Summary:

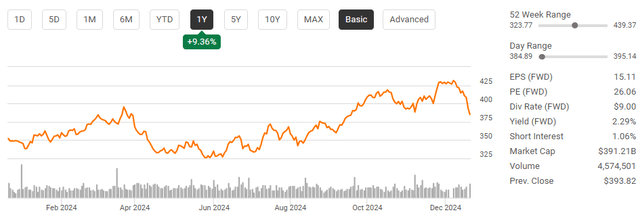

- The Home Depot’s valuation is becoming attractive as its share price declines, despite risks tied to the housing market and consumer spending trends.

- HD’s business could benefit from potential rate cuts and tax reductions, which may boost housing market activity and reduce corporate tax burdens.

- HD appears undervalued compared to peers like Walmart and Costco, offering a better valuation and a more enticing dividend yield.

- I am not a buyer yet, but HD is on my radar; I may start a position if shares decline to 18 times 2026 earnings.

Iryna Tolmachova/iStock Editorial via Getty Images

The stock market has been fueled by continuous innovations throughout the technology sector, from the internet to cloud computing and now innovations in artificial intelligence. The Home Depot (NYSE:HD) isn’t a technology company and isn’t necessarily on the verge of any innovative breakthroughs, but its business operations are becoming more exciting to me as the share price falls. Maybe the golden era of store expansion and stock splits from HD are a thing of the past, but HD has limited competition and is entering a macroeconomic environment that should be bullish for its operations. HD has maintained an effective tax rate of over 23% for the past decade, and it has over $48 billion in long-term debt on the balance sheet. Shares of HD recently reached their 2021 highs, and since the beginning of December, they have retraced by -12.37% ($54.35) after coming off a double beat with their Q3 earnings. If the downtrend continues, I would be very interested in starting a position in HD as the valuation will become extremely attractive, especially since I believe there are several business tailwinds that will drive revenue higher in 2025.

Risks to investing in The Home Depot

Just because I am paying more attention to HD after the recent retracement doesn’t mean that I will turn bullish or start a position in HD. Investors should consider the fact that HD’s business is tied to the housing market to some degree and trends in consumer spending. If we experience an economic turndown, it’s less likely that individuals will make capital improvements to their homes or mini-side projects, which could impact HD’s top and bottom line. If the Fed halts rate cuts for a while after increasing their 2025 and 2026 projected rates, it will prolong a recovery in the housing market. Inflation has increased from 2.4% to 2.6% in October and then to 2.7% in November. If inflation continues to increase, it could lead to increases in the cost of goods and services, which could put pressure on HD’s margins and revenue. There are several risk factors to consider before investing in HD, and investors should conduct their own due diligence.

Why I am getting interested in The Home Depot and think that 2025 could be a strong year for them

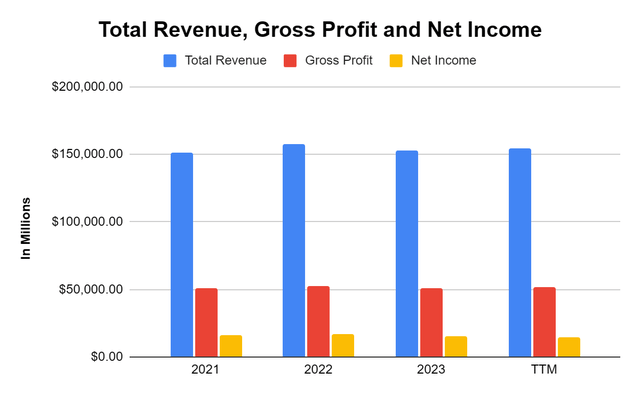

Prior to interest rates crossing over the 5% threshold, HD had its strongest year from both a revenue and profitability standpoint. In the 2022 fiscal year, HD generated $157.4 billion in revenue and $17.1 billion in net income. In 2023, revenue declined by -3.01% (-$4.73 billion) while their net income decreased by -11.47% (-$1.96 billion). On a YoY basis in 2023, HD’s gross profit margin declined by -0.15% while its net income margin declined by -0.95%. On a YTD basis in 2024, HD has generated $154.6 billion in revenue and $14.61 billion in net income. While HD’s revenue has increased on a YoY basis by $1.93 billion, its net income has declined by $533 million, and its profit margin fell by 0.47% to 9.45%. HD may not exceed its 2022 fiscal year for the second consecutive year, while many other companies, such as Nvidia Corporation (NVDA), are generating record revenue and profitability. Despite not growing, I think that the business landscape is setting up well for HD in 2025.

Steven Fiorillo, Seeking Alpha

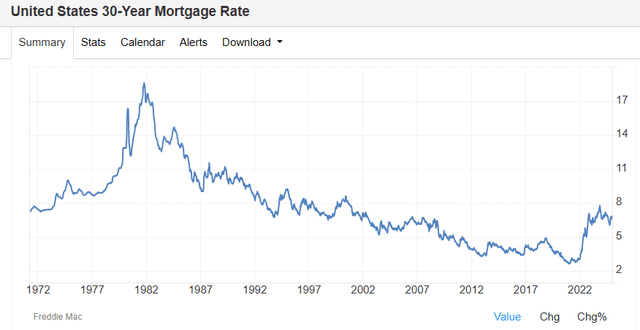

Mortgage applications declined by 0.7% from last week after increasing by 5.4% in the first week of December. The United States 30-year mortgage rate is hovering around 6.72%, and this is the highest consecutive level since the early 2000s. After rates fell to sub-3% in 2020, it’s been very difficult for homeowners to eliminate the golden handcuffs because selling their home and taking on new debt at almost 7% doesn’t make much sense. This is a problem for HD because the housing market is still in a restrictive landscape, as the cost of capital is prohibiting many Americans from either purchasing their first home or upgrading to a larger home. In addition to mortgages being around 7% when the cost of capital is higher, it also impacts the builders by increasing supply and current homeowners tapping their home equity lines of credit to make improvements on their existing homes. HD thrives in environments where all areas of the housing market are booming as their products are used to build new homes and renovate existing homes.

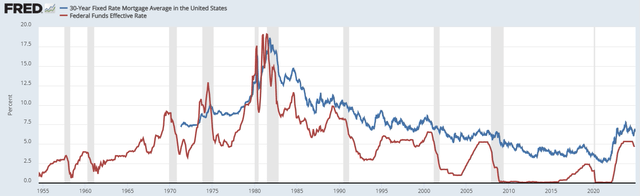

When I look at historical data for the Fed Funds Effective Rate compared to the 30-year fixed mortgage rate, there is a strong correlation between them. As the Fed lowers rates, borrowing costs on both sides decline, but even in minimal rate environments, 30-year mortgage rates have still primarily been above 3.5%. Realistically, the days of 3% mortgages are gone unless a black swan event occurs. I think it’s much more likely that 5.5% will be the new normal next year, and maybe we see rates go under 5% in 2026. The Fed revised their forward assessment to 3.9% in 2025 and 3.4% for the Fed Funds Rate in 2026 as they came out with a hawkish cut this week. While 5% isn’t 3%, it certainly makes mortgage payments more affordable than 7-8% mortgages. I think that we will see increased mortgage applications in the new year as the Fed takes rates lower.

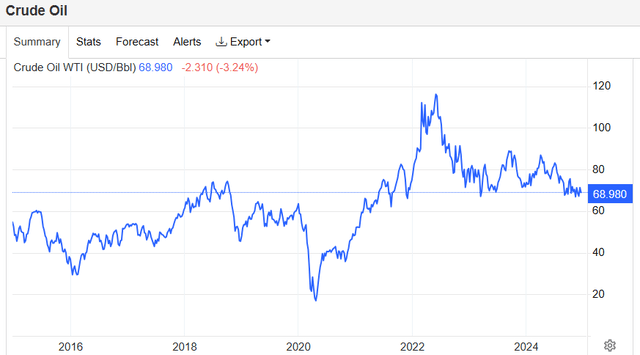

I think the Fed is being overly hawkish and that they will cut more than 2 times next year. One of the main drivers of inflation is commodity prices, and oil has been hovering around $70 per barrel for several months. Looking back at President Trump’s first term, oil spent a considerable amount of time under the $60 level prior to the pandemic when prices plummeted. When he took office, the U.S. produced 8.87 million bpd, which increased to 13 million by the time he left office. President Trump ran on deregulation and is a believer in increasing oil production to fight inflation, which I agree with. When there is more supply, demand is crushed, and prices are driven lower. When oil is lower, transportation costs decline, manufacturing input costs decline, fertilizer costs decline, and the rate of change declines. We just had 2 consecutive months of CPI prints expanding, but there is a strong possibility that we will see this level off in 2025 and start to decline again if oil production increases. I also believe that President Trump’s cabinet will apply pressure on the Fed to lower rates because right now, higher rates are a direct cause of inflation as it causes housing and rent prices to increase. When the cost of capital is higher, it restricts builders and increases financing costs for rental units. I think there is a scenario where we see lower oil prices lead to reduced inflation, which will allow the Fed to pivot to a more dovish stance and cut more than 2 times next year, which should positively impact the housing market and benefit HD tremendously.

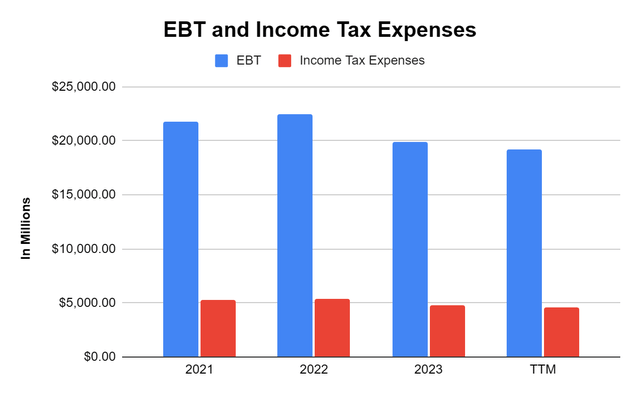

Over the past 4 years, HD has had an average effective tax rate of 24.05% as they have paid $20.05 billion in taxes on $83.34 billion on earnings before taxes. In the TTM HD has paid $4.59 billion in taxes. President Trump campaigned on lowering the corporate tax rate to 15%. If he gets this to pass, it would be bullish for HD as their tax bill in the TTM would have been lowered by -$1.71 billion. HD only has 993 million shares outstanding, so saving $1.71 billion in taxes would convert to an additional $1.72 in EPS, which drops right to the bottom line. If this is passed, it may not go into effect until 2026, but it would be extremely bullish because it would make the valuation more enticing.

Steven Fiorillo, Seeking Alpha

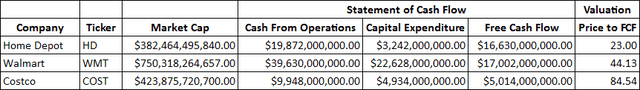

The Home Depot looks to trade at an attractive valuation with a modest dividend yield

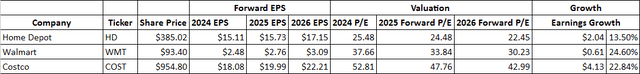

When I compare HD to Walmart (WMT) and Costco Wholesale (COST) it looks undervalued. HD is generating $16.63 billion in free cash flow (FCF) and trades at 23 times its FCF. WMT generates less than $500 million more in FCF at $17 billion and trades at 44.13 times its FCF, while COST is generating $5.01 billion in FCF and trades at 84.54 times its FCF. This valuation seems low compared to its big-box retail peers, and when I look at the forward EPS, it remains undervalued. HD is expected to generate $15.11 of EPS this year and trades at 25.48 times earnings and is expected to generate $17.15 of EPS in 2026 placing its forward P/E at 22.45 times. COST and WMT trade at 52.81 and 37.66 times this year’s earnings and 42.99 and 30.23 times 2026 earnings. HD is starting to look like a value play as the share price declines.

Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha

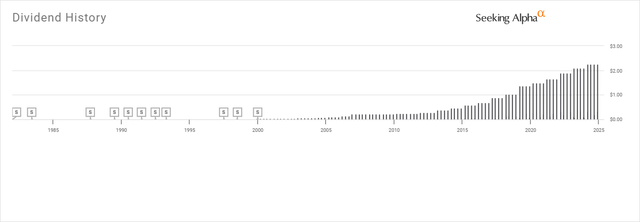

Shareholders are also getting rewarded with a dividend yield that has crossed over the 2% level with HD. Over the past 15 years HD has increased its dividend at a 5-year dividend growth rate of 10.59%. HD is paying a $9 dividend, which is a 60.4% payout ratio compared to its earnings. WMT has a dividend yield of 0.89%, while COST has a dividend yield of 0.48%. There is more than enough room for HD to continue increasing the dividend, but if corporate taxes get lowered to 15%, it could increase the growth rate HD is able to grow the dividend. When I compare HD to COST and WMT, I see that it is trading at a better valuation with a more enticing dividend.

Conclusion

I am not a buyer of HD at this time, but it is now on my radar, and if shares continue to decline, I will be starting a position. I think we could see shares continue to sell off into the beginning of 2025 as the Fed came out with a hawkish cut, which has put unwanted pressure on mortgage rates. HD’s valuation continues to become more attractive as shares retrace, and if the market is overreacting to the recent Fed conference, then HD could be a candidate for a rebound in the coming months. For HD to get back to growth and exceed its 2022 fiscal year it needs rates to decline, so the housing market becomes unlocked. I think that over the next 2-years, we could see HD benefit from mortgage rates declining, which allows more activity in the housing market and more renovations to occur as it will be cheaper for homeowners to tap their home equity lines. I also believe that there is a strong chance that President Trump will lower corporate tax rates, and if he does, HD stands to benefit as it has been paying an average effective tax rate of 24.05% over the past 4 years. HD could see an additional $1.72 generated from a tax decrease to 15%, which would supercharge their forward earnings valuation. As of now, HD looks interesting as it trades at 23 times FCF and 22.45 times 2026 earnings. If shares continue to decline, I would get bullish around 18 times 2026 earnings, which is a share price of $308.62.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.