Summary:

- I give a neutral rating due to its valuation being above its historical average, which may lead to a price correction.

- Home Depot’s scale advantage, extensive store network, and buying power give it a competitive edge in the home improvement industry.

- A weak macro environment presents an opportunity for HD to consolidate market share from smaller competitors.

- There is room for margin improvement through technological enhancements and increased control over appliance installation.

Justin Sullivan

Overview

My recommendation Home Depot, Inc. (NYSE:HD) has a neutral rating as I expect valuation to revert back to its historical average, which is a headwind to total returns. I like HD’s business because of its scale, competitive advantage, and ability to further improve margins. However, every time HD trades pass 22x forward PE, multiples will quickly trade back down to their historical average, and I expect the same to happen this time. I will be waiting for a better buying opportunity when the price correction comes.

Business

HD is the largest home improvement retailer in the US, with more than 2,000 stores in North America and Mexico. The business sells a wide range of products, from building materials to gardening to DIY products, etc. HD is a brand that has a long operating history, going all the way back to 1979, making 2024 its 45th year of operation. Operating performance throughout the years was nothing but spectacular, as the only time that HD did not print positive growth was during the subprime crisis. Post-subprime growth had been consistent at the mid-single-digit percentage level until COVID struck, which caused a surge in home improvement demand as consumers were forced to be at home (due to lockdown). HD has also improved its profit margins over the years, with the EBIT margin expanding from 6% in FY08 to the current mid-teens percentage level in FY22. Because of the strong profit profile, HD has mainly maintained a decent net debt position of around 1.5x net debt to EBITDA and currently has $40 billion in net debt (excluding operating leases).

Scale is HD’s biggest competitive advantage

With more than 2,000 stores and $150 billion in sales, HD has a huge scale advantage when compared to subscale peers, and importantly, scale is a key element of HD’s store strategy. HD Store’s strategy is to open big box stores that serve as a one-stop shop for customers. To do that, HD will need to offer a very wide selection of products. It is true that any player is able to purchase from manufacturers and offer a wide selection of products, but being able to consistently convert these inventories into sales is the trick. Remember that a competitor does not only need to load up on a wide range of products; it also needs to have depth (each product must have a certain quantity available in case of a surge in demand). As such, to facilitate these, one would need a very strong balance sheet and also the ability to distribute the products effectively. HD has both of these. It generates more than $10 billion in FCF annually and has further flexibility to gear up its balance sheet if need be. In terms of distribution, HD has the largest number of stores, which enables it to effectively shift inventories to stores that have lower stock to meet demand. Unlike a subscale player, HD does not need to load all of its stores with the maximum amount of inventory. Because of its logistical network, it just needs to maintain a certain amount of inventory at each store and have sufficient inventory available at its backend warehouse. Whenever there is a need, stores can just indent in from the warehouse. Again, to do this effectively, you need to have sufficient insights into demand trends in each region or store. HD certainly has this, as it operates in every state of the US and has more than 40 years of experience. The result of this is HD has a leading inventory day metric, where it converts inventory to sales in just less than 90 days, way better than peers like Floor & Décor Holdings (inventory days of 172) and Lower’s Cos (inventory days of 106 days).

Finally, another big advantage of having a large scale is buying power. Given that HD is the industry gorilla, it is able to negotiate for lower costs and better terms from its suppliers. This provides HD with a meaningful cost advantage versus its competitors, especially the small retailers. The advantage here is a lot more than just better gross margins. It also means that HD can effectively price its competitors out of the industry, and this advantage scales over time as HD becomes larger.

Weak macro is an opportunity for HD to consolidate market share

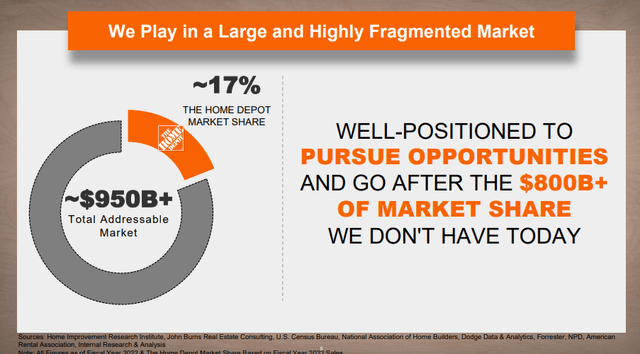

I won’t argue with the fact that a weak macro environment is a negative thing for HD. In a weak macro situation, retail sales turn weak as consumers spend less on discretionary items. In a way, one could argue that HD sells discretionary products. However, I think HD stands to benefit from this. Being the leader in this industry, HD has enough balance sheet power to tide through this macro-downturn easily. The ones that get hurt the most are the subscale and weak balance sheet players. Given the large fixed costs associated with operating this business, in a macro downturn, a lot of retailers go out of business. What happens to the consumers who visit these stores before they go bankrupt? HD will be there to pick up this market share. The reason I point this out is that the industry in which HD competes is very fragmented, meaning that there are a lot of mom-and-pop retailers that simply cannot compete with HD in almost every aspect. Based on HD’s 2023 inventory and analyst conference, HD only has around 17% market share of the $950 billion TAM, suggesting there is still significant room for HD to continue capturing share ahead.

Room for margins to continue improving

The bad thing about being a >40 year old business is that there are a lot of inefficiencies built through the years, but it is also a good thing from a margin expansion perspective. These inefficiencies can be found in various parts of the business, for instance, in-store operations and supply chain. As an example of a significant upgrade, there is Sidekick, a homegrown app and operational enhancement that is enabled by technology. Simply put, the device “shows” the associate the precise location of the back stock when a customer scans a shelf tag for an item that isn’t currently on the shelf, making it easy to retrieve the item for the customer. Sidekick employs machine vision to pinpoint precisely where the product or box is located in the store. As a result, associates have less work to do, which leads to better service, higher on-shelf availability (OSA), and better sales. As per the investor day, a boost of ~100bps in OSA is equivalent to a sales increase of several hundred million dollars. HD first launched Sidekick in January 2023, and I believe as it continuously rolls this out across the entire store, margins should see further improvement.

Another margin driver is HD’s focus on the downstream appliance installation. With the recent acquisition of Temco Logistics, HD is now able to handle this installation process internally. Maintaining complete control over the delivery and installation of appliances is greatly increasing customer satisfaction and service levels. This new procedure is now in effect for one-third of the stores, and more are on the way.

it is very material to our appliance experience and is exactly the customer-first mindset we are applying to create a frictionless customer experience. While investments over the last several years have focused on enabling the expansion and build-out of our fiscal supply chain assets, we have been able to leverage our scale to extend our low-cost position. And there’s still significant opportunity for this as we continue. Investor day

Valuation is not attractive

Author’s valuation model

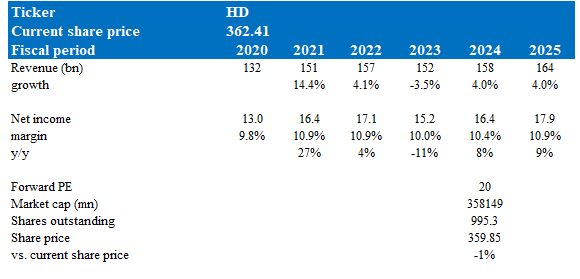

Using management FY23 and stable-market guidance, I expect growth to decline by 3.5% in FY23 and grow by 4% in FY24 and FY25. Margins should improve over time as HD continues to improve operation efficiencies across its store base. The only problem I have with HD today is that its valuation at 23x forward PE is not attractive at all. HD tends to trade within a range of 18x to 22x over the past decade, and every time it passes 22x, valuation will always find its way back down within the next few months. HD recently passed the 22x mark, and while I do long the business, I don’t see a very strong growth catalyst that can sustain this valuation for a long period of time. Hence, my assumption is that HD will trade back to 20x its historical average eventually, and that gives me my target price of ~$360. I believe the time to long HD will come eventually, just that it is not today (HD was trading below $360 for the entirety of 2023).

Summary

I am neutral-rated for HD. As the largest home improvement retailer in the U.S., HD benefits from its large-scale advantage, stemming from its extensive store network, buying power, and >4 decades of experience. While the macro situation is bad, it also gives HD the opportunity to consolidate market share from smaller competitors. Despite being a large player, there are still opportunities for margin expansion through technological enhancements like Sidekick and increased control over appliance installation. However, the current valuation, exceeding historical averages at 23x forward PE, presents a headwind, and I anticipate a correction toward the typical 18x to 22x range. While I recognize HD’s strong fundamentals, I await a more favorable entry point for potential investment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.