Summary:

- According to Argus Research, about 70% of U.S. homes are more than 25 years old and likely need home improvement. Home Depot is an undisputable leader in the industry.

- The company’s financial performance has been firm over the long term, creating vast value for Home Depot shareholders.

- My valuation analysis suggests the stock is attractively valued.

KenWiedemann

Investment thesis

Home Depot (NYSE:HD) has been demonstrating solid financial performance over the last decade, which was highly appreciated by the market. The stock delivered a stellar 14% annualized return only from the price appreciation and dividend ignored.

I believe HD stock represents a compelling investment opportunity given its attractive valuation at current levels and bright long-term prospects given the aging homes across the U.S. which need home improvement. For sure, temporary headwinds are in place, but I believe the benefits outweigh them.

Company information

Home Depot is the world’s largest home improvement retailer. The company sells appliances, tools, and other home improvement supplies in its warehouse-sized stores with an average size of above 100,000 square feet. The company’s total selling space is approximately 240 million square feet. According to the company’s latest 10-K report, as of the end of fiscal 2022, HD operated 2,322 stores located throughout the U.S., Canada, and Mexico. Approximately 92% of the company’s sales are generated in the U.S.

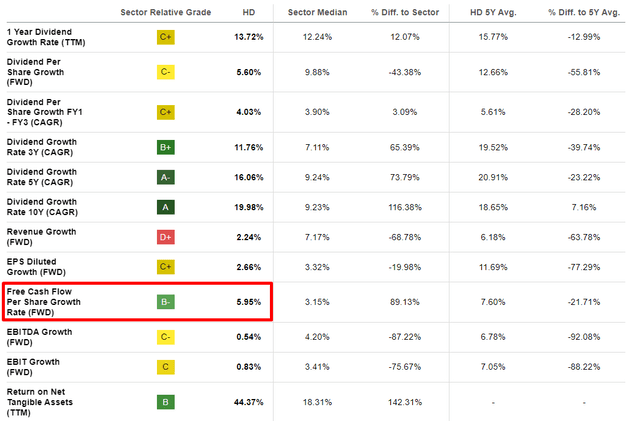

The company offers its customers various products, which you can see from the revenue breakdown by merchandising department below.

Home Depot’s latest 10-K report

Financials

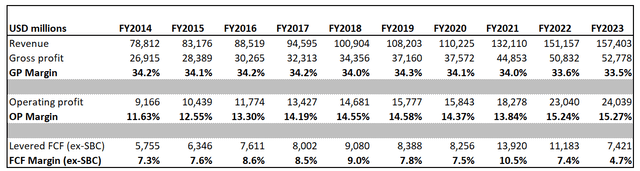

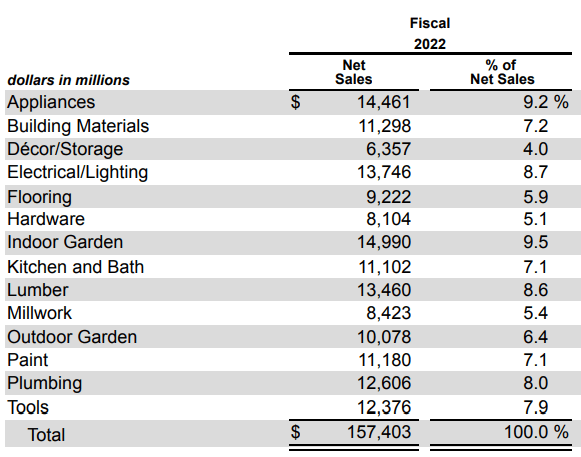

Home Depot’s financial performance has been impressive historically. If we look at the financials over the last decade, the topline grew at an 8% CAGR with a gross margin in a narrow 33-34% range. Operating margin improved notably over the decade from 11.6% to 15.3% meaning the management has been efficient in managing growth. These all ultimately led to an attractive FCF margin above 7%, though in the last FY in deteriorated below 5% due to macro headwinds.

I consider the company’s balance sheet is strong, with solid liquidity metrics. The level of debt has been high historically, though it is balanced by high real estate ownership which I consider significant as well. Recently, Fitch affirmed the investment grade for the company’s debt which for me is a quality sign. Thanks to strong capital allocation, apart from impressive long-term stock price appreciation, HD is creating additional value for its shareholders by paying dividends and repurchasing shares. The current dividend yield of 2.88% is worth considering in my opinion. During FY 2022-2023 the company repurchased shares worth over $21 billion, which I consider significant.

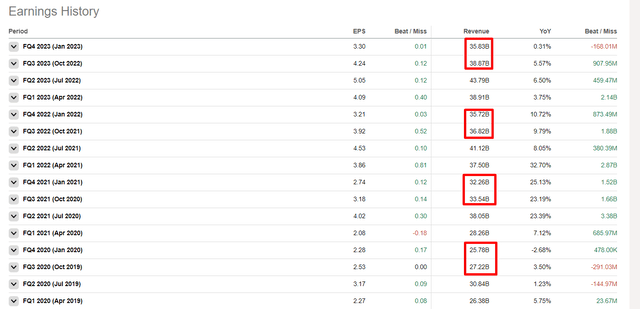

Narrowing down to the latest earnings, HD missed slightly on revenue and delivered EPS somewhat higher than consensus estimates. Sales were almost flat YoY and slipped about 8% sequentially. Due to business seasonality, I don’t see a red flag in the sequential topline decrease since FQ4 has been consistently weaker than FQ3 in recent years. Though, the extent of sequential decline is higher this year than it was in recent years.

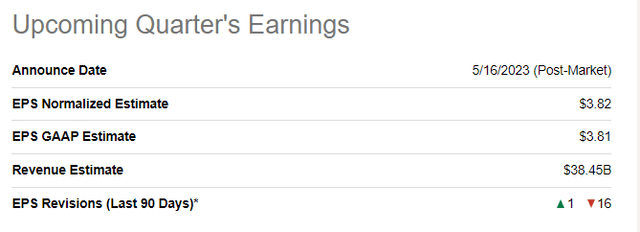

The upcoming earnings are quite close, with FQ1 2024 scheduled to be announced on May 16 post-market. Revenue is expected to demonstrate a seasonal sequential rebound of 7.3% and about a 1% decline YoY. According to earnings surprise history, the company rarely misses consensus estimates on revenue and even more rarely misses on EPS. The fact that there were 16 downward EPS revisions for the upcoming earnings gives the additional conviction that the company will deliver an EPS beat.

During the latest public speech at JPMorgan (JPM) retail round-up conference, Richard McPhail, the CFO, shared his optimism about the industry.

I think that home improvement is one of the most enduring, healthy sectors of the consumer economy in North America.

He also underlined that the home value of housing stock in the U.S. increased from $20 trillion in 2012 to $50 trillion now, with mortgage debt remaining stable. It indicates a strong homeowners’ equity position, which is “much healthier than we’ve seen ever before”.

Valuation

I like stocks like HD for valuation exercises because the level of uncertainty for assumptions is low. Also, we have different approaches available to implement: discounted cash flow [DCF], dividend discount model [DDM], and multiples analysis.

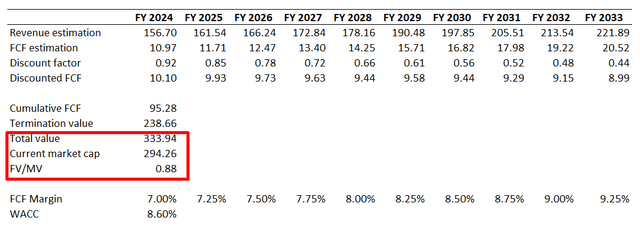

Let me start with the DCF. For WACC I use 8.6%, which is provided by valueinvesting.io. According to consensus estimates, revenue growth is expected to be at around 3.5% CAGR over the next decade. I consider this growth trajectory conservative compared to the 8% revenue CAGR over the past decade. FCF margin I expect to be at 7% in FY 2024 and to expand by 25 basis points per year.

Incorporating all the above assumptions into my DCF template gives me fair value of the business at approximately $334 billion, which is 12% higher than the current market cap, indicating the respective upside potential.

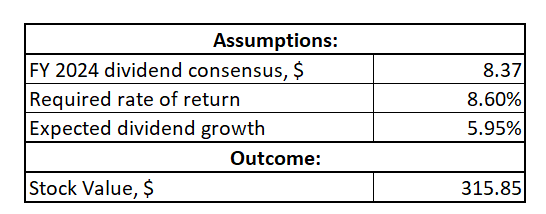

To cross-check me, now let me move to DDM. I use the same WACC for the required rate of return, as I did for the DCF approach. FY 2024 dividend consensus estimate is at $8.37 per share, and I expect dividend growth to align with the forward growth rate of FCF per share at 5.95%.

Incorporating all the assumptions for DDM gives me a fair share price of about $316, 9% higher than the current levels.

Author’s calculations

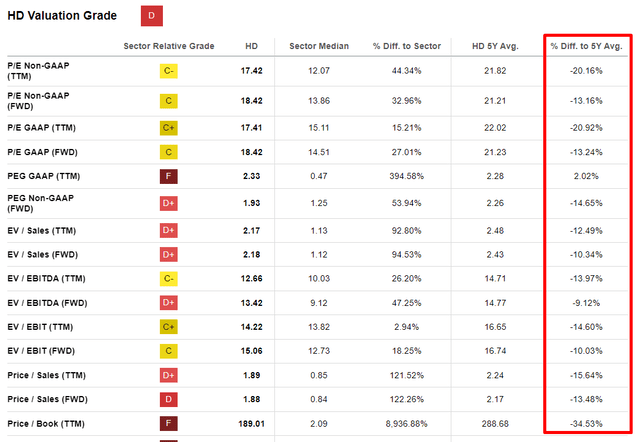

To finalise my valuation analysis, I would also like to look at valuation multiples. Seeking Alpha Quant valuation grade of HD is “D”, but let me remind you that Home Depot is an undisputable market leader in the home improvement industry with very high profitability metrics. Therefore, it is not a surprise for me that the company’s valuation ratios are much higher than the sector median. Thus, to get a more fair view on the valuation based on multiples, I prefer to compare HD with HD’s 5-year average ratios. And we can see that current levels are lower than comparable historical metrics almost across the whole board. For me, it also indicates undervaluation.

To summarize valuation, I believe HD is attractively valued with an upside potential of about 10-12%, especially given the dividend yield of 2.88%. Also, it is important that there is high conviction regarding the fairness of underlying assumptions for both DCF and DDM.

Significant risks to consider

As below two sections of my analysis suggest, I am bullish on the stock, but I have to mention some concerns as well.

Due to current headwinds in the macro environment, there is a high probability that customers will moderate their home improvement spending. The aggressive home improvement spending during the COVID pandemic also might suggest that the demand will be naturally cooling. On the other hand, Christopher Graja from Argus Research suggests, that about 70% of U.S. homes are more than 25 years old and likely in need of upgrades and repairs. He also underlines that there is also a shortage of homes after more than a decade of underbuilding following the Great Recession. Therefore, I believe there might be temporary headwinds for home improvement spending, but the overall trend looks favorable for HD.

Overall weaknesses in the housing market are also a risk for HD. High mortgage rates are likely to cool down property prices. Lower home prices usually discourage homeowners from investing in home improvement and renovation, adversely affecting demand for Home Depot’s products. However, HD has a strong market position and diversified product mix, including do-it-yourself offerings, which helps the company to be less vulnerable to the unfavorable macro environment.

Bottom line

Overall, I believe that HD stock is a good investment opportunity with moderate upside potential and a worthy dividend yield. The company might face some short-term headwinds due to the challenging environment especially given high mortgage rates, which put downward pressure on the housing industry. Nevertheless, the secular trend of increased demand for home improvement is favorable for the company. I believe it is a Buy for long-term investors seeking an attractive risk-to-reward opportunity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.