Summary:

- Today, we will walk through an investing framework that underpinned my purchase of Airbnb in late 2022 and early 2023.

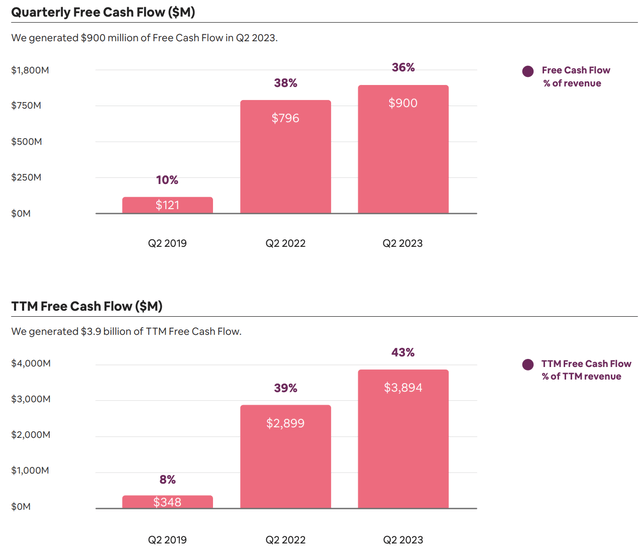

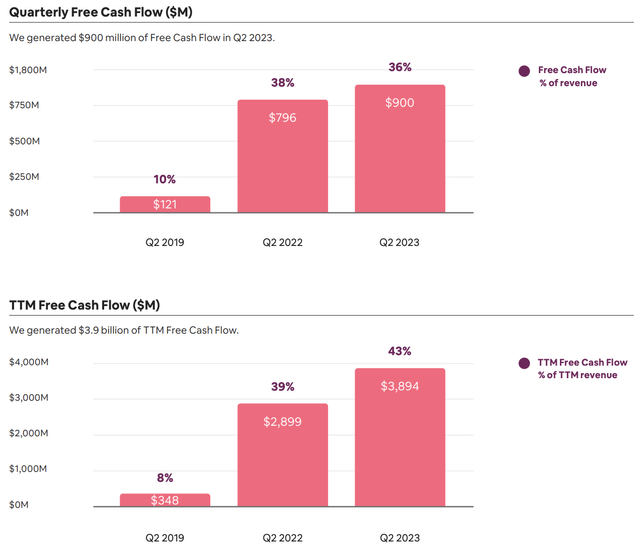

- With 43% free cash flow margins and $3.9B in TTM free cash flow generation, I believe Airbnb’s profitability reflects its differentiation, which is a key component of this framework.

- Surprisingly, there appears to be a very long runway for growth globally still ahead of Airbnb.

- With healthy growth, robust free cash flow, a long runway for growth, and a sustained share repurchase program, Airbnb will likely produce solid returns for investors for years and decades to come.

Martin Puddy/DigitalVision via Getty Images

Airbnb’s Differentiated, Competitively Advantaged Platform Produces Massive Cash Flow

Airbnb Q2 2023 Shareholder Letter

Exploring Airbnb Through The Lens Of The Inverse Bubble Framework

In early 2023, after years of waiting to buy Airbnb (NASDAQ:ABNB) (valuation concerns), I finally purchased my first shares ~$88/share, and I’ve been highlighting it ever since.

In our recent review of MercadoLibre (MELI), I shared one of my foundational philosophies for investment: Inverse Bubbles framework. In short, an Inverse Bubble is a market with substantial competition, fragmentation in various ways, low product differentiation, and, importantly, consumer spend that is waiting to shift to the next generation of products that will provide a better consumer experience/more consumer surplus.

To elaborate the concept of Inverse Bubbles, I detailed the idea that I buy companies that have created materially better products within industries (read: Inverse Bubbles) that already exist. In these industries, there’s substantial competition, fragmentation in various ways, low product differentiation, and, importantly, consumer spend that’s waiting to shift to the next generation of products, creating an opening for our companies’ materially better products to capture market share.

On one of my recent podcasts, in which I discussed my thesis for Airbnb, I shared an investment that Mr. Peter Lynch detailed for us in One Up On Wall Street that went by the name of La Quinta Inn.

Mr. Lynch’s La Quinta Inn investment represented the quintessential “Inverse Bubble” investment, which, as an aside, is a concept you won’t find anywhere else (I share because Googling it won’t yield results).

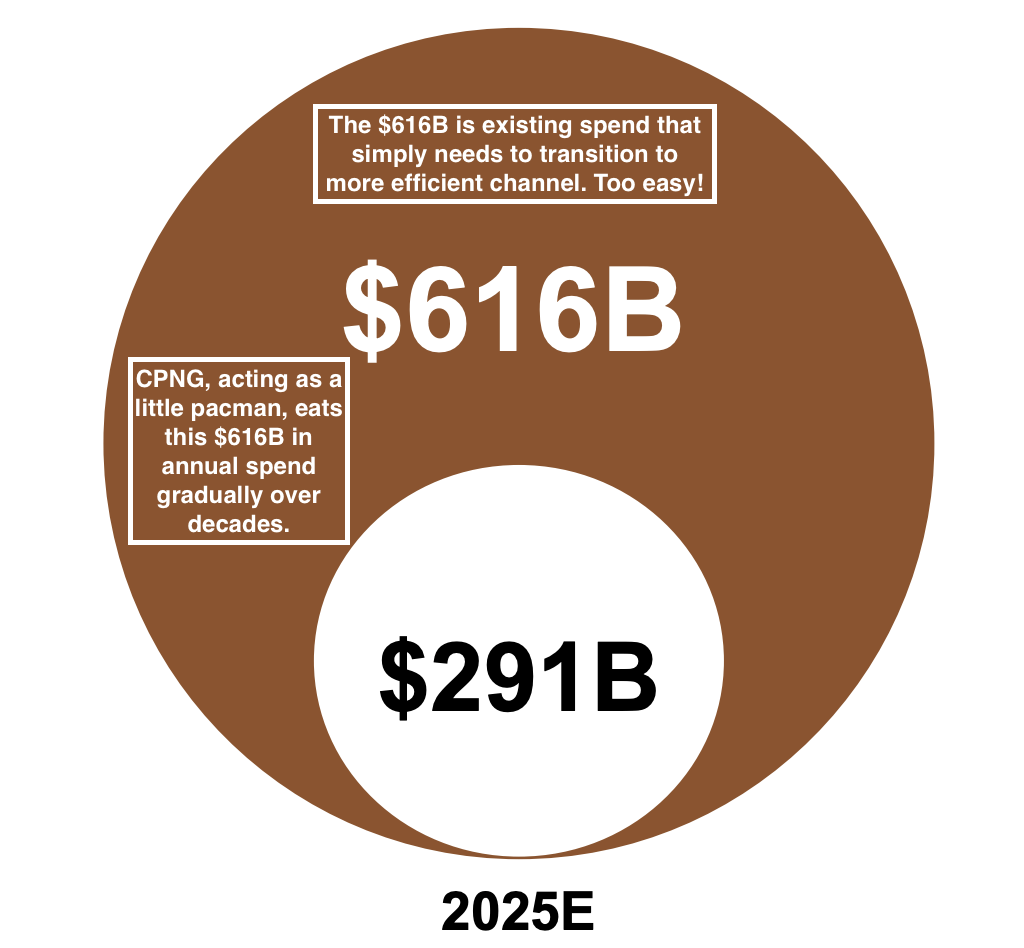

To aid in your understanding of this investment framework, below, I shared a chart of Coupang (CPNG) consuming market share within its specific “Inverse Bubble.”

Instead of $616B in “products spend in the Korean economy,” we could substitute “hotel spend in the Korean economy,” for the purposes of this example.

And, instead of “CPNG,” acting as a little Pac-Man eating the $616B in spend gradually over the course of a couple decades, we could substitute “La Quinta Inn” gradually consuming market share over the course of a couple decades, for the purposes of this example.

Coupang’s Inverse Bubble

Coupang Investor Presentation

In the case of Coupang, the business has rapidly consumed commerce market share in Korea because it operates a highly differentiated, vertically integrated, largely autonomous commerce engine/platform.

This creates consumer surplus that attracts dollars away from traditional commerce engines/platforms (for instance, legacy e-commerce platforms whose infrastructure may not be as competitive, physical retail/department stores, grocery stores, or convenience stores).

Because Coupang offers a differentiated, materially better consumer experience, it gradually eats away at the total addressable market [TAM], which is also populated by the above-mentioned legacy commerce engines/platforms, over the course of decades.

Similarly, La Quinta Inn offered a differentiated, materially better consumer experience via which it gradually ate away at the hotel TAM in the U.S. over the course of a couple decades.

Notably, and as something of an aside, in the 2020s, we’re sort of just replaying what happened in the 1980s, and what Mr. Lynch invested in the 1980s (Mr. Lynch also made Taco Bell his largest weighted position, and I have done the same on and off over the last half decade). From our successful investments in Coupang to Chipotle to Airbnb, we’ve often stood on the shoulders of giants, with Mr. Lynch being fore among those shoulders.

By now, you’ve likely drawn the parallels between Airbnb and La Quinta Inn: Both fielded a differentiated, materially better product into a highly competitive, fragmented, low differentiation, existing market and gradually ate market share.

To close out this introductory section, here’s a chart to help summarize all of the above-presented ideas:

| Industry/TAM | Incumbents | Differentiated New Entrant |

| Hotels | The entire hotel industry | (ABNB) |

| Hotels | The hotel industry, specifically legacy hotels designed in the mid-20th century | La Quinta Inn |

| Commerce | Mom & pop grocers/Department Stores | (WMT) |

| Commerce | Physical commerce platforms, e.g., retail stores/convenience stores | (CPNG) |

This process of industry formation (and the aggregation of spend associated with this industry formation) and reconstitution is ubiquitous in reality: It’s not just a stock market/business phenomenon; instead, it’s a pervasive facet of our reality.

From our universe to our biological cells, the process of life, death, and rebirth repeats ad infinitum and understanding this process can allow us to create exceptional returns in investing.

Ensuring Sound Quantitative Investing Alongside The Inverse Bubble Framework

Of course, this is one manner in which to invest, and, to be sure, there’s risk associated in this style of investing, as is the case for all styles of investing. We’re betting on businesses that are often less than 20 years old, and that carries risk.

However, as I often note, my work is one part qualitative, bordering on philosophical analysis and one part very much quantitative analysis (I, for instance, have invented a proprietary valuation model.).

In this vein, each of the businesses that I own, which are, in some sense, the latest versions of La Quinta Inn or Walmart, are insanely well capitalized.

I mean our businesses have almost preposterous amounts of cash on their balance sheets.

In the case of Airbnb, the same could be said: It has a truly giant cash hoard of $10.6B that dwarfs its ~$2B in convertible notes.

Airbnb Q2 2023 Shareholder Letter

Further, as I shared as an introduction to this note, Airbnb generates immense free cash flow via its 43% free cash flow margin.

Net income was $650 million, representing a net income margin of 26%, our highest second quarter ever. And free cash flow for the quarter was $900 million, up 13% year-over-year. In fact, on a trailing 12-month basis, our free cash flow was $3.9 billion.

And this represented a trailing 12-month free cash flow margin of 43%. And because of our strong cash flow and balance sheet, we were able to repurchase $2.5 billion of our stock in the last 12 months, which has more than offset the impact of shared dilution.

Turning To Airbnb’s Core Business And Recent Report

As I mentioned in the bullets, the Airbnb call was packed with gems that will further enhance your understanding of what makes Airbnb unique and why it’s up over 70% from my aforementioned original entry point.

In the previous section, I detailed the concept of Inverse Bubbles, and I specifically (and coincidentally) used one of Airbnb’s predecessors: La Quinta Inn.

One of the selling points for La Quinta vs. its incumbent competitors was its price differentiation.

The concept was simple. La Quinta offered rooms of Holiday Inn quality, but at a lower price. The room was the same size as a Holiday Inn room, the bed was just as firm (there are bed consultants to the motel industry who figure these things out), the bathrooms were just as nice, the pool was just as nice, yet the rates were 30 percent less. How was that possible? I wanted to know. Biegler went on to explain. La Quinta had eliminated the wedding area, the conference rooms, the large reception area, the kitchen area, and the restaurant—all excess space that contributed nothing to the profits but added substantially to the costs. La Quinta’s idea was to install a Denny’s or some similar 24-hour place next door to every one of its motels. La Quinta didn’t even have to own the Denny’s. Somebody else could worry about the food. Holiday Inn isn’t famous for its cuisine, so it’s not as if La Quinta was giving up a major selling point. Right here, La Quinta avoided a big capital investment and sidestepped some big trouble.

On Airbnb’s call, management cited price differentiation many times. To wit:

I also just want to point out one thing, which is our prices are essentially flat year by year.

I think they’re about 1% up year-over-year, but in North America, our prices are now down 1%. Now, when you take out mixed shifts, because people are booking larger homes, our prices in North America are actually down 4%. And if you compare it to hotels, depending upon which data you take, hotels are up some between 4% or as much as 10%.

And it seems like hotels are suggesting, based on some of the public remarks, that they aren’t going to come down. In fact, those prices might come up. So to answer your question, I think people come to Airbnb for one of the kindspaces at great value. And if we can keep prices very affordable, and then also focus on reliability, I think there’s going to be a lot of demand to come.

Brian Chesky, CEO, Q2 2023 Airbnb Earnings Call

Later on the call, Airbnb’s CFO remarked,

So that just shows you the desire for people to have great value. In North America specifically, what we saw was it was down 1% year-of-year, but like for like, so that means the same property on average, excluding mix of size, location, and type was actually down 4%. So on a like for like basis our ADRs in North America is actually down 4%. And that’s very different than what we’re seeing the hotel industry kind of touting increases of six to 10% or more. So that’s where the gap in value continues to widen.

Dave Stephenson, CEO, Q2 2023 Airbnb Earnings Call

And, despite generating over $9B in 43% free cash flow margin sales after just about a decade since finding product market fit, it’s likely that Airbnb’s materially better value proposition still has room to grow and will continue to consume market share within the giant hotel TAM.

That being said, in the long run, Airbnb started as an affordable alternative to hotels. And I think that we always have to remember that for every dollar people spend on Airbnb, they spend as much as many as $10 in the world on hotels. So we’re still a very small player in a very large market.

Brian Chesky, CEO, Q2 2023 Airbnb Earnings Call

We can see evidence of this claim, which suggests Airbnb could sustain elevated growth rates for decades to come, in Airbnb’s supply growth statistics.

Growth in the supply of homes on the Airbnb platform has actually accelerated in the past few quarters.

In Q2, supply growth is 19% year-over-year, and this is actually up from 18% in Q1. In fact, in every quarter since we’ve gone public, we’ve seen an acceleration in total active listings growth. And we’re continuing to see strong supply growth across all regions, all market types, and all price points.

Brian Chesky, CEO, Q2 2023 Airbnb Earnings Call

At the end of the day, the total TAM for Airbnb is defined by “total accommodation nights,” and Airbnb continues to consume market share within its Inverse Bubble.

And all the work that we’re doing to make sure that we’re providing great value and even either moderating or having prices come down just gives us greater value relative to alternatives, which I think is the tailwind on why we’re continuing to, by all of our estimates, gain share of total accommodation nights, both quarter-over-quarter and year-over-year.

Dave Stephenson, CEO, Q2 2023 Airbnb Earnings Call

Accelerating The Flywheel

The aforementioned expansion of supply fuels the network effects (defined by the flywheel I’ve described to you in the past; which I shared just below) that Airbnb enjoys.

In my most recent note on Airbnb, I described Airbnb’s network effects (underpinned by the aforementioned flywheel) as follow,

Network Effects moat: Airbnb has robust network effects that are also reinforced by Airbnb’s brand moat. That is, because I associate travel with Airbnb, I use the Airbnb platform to search for places to stay. Because I use the Airbnb platform to search for places to stay, hosts use the platform to list their places to stay. Because hosts use the platform to list their places to stay, I use the platform. Because this cycle repeats consistently, I continue to associate Airbnb with travel, and, as such, my identity association with Airbnb continues to build. “I, Louis, start my travel journey on Airbnb. That’s just who I am.” Notwithstanding the divorce rate in the U.S., humans generally tend to dislike change. They “become set in their ways.” This natural human tendency is the ally of the high character business and associated consistent product.

Importantly, supply growth is a necessary component of this flywheel, which is part and parcel of Airbnb’s network effects, serving to accelerate its spin and thereby further strengthen network effects.

In Q2, supply growth is 19% year-over-year, and this is actually up from 18% in Q1. In fact, in every quarter since we’ve gone public, we’ve seen an acceleration in total active listings growth. And we’re continuing to see strong supply growth across all regions, all market types, and all price points.

In fact, we added a record number of new listings in Q2, and we ended the quarter with more than 7 million total active listings. Second, we’re perfecting our core service. We want people to love our service, and that means obsessing over every detail. Millions of people have given us feedback on how to improve Airbnb. We’ve listened. On May 3rd, we introduced over 50 new features and upgrades as part of our 2023 summer release.

Brian Chesky, CEO, Q2 2023 Airbnb Earnings Call

I believe this sustained supply growth indicates that more and more consumers are choosing Airbnb as effectively the “Google” (GOOGL) (GOOG) of their travel experience. That is, they start with Airbnb and only leave if there is not enough supply.

As a loyal customer of the brand, I’ve noticed over the years that supply has been Airbnb’s central issue, so it makes sense to me that supply would continue to pour onto the platform, which has likely served to reinforce the network effects described above.

And, of course, these network effects will continue to enable Airbnb to consume more and more market share within its Inverse Bubble.

I just want to say one thing about the Core, which is that the hotel industry is more than about 10 times the size of Airbnb. And I think that almost anyone that stays in a hotel could consider staying in an Airbnb. I mean, the spaces are one of a kind…

So I think there’s a lot more runway just in the core business. I think we’re only scratching the surface, and that’s partly why we are so focused on perfecting our core.

Brian Chesky, CEO, Q2 2023 Airbnb Earnings Call

Brand Moat

In our most recent review of Airbnb, I argued that its brand moat was a key pillar of the investment thesis.

I believe the most clear indication that Airbnb has a brand moat can be seen in its profitability, which is actually quite astonishing, to the extent that I think it’s surprised even the most bullish Airbnb investors over the last 12 months.

And then in terms of profitability, I’m just really proud of our continued progress of increasing our overall margins over time. We made some hard choices in the midst of COVID to reduce our fixed costs, get back to the core, and focus on our overall profitability. The major shifts of things like our marketing expenses that we just talked about, where 90% of our traffic remains direct or unpaid, it gives us a lot of leverage for improving our overall profitability. And we’re going to continue to do that this year. We continue to make great improvements in our overall variable costs, things like operations and support costs, or community support, infrastructure costs, etc.

David Stephenson, CEO, Q2 2023 Airbnb Earnings Call

This operating leverage, in my eyes, is a very clear indication of Airbnb’s brand moat.

First Hotels, Then Rentals (Highlighting Zoom brand moat, as an aside)

Interestingly, Airbnb appears to be growing within two distinct Inverse Bubbles:

- Hotel TAM

- Long Term Rentals TAM

I’ve now had a couple experiences using Airbnb’s long-term rentals, and they’ve been fantastic. The product totally eliminates the background check, credit check, interview process, etc., associated with the traditional long term rental process, which creates a very poor user experience for both parties involved.

As a part of business travel for myself, I’m staying in a 30-day long-term Airbnb stay in August, and the process for booking it was totally seamless. Brilliant experience. I would not want to use anything else after experimenting with this.

I also think this Long Term-Rentals TAM, like the hotel TAM, is a quintessential Inverse Bubble. The Long-Term Rentals TAM could be defined as having “substantial competition, fragmentation in various ways, low product differentiation, and, importantly, consumer spend that is waiting to shift to the next generation of products that will provide a better consumer experience/more consumer surplus.”

As I just mentioned, I had a brilliant experience using Airbnb’s long-term rentals platform, and I see and understand the consumer surplus very clearly.

Mr. Chesky provided two perfect data-based pieces of commentary that substantiate the idea that Airbnb’s growth in the Long Term Rentals TAM could have a very long runway ahead:

So long-term stays are 18% of our nights book. Long-term stays obviously defined by a month or longer. And as I mentioned before, they were around 13% before the pandemic. Now, it’s very hard to predict exactly how it will change in the next one, two, three, four quarters from now. So I’m not going to make a prediction about where 18% might be in Q4 or next Q1.

But what I can say with a fair amount of confidence is I think in the next decade, it’s going to be a lot higher than 18%.

I think the overall wins are towards longer and longer stays. And the reason why is because more than ever in any time in human history, you’ve got hundreds of millions of people and one day, perhaps more than a billion people that have a job via laptop that has some incremental flexibility that did not exist 10 or 20 years ago. Think about the number of people that are young that don’t have a family and can actually work from a laptop and move around. Then you have people of families that have kids in school that can’t do that, but their kids aren’t in school in the summer. So you’re going to see more and more people still go away from the summer.

I think all you have to believe is Zoom is here to stay to believe flexibility is here to stay. If you believe that, you’re going to see a lot more people either living nominally or some people traveling for the summer, going away for the winter, or extend to weekends, which is a whole new category between travel and housing.

Brian Chesky, CEO, Q2 2023 Airbnb Earnings Call

And, lastly, on the subject of Long Term Rental stays, Mr. Chesky remarked,

We also rolled out more affordable monthly stays. Guests are staying longer in Airbnb. So we took steps to make longer stays more affordable. We significantly reduced fees for stays longer than three months. We started offering U.S. guests the option to save money by paying with their bank account, and we made it easier for hosts to offer monthly discounts. And as a result, the percentage of our new active listings to offer monthly discount jumped from 22% to 50%.

[Mr. Chesky said this emphatically.]

Brian Chesky, CEO, Q2 2023 Airbnb Earnings Call

That really is huge, and it will entice folks like myself to leverage this service more and more.

In the future, I think it’s entirely conceivable that a very large proportion, if not most, rental properties start on Airbnb.

Concluding Thoughts: International Growth

One of my central concerns for Airbnb has been its international growth prospect. However, based on the data we received from management, international growth appears to be exceeding expectations.

One of the things we’ve seen is that Airbnb has a lot of, we’ve got a lot of scale in the United States, and we’ve got a lot of scale in top markets in Europe, but actually, Airbnb is under-penetrated in most countries around the world. Just to give you an example, a couple years ago, a few years ago, we were concerned about the lack of penetration we had in Germany. We were also pretty nascent in Brazil. Since the beginning of the pandemic, Brazil is more than double the size, and Germany is more than 60% larger.

And Germany is on track now to be one of the largest countries in the world on Airbnb. So we’re going to take that playbook, and we’re going to bring it to Asia, and we’re starting with Japan and Korea. But Asia Pacific is a frontier. It’s a huge opportunity for growth. I think that is just one of many markets, including Latin America. And the other thing I should point out within Europe is, beyond UK, beyond France, beyond some of the really top markets, there’s a lot of countries in Europe where we’re not actually that penetrated. So there’s a lot of international expansion.

Brian Chesky, CEO, Q2 2023 Airbnb Earnings Call

In the past, Booking Holdings (BKNG) has dominated Europe, but it appears that Airbnb’s consuming market share here as it has in America.

In fact, Booking.com’s dominant market position in Europe has been the central bear thesis for Airbnb throughout my years of analyzing the company; however, the bear thesis appears to be unraveling with each passing quarter.

Thank you for reading, and have a great day.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABNB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.