Summary:

- The Home Depot’s stock has performed better than we have expected in the past year, with returns in line with those of the broader market.

- The improving macroeconomic environment, including consumer confidence and inflation rates, could boost HD’s business in the coming months and quarters.

- In our view, the firm remains overvalued.

- Despite macroeconomic headwinds, HD’s profitability has remained resilient, and the latest uptick could be a reflection of the improving environment. For this reason, we upgrade the stock to “hold”.

Justin Sullivan

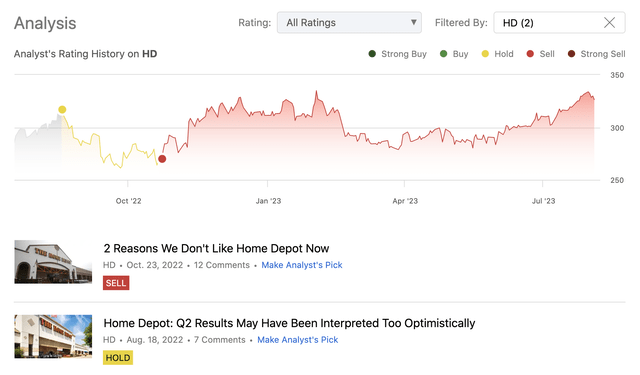

The Home Depot, Inc. (NYSE:HD) operates as a home improvement retailer. We have started coverage on the firm in August 2022 with an initial neutral rating, which we have later downgraded to a “sell” in October 2022.

The primary reasons for our downgrade have been the challenging macroeconomic environment and the apparent overvaluation based on a single stage dividend discount model, which has resulted in an estimated fair value of $213 per share, using a required rate of return of 8.75% and a perpetual dividend growth rate of 5%.

Since our writings, HD stock has actually performed better than we would have expected and its returns are about in-line with the returns of the broader market during the period of our coverage.

Today, we aim to see what could justify this performance and whether it is sustainable or not in the coming quarters. At the end, we will also give an updated view on the valuation, considering potential updates to our inputs to the dividend discount model.

Macroeconomic environment

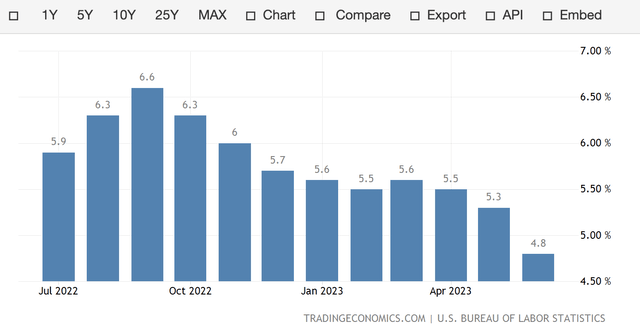

Since our last writing the macroeconomic environment has improved substantially. The inflation rates in the United States and around the globe have started moderating.

U.S. Core inflation rate (Tradingeconomics.com)

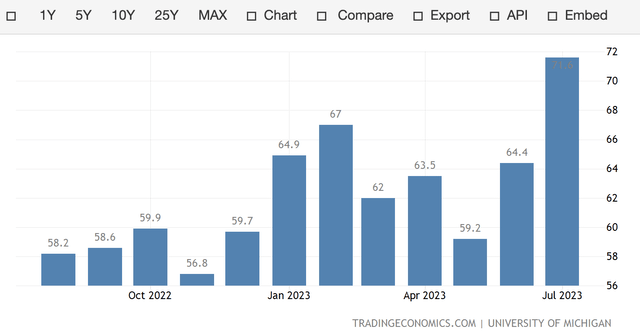

At the same time, the consumer also appears to have gained more confidence.

U.S. Consumer confidence (Tradingeconomics.com)

In our view, both of these developments could provide significant boosts to HD’s business in the coming months and quarters. On one hand, the improving consumer confidence may have a positive impact on the firm’s top line results. Better consumer sentiment may be an indication that people are becoming less concerned and more optimistic about their financial outlooks and about the health of the overall economy in general. As a result, they may start spending larger sums on non-essential, durable goods, like the one HD is selling. In our view, this could boost the demand for HD’s products in the near term.

On the other hand, the falling inflation rate may have a positive impact on the costs. Cost of goods sold, transportation- and freight costs, as wells as SG&A expenses may fall as a result, which could lead to margin expansions and improved profitability.

And this actually takes us to our next discussion.

Profitability

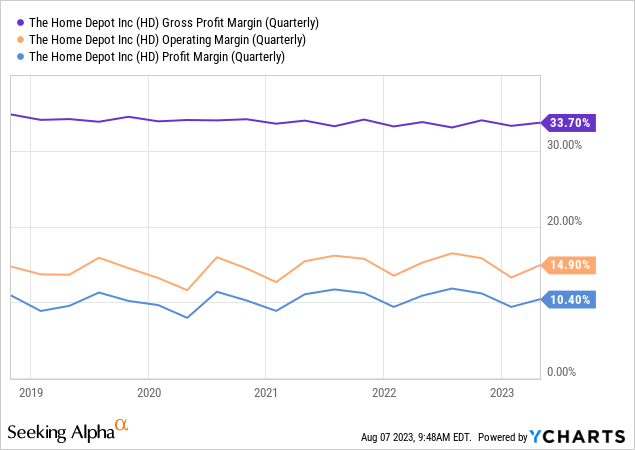

In this section, we are going to take a look how the firm’s profitability has been developing over the past 5 years and how they may be developing further. Three key measures that are popular to gauge profitability are the gross profit margin, the operating margin and the net profit margin.

All three measures show that despite the macroeconomic headwinds, HD’s business has remained resilient and its profitability has not been significantly hurt. Further, the uptick in the latest quarter could also be a reflection of the improving macroeconomic environment.

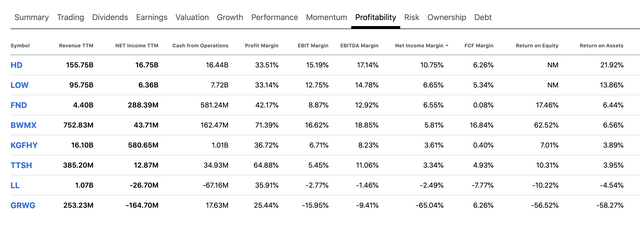

It is important to mention here that it is not only the stable profitability, but also the level of profitability, which is attractive. HD’s profitability, based on most measures, appears to be one of the strongest in the home improvement retail industry.

Based on the development of the consumer confidence, the core inflation rate and the profitability of the firm, looking forward we are somewhat more bullish than we were in Q4 2022. But to answer the question whether a rating upgrade is justified or not, we once again have to take a look at the valuation.

Valuation

We will approach now the valuation from two point of views. First, we will update the input parameters of our single stage dividend discount model to get a better idea of what the fair value of the firm based on its dividend are now.

Dividend discount model update

There are two input parameters that need to be considered. First, the perpetual dividend growth rate, second the required rate of return.

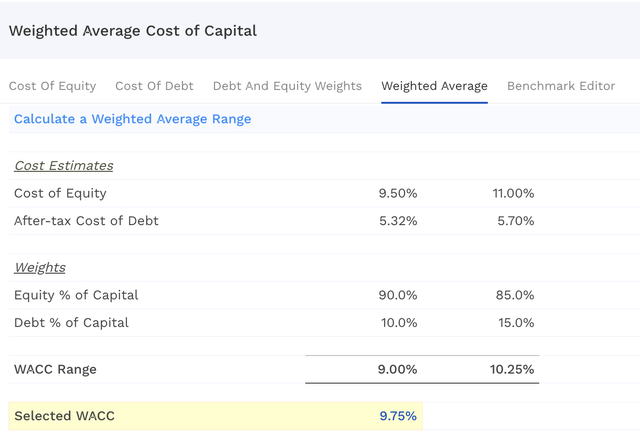

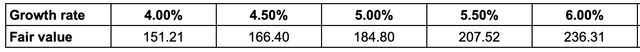

We believe that our previously assumed range of 4% to 6% for perpetual dividend growth, based on historic figures, is still valid. However, our required rate of return, which is driven by the firm’s weighted average cost of capital, is 1 percentage point higher now, partially due to the higher interest rates, partially due to the higher cost of equity.

As a result of this change, our previously established fair value range has shifted even lower to $151 to $236 per share, representing a significant downside from the current price levels.

This approach, however, does not take into account potential near term growth or the positive impact of potential future share repurchase programs and therefore may be overly conservative. For this reason, now we are going to look at the valuation from a different perspective

Price multiples

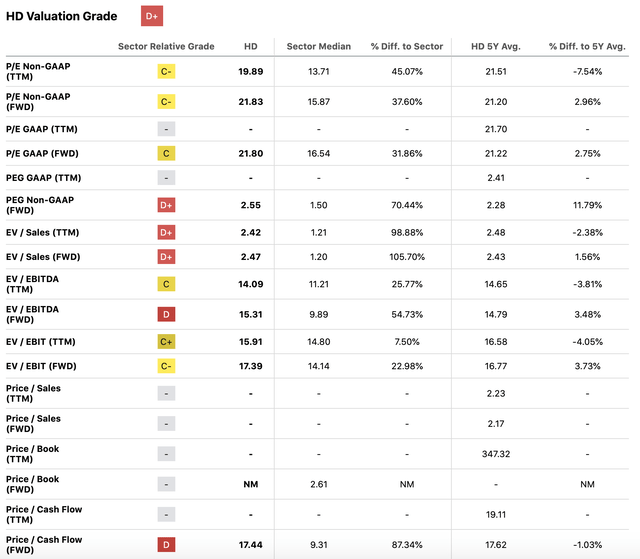

Just like based on the dividend discount model, HD’s stock also appears to be trading at a premium compared to the consumer discretionary sector median.

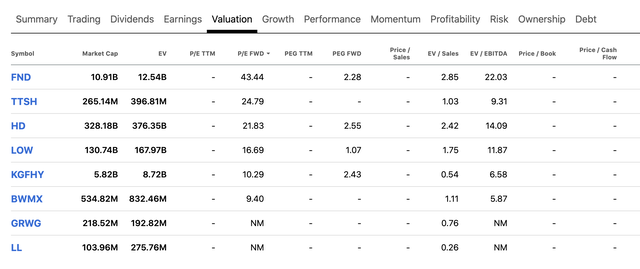

If we narrow down our peer group to the home improvement retail sector alone, HD’s shares still appear to be trading on the more expensive side of the scale.

We believe that based on both of these approaches, HD’s stock remains overvalued. While the macroeconomic environment has indeed improved and the firm has the lead in profitability in the industry, we believe that this level of premium is not justified.

Conclusion

HD’s stock has performed much better in the past quarters than we have expected. Its returns have been more or less in line with those of the broader market.

The firm has also remained resilient from a profitability point of view, and has also remained the leader in the industry, based on a several profitability metrics.

The improving macroeconomic environment may lead to top- and bottom-line growth in the coming quarters.

We believe that the firm remains overvalued, based both on its dividends and on a set of traditional price multiples.

We, however, upgrade the firm to a neutral rating, based on the improved macroeconomic indicators.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.