Summary:

- The Home Depot, Inc.’s long-term earnings growth track record has been strong as the company has expanded its retail network.

- The recent weakness in the housing industry, and in the consumer sentiment, have driven an earnings hiccup in recent quarters. The macro-driven issues should slowly start to subside.

- While Home Depot’s growth outlook stands quite good, the valuation is too expensive at the current stock level.

Romanista

The Home Depot, Inc. (NYSE:HD) operates as the largest home improvement retailer in the United States and other countries with a total of 2340 retail stores. With Home Depot’s fairly consistent growth and good capital efficiency, the stock has appreciated at a CAGR of 15.9% in the past decade. On top, Home Depot pays out a dividend with a current yield of 2.2%.

Yet, with a recent earnings hiccup due to a weaker macroeconomic backdrop, and an increasingly tight valuation, I believe that investors aren’t likely to see the great historic return to repeat.

Ten Year Stock Chart (Seeking Alpha)

Home Depot’s Earnings Have Grown Well & Capital Efficiently

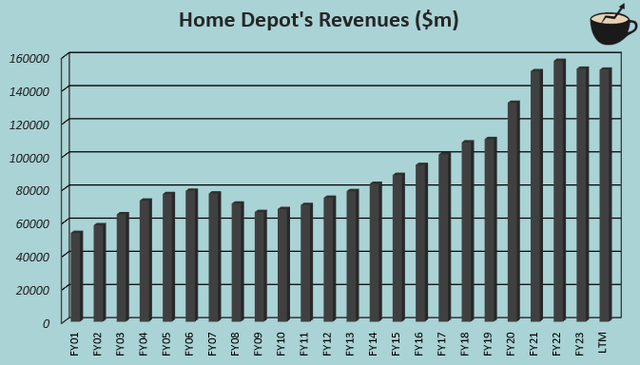

Over the long term, Home Depot has expanded its retail network consistently while also growing same-store sales. As a result, the company’s revenue CAGR stands at a good 4.7% level from FY2001 to the current trailing revenues of $152.1 billion as of Q2/FY2024. The company also recently acquired SRS, a roofing, landscaping, and pool distributor, for $18.25 billion in June, bolstering future growth prospect.

The growth has also been achieved at a great return on total capital of 21.9%, and with a good trailing 13.9% operating margin, making Home Depot’s growth valuable to investors.

Author’s Calculation Using TIKR Data

Ultimately, Home Depot’s growth story has still been similar to competitor Lowe’s Companies’ (LOW). Lowe’s has also grown revenues at quite a similar 4.3% CAGR from FY2014 to Q2/FY2024, having an even better 25.0% return on total capital but a slightly lower 12.5% operating margin. While leading the home improvement retailing industry in size, Home Depot isn’t unique as an investment in the industry.

Recent Macro-Driven Industry Hiccup Could Start to Subside

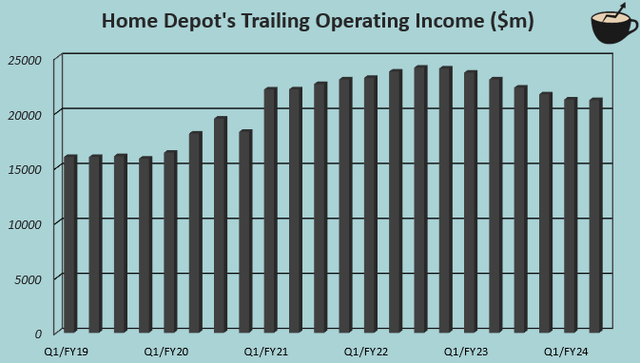

The good historical earnings growth has recently paused into moderate earnings declines after a peak in mid-2022. For example, in Q2, the company’s operating income still declined -0.8% year-on-year to $6.5 billion, and Home Depot guides for around a -1.8% total FY2024 operating income decline at the current guidance’s mid-point. With Home Depot’s relatively safe amount of debt and quite resistant earnings, the company is still positioned to weather further earnings declines.

Author’s Calculation Using TIKR Data

Underneath, the macroeconomic backdrop has been weak as interest rates have risen and as the consumer sentiment has been weak. Existing home sales in the United States have also stayed at an incredibly low level, affecting home improvement product demand. Highlighting the weak industry, Lowe’s also downgraded the company’s guidance in August with similar earnings headwinds as Home Depot has reported. As Home Depot’s earnings declines are clearly macroeconomic in nature, I still believe that the long-term earnings outlook still stands good with an eventual uptick in the macroeconomic backdrop.

Positive trends in the industry could already start to be seen soon. As I wrote in my recent article on PulteGroup (PHM), focusing on the relatively weak short-term housing market but stronger long-term trends, lower mortgage rates have already started to have an impact on the housing market. Further, with a slowly recovering consumer sentiment and lowering inflation, improving purchasing power should start to transfer to Home Depot’s top and bottom line.

Also, while transitory in nature, the recent Hurricane Helene should aid home improvement retailers in upcoming quarters with a large amount of rebuilding, improving the short-term outlook. Home Depot should finally start to stabilize along with Lowe’s and others, and the relatively stable implied H2 guidance seems to already suggest starting stabilization.

Home Depot still sees macroeconomic uncertainty ahead as discussed in the Q2 earnings call, highlighting that the short-term outlook is still uncertain despite some optimistic macroeconomic metrics for the company.

Home Depot’s Valuation Is Too Tight

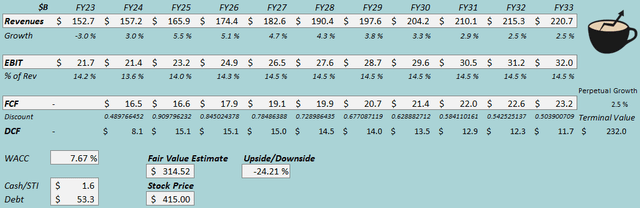

I constructed a discounted cash flow [DCF] model for the HD stock to estimate a rough fair value.

In the DCF model, I estimate Home Depot to return to fairly good growth in FY2025 with a 5.5% growth, slowing down gradually to 2.5% perpetual growth. The model considers fairly well-continuing long-term growth at an estimated revenue CAGR of 3.8% from FY2023 to FY2033.

The growth should also aid Home Depot’s margins back up slightly, and I estimate the EBIT margin to return to 14.5% from an estimated 13.6% margin in FY2024. With Home Depot’s good working capital management and moderate capital expenditures, I estimate the company’s cash flow conversion to be good in the future as well.

DCF Model (Author’s Calculation)

The estimates put Home Depot’s fair value estimate at $314.52, 24% below the stock price at the time of writing. The stock’s current valuation seems to price in growth above a historical performance, making for a likely weaker future return and a weak risk-to-reward.

Also, despite a lower return on capital and quite similar growth, Home Depot’s forward 19.1 EV/EBITDA exceeds Lowe’s 16.1 forward EV/EBITDA by a considerable margin. While I believe Home Depot to return to relatively good and valuable growth, I believe that better alternatives exist in the market due to the steep valuation.

CAPM

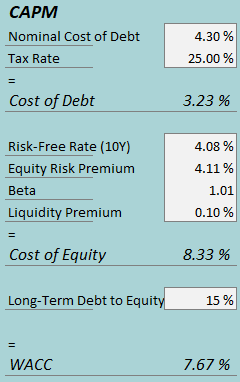

The DCF model uses a weighted average cost of capital of 7.67%. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q2, Home Depot had $573 million in interest expenses, making the company’s interest rate 4.30% with the current amount of interest-bearing debt. I estimate a moderate 15% long-term debt-to-equity ratio.

To estimate the cost of equity, I use the 10-year bond yield of 4.08% as the risk-free rate. The equity risk premium of 4.11% is Professor Aswath Damodaran’s estimate for the US, updated in July. Yahoo Finance estimates Home Depot’s beta at 1.01. With a liquidity premium of 0.1%, the cost of equity stands at 8.33% and the WACC at 7.67%.

Takeaway

Home Depot’s good long-term growth has been disturbed by a weak macroeconomic backdrop, also seen throughout the housing market and with competitor Lowe’s earnings. The industry’s outlook should slowly start to improve with lower interest rates, improving consumer sentiment, and lower inflation, and also aided in the short term by Hurricane Helene. Yet, the short-term outlook stands more uncertain.

Despite the recent earnings hiccup, investors are pricing Home Depot’s stock at an increasing valuation ahead of an earnings recovery. As the stock now seems priced for too ambitious earnings growth, I initiate Home Depot at a Sell rating despite the company’s long-term success.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.