Summary:

- Home Depot stock has performed well despite a lackluster operational performance.

- The company saw a drop in same-store sales in Q2, marking its 3rd straight quarter of negative SSS sales.

- Meanwhile, remodeling activity is expected to start to decline in 2024.

Justin Sullivan/Getty Images News

Back in March, I placed a “Sell” rating on Home Depot (NYSE:HD), on the belief that the stock was overvalued and that the repair and remodel market would start to slow while the company faced pressures from wage inflation and lumber deflation. The stock, however, has been a solid performer since then, up over 16% versus 12% for the SP over the same period.

Company Profile

As a refresher, HD is a home improvement retailer that sells a variety of items including home improvement products, tools, building materials, lawn & garden items, repair & maintenance, and home décor. It operates warehouse type stores that typically stock between 30,000 to 40,000 items in a year.

The company caters to both professional and do it yourself (DIY) customers. It also offers installation services in several areas. About 37% of its sales are building materials, 32% décor, and 31% hardlines. The company ended Q2 with 2,326 stores.

Q2 Overview

For fiscal Q2, HD saw revenue drop -2.0% to $42.92 billion. That topped the analyst consensus by $690 million.

Same-store sales fell -2.0% both in the U.S. and overall. Transactions fell -2.0% in the quarter, while average ticket edged up 0.1%.

The company said deflation from core commodities, largely lumber, negatively hurt average ticket by -160 basis points. Framing lumber prices were down -40% year over year.

Six of HD’s 14 department saw positive comps, including building materials, plumbing, millwork, hardware, tools, and outdoor garden. Big ticket comp transactions were down -5.5%. The company said items like patio and appliances were weak, likely indicating an earlier pull-forward of demand from Covid.

The company said Pro sales were slightly negative and outpaced sales from DIY customers.

Gross margins were 33.0%, down -8 basis points. OpEx was 17.7% of sales, up 100 basis points

Earnings fell -9.9% to $4.7 billion, while EPS dropped -7.9% to $4.65. Analysts were looking for EPS of $4.45.

Overall, HD set a low bar ahead of the quarter after reducing its full-year guidance the prior quarter and then jumped over it. The company certainly saw a sequential improvement versus Q1, but overall it was nothing to get too excited about, with negative same-store sales and continued lumber deflation pressure.

FY2024 Guidance

Looking ahead, HD reaffirmed its full-year guidance. The company is looking for same-store sales to decline by between -2% to -5%. It’s looking for an operating margin of between 14-14.3%. It expects EPS to decline by -7 to -13%.

Notably the company did reduce its guidance in May when it reported its Q1 earnings.

HD originally guided for flat revenue and same-store sales in fiscal year 2024 ending January. EPS at the time was projected to fall by mid-single-digits, while operating margins were forecast to be 14.5%.

On its Q2 earnings call, CFO Richard McPhail said:

“First, just with respect to stacks and progression, what we’re encouraged by what we’re seeing — as cost pressures in our industry sort of abate, we’re seeing ticket and transactions actually begin to converge. And we think that that’s actually a healthy signal in the business. So I think that’s the most macro comment that we could make about ticket progression. With respect to large versus small projects, certainly, our customers and our contractors tell us that there is some stance of deferral when it comes to large projects. Customers are more likely to opt for smaller versus larger, and that may have some impact on ticket. But we’re also seeing the impacts of what we call softness in certain large-ticket discretionary item purchases like patio and appliances. So there’s a lot going on there, but I think that maybe the most important dynamic is just kind of that nice recovery in transactions as both ticket and transactions begin to converge and normalize.”

Management noted that the low-end of its guidance assumes that its share of PCE (personal consumption expenditures) reverts back to 2019, pre-Covid levels. However, it said it saw no indication of this. It also noted that the fears for a severe recession have subsided and that its core customer remains strong.

Overall, HD’s outlook was cautiously positive. After Q2 outperformed its lowered full-year guidance, though, the company kept its forecast steady. Currently, home improvement is still getting a larger percentage of the consumer spending pie than it did before Covid, which could become an issue.

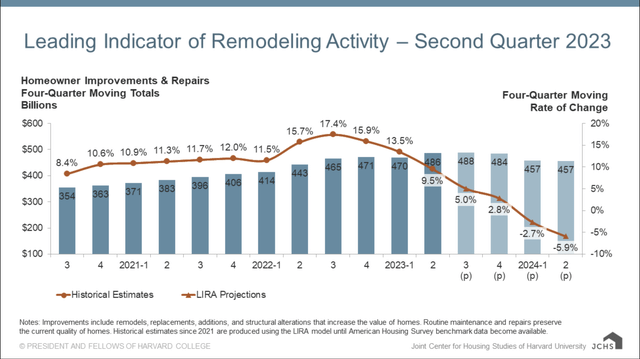

For its part, the Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University now predicts that remodeling activity will start to decline beginning in 2024, with that decline accelerating throughout the first half of 2024. Such a scenario would not be good for HD in 2024.

Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University

Valuation

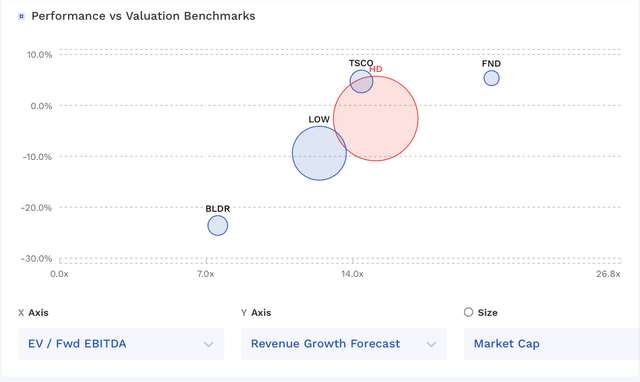

HD stock currently trades around 15x the FY2024 (ending January) consensus EBITDA of $24.9 billion and 14.4x the FY2025 consensus of $25.9 billion.

It trades at a forward PE of 21.4x the FY24 consensus of $15.26, and 20.2x the FY25 consensus of $16.21.

Revenue growth is expected to be fall -2.6% this year, and then grow around 3% a year over the next few years.

HD trades in the middle of its peer group and at a nice premium to its closest rival Lowe’s (LOW). The company has generally traded at a premium due to its better historical performance and stronger ties to the Pro market.

HD Valuation Vs Peers (FinBox)

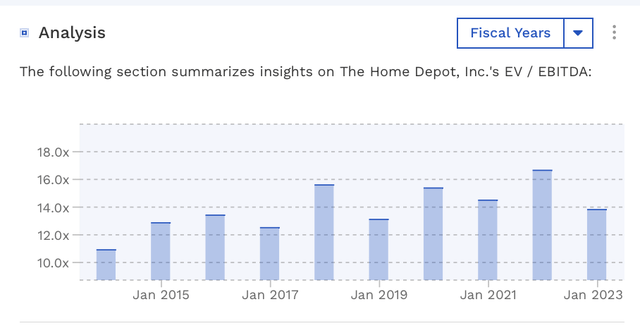

From a trailing EV/EBITDA standpoint, the stock is trading at a premium to where it has historically traded prior to the great recession.

HD Historical Valuation (FinBox)

Conclusion

HD has been a bit of a Teflon stock since I placed a “Sell” rating on the name. Despite its high historical valuation, the stock was able to shrug off lowered full-year guidance after Q1 and cautious commentary after its Q2 report to move steadily higher. Meanwhile, it faces a potentially dire outlook from home remodeling in 2024.

With the stock up and estimates lower since I last looked at the name, along with remodeling activity expected to worsen next year, I see no reason to change my rating at this time. HD is a strong company, but its valuation and the outlook for the industry right now don’t match up. Lower home sales, a common time when people remodel, and higher interest rates, which are used to fund large projects, should begin to impact the industry more meaningfully next year.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.