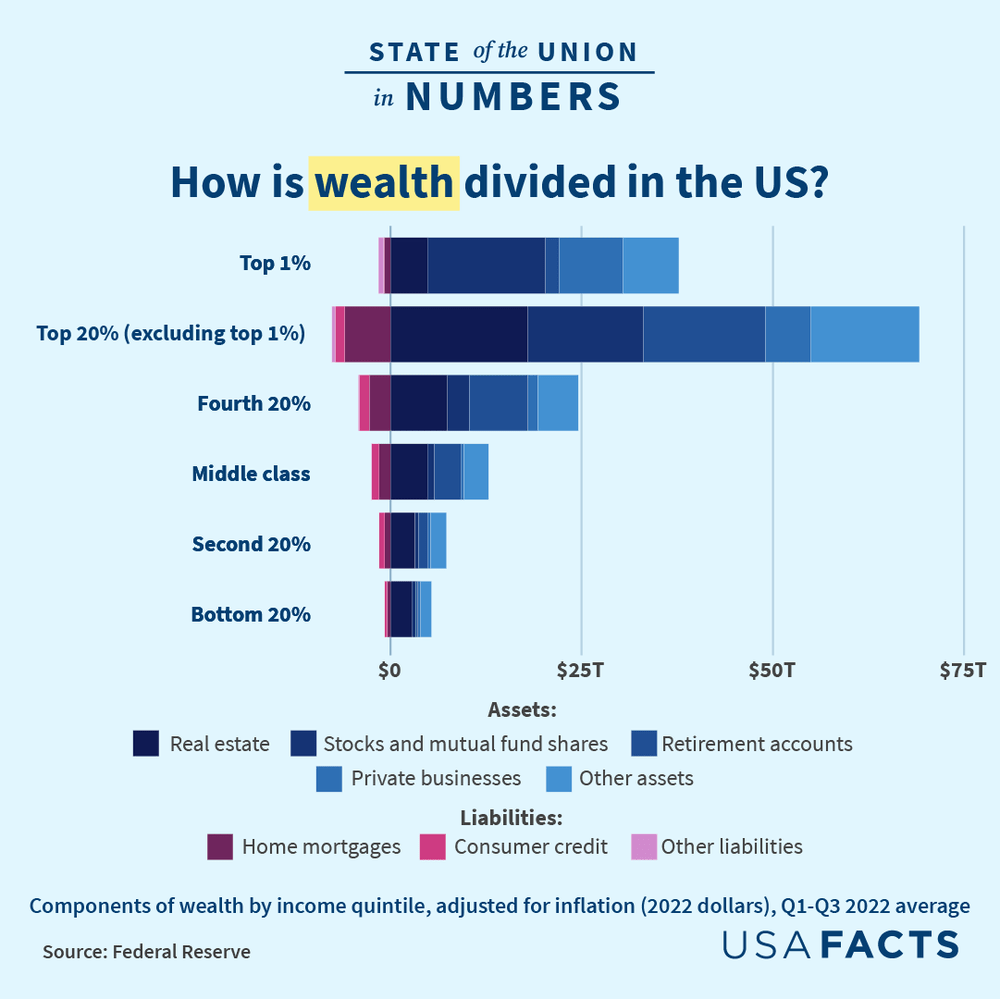

Still, it also has an excellent economic feature of having a customer base that is highly concentrated in the top income quintile, given the focus on homeownership. That quintile is remarkably resilient and can keep spending despite a cyclical downturn in economic activity. All in all, this should make Home Depot less cyclical than in previous cycles.

Federal Reserve, White House

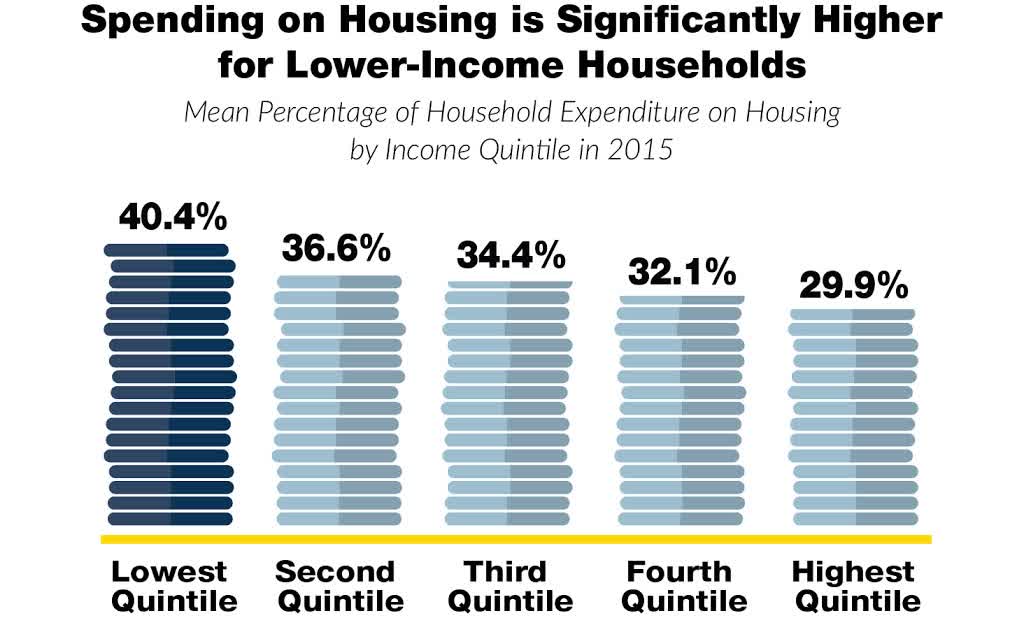

Of course, the firm also sells many products of people to all classes. Still, this customer feature is undeniable, and it is also more valuable in this cycle than it has been in previous cycles. Why? Because the top income quintile holds so much more of the total pie than they have in the past. And, of course, since the top income quintile spends less of their total income on shelter, they have a lot more disposable income to spend on home improvements and construction.

National Housing Conference

Based on economic reports, There’s no need to get fancy or move in and out of this company. Own it, and keep buying it, particularly when share prices drop. However, here’s what makes the stock a blue chip. For the bottom income quintiles, despite having less to spend on housing and improving their homes, it is a greater imperative since it comprises a much more significant portion of their total wealth.

So, for Home Depot, predicting the ultimate path of the stock will be very tied to two things: the economy’s health and the consumer’s health. On both these fronts, most hard data sends overwhelmingly positive signals despite negativity on the survey data side.

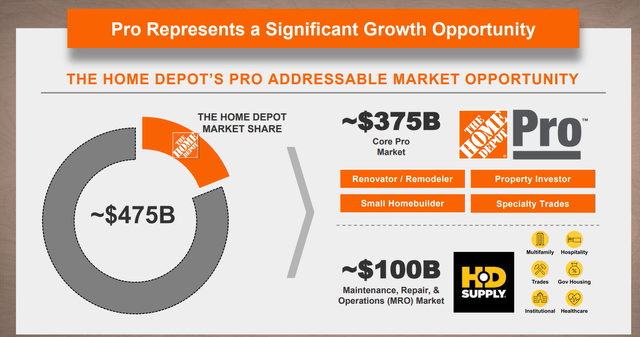

Home Depot Investor Day Presentation

The company can also expand into other non-core markets with real economic promise. The company is continuing efforts to spread its tentacles into more corners of the vast American economy. This firm is one you can feel comfortable owning for the long term. Price weakness is a gift you should not squander, and if the housing crunch shows up in this earning report, I highly suggest you make a large purchase to lower your cost basis.

Risks and Where I Could Be Wrong

While Home Depot’s diverse customer base and colossal size are natural hedges against significant drops, there are many changing dynamics in the housing market. And we don’t need to be told just how bad unforeseen risks in the housing market can affect the economy. There are some signs that the bottom four quintiles of consumers are becoming exhausted.

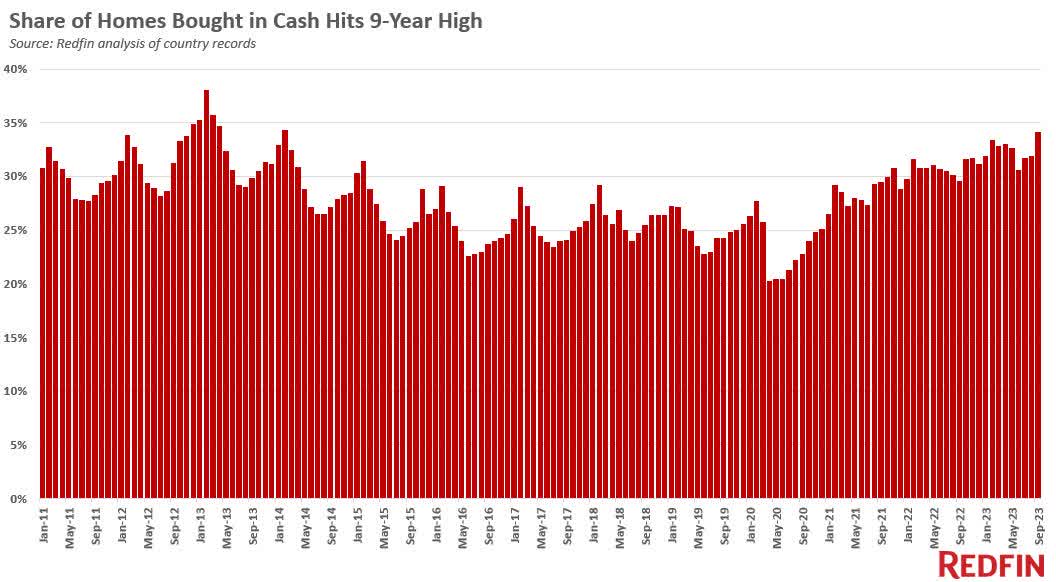

One potentially ominous sign is that the percentage of cash purchases for homes is at the highest level in 9 years. This could suggest that the wealthy are artificially propping up a market in much worse shape than headline numbers suggest. Ultimately, severe price drops in housing stock could prove very problematic for this housing-oriented firm.

Redfin

Home Depot is such a large company that it is undoubtedly vulnerable to recession, and the significant building risks stalking the global economy and stock market could ruin the party and result in some price weakness. Many investors will want to leave Home Depot if the following risks worsen, particularly unexpectedly.

- Geopolitical risks in Ukraine, the Middle East, and Taiwan

- Credit event (Junk bond spreads rising).

- Political Risk and Fiscal Situation.

- Commercial Real Estate.

- Reignition of the banking crisis.

- The lag effect of high rates/Fed policy error.

Ultimately, though, I am encouraged by the persistent strength of the US economy. As the U.S. economy goes, so goes Home Depot. And I think the preponderance of data shows that Home Depot is more likely to outperform expectations than disappoint them, given persistent economic strength.

Conclusion: Still Waiting For Recession

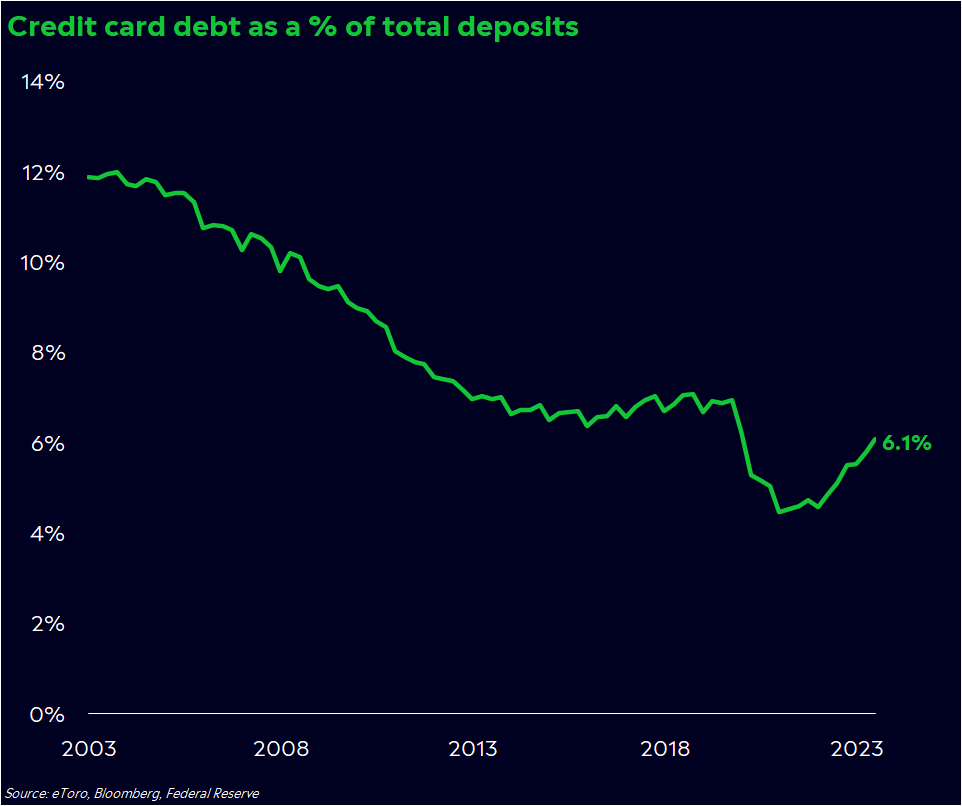

Unfortunately, many investors seem paralyzed by fear and a genuine belief that a recession is just around the corner. But the data doesn’t support this. Home Depot’s financial fate is indelibly tied to the strength of the U.S. consumer, and the U.S. consumer continues to send strong signals. And the hostile media environment is complicating perceptions, as well. You might see headlines about a trillion dollars of credit card debt. This isn’t as significant as it seems.

eToro

There is no denying that many people feel economic pain and are hurting. However, it’s important to remember the results of these feelings. When people feel economic heat from higher prices, it doesn’t promote the irrational and ebullient risk-taking behavior preceding a recession. But here’s the thing: when the consumer was stretched in past times, they ran up their credit cards and HELOCs a lot more than they have now.

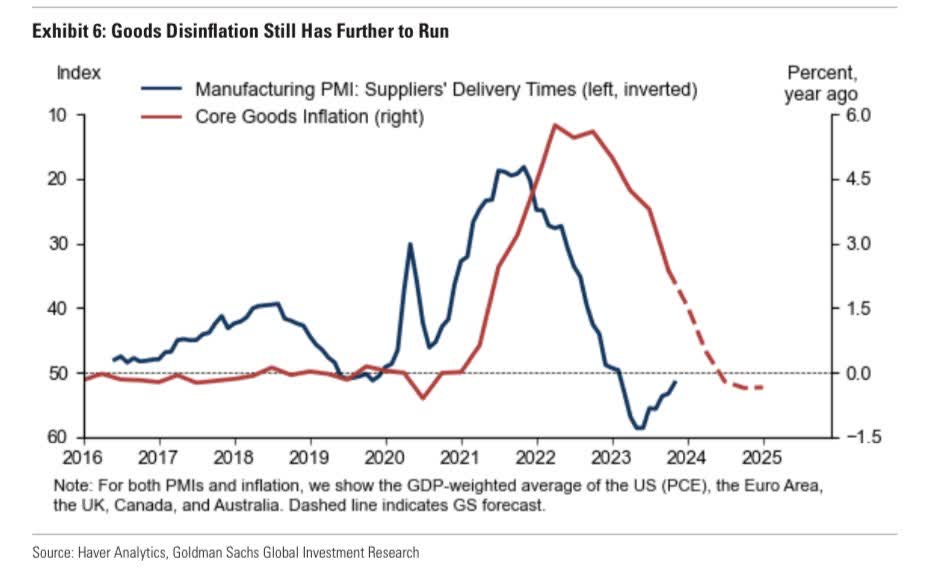

This implies they have a lot of gas in the tank. And without the pressure on their wallets from gasoline, which should be alleviated on a seasonal basis, it looks like a recession isn’t coming anytime soon. And this means Home Depot does very well, in my estimation. Furthermore, I agree with Goldman that the last leg of vanquishing inflation will be easier than consensus expects, and this will also be a benefit for large economically enmeshed companies like Home Depot.

Goldman Sachs

Quite to the contrary, it promotes sensible behavior, preparing for the worst. Still, when the worst doesn’t come, it can have quite a positive economic effect when it occurs widely enough. I think this is happening across the economy, and the counterintuitive result of excessive fear is quite admirable economic behavior that reduces risk on a macroeconomic level.

Ultimately, a bet on Home Depot can be considered a bet on the continued outperformance and resilience of the US economy. There is a lot of evidence suggesting this is a good bet. I am firmly convinced that soft-landing is underway, and in a soft-landing environment, I think Home Depot can handily outperform the expectations of an overly pessimistic consensus. I recommend owning this stock for the long haul. Keep buying. Don’t look for years. Smile when you do.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.