Summary:

- Airbnb stock has underperformed the market since its direct listing, despite very strong fundamentals.

- We believe the company has lost its way somewhat and ought to return to the business of deflation, not fee-farming.

- But the stock is priced as a value name, despite its growth-company numbers. We rate at Hold as a result.

imaginima

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

It’s About The Money, Stupid

Airbnb (NASDAQ:ABNB) at launch was to the hospitality industry as Ethernet was to the telecom industry. Cheap, chaotic, loved by customers and suppliers alike, in comparison to the turgid, expensive, guild-bound industry that came before it.

As a consequence, the company took off like a rocket. It hit problems soon after IPO as a result of COVID lockdowns, but wisely raised big money to tide them over, and has since sailed back to health including a very fat balance sheet. It has all the hallmarks of a software-eating-the-world winner. Right?

Er, no.

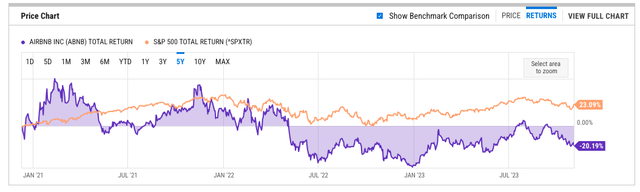

ABNB vs S&P 500 Total Return Since ABNB Direct Listing (YCharts.com)

As far as buy and hold goes, from the date of the direct listing you would have been better just to put your hard-earned in the S&P and go play golf instead.

Sure, the stock got off to a blazing start, but it has just lagged since late 2021 – and that’s exactly when lockdowns were easing and travel restrictions lifting and so you’d expect it to outperform.

Why hasn’t it?

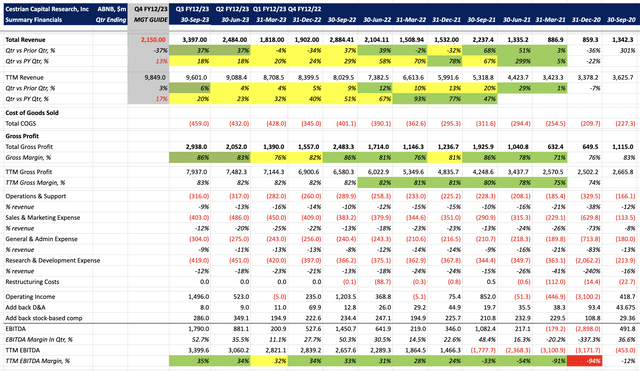

Well, the numbers are pretty good as it happens. The company continues to grow at 20% pa on a TTM basis, though the growth rate has been falling since, ever. Q3 delivered +18% vs the same quarter last year. Cash flow margins indicate the power the company has in its value chain – 40% unlevered pretax FCF on a TTM basis. That doesn’t look like the average S&P 500 component – it looks like a top player like Microsoft (MSFT), which has way outpaced the S&P 500 over the same period.

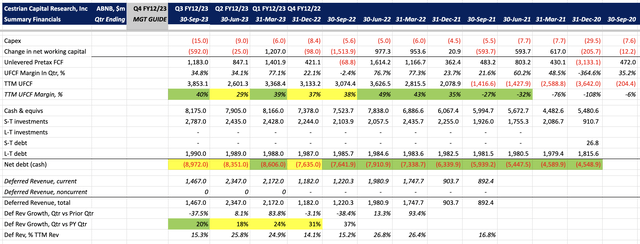

But the stock – a growth stock – is priced like a value stock. At the time of writing, the market is asking you to pay 16.8x TTM unlevered pretax free cash flow – that’s about three-quarters of what you’ll pay for an ex-growth tier-1 defense contractor and before you say “yes but buybacks and dividends,” ABNB is fair plowing money into buybacks, and it will take you a long time to recoup the valuation delta on the meager dividend yield that your Northrop Grummans or Lockheed Martins reluctantly dole out.

We post the numbers and the charts and all that below. The punchline is that we rate the stock at “Hold” on technicals and, frankly, on that cheap valuation. The company has its problems at the moment, as much feted in the press (not least by the “We Must Do Better” stuff that the CEO is walking around the Internet with). But it’s cheap and the chart looks good. And if you think that’s a dumb reason to want to own a stock, well, we ask you to consider Meta Platforms during The Great Metaverse Debacle when nobody wanted to buy the thing even though it was trading at 7.5x TTM unlevered pretax free cash flow and managed by a natural-born winner who would happily fire thousands by text message and toss his former corporate savior under the bus in the quest to win once more. We wrote that one up here.

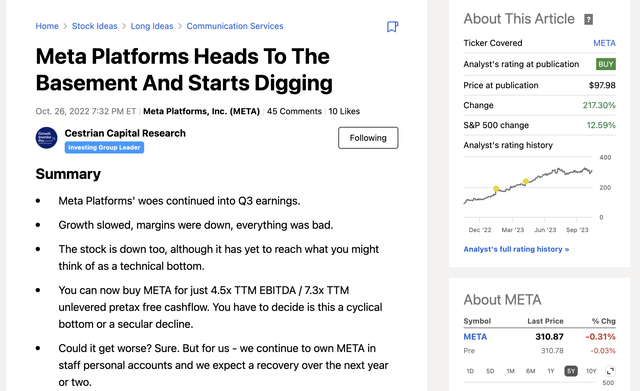

Meta Platforms Bottoms Out (Cestrian Capital Research, Seeking Alpha)

For what it’s worth, we think the reason Airbnb stock is struggling is that it has forgotten what it means to be an online deflator of ossified old industries. Which is to say you do actually have to deflate them. The experience can be worse, but it needs to be a lot cheaper. To go back to the telecom analogy, in the early days of Ethernet on the wide area network, would your average small company have preferred a dedicated leased line running IP over ATM and managed by Verizon? Sure they would. But then they would be giving Verizon a whole lot of money for the privilege. Like, all the money. So when folks came along offering high speed Ethernet, small companies bought this stuff like there was no tomorrow. More downtime than a T-3? Sure. No IBM-er type sales executive taking you to lunch? Absolutely. Anyone care? Nope. Why? Because it was good enough, and it was 10x cheaper.

And this, we believe is Airbnb’s problem. Today with the various fees and whatnots you’ll often pay hotel rates to stay in someone’s shepherd hut, except you have to clean up your own crumbs and probably the garden furniture tends a little more to the, shall we say, rustic, than you will find at your average Marriott. In some ways this is a mortgage market problem. If you’re paying actual money to service the mortgage on your beach house, as opposed to ZIRP-era mortgage rates, then, sure, you gotta recoup that somehow, and if it’s cleaning fees, so be it. Gotta eat, right? And this is passed on to customers. The trouble is that for the most part, hotel leverage is a whole lot cheaper than personal leverage, so the cost of money hasn’t hit the hotel industry nearly as much as the “I levered up and now I own four rental properties wow am I a real estate magnate now or what” Airbnb complex.

So, if Brian calls you and asks your advice for how they can do better? Our answer would be, deflate, always deflate. That’s how you win online. It’s always how you win online. That’s Silicon Valley’s gift to the world. Cram down prices, drive down quality, collect oodles of money, rinse and repeat. Once again – prices down, quality down, make price elasticity of demand work in your favor. Want to win using technology? Ride the cost curve – down. Simple.

And with that, numbers, valuation and chart follows. We rate the name at Hold and are long the stock in staff personal accounts.

Airbnb Fundamental Analysis

ABNB Fundamentals I (Company SEC filings, YCharts.com, Cestrian Analysis)

ABNB Fundamentals II (Company SEC Filings, YCharts.com, Cestrian Analysis)

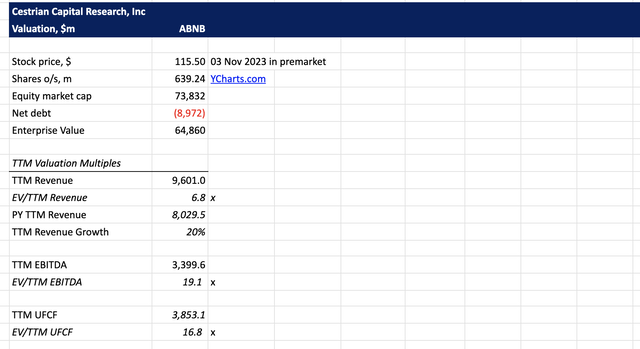

Airbnb Stock Valuation

ABNB Valuation Analysis (Company SEC reports, YCharts.com, Cestrian Analysis)

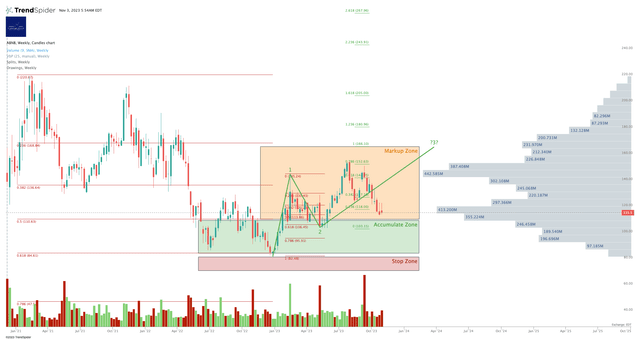

Airbnb Stock Technical Analysis

We rate the name at “Accumulate” between $82-110/share. There was a full year in which the stock could have been bought in that zone, and we wouldn’t be surprised to see the name lapse back into that area once more. Above $110/share we’re at Hold, and if the stock drops below $80 something bad is happening and you may want to think about what you’ve done and how you’ve spoiled things for your family.

ABNB Stock Chart (Cestrian Capital Research, Inc, TrendSpider)

Take a good look at the price x volume profile by the way – gray bars on the right hand side of the chart above. The clock starts at the direct listing in late 2020. It tells you that there’s a lot of unsold inventory up there in the $140s-150s/share, most likely retail casualties who were busy providing exit liquidity to bigs’ distribution requirements at those levels. And so if the stock moves up you can expect material resistance there, as relieved amateurs everywhere unload at cost or close thereto. Once the stock clears $155/share, if indeed it can do so, then the air above gets a lot thinner and the rate of ascent can increase accordingly.

Alex King, for Cestrian Capital Research, Inc – 3 November 2023.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives.

Business relationship disclosure: See disclaimer text at the top of this article.

Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, ABNB

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

GET INSTITUTIONAL GRADE BUYSIDE RESEARCH FROM CESTRIAN CAPITAL RESEARCH

We provide investment research prepared to institutional investor quality, presented in a way anyone can understand. Our work allows you to make sense of company fundamentals and stock technicals without resort to jargon or esoterica. We offer Free, Basic and Full membership tiers in our “Growth Investor Pro” service. Join us! Click HERE to learn more.