Summary:

- A sluggish residential real estate market affects major home-improvement retailers and homeowners’ intentions to invest in big-project upgrades.

- Home Depot’s Q1 revenue missed expectations, but management reiterated FY 2024 guidance.

- A delayed spring selling season was cited for the mixed start to the year.

- HD’s valuation is not all that compelling, but the company remains a free cash flow generator with an above-market dividend yield.

- I highlight key price levels to watch on the chart following a steep pullback from its March high.

Oleg Kovtun/iStock Editorial via Getty Images

A sluggish residential real estate market from the perspective of transaction volume and folks moving about the country emerges as a bearish trend for major home-improvement retailers. Homeowners spent excess savings from the pandemic on household upgrades years ago, now, as people generally sit tight in their dwellings, there is less need to spend a Saturday driving back and forth to Home Depot (NYSE:HD). At least that’s the narrative the bears spin today.

I am downgrading HD from a buy to a hold. I see this blue-chip consumer company as about fairly valued as its strong management team aims to weather the tough environment at the moment. Market share gains over the last several years with impressive execution across cycles should help HD get through to the next bullish phase, but the P/E is not bargain right now.

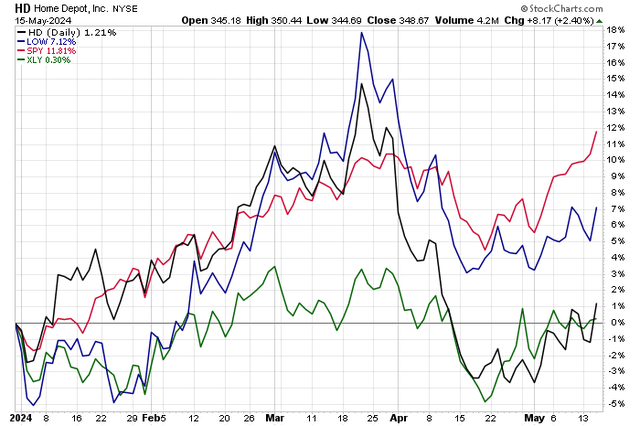

HD & Lowe’s Lag S&P 500 ETF YTD

According to Bank of America Global Research, founded in 1978, Home Depot is a leading North American home improvement retailer, with over 2,300 stores, including 182 stores in Canada and 133 in Mexico in FY22. HD sells to both the do-it-yourself and professional contractor markets.

Home Depot reported a mixed set of Q1 results. GAAP EPS of $3.63 topped the Wall Street consensus forecast of $3.59, but revenue of $36.4 billion, down 2.4% from year-ago levels, was a $250 million miss. Comp-store sales dropped 2.8% YoY, while in the US alone, sales were even weaker. Still, the management team reiterated FY 2024 guidance. They see total sales growth of 1% in 2024 with a 1% comp-store sales decline this year.

Helping boost the bottom line despite the soft revenue number was a lower effective tax rate – not the most encouraging catalyst. Weaker consumer demand was pinned to a slow start to the spring selling season – a usually strong part of the calendar for HD and its peers. Weakness in large projects was another bearish factor – big ticket sales dropped from the same quarter a year ago. But these are likely short-lived headwinds, and HD remains positioned for long-term growth.

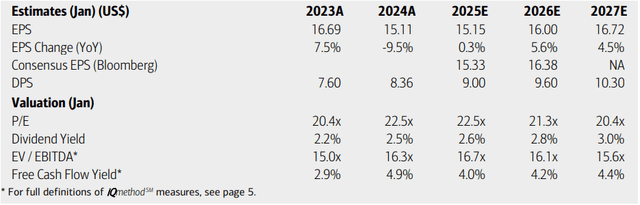

On valuation, analysts at BofA see earnings rising just modestly this year, while per-share profit growth is expected to accelerate in the out year. By 2027, operating EPS may rise to near $17. The current Seeking Alpha consensus numbers are more upbeat than what BofA projects, though there have been a significant number of sell-side EPS downgrades in the last 90 days given the difficult macroeconomic conditions mentioned above.

But as a strong and dominant player in its industry, HD commands a premium valuation multiple. Moreover, dividends are expected to rise at a 6% annualized clip over the quarters ahead, while its free cash flow yield remains firmly positive.

Home Depot: Earnings, Valuation, Dividend Yield, Free Cash Flow Yield Forecasts

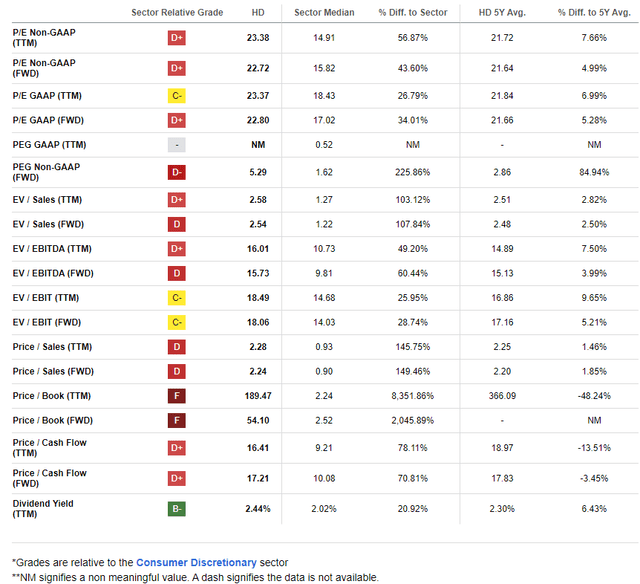

HD’s valuation is not indicative of a screaming buy, and with weak near-term bottom-line growth, a 22x multiple is not all that attractive. If we assume non-GAAP EPS of $15.75 over the next 12 months and apply the stock’s historical P/E of 21.6, then shares should trade near $340, not far from where the stock trades at today. The firm also trades in-line with historical price-to-sales multiples.

HD: A Premium Valuation, But Above-Market Dividend Yield

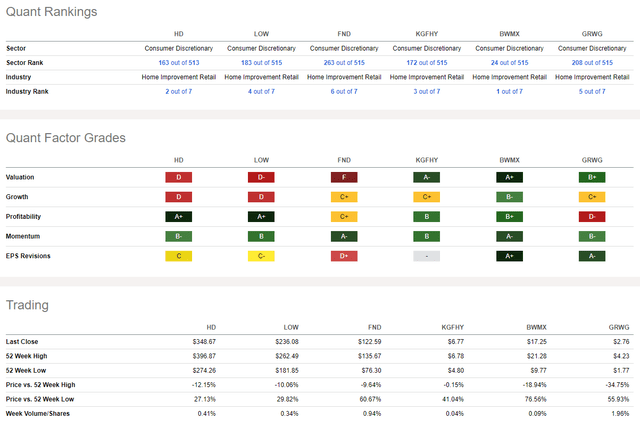

Compared to its peers, the stock’s valuation rating is indeed weak, as is the growth trajectory. That is not a compelling investment thesis from a quantitative perspective. But Home Depot is a cash flow machine with strong profitability trends. What’s more, despite the weak trend in sell-side EPS revisions, share-price momentum is not particularly bad, but I will detail that later in the article.

Competitor Analysis

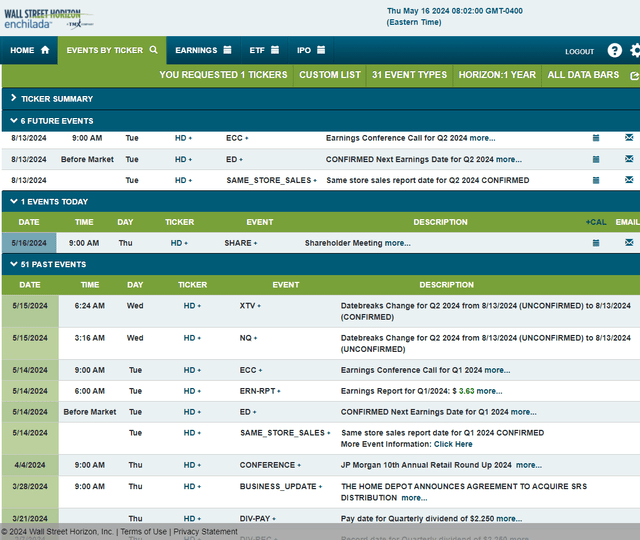

Looking ahead, corporate event data provided by Wall Street Horizon shows a confirmed Q2 earnings date of Tuesday, August 13 BMO with a conference call immediately after the numbers hit the tape. You can listen live here. The firm wrapped up its annual shareholder meeting on May 16.

Corporate Event Risk Calendar

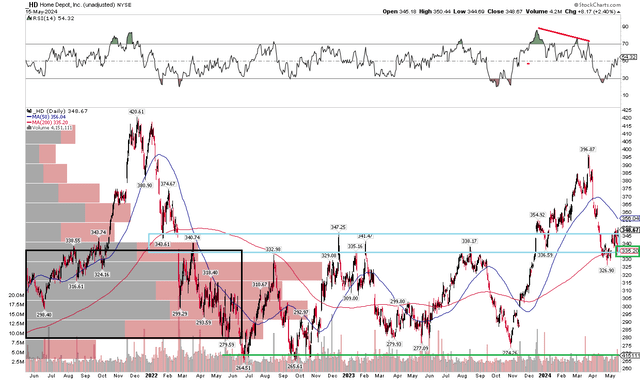

The Technical Take

HD has been a significant laggard compared to the broad market, as charted at the onset of the article. Notice in the graph below that shares are down sharply from a late-Q1 high just shy of the $400 mark. The pullback reached nearly 20% when HD fell under its long-term 200-day moving average a few weeks ago. That is where the stock came into significant support in the $330 to $350 zone – there is a high amount of volume by price beginning there down to about $270.

That significant retreat came after the RSI momentum gauge at the top of the chart notched a bearish divergence, indicative of weak forward price action. What I would like to see technically is for the bulls to defend the low to mid-$350s and for the stock to recover above the falling 50-day moving average. With poor relative strength, however, and a stock that is down big from its December 2021 all-time high, the trend is merely sideways today.

Overall, with no clear uptrend and negative alpha to the market, the chart situation is not all that appealing despite HD falling to a support range.

HD: Bearish RSI Divergence in Q1, Shares Fall To Key Support

The Bottom Line

I am downgrading HD from a buy to a hold. It was a strong rally from Q4 2022 through last March, but the bears have reasserted themselves. I would like to see improved earnings growth and a lower P/E before upgrading the stock back to a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.