Summary:

- RBC analysts noted that luxury fashion buying is dwindling.

- Squeezed consumers are turning to sportswear.

- Earnings update and advice on when to buy Nike shares.

Robert Way

NIKE (NYSE:NKE) recently released its Q3 earnings report which beat analyst estimates. The company may be at the start of favorable headwinds as consumers shy away from luxury fashion.

Nike tops analyst estimates for Q3 earnings

Sportswear giant Nike released its Q3 earnings report this week. The company announced earnings per share of $0.79 per share, with analysts expecting around $0.52 per share. The figure was still lower than last year’s $0.87 per share for the same quarter.

Nike CEO John Donahoe said the company delivered a “strong quarter in Q3, with revenue growth of 14%,” and he also noted growth in all geographic sectors.

“We had strong digital growth of 24%, which once again was fueled by double-digit increases in traffic on mobile and our apps. While Direct, led by digital, remains strong and will continue to drive our growth, our wholesale channel continues to be an important part of our strategy,” he added.

Nike could see a boost in sales from the recent March Madness college basketball tournament and the April 5 launch of the Ben Affleck film “Air,” which tells the story of the company’s deal with Michael Jordan.

Analysts see a slowdown in luxury goods sales

The key to the investment thesis for Nike is a trend toward slowing sales in luxury goods. As inflation has soared in the developed world, consumers are likely feeling the strain and are turning toward the sportswear sector.

Analysts at RBC said that website traffic trends at sportswear firms was “buoyant”, with Puma seeing 58% growth in February compared to last year. Nike and Adidas were also up around 25% compared to February 2022.

RBC placed an “outperform,” rating on Nike with analysts noting its strong brand and a potential for margin recovery.

The Mortgage Bankers Association recently reported that monthly payments had hit $2,060 in the U.S.- the highest in the 14 years that the group has collected the data. The trend in developed countries has been an intense squeeze on spending with rising energy costs, food prices, and house payments. This could continue to spur improved spending on brands such as Nike.

According to Seeking Alpha data, Nike has 16 Strong Buy ratings, 9 Buys, and 13 Holds among Wall Street analysts with no Sell ratings.

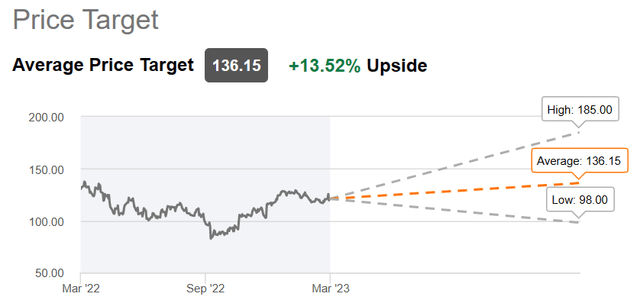

NKE Price Targets (Seeking Alpha)

Analysts currently have an average price target of $136.15 marking a 13.5% upside from the current price.

Margins are still a problem for Nike

RBC noted that it expects margin recovery to improve at Nike faster than analysts expect. This is a key headwind to the long thesis on Nike and why I would urge patience in acquiring the stock.

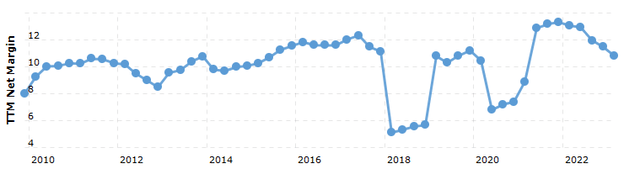

NKE Net Margins (Macro Trends)

Nike has seen its gross and net margins collapse from the onset of the Ukraine conflict. However, the numbers have retreated from 10-year highs and if investors believe that inflation is turning a corner then Nike can recover.

The outlook could be good for Nike as part of the weight on recent profits has been from China. Nike saw its inventory rise 16% compared with the year ago quarter and put that down to higher input costs and freight expenses.

During this week’s earnings call, management said they are “increasingly confident” Nike will secure stronger inventory levels by the end of the fiscal year. They also predicted “even leaner inventory” than previously expected due to sales trends.

Nike’s CEO also cited the growing trend toward fitness in China.

“The fundamentals of this market are good, right? It is a very large market that’s growing. Sport and wellness is a key trend and tailwind there. There’s a desire for innovation and style. And the key to winning in this market is simply put: having great innovation and connecting with Chinese consumers in a locally relevant way”.

Nike could take further ground from Adidas

If Nike has a few issues to resolve then the task is easier than at German rival Adidas. The company has recently parted ways with singer Beyonce as the company tries to deal with a huge $1.3bn inventory of unsold Kanye West sneakers. Adidas ended its relationship with the rapper after some controversial statements but the firm’s stock was hammered after announcing the footwear backlog.

The Hollywood Reporter said that “major creative differences” were the issue, however, there may be a link to West and his relationship with Beyonce’s husband Shawn Carter. Despite that, reports said that the brand was not selling well with the Wall Street Journal reporting that the Beyonce and Adidas Ivy Park label brought in $40 million projected revenue was set around the $250 million mark.

Adidas CEO Bjorn Gulden said earlier this month that the brand had received offers for the Yeezy footwear. “Since I started here, I probably got 500 different business proposals for people who would like to buy the inventory. But again, that will not necessarily be the right thing to do.”

That seems a strange statement from a company that has tried to cut ties completely with the inspiration for the shoes. It’s possible that the company were given offers below market value but it highlights the predicament at Adidas which will now suffer from lower investor confidence and the Beyonce episode may be a sign that artists are growing wary of the brand in the same way that investors are questioning the decision-making. Nike could benefit from the recent negative sentiment at one of its key rivals.

Valuation urges caution in Nike

The purpose of this article was to offer a diversification option for investors. My immediate thoughts are that Nike has some weight on its valuation when margins are in freefall.

The company is currently valued at 33.92x earnings and gets an F rating from Seeking Alpha on its valuation. The sector median is around 11x and I would prefer to buy Nike stock at a lower price level.

I would look for Nike to retreat toward the $100 level on current trends and with a 1% dividend yield, investors can get access to a company that will benefit from the changing tide in luxury fashion and a China reopening.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.