Summary:

- Home Depot is on course to deliver its weakest financial performance since 2009, with both sales and earnings poised to drop YoY.

- HD’s dividend policy, as listed in the annual report, is to “increase its dividends as it grows its earnings”.

- With diluted EPS poised to drop by -7 to -13%, how safe is the dividend?

ansonsaw

Impressive Dividend Credentials

Investors primarily veer to the Home Depot (NYSE:HD) stock for its dominance in home improvement retailing, but besides its core competence in this field, one shouldn’t also cast aside HD’s credentials as a long-standing dividend payer. For context, HD has been doling out dividends for 145 straight quarters, whereas most other consumer discretionary alternatives have typically only been doing so for 36 quarters or so (the median figure).

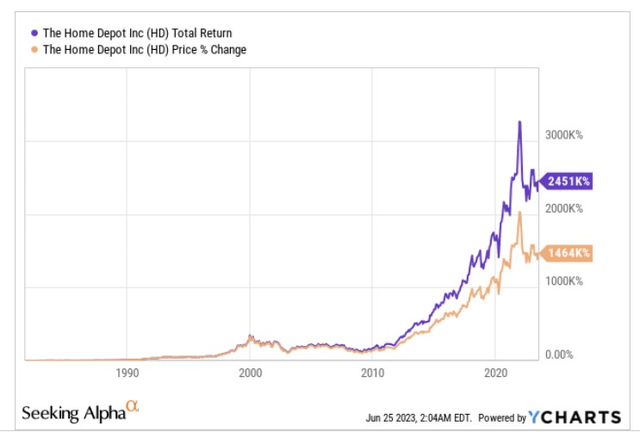

The image above contextualises the emphatic role that the dividends have played in levering up the total returns over the price returns since the stock’s listing date (differential of ~1.7x).

In recent years (since 2018), the dividend has grown at a decent enough pace of 15% CAGR as well.

HD’s Weakest Outlook in 14 Years May Prompt Question Marks Over The Dividend

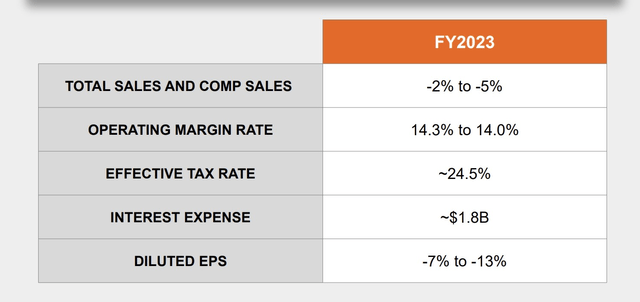

However last month, when HD published its Q1 results, it came out with a fairly underwhelming financial outlook for the year, which is not in keeping with the company’s previous standards. Basically, you’re looking at a business that had consistently grown its topline every single year since 2009, with the recent sales CAGR from FY19 to FY22 coming in at an impressive figure ~13%. Whilst management was previously budgeting for flat sales in FY23 (announced during the FY22 results event), during the Q1 event, they scaled the forecast down even further to a -2 to -5% comp sales growth.

Besides that, the operating margin forecast which was previously estimated to come in at 14.5% (an 80bps decline from the previous year, mainly on account of a bump in compensation for frontline hourly employees) was downgraded even further to 14% to 14.3%.

Crucially, HD’s diluted EPS, which had grown at 60% over the past three years, looks set to decline by 7 to 13% this year.

In light of these severe downgrades to key financial metrics, it’s reasonable to wonder if this could hamper HD’s long-standing dividend narrative. Let’s dive in and investigate.

Dividend- Fine Or Not?

Without providing any specific numbers, Home Depot in its 10K states that its capital allocation process is first centered around reinvesting in the business to ensure market share gains followed by the payment of a quarterly dividend which they “intend to increase, as they grow earnings”.

Based on the last statement, and given that HD will likely witness negative earnings growth this year, we would advise investors not to take the dividend for granted. Having said that, our calculations suggest that the company may still have enough in the tank to pay its dividends.

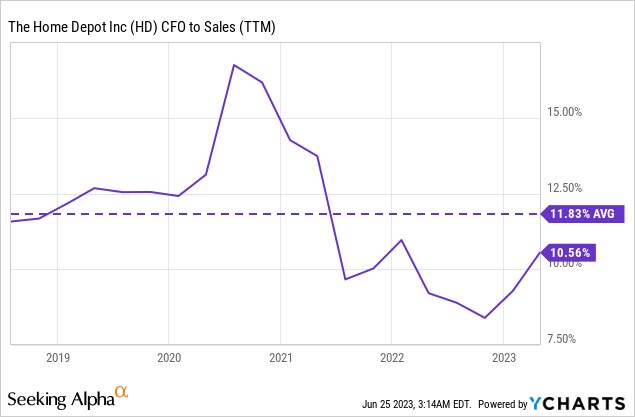

Firstly, after hitting 10-year lows last year, Home Depot’s sales to operating cash flow conversion (on a trailing twelve-month basis) has been trending up of late and is now not too far from hitting the historical average of ~12%.

YCharts

If the demand environment will likely be weak as management expects, we see no reason for the firm to inundate its balance sheet with excess inventory, which should help the OCF margin get closer to the 12% level or perhaps even better it. In fact, in the recent 2023 investor conference event, the CFO confirmed that “we are on the way towards normalization with respect to inventory”.

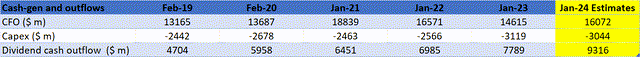

Consensus (the average of 32 estimates) currently points to a topline figure of $152.2bn for FY23 (implying a -3% YoY decline). If one wants to be conservative and not assume an improvement in the sales to OCF mean, we could still go with the existing figure of 10.56%. This would translate to expected operating cash flows of over $16bn.

On the CAPEX front, HD has previously maintained a policy of devoting approximately 2% of its sales to this initiative; that would put the FY23 CAPEX outflow at $3bn (based on the sales estimate of $152.2bn). That would leave HD with $12bn of FCF which it could devote to its dividend.

Note that besides the dividend, HD also has a policy of buying back its shares, and FCF reserves will be required for that as well. However, management has implied that this comes last on their list of capital allocation priorities, and even though they have over 63% of their existing $15bn share buyback program (announced in August 2022) yet to be executed, the good thing is that this program does not come with a specific expiration date (which always gives them the option to pause buyback spend).

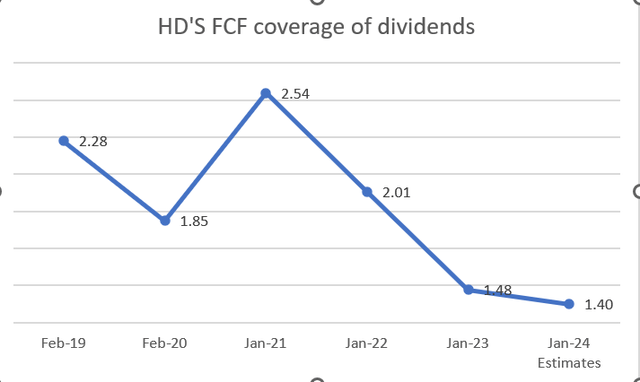

Nonetheless coming back to the dividend, note that HD has grown its quarterly dividends at roughly 10% per year for 3 out of the last 4 years (in FY21 it grew at 15%). If we assume a similar growth cadence of 10%, and stable shares outstanding, that would translate to a quarterly DPS of $2.3 (FY figure of $9.2). On an FY basis, the cash outflow that would be required would be roughly $9.3bn, which the FCF could comfortably cover whilst also leaving room for buybacks and debt pay downs.

Seeking Alpha, YCharts, Author’s calculations

Yes, at those figures, the FCF coverage of dividends would continue to decline for yet another year (note that it has been trending lower every year since the year ending Jan 21st), but it would still be over 1x and that’s what counts.

Closing Thoughts

To conclude, even though Home Depot’s financial outlook isn’t the most encouraging, we still believe the company will have ample internally-generated cash ammunition to keep its dividends going.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.