Summary:

- Home Depot performed well in most recessions with the housing crisis in 2007/2008 being the exception.

- The company also had to report declining revenue and earnings per share in the first quarter of fiscal 2023, but only in the single digits.

- While the housing market might be seen as problematic in the next few quarters, renovation of the aging housing stock in the United States might be a tailwind.

- HD stock seems to be fairly valued right now, but is probably not the best investment at this point.

M. Suhail

In some cases, an investor can have a clear opinion about a stock and if it is a good investment. Some stocks are clearly overvalued, and some stocks are clearly undervalued. And while I don’t always have to be right some stocks present themselves as a compelling buy – Meta Platforms (META) might be an example that worked out already, Alibaba (BABA) might be another (that didn’t work out so far).

Aside from such companies and stocks that present themselves as clear buys to me, there are other stocks where it is more difficult to make up my mind. Home Depot (NYSE:HD), which I covered in March 2022 for the first and only time, might be an example. Back then I rated the stock as a “Hold” and the company is trading more or less for the same price right now. Let’s take another look at the company and stock, which I still see as a “Hold” as I can’t make neither a compelling bull case nor a compelling bear case.

Recession

Usually, we start by looking at the last quarterly results and provide an update on the financials of the business. But in this case, I will start with a negative aspect – the risk for a potential recession and the effect this might have on Home Depot.

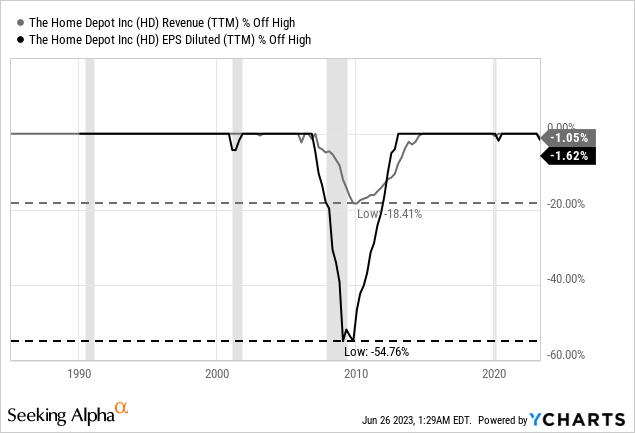

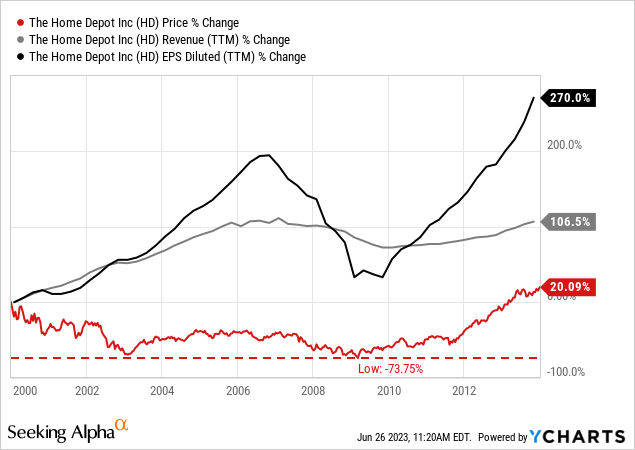

When looking at the performance of Home Depot in the last four decades, the Great Financial Crisis is standing out and we see revenue and especially earnings per share declining steeply. While revenue declined about 18.5% (TTM numbers) from its previous high, earnings per share declined 54.8%. And while the decline is looking horrible, we should remember that many other businesses declined much steeper. Additionally, the decline looks so extreme in my opinion as Home Depot performed so well in the other years. It is also part of the picture to mention that the other three recessions happening in that timeframe are hardly visible as revenue and earnings per share almost didn’t decline.

Of course, Home Depot was a rather young company back then with the ability to grow with a high pace. In 1990 Home Depot generated $3.8 billion in sales, in 2000 it generated $45.7 billion in sales and with lower revenue it is easier to keep growing with a high pace – even during a recession. And aside from Home Depot being a more mature company during the Great Financial Crisis (making it more vulnerable for declining revenue), the is another reason for the horrible performance during the Great Financial Crisis: As we all remember, the 2007 recession was triggered by a collapsing housing market. I already mentioned in my last article the importance of the housing market for Home Depot:

We also must expect that the housing market will not only slow down at some point during the next few years but decline rather steep (although it does not have to be as extreme as during the Financial Crisis). While we suddenly can’t be so sure (due to the invasion of Russia into Ukraine) that the Federal Reserve will increase rates several times over the next few months, rate hikes are likely and will lead to fewer people building new homes or buying old homes and renovate them – and both will have a negative impact on Home Depot’s business.

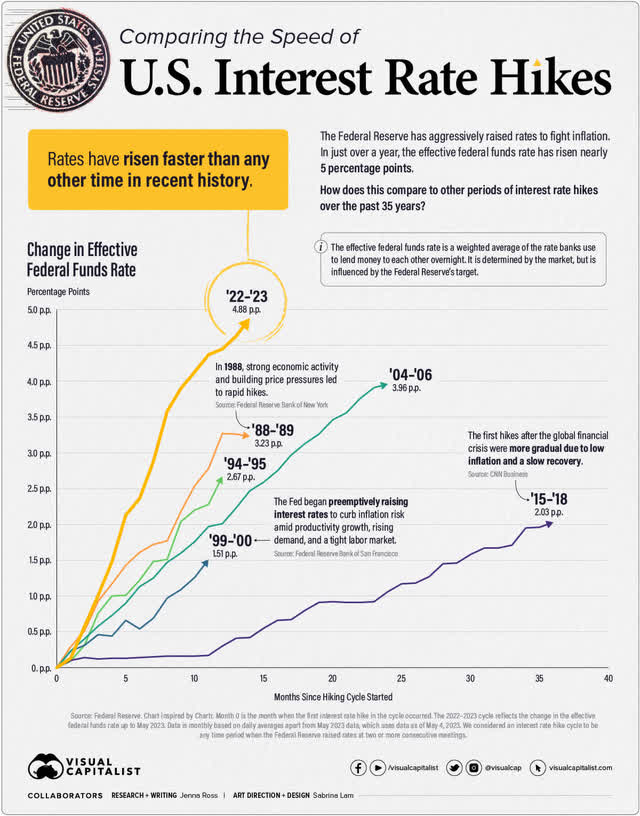

We can now update these numbers a little bit. First, the FED continued to raise rates – aggressively. When I wrote my last article about Home Depot, interest rates were still close to zero percent and in the meantime, the FED raised rates with one of the most aggressive paces in the last few decades.

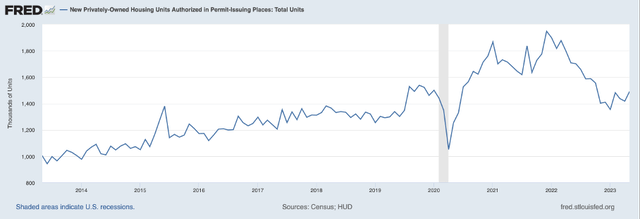

While the speculation that the FED might hold back on rate increases due to the war was wrong, the prediction about a possibly struggling housing market was correct. To be clear, we are nowhere near the levels of 2007 and 2008, but we see declining housing permits in the last 1.5 years. Between December 2021 and January 2023, housing permits constantly declined from 1,948 million to 1,354 million. In the last few months, we are seeing stagnating numbers (or even slightly improving numbers).

When looking at further construction metrics, like the total employees in construction or the total construction spending in the United States, we are seeing still improving numbers and not really a sign of a major crisis.

Quarterly Results

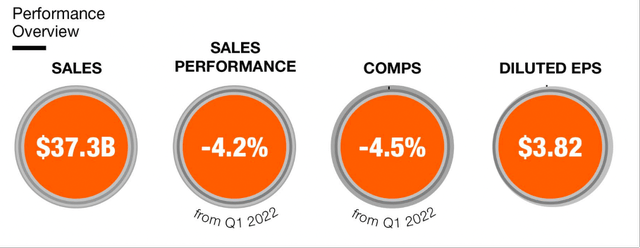

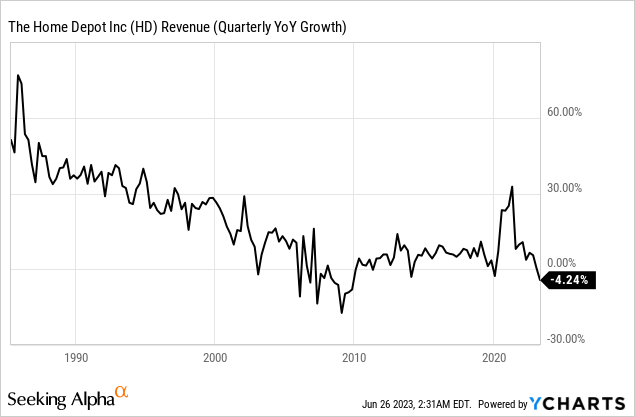

And a similar picture is presented when looking at the last quarterly results. Home Depot can’t grow anymore and is seeing declining numbers, but the declines are still moderate. Sales in the first quarter of fiscal 2023 declined from $38,908 million in the same quarter last year to $37,257 million this quarter – a decline of 4.2% year-over-year. Operating income also declined from $5,929 million in Q1/22 to $5,551 million in Q1/23 – reflecting a decline of 6.4% YoY. And finally, earnings per share declined 6.6% from $4.09 in the same quarter last year to $3.82 this quarter.

Home Depot Q1/23 Performance Overview (Home Depot Q1/23 Infographic)

Looking at additional data, we see that customer transactions declined from 410.7 million in the same quarter last year to 390.9 million this quarter and that decline was responsible for the lower reported revenue. Average ticket per customer slightly increased from $91.72 in the same quarter last year to $91.92 this quarter.

Growth

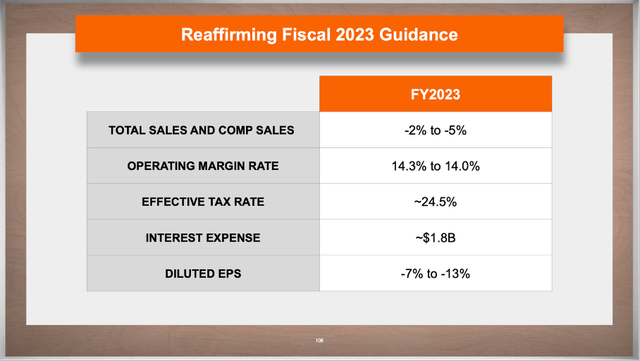

And management is seeing similar declines for the coming quarters. For fiscal 2023, Home Depot is expecting sales (as well as comparable sales) to decline between 2% and 5% and diluted earnings per share to decline between 7% and 13%.

2023 Investor & Analyst Conference

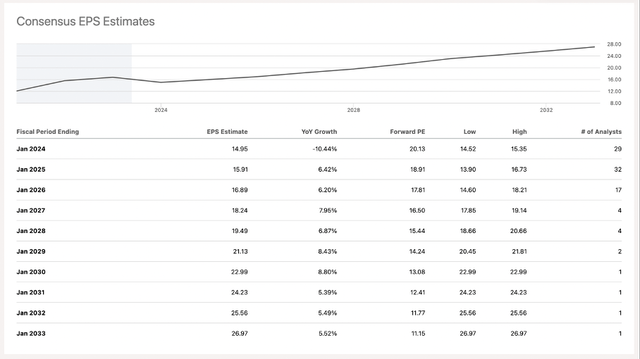

This is also in line with analysts’ assumptions, which expect earnings per share to decline about 10.5% year-over-year in fiscal 2023.

Home Depot Consensus EPS Estimates (Seeking Alpha)

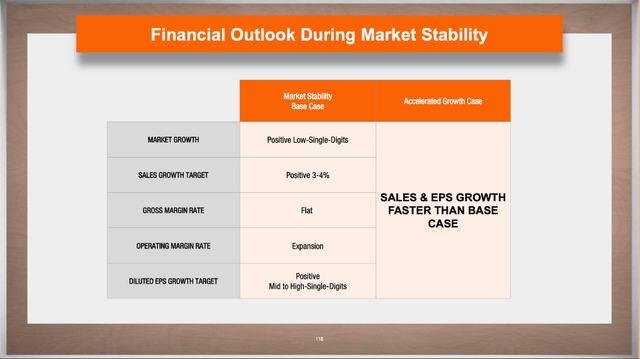

But following 2023, analysts are expecting Home Depot to grow in the mid-to-high single digits annually until 2032. On average, analysts are expecting earnings per share to grow with a CAGR of 4.92% (between fiscal 2022 and fiscal 2032). Management seems to be similar optimistic and is expecting earnings per share to grow in the mid-to-high single digits in the years to come.

2023 Investor & Analyst Conference

Management is expecting sales growth to be between 3% and 4% over the long run. Part of the strategy to grow top line is opening new stores. In the next 5 years, management’s target is to open 80 additional stores. Aside from sales growth, management is also expecting margin expansion (gross margin is expected to be stable, but operating margin should improve). And similar to the last ten years, Home Depot might continue to buy back shares and a declining number of shares could also contribute to bottom line growth.

The question also is what growth rates are realistic to assume for Home Depot. When looking at the long-term revenue growth rates we saw growth rates slowing down constantly until the late 2000s and since about 2010 growth rates have been fluctuating in the mid-single digits.

Only the years 2020 and 2021 have been an exception and we must see these years as an outlier.

Realistic Assumptions?

The question how realistic these assumptions are, is depending on several different aspects. When looking at growth rates in the last ten years, we see revenue growing with a CAGR of 7.73% and earnings per share growing with a CAGR of 18.72%. Of course, we must keep in mind that the last ten years also include the years during COVID-19 that have been extremely successful for some retailers.

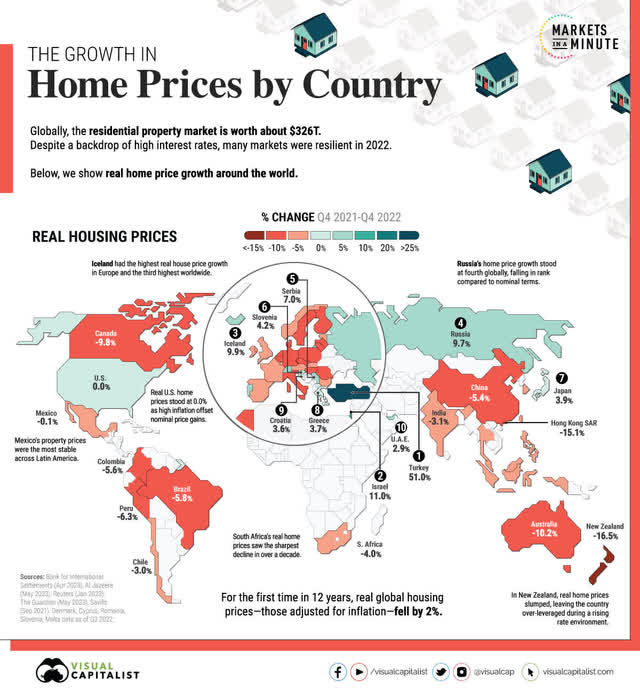

First, we can look especially at the next few quarters and try to make predictions about the housing market. I personally expect the situation to get worse, although this does not mean we have to expect another Financial Crisis with similar negative effects as in 2008 (however, we also should not rule such a scenario out). With the rapidly increasing interest rates and extremely high housing prices, the situation is anything but perfect. The housing market can still be described as stable and resilient, but we have seen declining home prices for the first time in over a decade. And similar to past crises, it takes time to develop and might not be visible in most metrics at first.

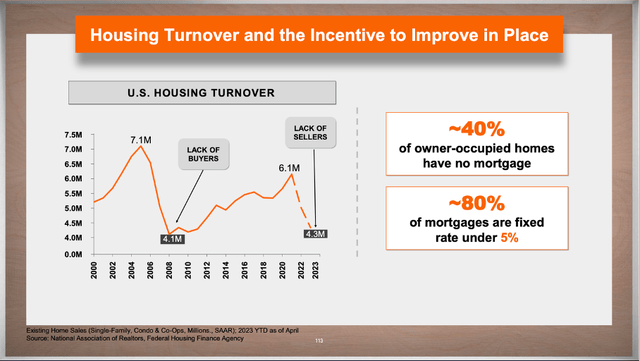

And while management is also pointing out in its presentation that 40% of homeowners have no mortgages and a huge part has fixed rates for some years, it is certainly not a perfect situation and the ingredients for a perfect storm are certainly out there. How the situation plays out remains to be seen as it is extremely difficult to make accurate predictions in a complex system.

2023 Investor & Analyst Conference

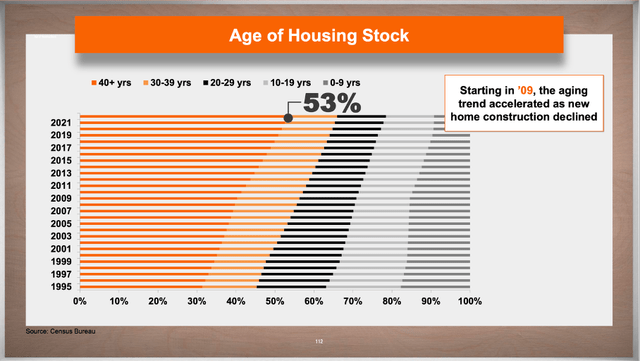

But aside from people buying or building new houses, there is another important market that should not be ignored – renovation. And we should not be too optimistic here either: When times are tough, people don’t spend money on renovation. With disposable income declining (as it is often the case during an economic contraction), huge investments (and a renovation is a huge investment) are often postponed. But over the next few years, people might rather tend to renovate their houses (especially when they can’t afford to buy a new house) and this could be a tailwind for Home Depot over the next 5 to 10 years. And with the average age of housing stock in the United States increasing (53% of houses are now 40 years or older), renovation might be a bigger issue in the years to come – and contributor to growth for Home Depot.

2023 Investor & Analyst Conference

Intrinsic Value Calculation

Aside from asking ourselves the question what growth rates are realistic in the years to come and how much the company can grow its top and bottom line, we also must put growth rates and assumed free cash flows in relation to the stock price we must pay for Home Depot right now.

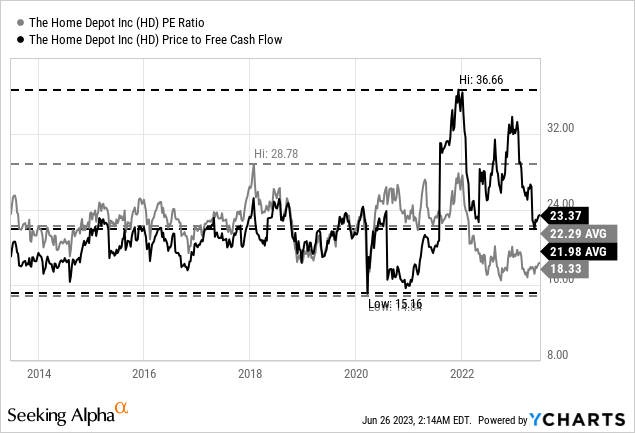

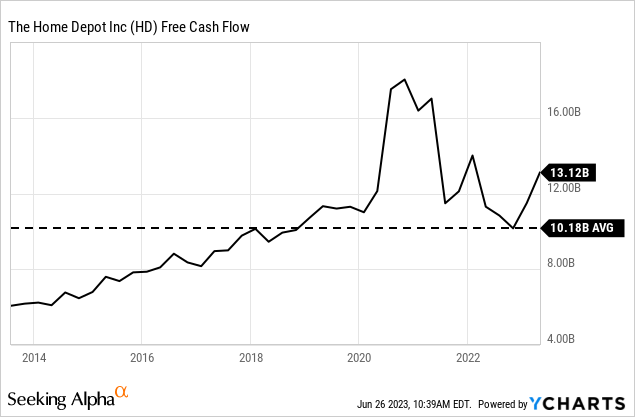

For starters, we can look at the two simple valuation multiples – the price-earnings ratio and the price-free-cash-flow ratio. At the time of writing, Home Depot is trading for 18.33 times earnings, and this is below the 10-year average of 22.29. On the other hand, Home Depot is trading for 23.3 times free cash flow, which is slightly above the average P/FCF ratio of the last ten years (21.98). And this is lower than the extremely high valuation multiples we saw in the last two years, but it also can’t be described as extremely cheap. Overall, we see Home Depot as fairly valued – and such an assessment can be backed up by using a discount cash flow calculation.

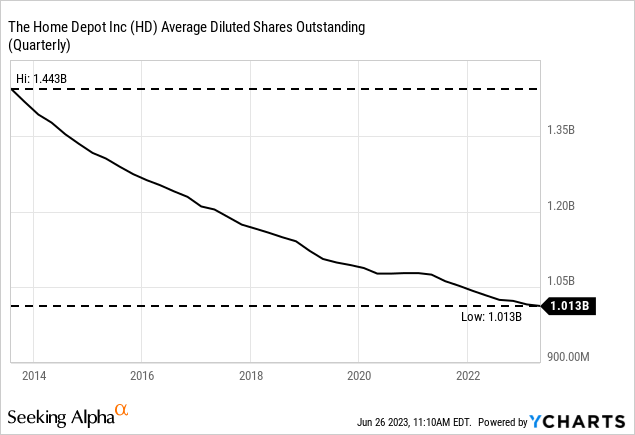

As always, we calculate with a 10% discount rate and in case of Home Depot, we use 1,013 million diluted outstanding shares. Additionally, we can use the free cash flow of the last four quarters, which was $13,120 million and seems like a realistic amount (and lower than the extremely high free cash flow of the last two years). When being rather cautious and assume a growth rate of 5% from now till perpetuity, we get an intrinsic value of $259.03 for Home Depot. When being a little more optimistic and assume 6% growth till perpetuity, we get an intrinsic value of $323.79. I see Home Depot as fairly valued right now. But it is not yet an investment for me. And of course, we can make the case for higher growth rates. However, I am assuming rather difficult years in the foreseeable future and would be more pessimistic (or cautious).

Conclusion

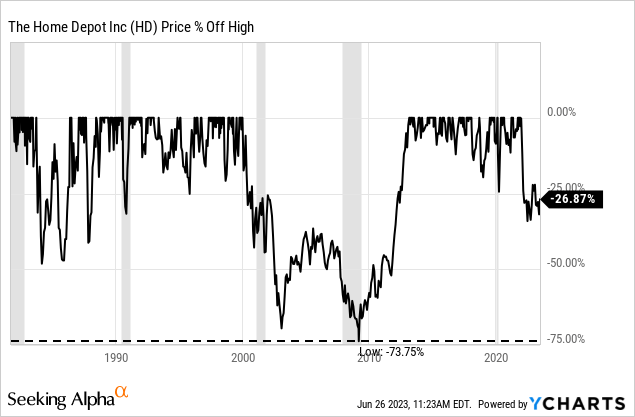

So far, Home Depot is trading about 27% below its previous all-time high. When looking at the performance in the last decades, we see many similar declines and one steeper decline (between 2000 and about 2012/13). Hence, we make the argument that the current decline is in line with previous crisis.

As final note, we also look at the performance of Home Depot following the years 2000. While revenue and earnings per share increased with a solid pace, the stock price struggled for almost 13 years. I don’t claim that Home Depot is similar hyped today, but it is a warning what the stock market faced – a lost decade. And while Home Depot probably won’t be among the worst performing stocks (as valuation multiples were still rather reasonable – compared to many other stocks) we should be cautious nonetheless.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.