Summary:

- Hopes that Brian Niccol can bring about the kind of success he had at Chipotle (CMG) are sanguine.

- Most of the tactics Niccol used at CMG cannot be replicated at SBUX or are already being used there.

- Niccol takes the helm amid a bad consumer macro environment and greater competitive demands.

- The big unknown is how Niccol will manage China. But we prefer he keep his focus on the domestic unit until it is returned to strong health and AUV growth.

- SBUX is a marginal “hold” on the possible China expansion, and Niccol restoring SSS and AUV to growth, but overall, we don’t expect much growth from merely naming Niccol Chair/CEO.

jetcityimage/iStock Editorial via Getty Images

NEW YORK (August 21) – The surprise ouster of Starbucks’ (NASDAQ:SBUX) CEO Laxman Narasimhan, and his replacement with Chipotle’s (CMG) CEO Brian Niccol, boosted the share price to levels not seen since February. Those hopes assume Niccol can effect the same kind of turnaround he led at the burrito chain. We are skeptical about his ability to do so. We think the markets are sanguine; displaying some, of what Alan Greenspan used to call, “irrational exuberance”.

OUSTER AND REPLACEMENT

SBUX had been under pressure for some time, with the turning point coming with the 2024 Q1 earnings call on April 30th. There, Rachel Ruggeri, the SBUX CFO, downgraded nearly all of the 2024 outlook, to reflect the disappointing first quarter.

According to the Financial Times, the 2024 Q1 results set off a chain of events whereby the SBUX board and key investors, including the guys at “suffer no fools” Elliott Management, moved rapidly to oust Narasimhan, apparently supported by SBUX branding pioneer, Howard Schultz. According to the FT, the board’s move to install CMG’s Niccol was surreptitious, with not even Elliott Management being given a heads-up about the board’s plans. Niccol had been a prospective CEO hire for SBUX earlier, but had not been available when the board had been looking.

The question for investors is: can Niccol replicate his CMG success with the coffee slinger? We think those hopes are sanguine, but not out of the question.

Why We Think Niccol Will Likely Fail

I know CMG very well. My very first article for SA was in the immediate aftermath of the Christmastime Norovirus outbreak at Boston College in 2015. I followed the company very closely until Steve Ells, the founder, and his executive team finally left. I had called for their ouster, including most of the board, less than two years after the Boston College debacle, after their continued missteps. I felt strongly that the CMG senior management could no longer be tolerated at the helm of a publicly traded, national, restaurant chain.

I stopped following CMG so closely, once Niccol, an experienced hospitality executive from YUM’s “Taco Bell” chain, took the helm and the Steve Ells’ management team were replaced. I felt the chain was in good hands, and, frankly, I lost interest.

Brian Niccol: “Past Performance is No Indication of Future Success”

That lawyerly prospectus warning should be stapled to the resume of every CEO, both those who have been fired (Lee Iacocca & Mike Bloomberg come to mind) and those who succeed.

Niccol turned CMG into an SSS and AUV powerhouse, but here are four things Niccol did, that enhanced CMG’s stock price that he may not be able to replicate at SBUX and why he likely cannot do them.

1. Niccol Replaced the CMG Founder’s Management Team

The New England Patriots went from a Fifth Place finish (5-11) in 2000 in the AFC, to First Place (11-5) in 2001 because an unknown, sixth-round draft pick quarterback (No. 199 in the draft) replaced Round 1 draft pick Drew Bledsoe at quarterback after an injury in Game 2 of the 2000-2001 season. The little known replacement was named Tom Brady, now considered to be the GOAT.

Niccol is a talented executive; no doubt. But, like Tom Brady, he caught a really lucky break replacing the CMG founder’s management, which had fared poorly managing multiple food safety crises. It made him look exceptionally good by comparison.

Some of the things Niccol did were “no-brainer” steps that anyone with a food safety certificate – let alone a nationally recognized food safety expert on staff, as he had – would have done. (In fact, some of the things Niccol did were things we recommended early on in our multiple SA articles during the Ells reign at CMG.)

SBUX has gone through an array of CEOs in the last several years. It’s doubtful any of them were performing as poorly as the CMG founder was. And while Niccol also asked for, and received, the title of Chair at SBUX, in addition to CEO, it’s doubtful that SBUX branding genius Howard Schultz will remain quiet if he sees a failure by Niccol.

2. Niccol Boosted Prices

For my money, your neighborhood burrito slinger is miles above the CMG offerings. A truly Mexican restaurant just a few doors down from the CMG near Boston College that triggered the 2015 Norovirus outbreak was far better – both cheaper and with more generous with its servings of meat proteins – than the “rice bomb” burrito that is the typical CMG offering.

I live and work in Manhattan. I can think of at least three Mexican restaurants within a 10-minute walk that are better than CMG’s; they’re cheaper, too.

But somehow, CMG seems to have a loyal following that allows them highly elastic pricing; it’s stunning, given the quality of the faux “Mexican” offerings. The company reports a staggeringly high 17%+ operating margin! Niccol is unlikely to have that much price elasticity.

First, SBUX may be at the upper limit of price elasticity, limiting Niccol’s ability to raise prices and increase AUV. A cup of Starbucks has always been at least double or triple the price of “coffee cart coffee” that us “Boomers” came to be accustomed to, before Starbucks came on the scene. It’s doubtful that Starbucks will have much price elasticity beyond, perhaps, a 500 bps price increase beyond inflation.

Second, SBUX now has plenty of local, standalone and small chain coffee purveyors in urban areas, many of which are superior. Those offerings are competitively priced with SBUX outlets. Additionally, if SBUX pricing goes much above a 500 bps increase, it could run into more serious competition in the super-premium lane from Nestle-backed Blue Bottle Coffee cafés, to say nothing of a growing legion of at-home and Blue Bottle amateur baristas who are office colleagues.

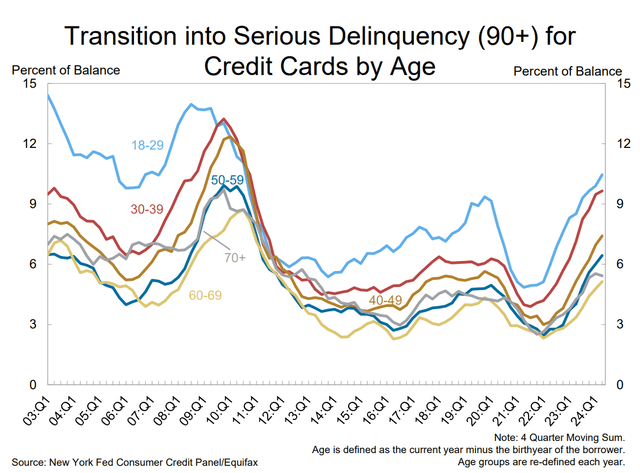

Finally, on a macro level, inflation has rocked the finances of most workers and, as illustrated in this chart from the New York Federal Reserve, discretionary spending on things like Starbucks coffee would appear to be under growing pressure, given the level of serious delinquencies in consumer credit; the worst since the waning days of the Great Recession.

Serious (90+ Days) Credit Card Delinquency by Age (2024 Q2 NY Fed Report on Household Debt & Credit)

3. Niccol Sold More Burritos by Innovation

Mealtime comes and goes in the restaurant business. We’ve all passed by quick serve and casual dining restaurants with lines that were too long that we passed by. Niccol was able to move that line faster and also to create second make lines – “digital kitchens”, in CMG PR parlance – in most restaurants that serve app and delivery orders during the pandemic that later evolved to also handle “Chipotlanes” for drive-thru pick-ups. Those innovations reportedly added nearly a million dollars a year in restaurant AUVs.

SBUX claims somewhere between 87,000 and 170,000 different coffee combinations and a reported 250+ menu items, at least the last time the Wall Street Journal reported on it a decade ago. It’s doubtful Niccol can expedite SBUX service or productivity by much. SBUX already has pick-up apps and delivery. Drive-thru and delivery only locations are already in the works. With respect to delivery, it’s hard to imagine much further growth in that area, especially when Blue Bottle is training amateur baristas to make their double latte grandes at home and some larger companies are installing elaborate coffee stations as employee perks to draw staff back to the office.

4. Niccol Split CMG stock 50:1

CMG stock had grown outside the means of most retail investors to buy a block. The board’s decision in March to effect a 50:1 stock split – the biggest in NYSE history – increased its accessibility and enhanced liquidity, both of which enhanced demand and, thus, the stock price.

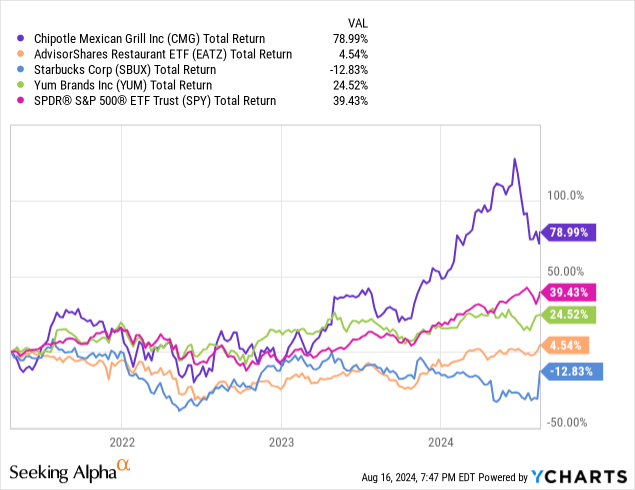

These two charts illustrate CMG percentage returns relative to competitors like EATZ and YUM, and the S&P 500 over the last 5 years, ending last week. SBUX is also included.

As you can see, CMG mostly outperformed its restaurant competitors, but not really excessively so until late 2023, when the chattering classes were all speculating about a stock split. (The Motley Fool alone had no less than three articles about an SBUX stock split in December 2023.) When it was finally approved in 2024, improved earnings and speculation about the split and boosted the stock well above its peers.

Sanguine Hopes a New CEO Can “Fix” SBUX

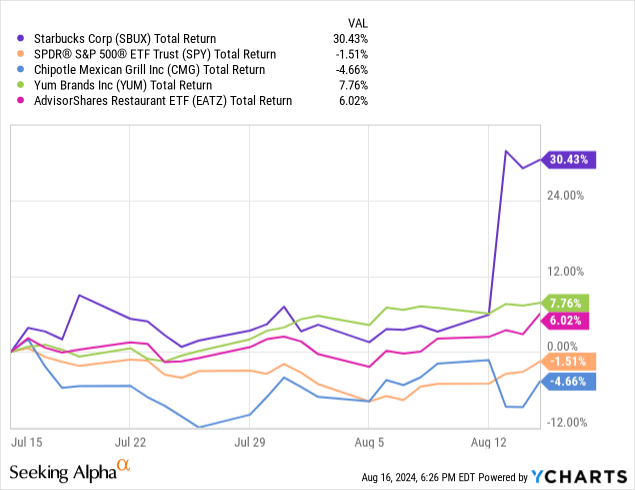

The charts below show what a significant change Niccol’s hiring, announced August 13, has had on its stock price.

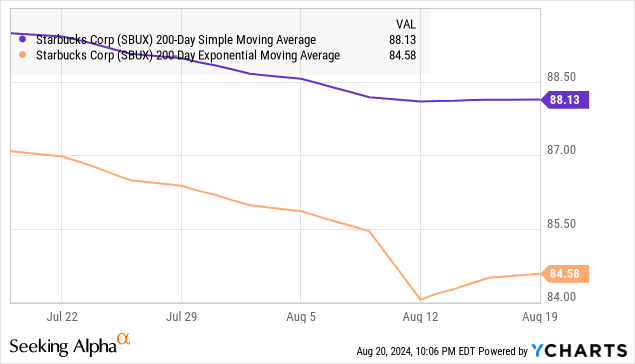

That is especially true with its exponential 200-day moving average, which reflects more recent events more than the simple average.

SUMMARY:

Our investment thesis is that markets are sanguine about Niccol being able to replicate his CMG success, for the reasons discussed above. We offer a “hold” evaluation at this point, because we have little basis to assess how Niccol will fare in Starbucks’ hope to expand in China, although we are not hopeful.

That said, we think there are a variety of things Niccol could do to improve SBUX revenues and operations. But, as with all our recommendations to companies we mention in our analysis (SEE: NOTE, below), our investment thesis for SBUX presumes our recommendations will not be adopted.

Things we would recommend are:

1. Dispensing “basic” drinks (like plain “coffee cart” coffee, which is my preference) in cafés by dispensing coffee cups from a vending machine and allowing customers to draw their own beverage from a coffee dispenser. Perhaps add other machines that allow additional customization with espresso shots, foamed milk, etc.

2. Do a broader market test of bubble tea or, perhaps, even consider acquiring or doing a joint venture with a bubble tea chain and grow it under a different brand name. We “boomers” are the biggest coffee drinkers, followed by the Millennials (i.e., those aged 25 to 40). Getting younger people – who are the biggest consumers of bubble tea – into the habit of ordering a morning beverage can only benefit Starbucks.

3. Dispense coffee (hot and cold brew) in cans, in vending machines. These machines are all over Japan, the third-largest coffee drinking nation in the world, in train stations, airports, shopping areas, filling stations, and the likes. (It will obviously take some time for Americans to adapt to the notion, a step Niccol’s marketing talents could aid.)

4. Much of SBUX hopes are pinned on growth in China, a hope we believe is likely misplaced. As Niccol has little experience there (Taco Bell was only in China since 2016; Niccol joined CMG in 2018 and CMG never operated there.), we think CMG should bring at least one – maybe two – native Chinese from the hospitality industry on to the SBUX board.

_____________________________________

NOTE:

Our commentaries most often tend to be event-driven and lean toward fundamental analysis, although we also consider technical analysis in our analysis if we deem it appropriate. They are mostly written from a public policy, economic, or political/geopolitical perspective. Some are written from a management consulting perspective for companies that we believe to be under-performing, and include strategies that we would recommend were the companies of our clients. Others discuss new management strategies we believe will fail. This approach lends special value to contrarian investors to uncover potential opportunities in companies that are otherwise in a downturn. (Opinions regarding such companies here, however, assume the company will not change or adopt our recommendations). If you like our perspective, please consider following us by clicking the “Follow” link above.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The views expressed, including the outcome of future events, are the opinions of this firm and its management only as of August 21, 2024, and will not be revised for events after this document was submitted to Seeking Alpha editors for publication. Statements herein do not represent, and should not be considered to be, investment advice. You should not use this article for that purpose. This article includes forward-looking statements as to future events that may or may not develop as the writer opines. Before making any investment decision you should consult your own investment, business, legal, tax, and financial advisers. We associate with principals of Technometrica, co-publishers of the TIPP Economic Optimism Index, on survey work in some elements of our business. Views expressed in this article are opinions of the author.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.