Summary:

- Apple’s stock is rising due to the announcement of Apple Intelligence, its new AI platform but capitalizing on the new technology will take time.

- Apple’s strengths include brand loyalty, innovation, and cash reserves for future growth, but challenges include AI integration and lagging competition.

- Management shows strong alignment with long-term goals, financial health is robust, but stock valuation appears overvalued due to high growth expectations.

- Initiation coverage with a hold given Apple the time it will take for Apple to capitalize on the new technology and overvaluation signals.

AleksandarNakic/E+ via Getty Images

Investment Thesis

Apple’s (NASDAQ:AAPL) stock has been on a tear after the announcement of Apple Intelligence, its new AI platform. I find that Apple presents an intriguing investment thesis for my “value with potential portfolio”. Its brand loyalty, history of innovation, and new AI platform, Apple Intelligence, position it for continued profitability and growth; however, in this research I will do a 360 review on the company and see if it’s aligned with my investment style.

Apple’s core strengths lie in its passionate user base and innovative spirit. The company’s loyal customer base and followers translates to consistent revenue and a launchpad for future adoption of AI-powered products. Additionally, Apple’s massive cash reserves fuel further innovation and strategic acquisitions.

I believe that Apple Intelligence holds the potential to significantly impact Apple’s future:

- Enhanced User Experience: Seamless AI integration can personalize experiences, leading to increased user engagement and potentially justifying premium pricing.

- New Revenue Streams: Ai could open doors to entirely new products or subscriptions services, like personalized advertising within the Apple ecosystem.

- iPhone upgrade boost: The need for newer devices to utilize AI features could trigger a significant iPhone upgrade cycle, driving immediate revenue growth.

While Apple excels at innovation, managing products costs to maintain healthy profit margins is crucial. Additionally, integrating AI features seamlessly with existing revenue streams like the App store will be key. Exploring new markets like healthcare or smart home automation with AI expertise presents exciting growth opportunities.

However, there are some challenges to consider:

- AI integration hurdles: seamless AI integration across various devices requires significant technical expertise. Potential roadblocks could dampen user enthusiasm.

- Fierce AI competition: Apple needs to stay ahead of the innovation curve in a fiercely competitive AI landscape.

- Overvalued stock: as you will read later, I find that the current price might already reflect a significant portion of the potential upside from AI.

In this article, I aim to find if AAPL is a solid candidate for my value with potential portfolio. To accomplish this, I will explore various factors like Management effectiveness, corporate strategy, and valuation metrics to determine if it’s aligned with this investment style.

Management Evaluation

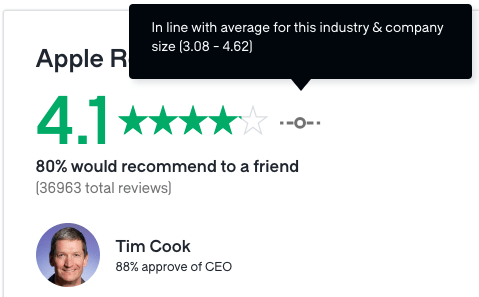

Tim Cook, Apple CEO, shows a high approval rating on Glassdoor. Cook has a long history with the company, having started in 1998, suggesting to me a strong alignment with the company’s long-term goals. I also believe his significant stock grant compensation, which I estimate at about 80% of his salary and vesting upon reaching company targets, further incentivize his focus on Apple’s success.

During the last earnings call, Cook highlighted the following key points for growth:

- AI integration: Cook sees Generative AI as a major opportunity across Apple products, which he later revealed at the WWDC Apple Annual conference with Apple Intelligence.

- Enterprise Market: Apple is actively targeting enterprise customers by promoting iPhones, iPads, Macs, and the new Vision Pro software.

- China Market: despite a recent iPhone sales dip, Cook remains optimistic about China’s long term potential.

I also find that he pointed two main challenges:

- iPhone sales: Cook acknowledged the need to improve iPhone sales outside of China.

- Global Competition: the smartphone market remains fiercely competitive.

Glassdoor Ratings

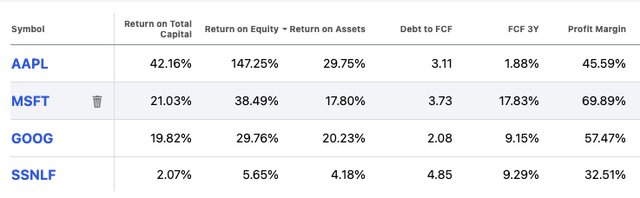

Luca Maestri, Apple CFO, has overseen a period of strong financial performance. Apple boasts a healthy balance sheet, with an impressive ROA of 29.75% – vs sector median of 1.82% and an ROE of 147% meaning that every dollar reinvested within the company generates another $1.47!

During the earnings call, he discussed maintaining shareholder value through dividends and buybacks. However, this is a continuous concern to me as FCF growth over the last 3 years has been flat, meaning Apple hasn’t released a product that could replicate the success of the iPhone and generate larger amounts of cash flow and every dollar that is paid out to shareholders is a dollar that is not reinvested for future growth projects.

Maestri also discussed the following Growth strategies:

- Services Focus are a major growth driver with double-digit growth.

- Emerging Markets: focus on India and Southeast Asia, where he mentioned that loyalty is high, and market share is growing.

For challenges, he discussed the following pointers:

- Balancing shareholder returns vs growth and finding the right balance

- Commodity cost fluctuations: raising memory prices pose a potential headwind to future margins.

- Foreign Exchange: a strong dollar can negatively impact reported revenue from international sales.

Overall, I find that AAPL leadership delivered a positive message on their growth plans and showed signs of innovation in their WWDC event. I find the company is financially sound and well positioned for the future. I have confidence in the management due to the combination of tenure with the company and experience in the industry and due to their success in the last years, I’m inclined to give management a “Exceeds Expectations”.

Corporate Strategy

I find that Apple’s current growth strategy hinges in two pillars:

- Premium hardware.

- Integrated services.

They leverage their strong brand loyalty to sell high-margin iPhones, Macs, and wearables. This strategy is fueled by continued focus on AI integration across devices to enhance user experience and potentially unlock new revenue streams like personalized advertising.

Looking forward, Apple is aiming to expand its services business, which already boost double-digit growth, and explore new markets like healthcare and smart home automation with AI. However, successfully balancing shareholder returns through dividends and buybacks with investments in these future endeavors is a key challenge they need to address.

Here is a table I created with key differentiators between AAPL and some companies in the industry offering similar services:

|

Apple |

Samsung (OTCPK:SSNLF) |

Microsoft (MSFT) |

Google (GOOG) |

|

|

Smartphones Global Market Share |

17.3% |

20.8% |

N/A |

Fractional but growing. |

|

Corporate Growth Strategy |

Focus on premium hardware & services integration, expanding into AI and wearables. |

Hardware dominance across smartphones, focus on the smart home market with TVs, appliances, expanding into foldable phones |

Cloud computing, productivity software, surface devices and gaming. |

Mobile-first strategy, Android OS, dominance diversifying into hardware with Pixel phones, and services to consumers, and small businesses, pending acquisition of HubSpot (HUBS) |

|

Advantages |

Strong brand, loyalty, premium design & user experience, closed system (software and hardware integration), high=profit margins |

Extensive hardware offerings, strong brand recognition in emerging markets, innovation in foldable phones and wearables. |

Established brand, strong enterprise presence, dominant PC operating system, Windows, and cloud services |

Powerful search engines and advertising platform (Android OS), diverse hardware portfolio (Pixel phones), freemium cloud platform. |

|

Disadvantages |

High product pricing, limited device customization, closed ecosystem can restrict user choice. |

Reliant on hardware sales, vulnerability to component shortages, quality control issues |

Reliant on PC market decline, challenges in mobile space, enterprise focused image. |

Reliant on advertising revenue, privacy concerns, fragmented Android ecosystem. |

Source: From companies’ website, presentations, Seeking Alpha, Bloomberg, Statista

Valuation

AAPL currently trades at around $227.57 The stock is up around 34% since its last reported earnings at the beginning of May and its hitting All-time highs. The stock is also up around 18.50% TR YTD, only slightly higher than the S&P 500 return of 17.90%

Now, to assess its value, I employed an 11% discount rate, this rate reflects the minimum return an investor expects to receive for their investments. Here, I am using a 5% risk-free rate, combined with the additional market risk premium for holding stocks versus risk-free investments, I’m using 6% for this risk premium. While this could be further refined, lower or higher, I’m using it as a starting point only to get a gauge using unbiased market expectations.

Then, using a simple 10-year two staged DCF model, I reversed the formula to solve for the high-growth rate, that is the growth in the first stage.

To achieve this, I assumed a terminal growth rate of 4% in the second stage. Predicting growth beyond a 10-year horizon is challenging, but in my experience, a 4% rate reflects a more sustainable long-term trajectory for mature companies that should be close to historical GDP growth. Again, these assumptions can be higher or lower, but from my experience I will use a 4% rate as a base case scenario due to the nature of their business. The formula used is:

$227.57 = (sum^10 EPS (1 + “X”) / 1+r)) + TV (sum^10 EPS (1+g) / (1+r)).

Solving for x = 21.5%.

This suggests that the market currently prices AAPL EPS to grow at 21.5%. According to Seeking Alpha, analyst consensus EPS over the next 3-5 years CAGR at 10.39%. This valuation looks very unrealistic, with the market expecting and demanding higher growth from Apple. Therefore, for me, it seems that AAPL is overvalued on a fundamental basis.

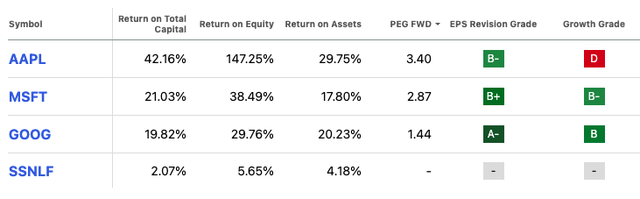

Further, I’ll also look at their forward price earnings to growth (PEG) ratio which sits at 3.40x -versus a sector median of 2.01x- implying the stock price is above the industry. However, when compared to a select group of companies, highlighted below, that are considered leaders in the industry, the company still looks overvalued given the higher growth expectations versus others in the industry.

However, I believe this overvaluation is somehow justified as AAPL is more capital efficient with higher ROA and ROE. However, I find AAPL right now at the crossroads of AI. While Apple is expected to integrate AI across devices with Apple Intelligence, the company seems to be lagging and competitors are already growing faster as shown on the above growth grades by Seeking Alpha.

The market is demanding similar growth from Apple but capitalizing on AI and driving significant phone upgrades to “AI iPhones” might take a few quarters. This lag creates a challenge: balancing shareholder returns with the investment needed to maintain their competitive edge in AI.

Technical Analysis

AAPL has been on a positive momentum since they last reported earnings and after their WWDC event. The stock has been hitting all-time highs ever since. However, the stock looks slightly overvalued by now, on a technical basis, with its 1-year average RSI in overbought territory at 68.5 and below its 14-day moving average of 69, indicating the stock price might be changing trends.

AAPL has formed a strong support level just below $210, and I will place the resistance level at its all-time high of $233.08. I believe the stock will move around this band, expecting results from the next earnings report on August 1.

Takeaway

Apple presents a compelling investment thesis with a strong brand, financial health, and promising AI platform. However, the current valuation appears stretched, and I believe the company will face an uphill challenge on capitalizing on AI quickly enough to meet market expectations. The recent stock run appears to be a catch-up to meet S&P 500 returns, so the stock is no longer undervalued and find it more in the fair valued to overvalued range for now. Therefore, I am inclined to start my coverage of AAPL with a hold, as I don’t believe it is aligned with my value with potential portfolio.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

My analysis specializes in identifying companies that are experiencing growth at a reasonable price or value companies with potential. Rating systems don't consider time horizons, risk profiles, or investment strategies. My articles aim to inform, not to make decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.